Not too long ago, upskilling was done in-house by companies, often reactively, limited in scale, and lacking innovation, or by very limited individuals on their own. But times have changed. With persistently low labor productivity and ever-changing/ dynamic work profiles, companies and workers face a unique challenge of a widening skills gap. Powered by PEs & VCs, this is now at least a USD 43 Bn opportunity in Southeast Asia.

White-collar upskilling alone now commands over USD 26 Bn, driven by demand for tech, digital, and managerial skills. Meanwhile, blue-collar and vocational skilling worth another USD14 Bn is rapidly formalizing through mobile-first platforms and public-private partnerships. Even traditional tertiary education is being disrupted by micro-degrees and outcome-linked education.

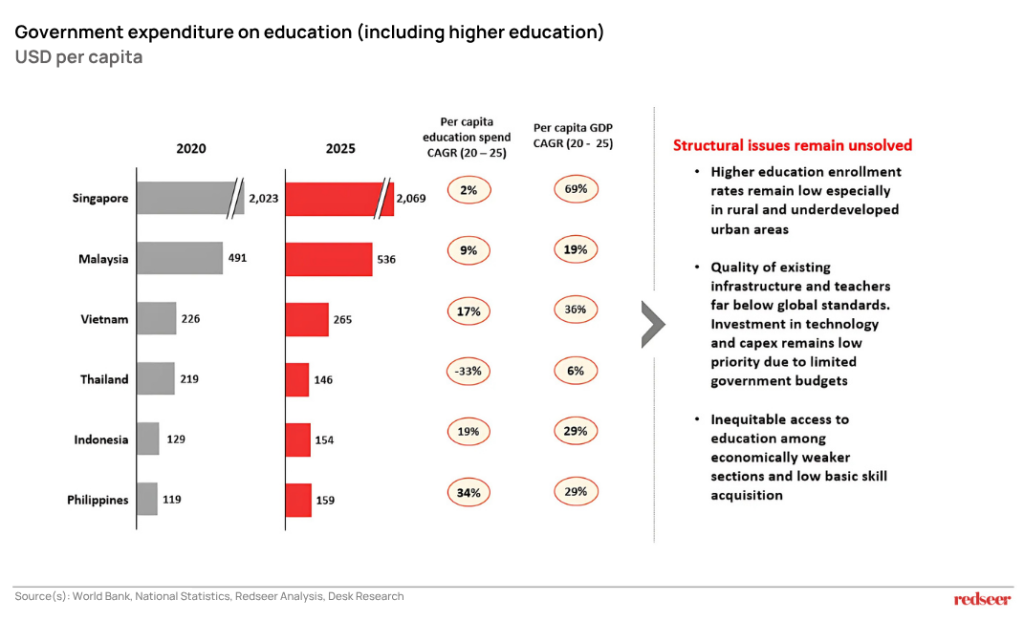

1. Southeast Asia’s education investment gap: Education spending out of sync with GDP growth; impacting the human capital building blocks

Southeast Asia’s education investment is lagging GDP growth, with Thailand seeing a decline in per capita education spending despite rising incomes. Structural issues persist, including low access to higher education, poor infrastructure, and limited capex in tech and teacher training. The government spends on education in SEA remains at just 3% of the GDP vs the global average of 4.4%.

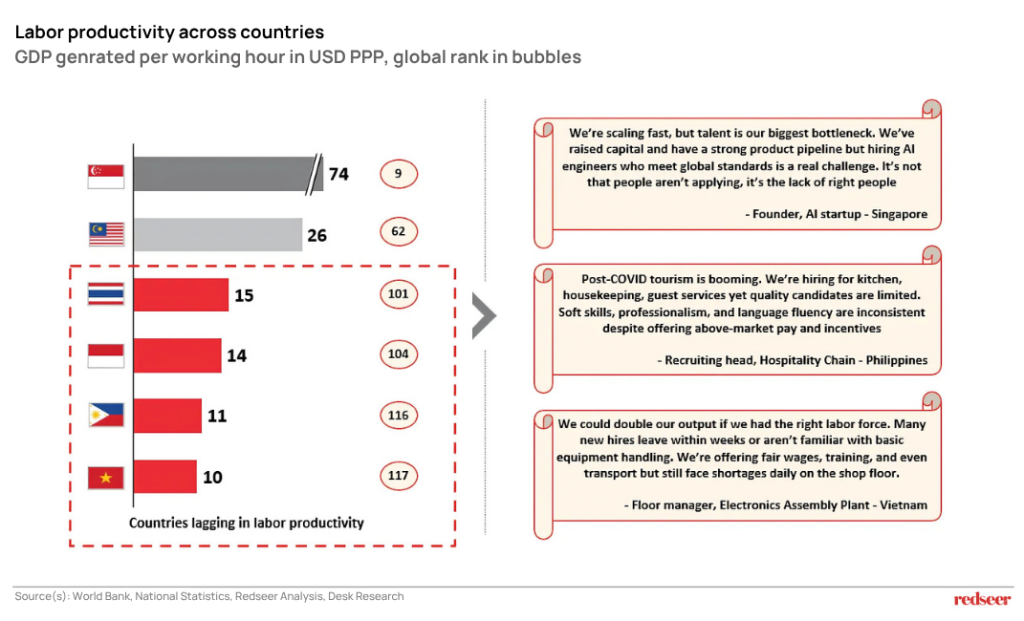

2. Widening talent deficit and poor labor productivity make upskilling initiatives imperative for business needs

Despite the economic growth, labor productivity remains alarmingly low in SEA markets like Vietnam, the Philippines, and Indonesia. Employer testimonials reveal a consistent theme: a shortage of job-ready talent. This human capital gap directly impedes business scaling and output, underscoring an urgent need for workforce development.

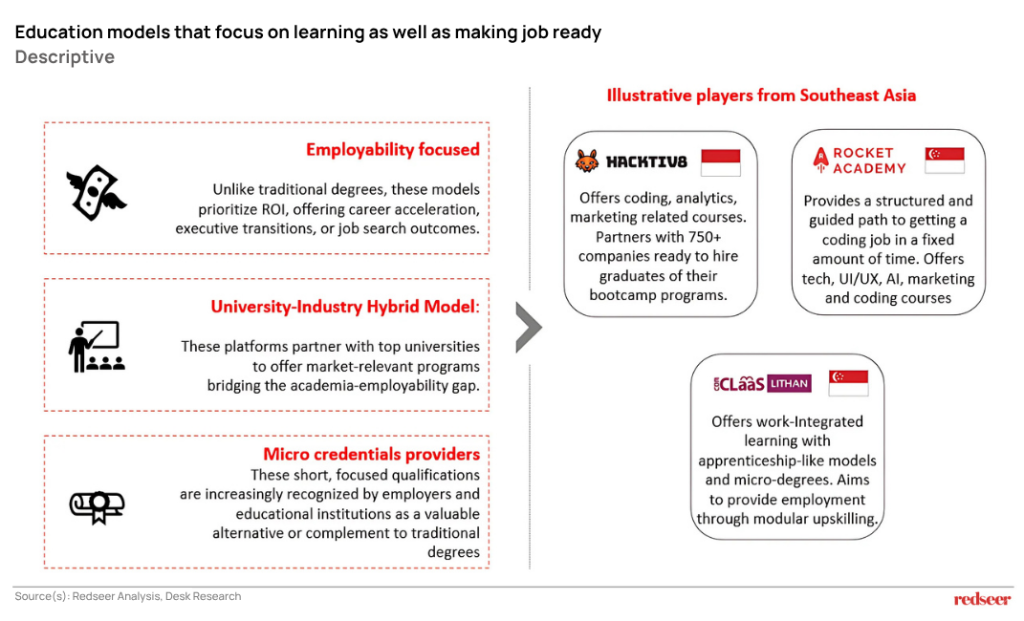

3. The popularity of outcome-focused learning that prioritizes job readiness, equipping individuals with practical skills, is on the rise

Employability is the bottom line: These models are often reverse-engineered from hiring outcomes and co-designed with employers. Bootcamp and modular formats are preferred over traditional degrees for speed, affordability, and specificity.

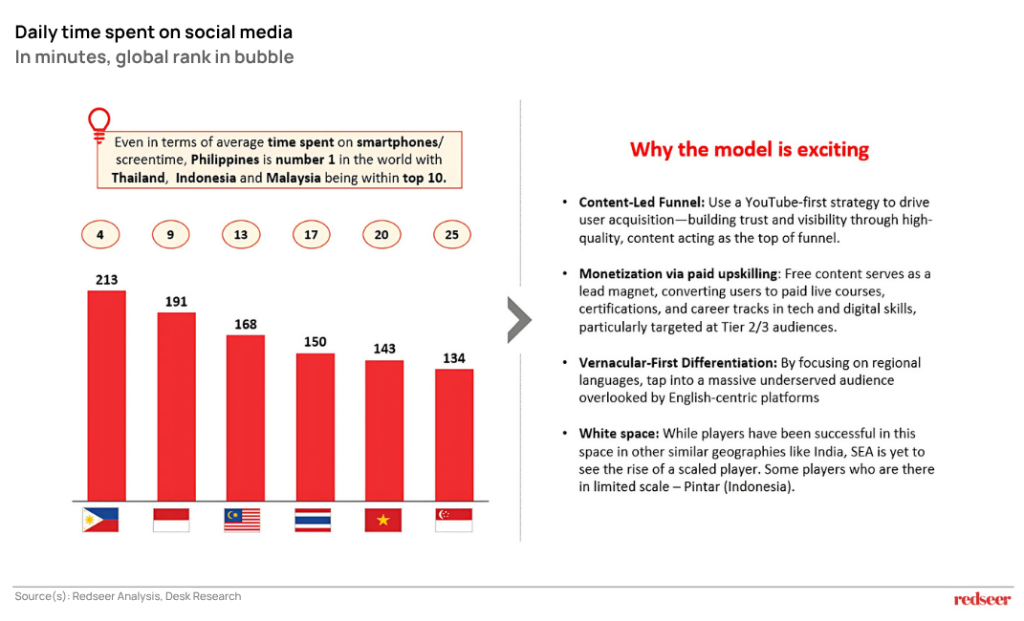

4. Content-led education is another scalable and effective approach to address upskilling challenges, offering accessible and engaging learning experiences

Considering high social media consumption in SEA, Gamified learning, and easy-to-consume content in the local language can be the go-to mode for upskilling, especially for the blue-collar workforce.

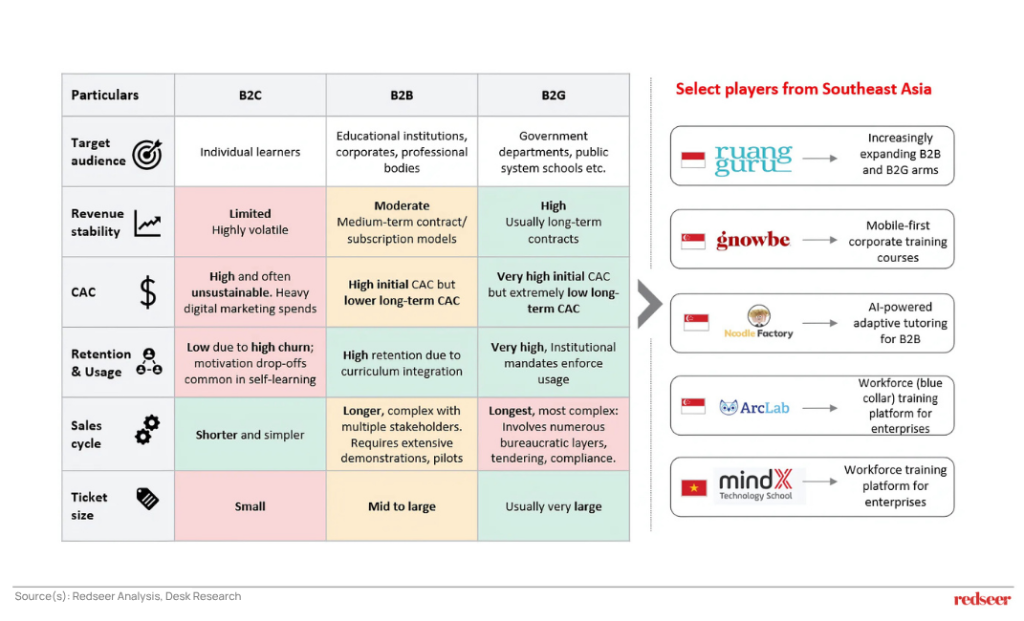

5. To address the talent gap and enhance productivity, B2B and B2G models are emerging, offering sustainable value beyond B2C models

SEA’s education future lies beyond direct-to-consumer plays. B2B and B2G models create defensible moats through embedded learning, institutional buy-in, and non-linear scale. These channels shift education from discretionary spending to systemic integration.

Leading players are now positioning themselves as long-term capability partners, not just content providers.