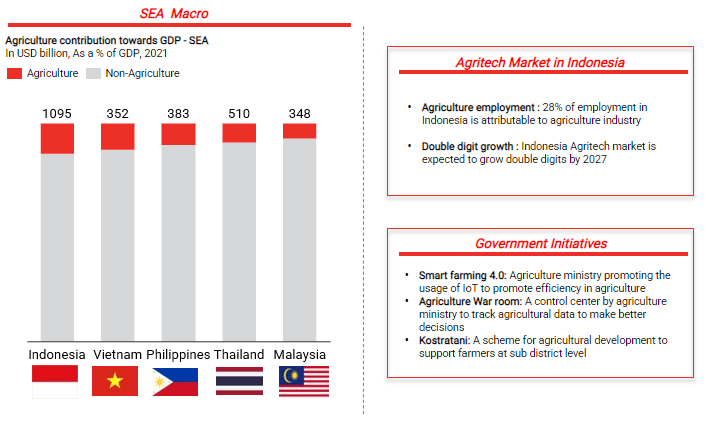

1. Indonesia has the highest contribution from Agriculture in Southeast Asia

Indonesia is the leading agriculture producer in SEA. Agriculture, including farming, fishery, aquaculture contributed around 14% of the country’s GDP. The sector has experienced significant growth in the last few years. The Ministry of Agriculture has been promoting technological interventions in the agriculture sector. This has resulted in higher yields, productivity, efficiency, quality and profitability.

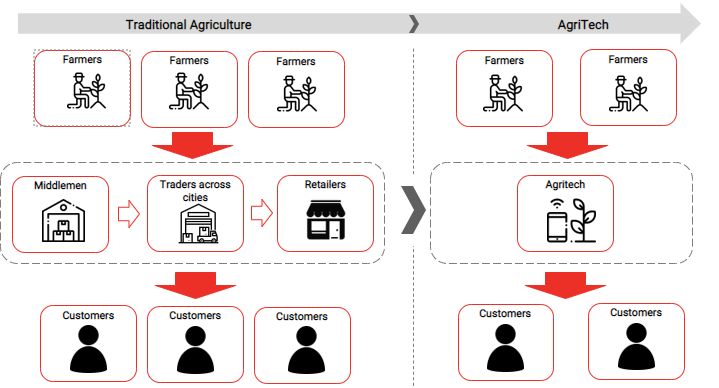

2. AgriTech is reducing inefficiencies in the supply chain by eliminating intermediaries, benefitting both the farmers and customers

Supply chain of traditional agriculture vs agritech, Illustrative

The traditional agriculture industry has several intermediaries in the supply chain. AgriTech is shortening this supply chain. While AgriTech is an early-stage sector, it is likely to witness rapid medium-term growth.

The farmers will benefit from getting better yields, directly connecting with the end customers, and getting better incomes. The customers will get higher quality products at cheaper price points.

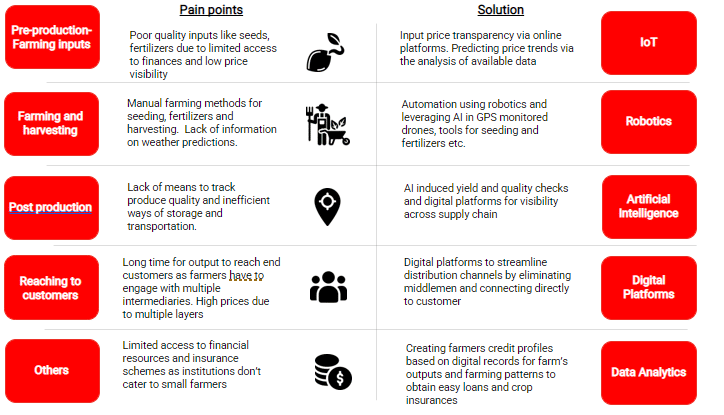

3. New-age technologies help to address farmers’ pain points across the value chain

Farmers face challenges across the entire agriculture value chain. Limited or no access to funds, markets, and technology are some of the prominent issues. Modern supply chain networks, data analytics etc. can help to address some of these issues. Currently, the startups in the market are providing solutions to these pain points.

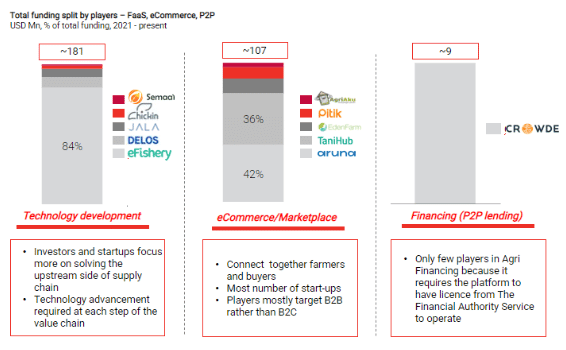

4. Total Agritech funding from 2021 till date has reached ~ USD 297Mn. Technological solutions accounted for ~60% of these.

There are three prominent business models in Agritech: Technology development, eCommerce/ marketplace, and financing.

Technology development is more focused on solving the upstream parts of the supply chain. The marketplaces are downstream focused. Financing relates to the help farmers can get to secure financial resources.

Technology developments have attracted the highest funding as it is relevant in every step of the value chain. Agri-financing has received less traction due to regulatory constraints such as the requirement to secure a license from Indonesia Financial Authority.

5. Rising demand for sustainable sourcing and products provides strong headroom for AgriTech growth

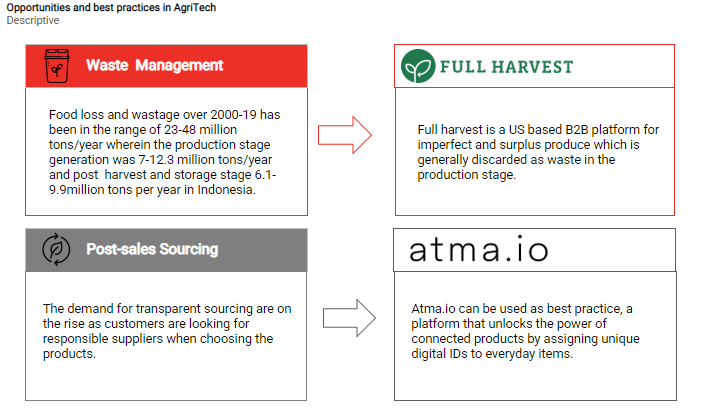

There are opportunities in waste management and post-sales sourcing. Food loss and wastage are likely to rise rapidly due to the increasing population. Yet, few players are looking at this opportunity to extract agricultural waste into reusable products/materials. The need for post-sales sourcing will increase as the demand for sustainable sourcing gains more prominence.