Going vernacular is the new music buzz in town and with the recent win of Natu Natu’s song at the Golden Globe Award and Oscar, the trend is just getting started. India has had a long history of audio content consumption in the form of radio and mass media channels that played non-stop music. With the advent of audio streaming, people had the choice of picking their favorite content leading to the streaming market’s exponential growth in the last few years. As the content type diversified across OTTA platforms, it attracted a wider spectrum of audience. In 2020 COVID-19 catalyzed the growth of the OTTA market adding 50 Mn new monthly active users in following 2 yrs (MAUs). While international music streams have been popular across platforms, the fastest growing genera has been regional musical as more vernacular listeners listened during COVID from Metro and non-Metro areas.

In this article, we give a quick insight into OTTA trends and how vernacular music is driving the growth of the sector.

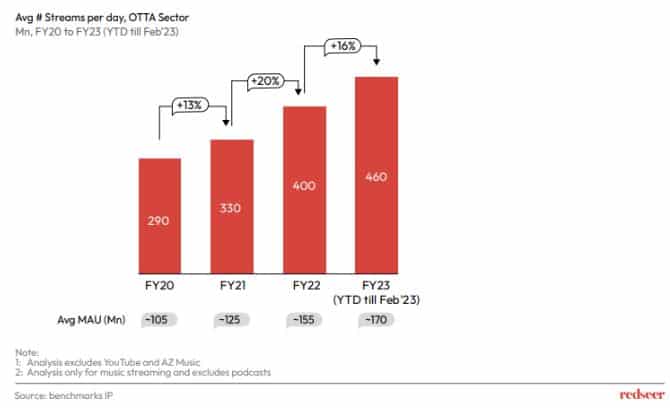

1. In FY23 OTTA platforms witnessed ~460 Mn streams every day growing at 16% y-o-y

The overall OTTA industry which witnessed 290 Mn streams per day in FY20 shot to 460 Mn streams by FY23 recording a 1.6x growth in three years. COVID-19 acted as a catalyst throughout FY21 and FY22 onboarding more than 50 Mn monthly active users (MAUs). More than 60% of the streams still come from the top 8-10 cities, while T2+ have been steadily contributing to the rest. Digital maturity in the smaller cities coupled with regional label partnerships have pushed vernacular streams to the fast lane.

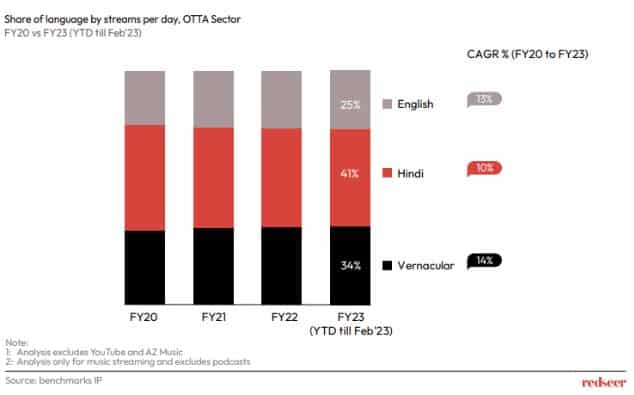

2. Regional music has been the fastest-growing genre in the last 4 years contributing to 34% of total streams in FY 23

An increasing number of users between the ages 18 to 30 from metro cities who have an inclination towards western music led the international music streams to grow by 13% CAGR. However, an increased number of listeners over the age of 40 who were onboarded during the lockdowns drove regional music streaming leading to 14% CAGR. Other contributing factors include the recommendation of vernacular playlists by platforms and higher number of partnerships with regional music labels. With players such as Spotify and Wynk penetrating the sector, the South Indian market has seen a spike in users and engagement in the last 2 years.

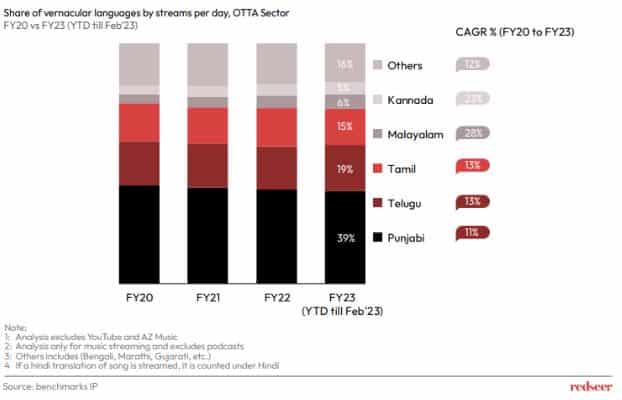

3. Within regional music South Indian languages have shown the fastest growth while Punjabi is the lead contributor with 39% share

Music from South Indian languages such as Kannada, Malayalam, Tamil, and Telugu has witnessed the fastest growth in the vernacular in the last 4 years. The growth can be attributed to more number of movies released in the last 2 years with a high reach of their songs in the vernacular. Increasing internet penetration also led to the onboarding of listeners across age groups. The highest contributor to OTTA with the non-film genre is Punjabi music across all states. Its growth can be attributed to composition and beats that listeners can relate to without going heavy on the lyrics.

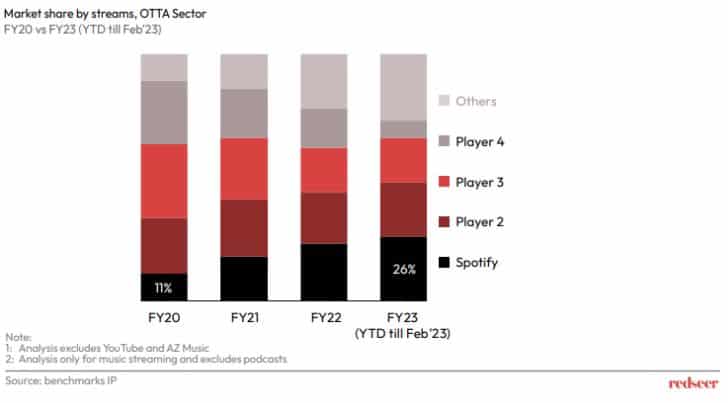

4. Spotify is the reigning market leader with 26% share by streams in FY23

Spotify has remained the dominant player with the highest number of users over the last 3 years. It has also been the key player to drive users between 15 to 30 years to OTTA in Metro cities. Spotify’s success can be attributed to a strong brand and product experience and generating penetration in both Hindi and vernacular music through its extensive music libraries of Hindi and regional music.

To be in the game, OTTA players should focus on improving user experience, expanding their content libraries, and developing flexible subscription packages to attract and retain more users, particularly in the Hindi and vernacular segment.