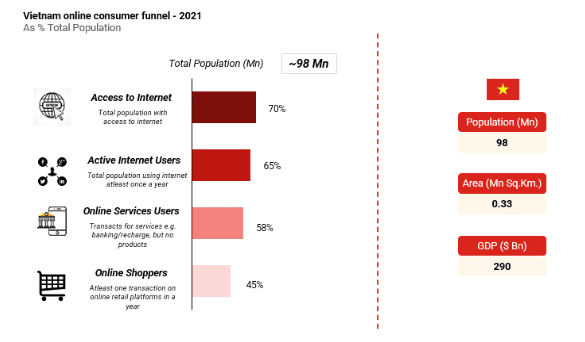

1. Vietnam- Fast digitizing economy with more than half of its population as online shoppers

Vietnam is the third largest Southeast Asian nation in terms of population with Ho Chi Minh and Hanoi being the most populous cities accounting for 18% of population and 35%+ of GDP. The digital penetration trends such as access to internet, active internet users etc in Vietnam continue to show strong growth momentum, thus setting tone for positive changes in the country’s consumer internet landscape in times to come.

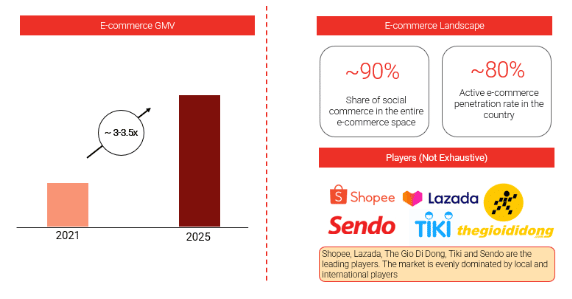

2. E-Commerce continues to leap ahead. Social commerce growth remains resilient

The major categories in e-commerce in Vietnam are electronics (35%), FMCG (34%) and Fashion (18%). The share of FMCG in the overall e-commerce basket continues to show rising trends going forward. Social commerce is relatively stronger in the tier-2 and below geographic locations, while formal eCommerce is strong in tier-1 locations. This is partly driven by consumers preference for seeking the nearest seller in tier-2 and below locations.

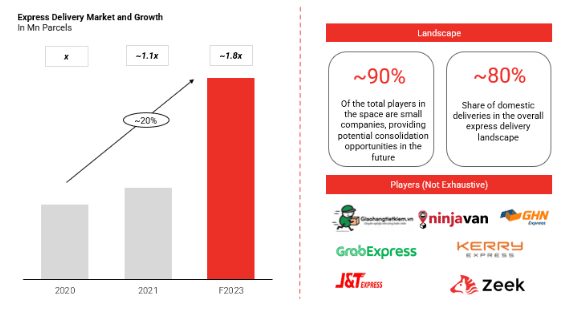

3. Vietnam express delivery market sees a promising growth with CAGR ~20% to 2023, with international players also eyeing to tap into this sector

Express delivery in Vietnam, which usually takes 24-72 hours to deliver goods, is witnessing a promising uptrend. Many local players have emerged, with international/regional players making significant inroads as well.

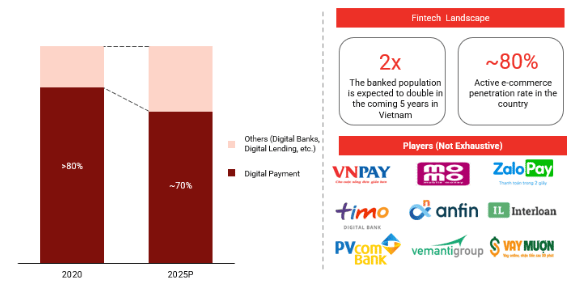

4. Digital payments dominates Vietnam’s FinTech. However, digital lending and banking are expected to gain share by 2025

Currently, digital payment players dominate Vietnam’s fintech market. However, we expect that by 2025, other services (e.g., digital lending and digital banking) will start to capture a higher share of the market, in terms of total transaction value.

Investors remain keen to explore opportunities in digital banks and trading platforms. Earlier this year, in January, several funding rounds were being raised.

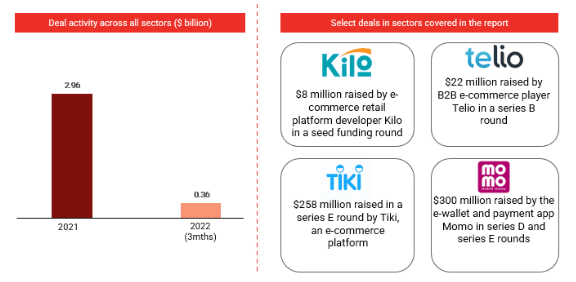

5. The fund-raising activity in 2021 in Vietnam has broken all previous year deal making records. 2022 continues to show a similar trajectory

The fund-raising activities observed in 2021 have been the highest ever for the country. A significant majority of the fund raising took place in the e-commerce and FinTech space. Almost 1/3rd of the total deals that happened in 2021 and 3m 2022 were in e-commerce and FinTech.