2026 To be A Bumper Year for MENA Tech IPOs

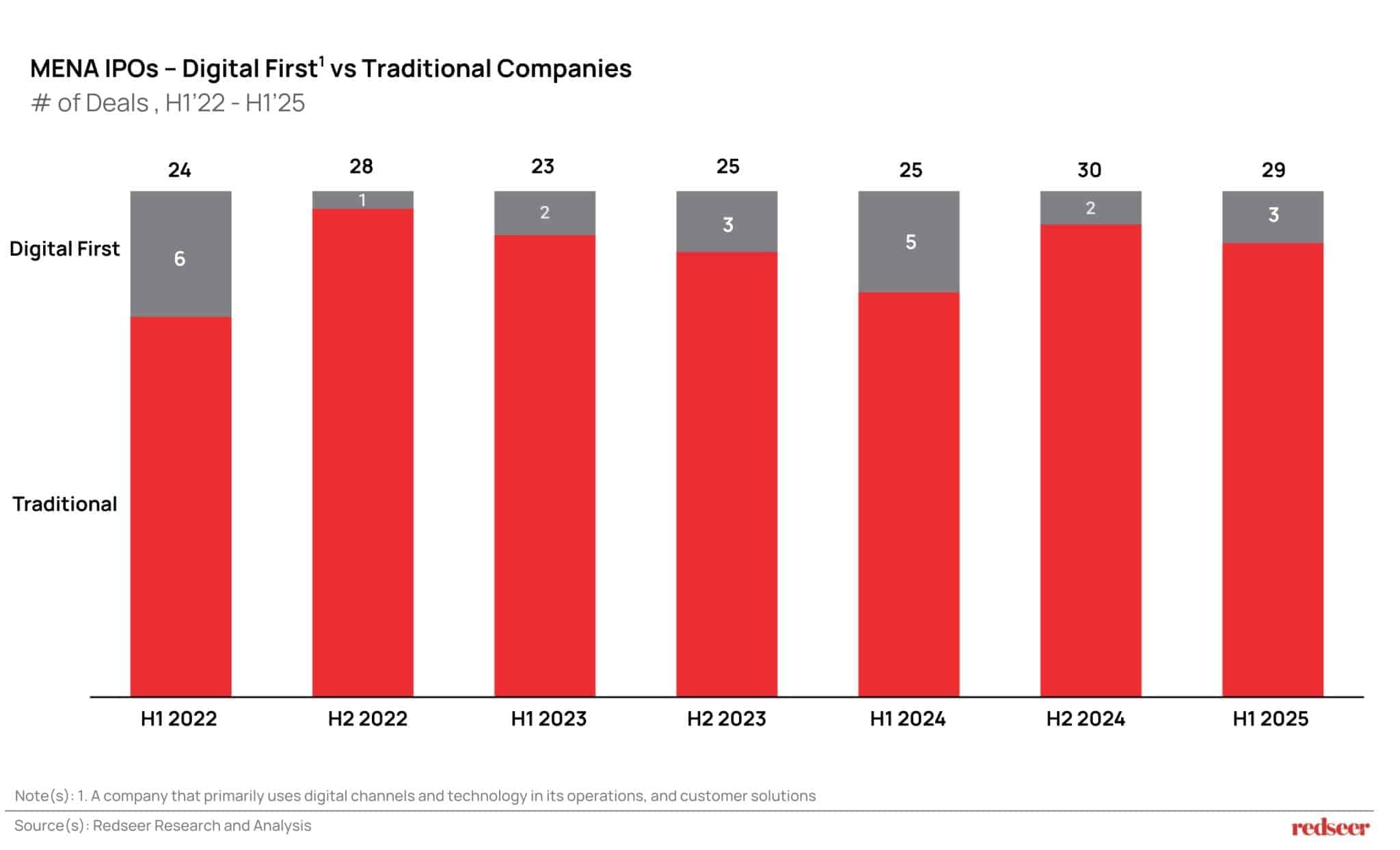

In our 5 Predictions for the MENA Digital Economy report last year, we expected 10 Tech IPOs in 2025. At mid-year, only three tech listings have materialized. While H2 typically carries heavier deal flow, a number of tech players are now likely to shift their listings into 2026 as they wait out geopolitical uncertainty.

That said, IPO momentum in the region remains strong, buoyed by traditional sectors and an active B2B deal pipeline.

H1’25 IPO Momentum Intact with 29 deals

Want to evaluate new investment and M&A opportunities?

2024 was a record year for MENA IPOs with 55 listings. Given ongoing geopolitical tensions, we had anticipated a softer start to 2025. Instead, the first half surprised to the upside with 29 IPOs.

Historically, H1 contributes 40–45% of annual IPOs, with activity peaking in Q3 and especially Q4. If that pattern holds, 2025 could once again rewrite the regional IPO record.

Sector-wise, Transportation and Real Estate led the way. Flynas ($1.1 Bn) and Umm Al Qura Real Estate ($522 Mn) were marquee deals, together contributing a third of total proceeds. Saudi Arabia remained the epicenter, accounting for 26 of 29 IPOs in H1’25 and consolidating its dominance in regional capital markets.

However, Tech Deals Slightly Delayed – but Pre-IPO Activity Strong

From our IPO readiness index, we had projected 10 Tech IPOs in 2025. So far, just three have been listed, including Nice One (BPC e-commerce, KSA) and Valu (consumer finance, Egypt).

Looking ahead, there are several names in the pipeline; however, we do expect some deals to spill over to the next year. Companies are opting for pre-IPO fundraises to secure strategic investors and strengthen growth before going public.

There has been significant Pre-IPO activity in the region. For example, Dubizzle’s acquisition of Property Monitor strengthens the case for a public listing. Tabby, having just closed a $160 Mn Series E, could look at a late 2025 or early 2026 listing. And in Saudi, Ninja, the quick grocery unicorn, secured $250 Mn in Series D funding earlier this year, with Bloomberg and Argaam reporting that it is in discussions for a potential IPO in the next year or so.

2026 Could Be a Bumper Year for Tech IPOs

Hence, while we still expect a high single-digit number when it comes to Tech IPOs in 2025, which will be higher than what we saw in previous years, we do feel a handful of the listings will move into the following year.

This means that 2026 could be the year when we see more than 10 tech deals and a few marquee ones as well – meaning the proceeds will also rise significantly. We’ve refreshed our IPO readiness index scores recently. And the sectors to watch out for are FinTech, Classifieds, Retail, and FoodTech, among others.

Please feel free to reach out to us if this is an area of interest. Happy to engage in a more detailed discussion.

Written by

Akshay Jayaprakasan

Associate Partner

Akshay brings over a decade of experience across consulting and technology, with deep exposure to India, Southeast Asia and the Middle East. He has delivered multiple keynotes, served on industry panels, and is frequently quoted by leading Middle East media on the digital economy.

Talk to me