Cross-border players grow, but trade shifts local

The GCC has long been a stronghold for cross-border e-commerce. Over the past few years, that momentum only grew stronger with the likes of Shein, Trendyol, and Temu doubling down on the region. But 2024 brought a surprising twist: Cross-border trade volumes declined, even as these players continued to perform well.

So, what’s really going on? Let’s break it down.

1. Cross-border players are powering Fashion E-commerce growth in UAE & KSA

At one point, cross-border trade accounted for more than 60% of the UAE’s total e-commerce. Over time, that share declined as local players scaled up and tailored their offerings to regional preferences. But in the past two years, CBT made a strong comeback, led by fast fashion giants.

Shein led the charge, but 2023 saw Trendyol and Temu enter with heavy promotions, making the UAE and KSA priority markets.

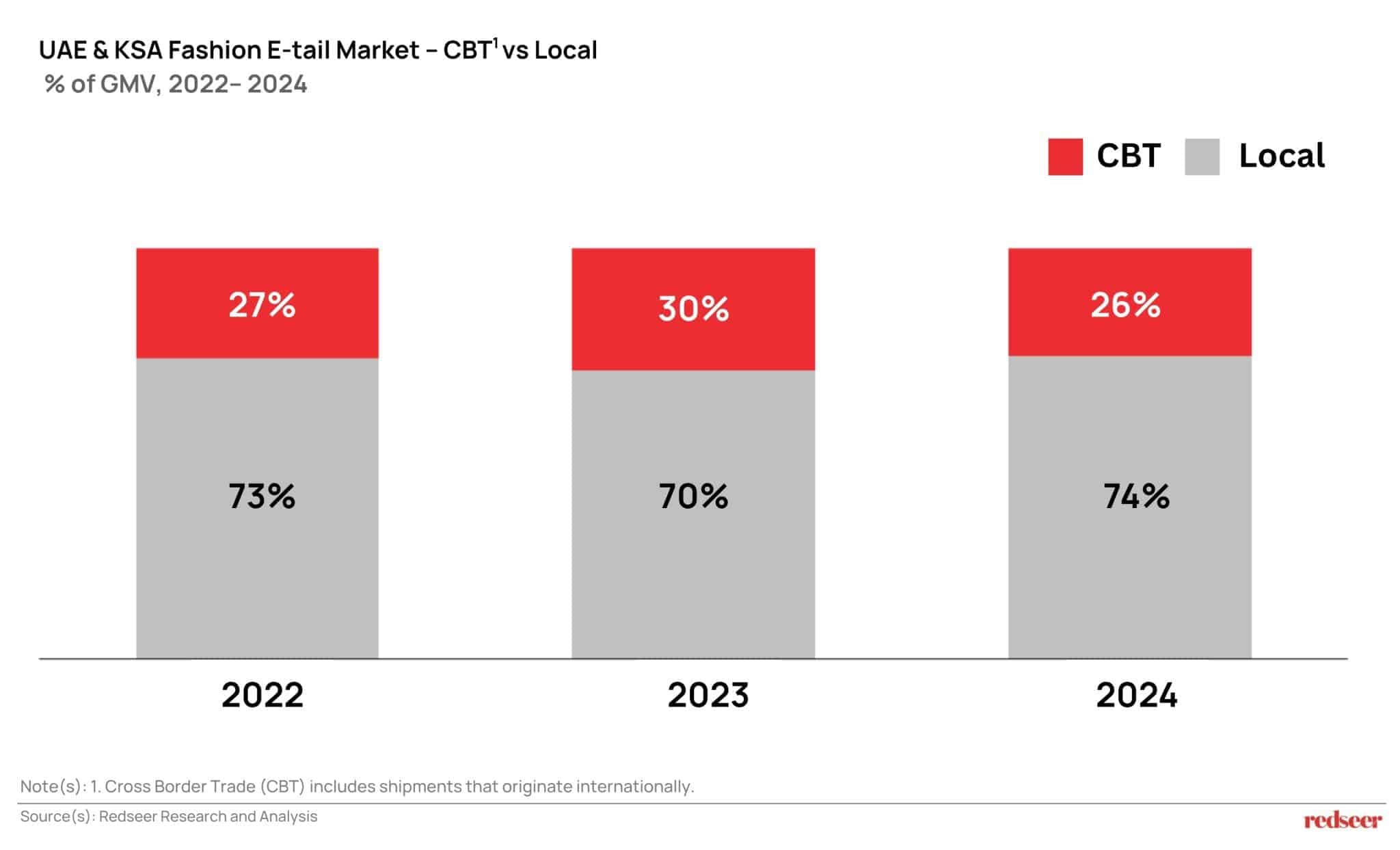

2. Yet in 2024, the cross-border trade (CBT) share dipped in both the UAE and KSA

Want to evaluate new investment and M&A opportunities?

When we did our annual e-commerce update earlier this year, a curious trend stood out: cross-border trade declined as a share of total e-commerce. This seemed at odds with what we were hearing that CBT players were still growing fast.

A deeper look offered clarity: major players like Shein and Trendyol have now set up local warehouses, shifting large parts of their GMV to local fulfilment. Shein currently operates a UAE-based warehouse, while Trendyol has local warehouses in the UAE & KSA, signalling an aggressive local push. As a result, much of their business is no longer being categorized as cross-border, even though the players themselves continue to grow.

3. 2025 could flip the trend again — CBT may rise

Early in 2025, Amazon and Noon began ramping up their Global Store strategies to counter the fast-fashion surge. While the full impact remains to be seen, we expect to see momentum build in the second half of the year.

Another wildcard: US tariffs. If rolled out, these could result in a push of inventory into the GCC, leading to a renewed spike in cross-border buying. That means lower prices, stiffer competition, and tighter margins but we believe the consumption engine will stay strong.

Is this an area of interest? Please reach out to us for a more detailed conversation

Written by

Akshay Jayaprakasan

Associate Partner

Akshay brings over a decade of experience across consulting and technology, with deep exposure to India, Southeast Asia and the Middle East. He has delivered multiple keynotes, served on industry panels, and is frequently quoted by leading Middle East media on the digital economy.

Talk to me