Education: Missing Link for Cryptocurrency Adoption

The global crypto conversation has shifted meaningfully in the past two years, and nowhere is this more visible than in the UAE. With progressive regulation, a maturing ecosystem, and a digitally savvy population, the UAE is accelerating its position as a global hub for virtual assets. Yet, despite strong early indicators, one critical unlock stands out: education.

Here’s a structured view of where the region stands today and what will define its next phase.

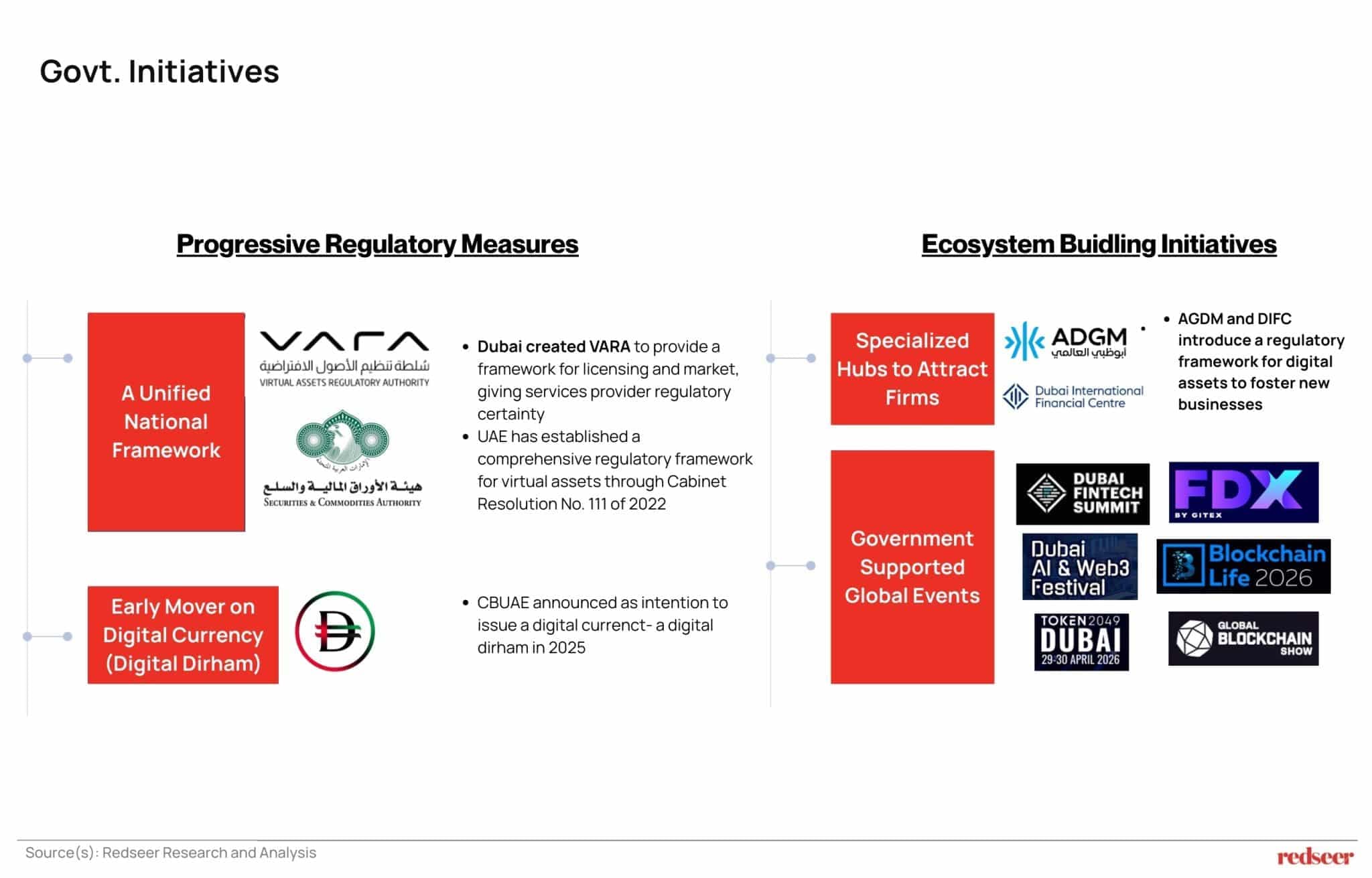

A progressive policy framework is powering the UAE’s virtual asset ambitions

Over the last few years, the UAE has built one of the most forward-leaning frameworks for virtual assets globally. The market’s evolution has been driven by a policy environment that provides clarity where other regions still debate fundamentals. Entities such as VARA, ADGM, and DIFC have established modern standards for licensing, compliance, and market conduct, giving both startups and established players the confidence to build in the region. Coupled with broader national initiatives, such as early exploration of a digital currency, the UAE has successfully positioned itself not just as a regional center, but as a global point of reference in virtual-asset regulation and innovation.

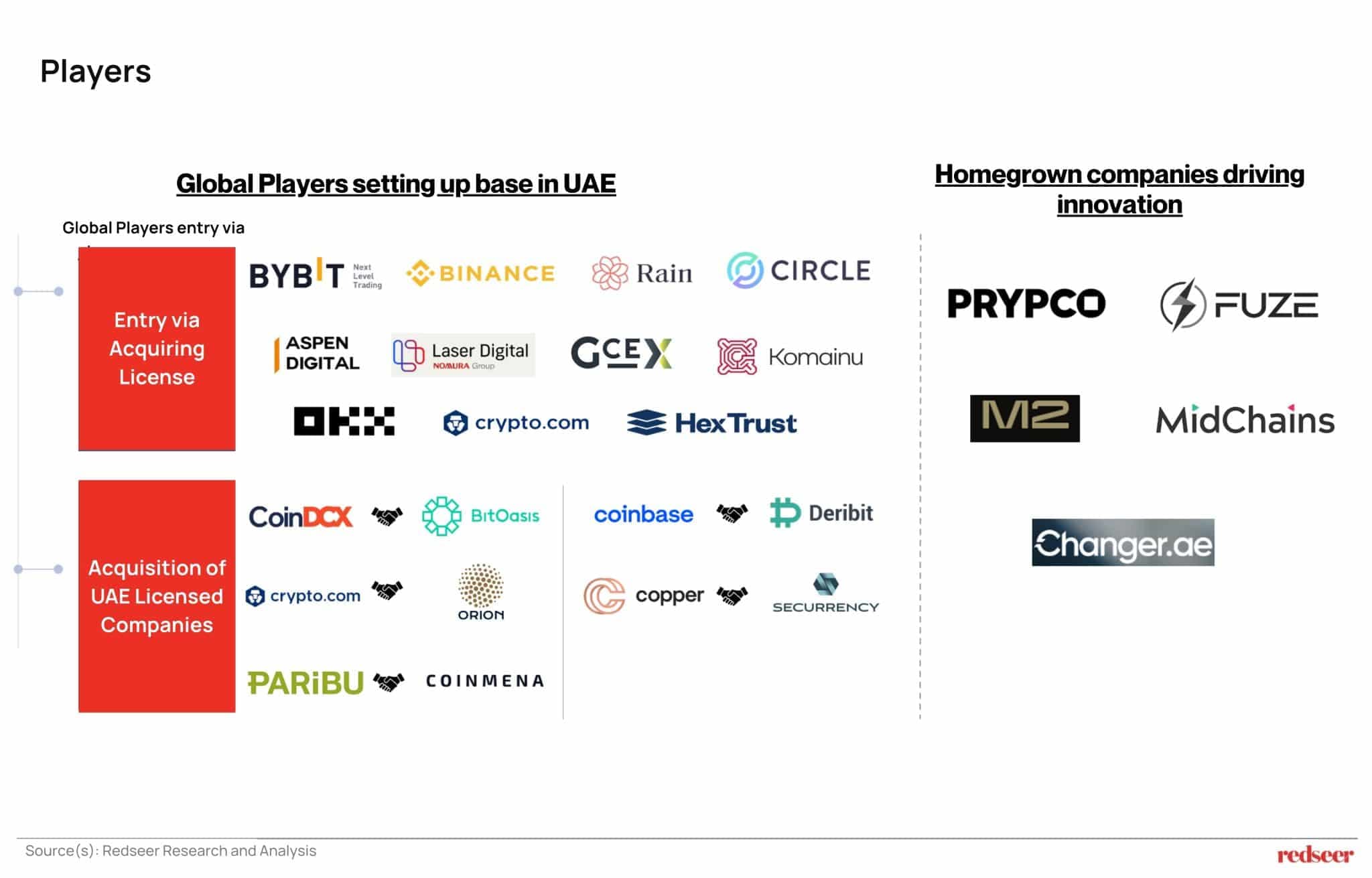

Global players and local innovators are converging to build a strong cryptocurrency ecosystem

This regulatory clarity has drawn a diverse mix of participants into the UAE market. Global exchanges, fintechs, infrastructure providers, and Web3 specialists are setting up regional bases through licenses, acquisitions, or operational hubs. Their presence brings technology, liquidity, and global best practices. In parallel, homegrown companies are scaling across blockchain infrastructure, tokenization, stablecoin solutions, developer tools, and consumer applications. The result is a balanced ecosystem where international expertise and local innovation reinforce each other. This convergence is a key strength for the UAE: rather than relying on one type of player, the market is developing depth across the value chain.

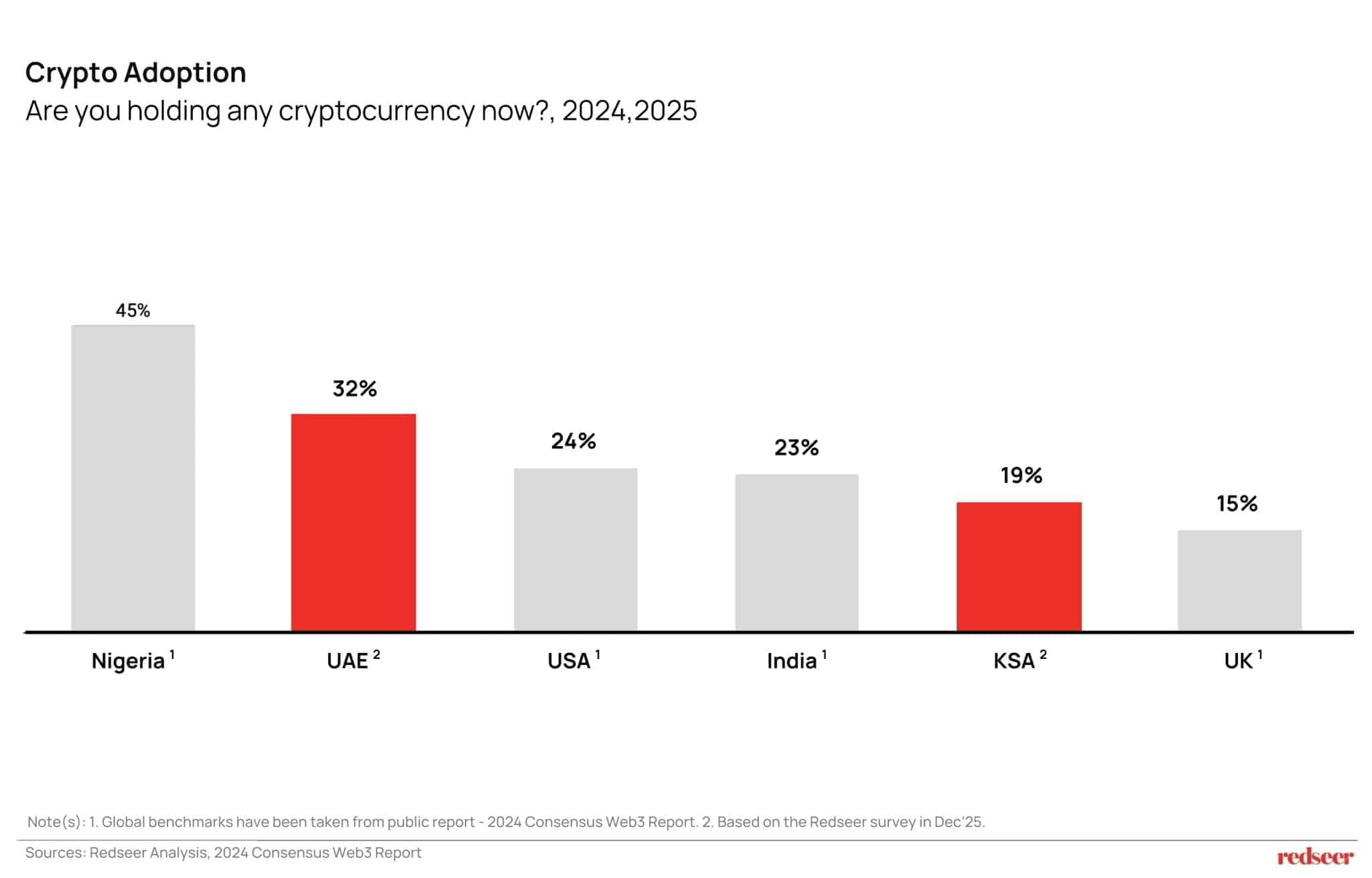

The UAE’s crypto penetration already outpaces many mature global markets

Consumer adoption in the UAE is tracking ahead of major global benchmarks. A large share of residents already holds or has previously used crypto assets, placing the country among the highest-adoption markets worldwide. This is driven by the UAE’s young demographic profile, strong digital-payments culture, and openness to emerging financial technologies. For many users, crypto is no longer a speculative curiosity; it has become a relevant part of their financial behaviour, whether investing, saving, or making everyday transactions. The UAE today resembles a frontier market rather than one still in the experimentation phase.

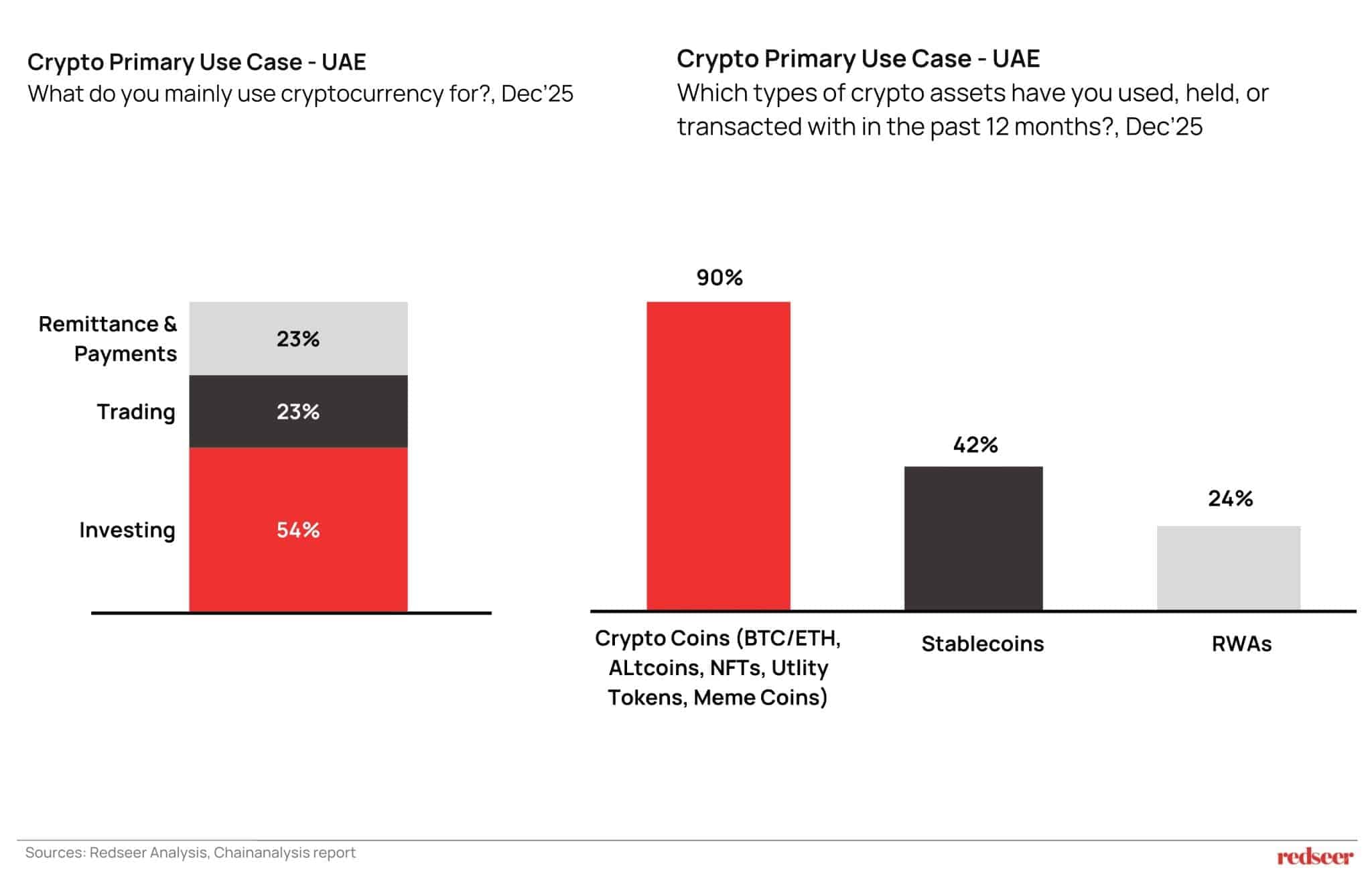

UAE users are developing more functional and diversified crypto use cases

The evolution of use cases is where the UAE stands out most. Users are moving beyond short-term trading and beginning to adopt crypto in more practical, utility-driven ways. Stablecoins have become an attractive option for remittances and payments, offering speed and cost advantages over traditional channels. Crypto assets are being used for both long-term investing and active portfolio diversification. Real-world asset tokenization is gaining momentum, giving retail investors access to fractional ownership opportunities that were once limited to institutional players. This diversification indicates a market that is maturing quickly, where crypto is not just an asset class but an enabler of broader financial functionality.

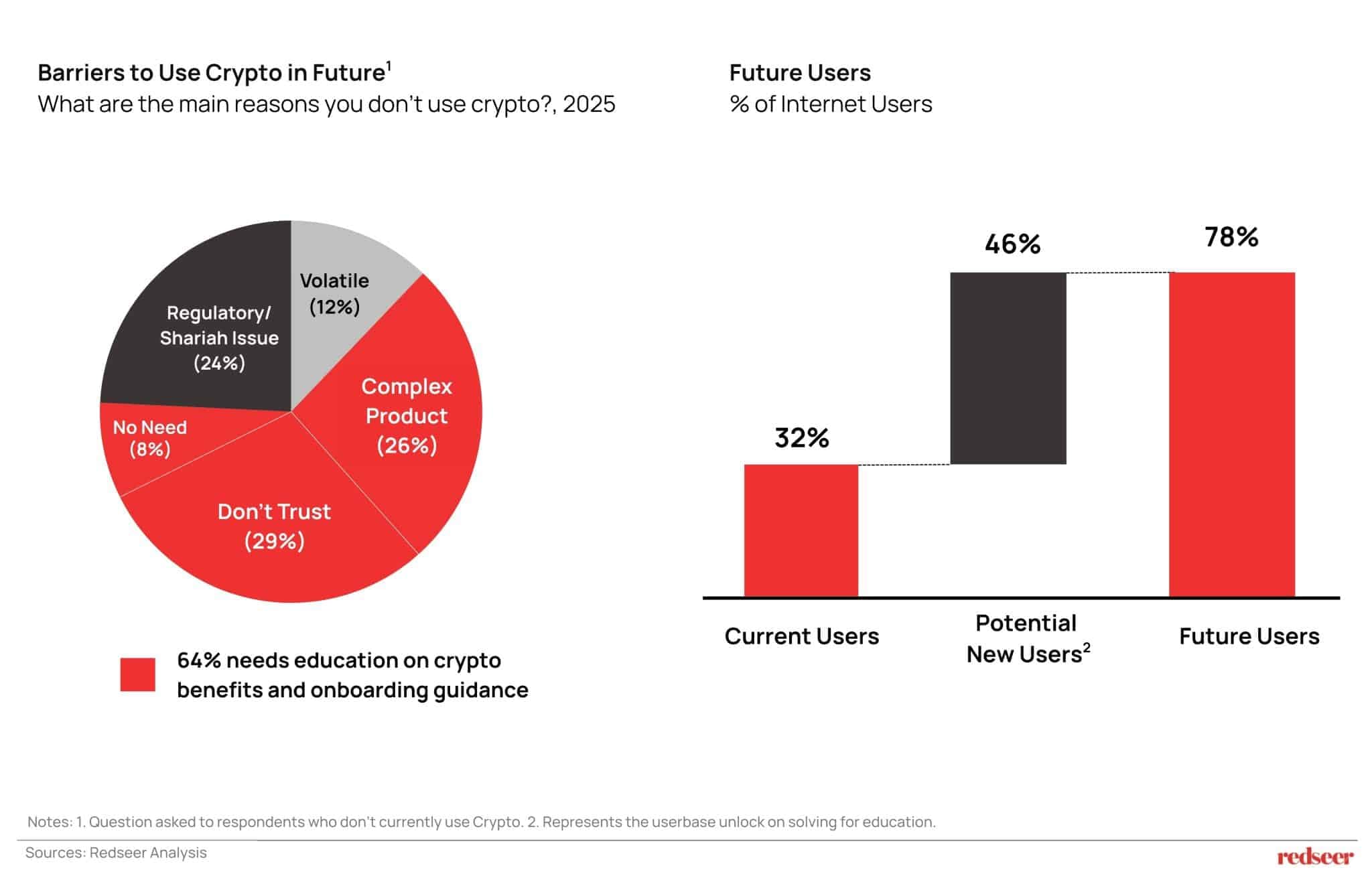

Consumer education is the biggest unlock for the next wave of adoption

Want to get strategic guidance?

Despite all the progress, education remains the single largest unlock for future adoption. Many potential users are held back not by lack of access but by lack of understanding of benefits, risks, onboarding flows, security practices, and regulatory safeguards. When consumers are unsure of how products work, trust becomes harder to build. Conversely, when education is done well, the pathway to adoption becomes significantly smoother.

Unlocking mainstream adoption will require focused, practical education that builds user confidence and clarifies real-world utility, rather than generic awareness.

Types of education that will be useful include:

- Simple explainers on core use cases (e.g., stablecoin remittances, tokenized assets)

- Clear guidance on safety, safeguards, and regulated pathways

- Step-by-step walkthroughs that simplify first transactions or conversions

Short, easy-to-consume formats such as quick videos, visual guides, FAQs, and in-app prompts will make the content easily accessible and maximize engagement.

Delivering education at the right touchpoints is also key. Some high-impact touchpoints could be:

- Remittance and payment journeys where users encounter real utility

- Digital wallets, banking apps, and fintech platforms are used for day-to-day financial activity

- Exchange onboarding flows and first-transaction moments

- E-commerce checkout pages where crypto-based payment options appear

The UAE has infrastructure, regulatory foundations, and ecosystem players in place. The next step is equipping consumers with clarity and confidence to participate safely and meaningfully. The potential upside from this is massive and could be a game-changer for the region.

We would be happy to discuss these trends in depth and explore what they mean for your organization. Feel free to reach out to us for a more detailed discussion.

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me