India’s Construction Industry: Promising Long-Term Demand, but Short-Term Turbulence is Expected

India’s infrastructure – capital expenditure flywheel is a key structural driver of its long-term growth story. Still, there are some near-term headwinds primarily led by slow on-ground project execution. Both infrastructure and real estate development are expected to be strong in the coming years, so robust management of shorter-term challenges will allow companies to make the most of long-term opportunities.

India’s construction output growth has outpaced GDP growth post-COVID

India remains the fastest-growing G20 economy, projected to be the 3rd largest by 2029, with the growth of the construction sector being particularly sustained by long-term catalysts –

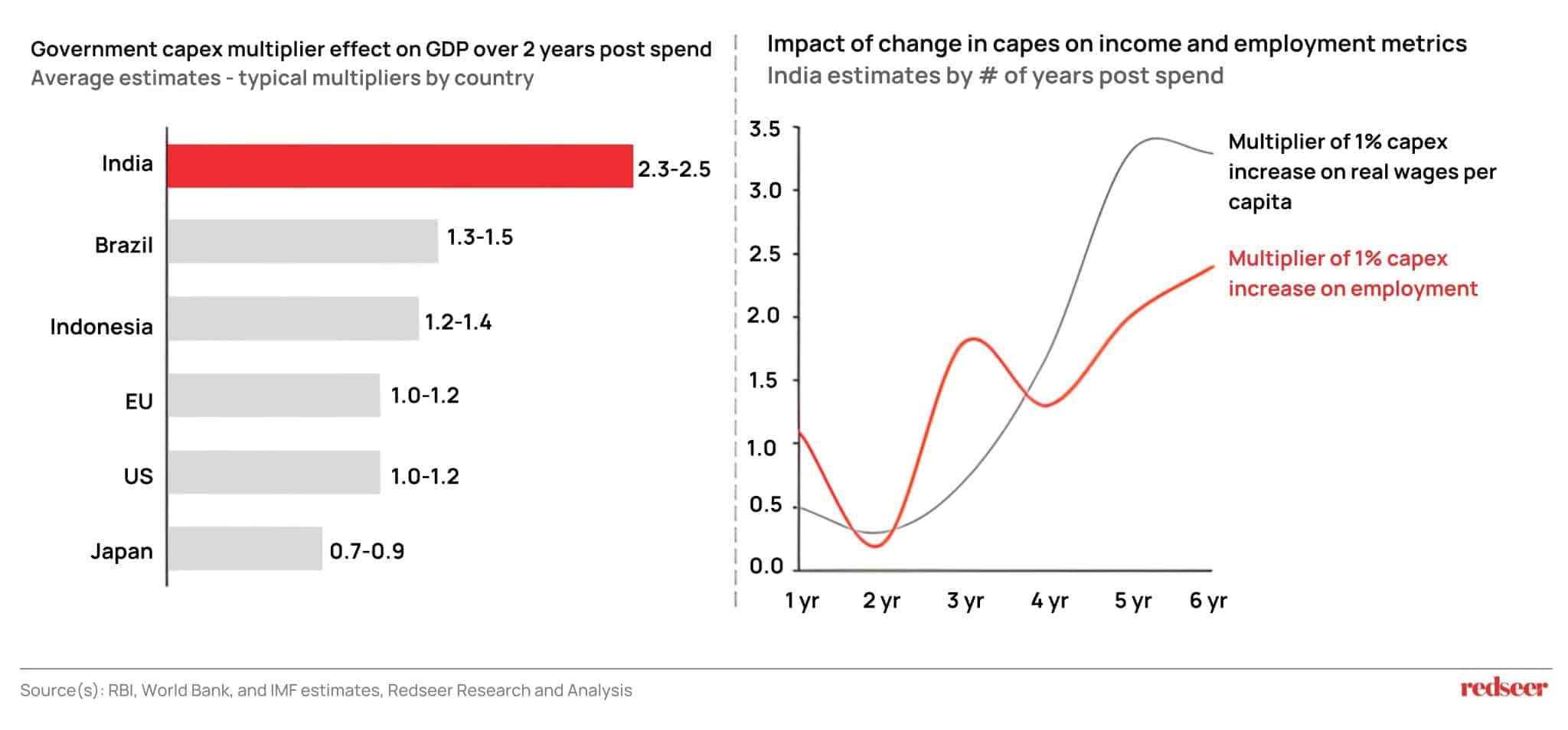

- Higher capital expenditure, combined with larger-scale projects, is helping drive a high infrastructure capex to GDP multiplier effect

- A multi-pillar policy reform agenda by the government has helped to fuel growth

- Tax simplification has eliminated interstate check posts, reducing transit time and logistics costs

- Digital payments have resulted in UPI payment value growth from ₹ 21Tn in FY20 to ₹ 261Tn in FY25

- PLI Schemes have attracted ₹1.61 Tn investment and boosted manufacturing output

- Inflation is under control with lower repo rates facilitating lending, though the construction industry has lagged other sectors in bank credit

Want to evaluate new investment and M&A opportunities?

As a result, construction has outpaced GDP growth since COVID – and is projected to continue doing so till the end of the decade.

However, the “missing middle” continues – the share of the secondary sector has remained stagnant, and actual public capex has trailed budgeted spends. The resilient rupee faces pressure because of oil prices and global tariffs. Geopolitical concerns and MSME credit access issues remain factors to watch out for.

India’s infrastructure capex is increasing, but there is a short-term slowdown in project execution

Public spend centres on core infrastructure, while private capex pivots to manufacturing, together creating a powerful multiplier. Infrastructure’s share in combined public and private capital expenditure has been steadily increasing in the last 3 years and now accounts for over half of the total spend. Further, infrastructure & real estate projects are becoming larger, with high-ticket projects being undertaken across all key sectors.

These investments have driven a high infra-GDP multiplier for India.

Despite the continued investment, there remain short-term factors to look out for –

- Progress in government programmes has been slowing down, particularly in FY25 (road construction under Pradhan Mantri Gram Sadak Yojana reduced by 37% in FY25, while just 13% of the targeted number of houses under Pradhan Mantri Awas Yojana – Gramin were completed in FY25)

- Some delay in vendor payments from the government has also been reported by players, with State Governments and Central PSUs having the largest payables

- Infrastructure dominates industrial credit deployment at 35%, but elevated NPA risk cautions lenders

Rising incomes and affordable housing are improving real estate sales, but slow execution is seen here as well

Residential and commercial property sales have reached record highs, indicating robust demand. Government initiatives are boosting affordable housing and have revived stalled real estate projects.

However, regulatory delays and legal disputes continue to hinder project execution timelines. Delayed policy clarifications (such as SEZ duties) are inhibiting decision-making. In metros, a 10% YoY drop in new housing supply was reported in June 2024 as developers are facing difficulties with pricing new projects competitively.

Despite slower on-ground project execution, long-term cement demand is expected to be strong

Cement consumption in India remains substantially lower than in developed countries, with India’s per capita consumption of 289 kg being significantly lower than the global average of 510-560 kg, suggesting a large headroom for growth.

Incumbents are responding to the increase in long-term demand by expanding capacity while consolidating supply to improve their pricing power. The top 5 players accounted for 58% of cement capacity in FY25, compared to 52% in FY22.

The construction equipment industry is seeing a short-term slowdown

FY25 saw a severe slowdown in overall construction equipment YoY registrations on Vahan, a 4% growth in FY25, compared to 26% in FY24. Construction Equipment Financing has lagged other segments due to credit quality concerns. We see that construction and cement demand growth show a fairly strong correlation to growth in gross bank credit received by infrastructure and construction projects.

The new Construction Equipment Vehicles (CEV) Stage V norms are expected to keep demand below the historical average in FY26. However, while the new norms will raise acquisition cost, lower total cost of ownership is expected due to lower lifetime fuel outlays and better resale value.

Outlook of leading listed players for FY26 is generally cautiously optimistic, despite some underlying challenges

India’s construction ecosystem remains on a growth trajectory, though sentiment for FY26 has shifted from highly optimistic to cautiously optimistic. Long-term structural drivers such as urbanization, rising incomes, and government infrastructure push continue to provide a solid foundation. However, profitability is potentially exposed to input cost volatility, financing risks, and policy-linked demand cycles. Companies are looking to balance core revenue growth with operational efficiency, diversificatio,n and capital discipline to navigate near-term turbulence.

Industry players must navigate short-term market turbulence

As players look to navigate the near-term, slightly turbulent waters of the concrete equipment manufacturing industry, here are some of the key questions that they should address:

- How can relationships with customers and financial partners be strengthened to help customers make capital expenditures?

- What is the strategy for EPC firms to manage liquidity and working capital in a delayed-payment environment (reassessing financial strategies, credit terms, debt management, cash flow forecasting)?

- How can cement and construction equipment manufacturers enhance operational efficiency (procurement, logistics, energy, working capital) to maintain profitability amid lower sales volumes? How can digitalization and automation help with this?

- How can real estate developers cater to premium and luxury housing demand during slowdowns in demand for affordable housing?

- What service-based revenue models (rentals, AMC, parts) can construction equipment players strengthen to bring resilience to softness in new product demand?

- How can revenues/order books be diversified beyond existing markets and offerings?

Discover the right strategies and market opportunities. Talk to our experts to solve for your next growth milestone.

Written by

Rohan Agarwal

Partner

Rohan Agarwal has been a part of the Redseer Strategy Consultants journey for over six years. He is an expert in digital strategy for traditional corporates and start-ups.

Talk to me