Tracking Growth Across Public-Market-Relevant Internet Sectors

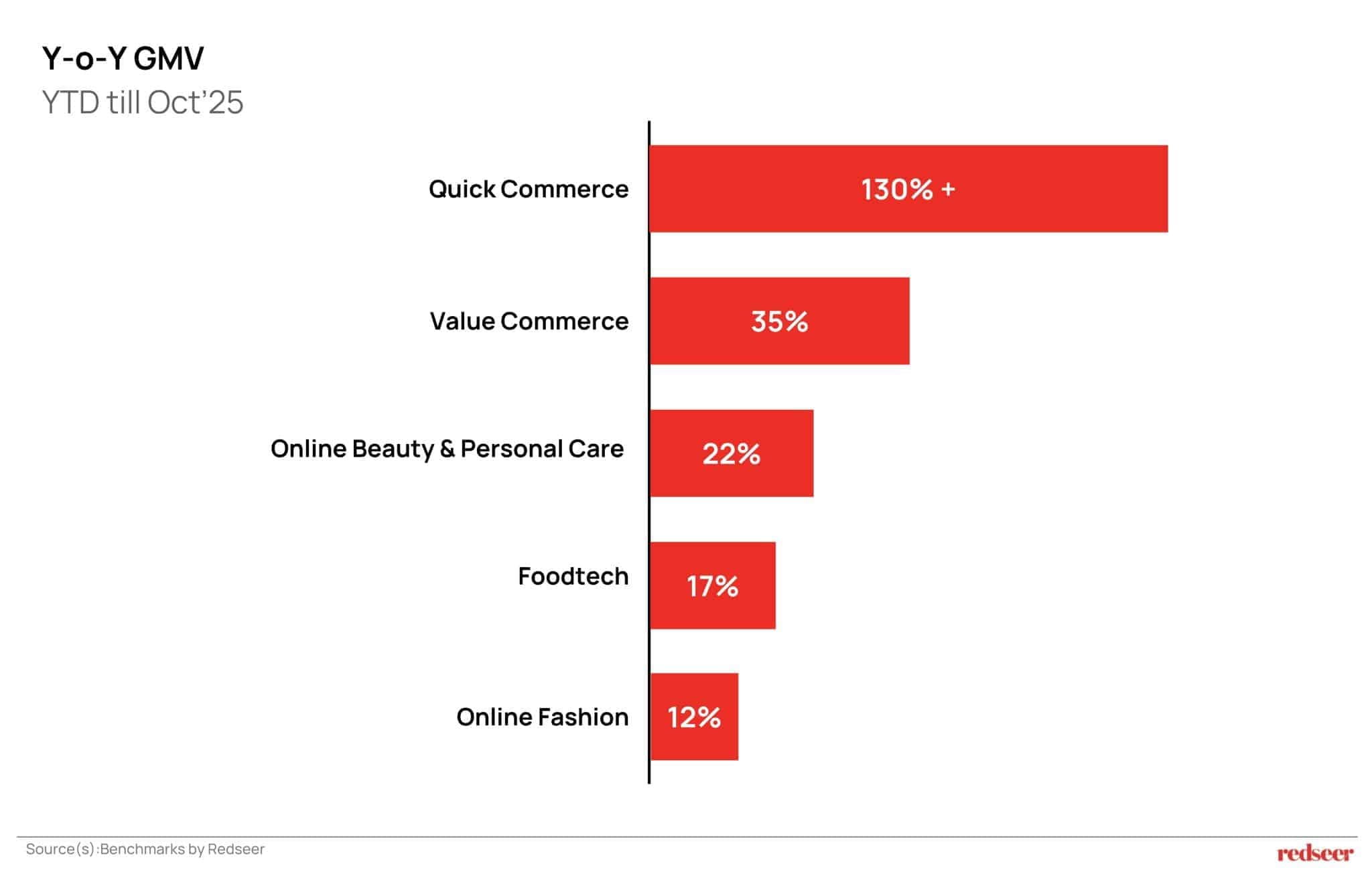

As India’s Internet economy enters the final stretch of CY2025, several key sectors with publicly listed exposure, i.e. Quick Commerce, Food Tech, Beauty & Personal Care, Fashion, and Value Commerce ecosystem, are demonstrating clear and consistent growth signals.

We solve the strategy behind scale!

For public market investors, the first ten months of the year highlight a market where high-frequency, repeat-driven behaviours and��category-specific adoption in Tier 2+ India are shaping the strongest compounding opportunities.

This edition breaks down where the momentum is coming from across sectors that matter directly or indirectly to listed players.

High-Frequency Categories: The Most Predictable Growth Engines for Listed Adjacencies

High-frequency categories continue to provide the most stable and visible compounding in the consumer internet landscape. Their scale, density, and repeat behaviour offer a clearer line of sight into top-line growth critical for public market investors tracking execution and sustainability.

- Quick Commerce: A Structural Driver of Volume for Public-Market Ecosystems

Quick Commerce has maintained its position as India’s fastest-growing digital category and a major driver of growth in the consumer internet market:

- GMV growth has stayed above 100% YoY through Jan–Oct.

- MTUs have grown more than 100%, driven by rapid geographic expansion.

- The dark store network has surpassed 5,000+ locations, averaging ~1,200 orders/day.

Despite being built on low-volatility categories like grocery and personal care, Quick Commerce has evolved into a high-velocity GMV engine.

- Food Tech: Stable, Habit-Driven Growth with Strong Urban Depth

Food Tech continues to deliver consistent, habit-driven demand, an important signal for listed platforms, restaurant chains, cloud kitchens, aggregators, and delivery ecosystems.

- GMV has grown ~17% in the first 10 months of CY2025.

- The top eight cities, now contributing ~68% of GMV, are growing closer to 20%.

- MTUs rising at 12–15%, with frequency steady at 4.5��5 orders/month, underline the sector’s stability.

This is now a mature category with predictable quarterly performance supported by cuisine depth, loyalty penetration, and rising repeat cohorts.

Category-Led E-Commerce: The Demand Mix Shaping Listed Brands & Marketplaces

Beyond high-frequency categories, several category-focused segments are showing strong momentum, many of which have meaningful representation across India’s public market universe (FMCG majors, beauty companies, fashion houses, and diversified marketplaces).

- Value Commerce (ASP < INR 350): A Fast-Expanding Volume Engine

The most surprising acceleration has come from the low-ASP segment, which has become a powerful source of incremental volume for marketplaces and long-tail sellers.

- Growing at more than 2× the speed of overall online retail.

- Tier 2+ users are driving higher traffic and conversion uplift.

- Rapid assortment expansion across Home, Beauty, and Electronics is deepening engagement.

This segment has implications for listed general-merchandise players, consumer staples, personal care brands, and e-commerce enablers that support low-price, high-volume fulfilment.

- Beauty & Personal Care (ex–Q-Comm): A High-Penetration, High-Momentum Category

With ~20% online penetration and ~26% Tier 2+ growth, BPC continues to be one of the most structurally attractive categories for public markets, particularly for FMCG majors, speciality beauty companies, and omnichannel retail groups.

- Grooming and makeup are driving penetration deeper into mass and masstige segments.

- Strong replenishment behaviour continues to strengthen digital contribution for listed beauty and FMCG portfolios.

- Fashion – A Broad-Based, Year-Round Driver of Digital Growth

Online fashion has sustained 10–12% annual growth, with the category now behaving more like a continuous, micro-occasion-driven market rather than a festival-centred one.

- This shift reduces quarterly volatility and stabilises digital contribution for apparel brands, footwear players, and lifestyle retailers.

- Increasing marketplace penetration and steady online adoption support predictable volume growth.

Summary for Public Market Investors

Across Jan–Oct 2025, Internet sector growth relevant to public markets has been shaped by habit-driven frequency at the top and category-specific acceleration from Tier 2+ at the base.

High-frequency categories such as Quick Commerce and Food Tech are delivering the most visible and sustainable compounding, directly influencing listed adjacencies in logistics, FMCG, retail supply chain, and urban fulfilment.

Simultaneously, category-focused segments, Value Commerce, BPC, and Fashion are expanding rapidly, reshaping the demand profile for listed FMCG majors, beauty specialists, fashion houses, and e-commerce marketplaces.

As the market moves into CY2026, growth visibility is improving, volatility is reducing, and mainstream retail categories are accelerating online adoption; strengthening the relevance of these sectors for public equity investors.

The insights have been derived from Redseer ‘Benchmarks’, the most reliable insights platform on the India Internet Landscape

Written by

Nikhil Dalal

Associate Partner

Nikhil has experience working with Cognizant in business development and strategy roles for the US healthcare sector. He appreciates analysing issues, solving complex problems, and case studies.

Talk to me