Who’s Winning in India’s Dating & Matrimony Market—and where are the opportunities for Platforms and Investors

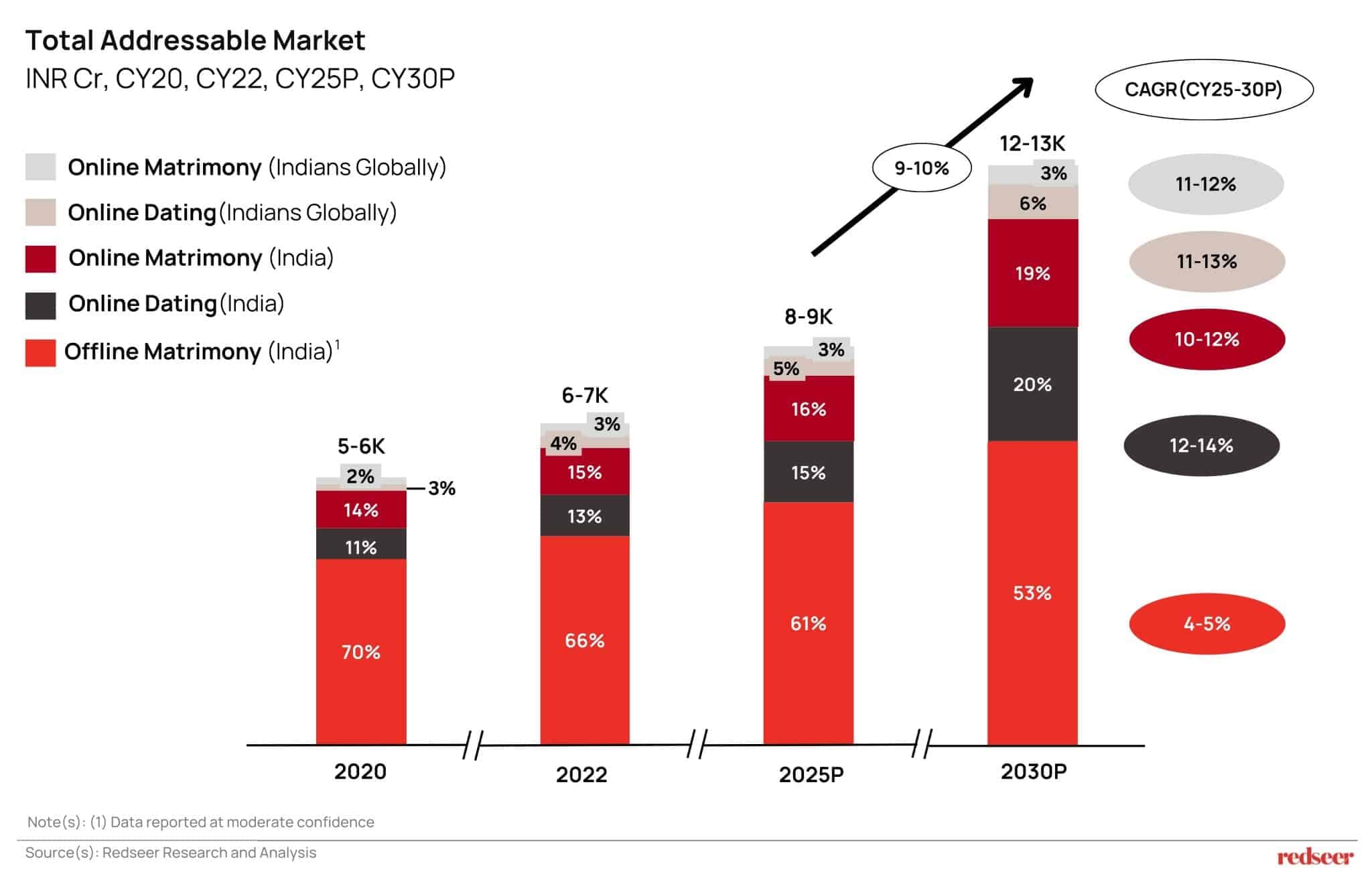

The Indian dating and matrimony landscape is undergoing a fundamental transformation. What was once dominated by newspaper classifieds and family networks has evolved into a sophisticated digital ecosystem serving millions of users across India and the global Indian diaspora. With more Indians at home and abroad warming up to the idea of meeting potential matches online, this space represents a significant opportunity, with the total addressable market growing at a robust 9-10% CAGR.

This growth is particularly significant, considering the declining engagement on dating apps globally. A popular swipe-based app reported a 7% y-o-y decline in monthly paying users in Q3 2025. More than 75% of Gen Z users on these apps reported “swiping fatigue” – burnout from superficial, photo-based match selection. On the other hand, apps that are positioned as the go-to for ‘serious’ dating reported a 17% increase in paying users. This signals an important pivot from the ‘swipe’-first model to authentic, intentional matchmaking. Around the world, people are seeking companionship built on a foundation of authentic circles, shared experiences, in-person connection, and relationship coaching.

Who makes up the Indian market?

Build new product innovation and market strategy.

The Indian dating and matrimony market comprises several distinct segments, each with unique characteristics and growth trajectories. The market breaks down into online dating, online matrimony, and offline matrimony within India, alongside a growing opportunity among Indians globally.

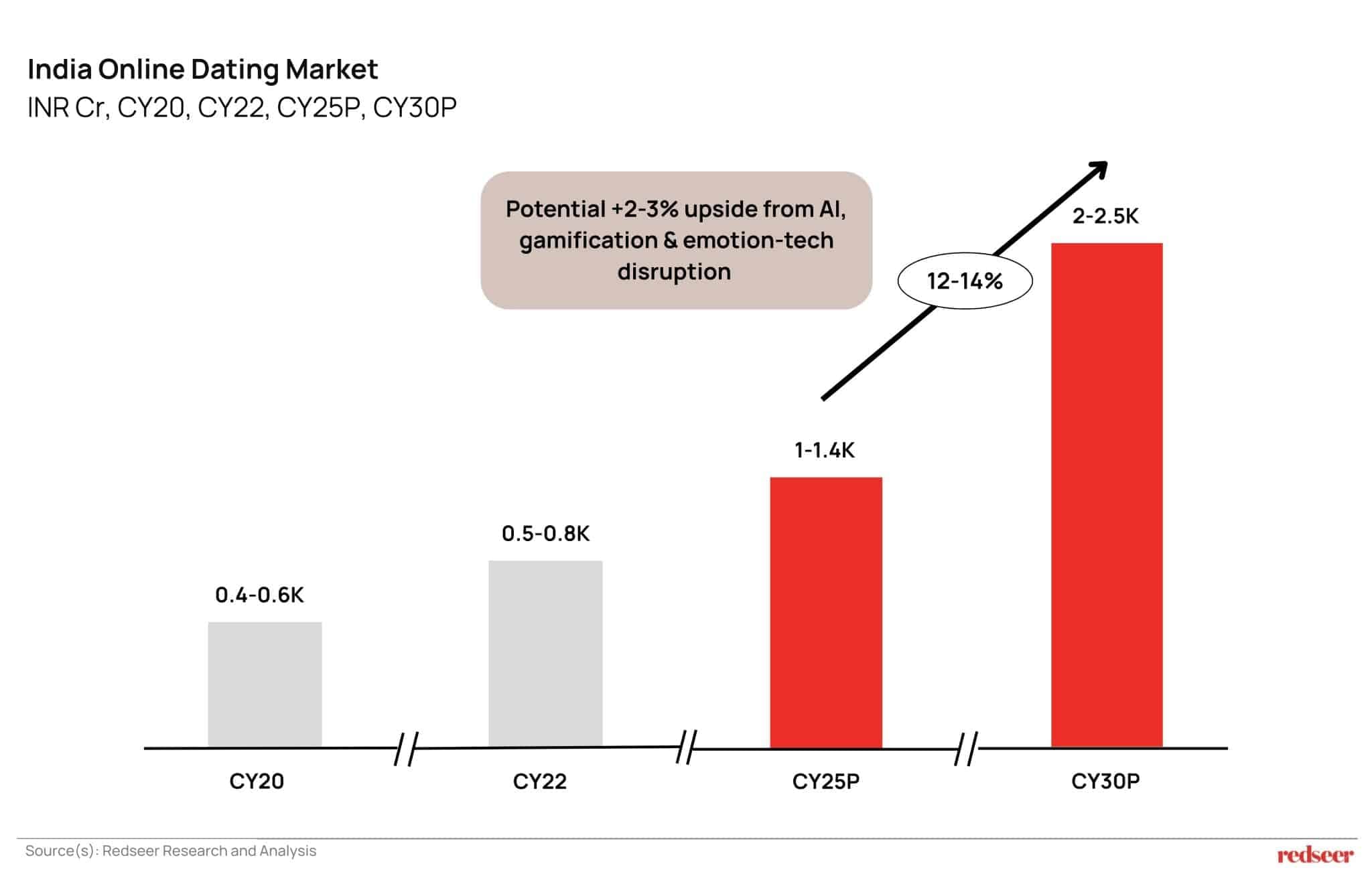

The online dating segment in India is expected to expand to INR 2-2.5k crores by 2030. This growth is particularly noteworthy given the country’s cultural context, where dating apps previously faced adoption challenges.

In the past few years however, their uptake has been propelled by the surge of Tier-2 and Tier-3 city adoption led by homegrown players like QuackQuack, Schmooze, and Aisle; cultural and linguistic customisation with apps like Aisle’s regional variants (Arike, Anbe, Neetho, Neene) adding new user bases; and enhanced trust and safety measures through ID verification and AI moderation that are boosting user confidence.

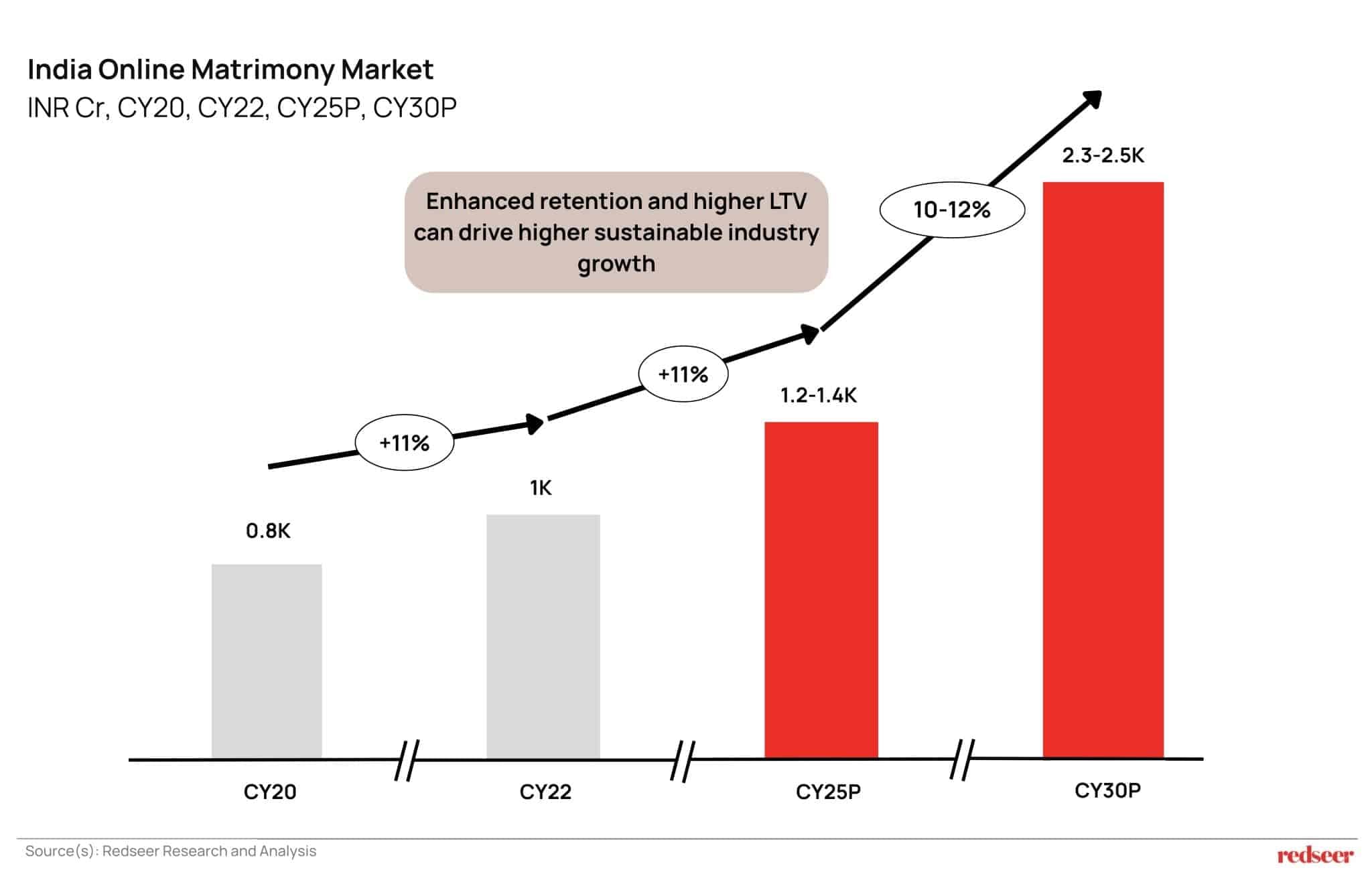

Online matrimony platforms form an INR 1.2-1.4k-crore market, poised to roughly double by 2030. These platforms benefit from greater cultural acceptance, favourable demographics, with a large marriageable-age population (25-34 years) expanding the potential user pool and rising disposable incomes, which fuel both adoption and conversion rates.

Additionally, there’s been a notable shift in cultural attitudes, with increasing comfort around online matchmaking over traditional arranged setups and greater acceptance of self-directed partner choice among younger cohorts. The role of parents has evolved from being the sole users to ‘co-pilots’. This is mirrored in the way the platforms are designed, as well as the selection criteria among users.

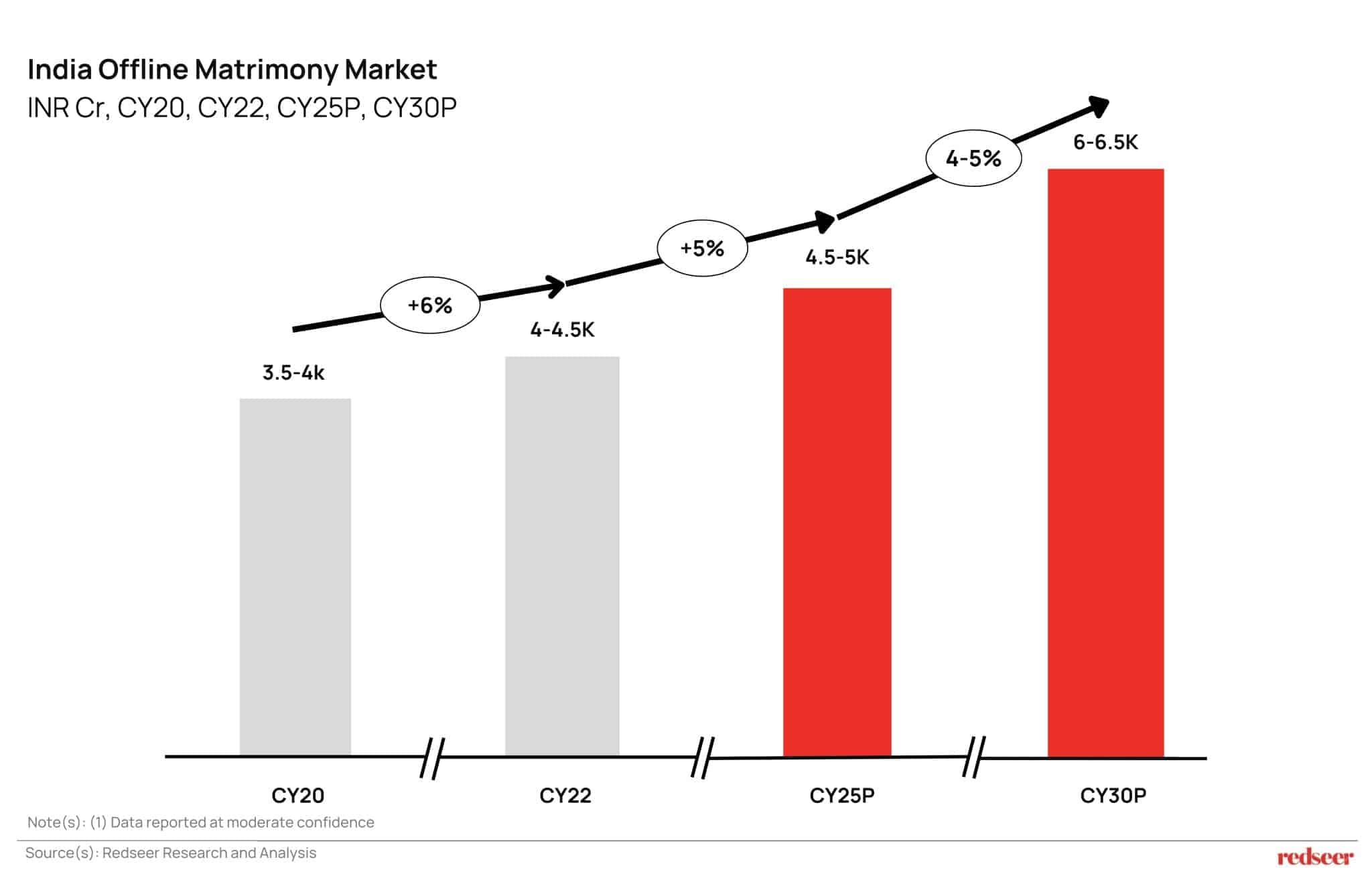

The offline matrimony segment, estimated to be at INR 4.5-5k crores in 2025, is expanding at a more modest 4-5% CAGR. This segment primarily comprises marriage bureaus, community organisations, and newspaper classifieds. Despite slower growth, offline channels remain relevant, particularly for older demographics and in markets where digital adoption lags.

The Indian Diaspora Opportunity

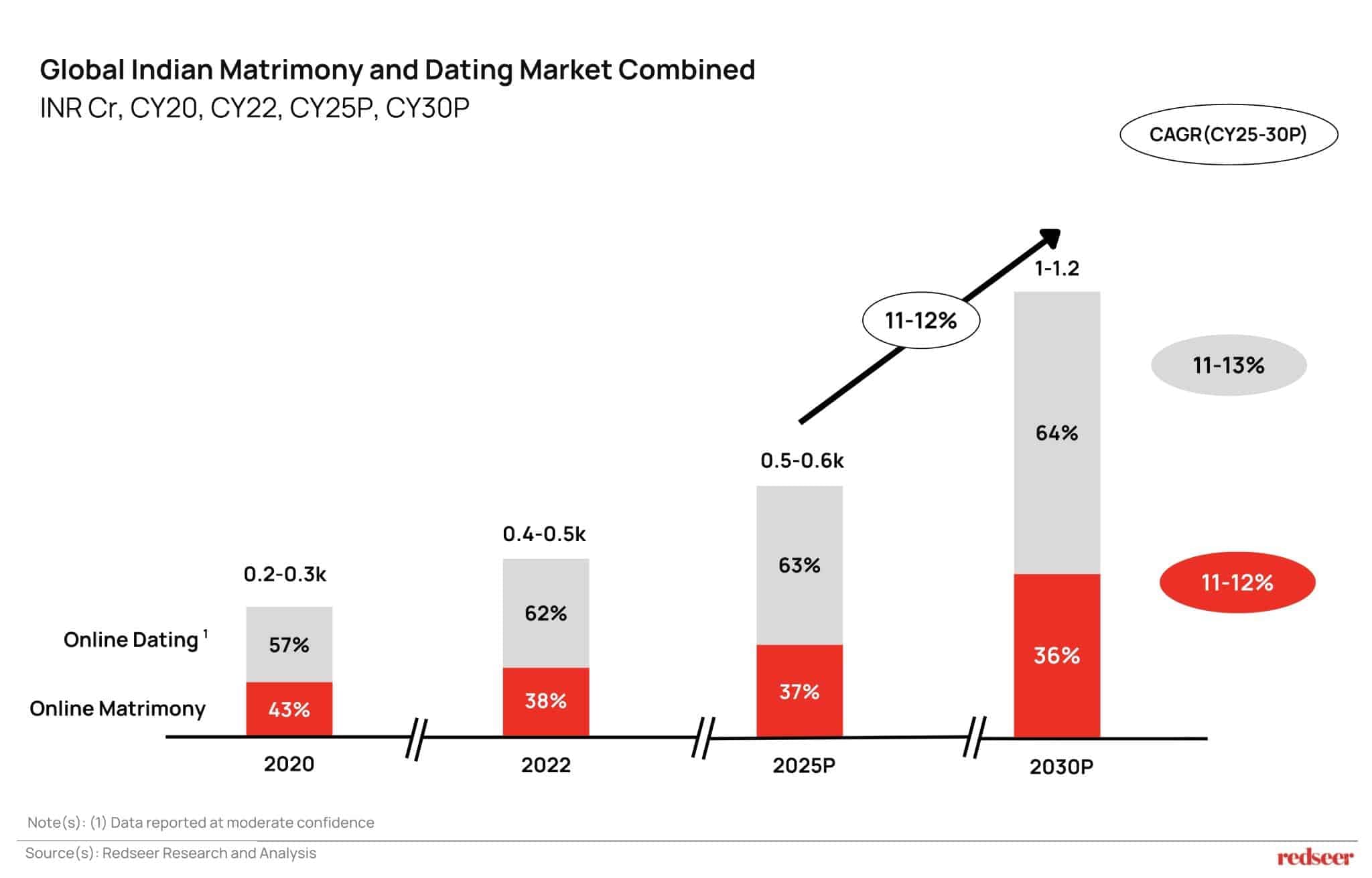

Beyond India’s borders, the Indian diaspora represents an emerging market opportunity. As matchmaking norms among diaspora evolve, the global Indian online dating and matrimony market is projected to grow to INR 1-1.2k crores by 2030.

This growth is driven by rising online adoption, with approximately 15% of diaspora couples meeting online today, and projected to reach 27% by 2030. This is complemented by the emergence of niche platforms like Dil Mil that focus on shared community and cultural identity. The diaspora market also demonstrates higher monetisation potential, with greater willingness to pay for premium services compared to domestic users, and stronger retention due to the serious nature of matchmaking and family involvement.

The growth patterns of online dating and matrimony highlight India’s accelerating shift toward digital matchmaking. As of 2025, online matrimony and online dating together account for ~30% of the addressable market, reflecting steady gains since 2022. These online segments are expected to continue expanding at a 10-15% CAGR through 2030, significantly outpacing the offline category. By 2030, digital matchmaking is expected to contribute >40% of the overall opportunity, reinforcing the growing comfort of Indians with meeting partners through online platforms.

This evolution mirrors global patterns while maintaining distinctly Indian characteristics. The global online dating market, valued at INR 70-75k crores today, is projected to reach INR 100-110k crores by 2030, driven by higher monetisation through premium tiers and smarter pricing, greater penetration as a result of expanding internet access, and category expansion into adjacent use cases like friendship and networking. India’s market has caught up with these global trends while retaining its focus on serious matchmaking over casual dating – a cultural distinction that shapes the entire ecosystem. Building on this foundation, the market has moved from traditional, community-led matchmaking to online matrimony platforms and is now entering an AI-driven phase. Players such as Verona, Knot.dating and Betterhalf.ai are redefining the experience with personalised matching, deeper verification, and intent-led journeys tailored to Indian preferences.

Who dominates the Indian landscape?

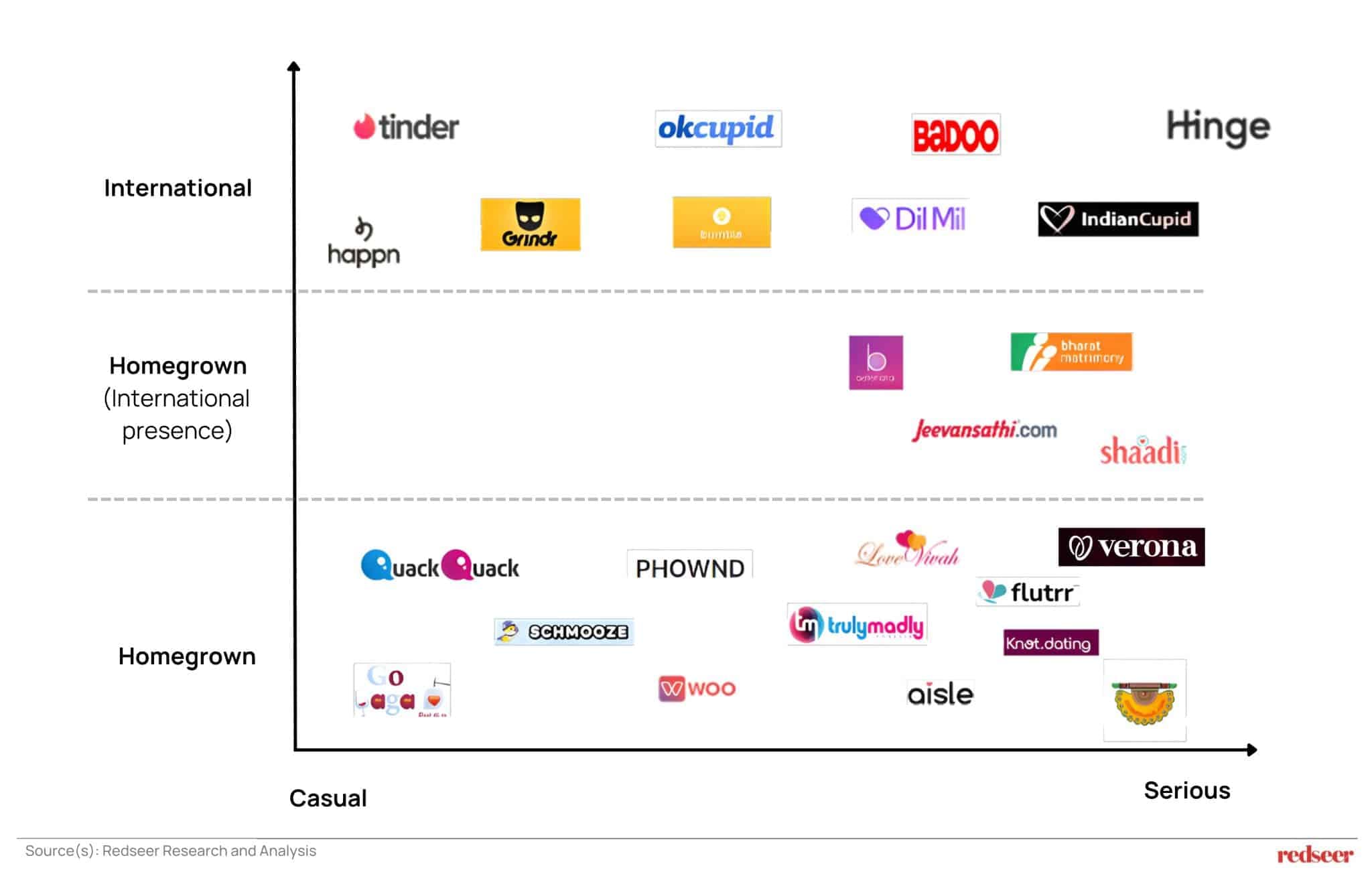

India’s matrimony ecosystem is anchored by homegrown platforms, with Shaadi.com and Bharat Matrimony at the forefront, followed by Jeevansathi. Notably, there is a large user overlap among these three platforms, which shows that users seek to maximise their matchmaking chances by accessing a wider set of profiles. In addition, a new wave of modern, experience-led platforms such as Verona, Schmooze, and Knot.dating are emerging, targeting younger, urban users who seek a more personalised and contemporary matchmaking experience.

The dating landscape features a mix of international and domestic players, with a more diverse array of offerings compared to the ‘marriage-first’ positioning of matrimonial sites. International apps like Tinder, Bumble and Hinge compete with homegrown platforms like Verona, Aisle, QuackQuack and TrulyMadly.

Each player has carved out its distinct positioning. Hinge focuses on relationship-oriented dating with its “Designed to be deleted” philosophy, while Aisle and its regional variants target serious relationships within specific linguistic communities.

Emerging Trends and Opportunities

Several trends are reshaping the market and creating opportunities for new-age players. Gen Z users are embracing “Quantum Dating” – exploratory dating for self-discovery – and favouring intentional slow dating with an emphasis on emotional maturity. There is a growing demand for niche and hyper-local apps focused on unique user experiences, lifestyle choices, and regional cultures, evident from the emergence of meme-based platforms like Schmooze and regional apps like Arike and Neene.

In matrimony, platforms are addressing previously underserved segments, such as individuals seeking second marriages and senior companionship with dedicated counselling and verification services; LGBTQ+ inclusivity through platforms like Matrimony.com’s RainbowLuv; and assisted matrimonial services for users seeking human-led personalisation despite digital tools. Technological innovation – such as AI-driven matching, video/voice interaction tools, psychometric testing, and hyper-local filters – is making matchmaking more secure, personalised, and value-driven, as offered by platforms like Verona, Knot.dating, and Betterhalf.ai.

Challenges for new and incumbent platforms

Despite the opportunity, the industry faces persistent challenges. Monetisation remains difficult, with only 5-15% of monthly active users typically upgrading to premium plans, resulting in high acquisition costs and low lifetime value for many players. There is a sharp gender imbalance, with women reported to represent approximately 26% of users on Indian dating platforms, creating a skewed dynamic where women face excess attention while men struggle for visibility. Technology and algorithm limitations continue, as matching based on basic biodata often misses compatibility on deeper values. Users’ trust in participants’ authenticity remains low with the rise of AI-driven fraud risks like deepfakes.

The Road Ahead

India’s dating and matrimony landscape is entering a new phase of maturity – one shaped by deeper digital adoption, evolving relationship intent, and rising expectations around trust, safety, and authenticity. While the INR 13,000 crore opportunity highlights strong market momentum, the real unlock for the next wave of platforms will come from how effectively they solve for user trust, experience quality, and cultural relevance.

Going forward, players must prioritise sharper positioning, product sophistication, and robust safety protocols rather than just scale and acquisition. Consumer behaviour is shifting clearly: Gen Z is signalling intent-driven dating, users expect curated and meaningful matches over swiping fatigue, and safety (ID verification, AI-driven fraud detection, behavioural monitoring) is becoming a non-negotiable hygiene factor. Platforms like Verona, Betterhalf.ai and Knot.dating exemplify this shift by building more personalised, experience-led journeys.

At the same time, data governance and PI protocols will be critical. As platforms collect sensitive personal data – including identity, preferences, behavioural signals – operators will need clear frameworks around consent, storage, algorithmic transparency, and responsible AI use. A strong stance on safety and data protection will increasingly become a competitive differentiator, not merely a compliance requirement.

For investors, the roadmap is equally compelling. With online matrimony and dating growing faster than offline channels, the market rewards platforms that:

- build deep trust moats (verification, fraud detection, robust moderation)

- deliver meaningful improvements to match quality

- localise by culture, community, language, and relationship intent

- show strong unit economics through paid conversion, retention, and LTV lift

As the category fragments by community, region, life stage, and intent, brands that combine cultural sensitivity, tech-enabled personalisation, and uncompromising trust and safety standards stand to capture disproportionate value. The next leaders will not just connect people – they will deliver secure, high-intent, and emotionally resonant matchmaking experiences tailored to India’s rapidly changing social fabric.

Written by

Jasbir S Juneja

Partner

Jasbir is a Chemical Engineer with a bachelor's in technology from the Indian Institute of Technology. Jasbir has worked with numerous high-profile clients in every industry to develop result-delivering strategies at Redseer Strategy Consultants.

Talk to me