The New Age of Borrowing: A Generational Shift Towards Digital Lending

Imagine a world where getting a loan is as easy as ordering a pizza. No long queues, no mountains of paperwork—just a few taps on your smartphone, and you’re set. Welcome to the new age of borrowing, which is on the brink of a major transformation, driven by the borrowing behaviors of Gen Z (aged 18-25) and millennials (aged 26-38). These younger generations are not just users of financial services but catalysts for change, shaping the market trajectory in unprecedented ways.

Want to evaluate new investment and M&A opportunities?

The retail lending landscape in India is undergoing a transformation, led by these younger generations. Our experts at Redcore have uncovered some fascinating trends: Gen Z, with their inherent tech-savviness, are not just open to borrowing—they’re leading the charge towards digital financial platforms for their financial needs and exploring new credit use cases like consumer durable loans and travel loans. This paradigm shift is redefining how loans are accessed and utilized, with an emphasis on digital-first solutions.

So, what does this mean for the future of retail lending in India? Let’s break it down and explore how the borrowing trends across Gen Z and millennials are driving the market, and showcase the growing potential of the digital lending space.

Comparing India with Global Benchmarks

India’s retail credit presents a substantial growth opportunity, even when compared to developing economies like China, and Brazil. For instance, household debt per capita in these nations surpasses that of India, underscoring a substantial growth potential within the Indian lending market. This gap isn’t just an opportunity for lenders—it underscores the need to educate more Indians, especially in rural areas, about the benefits of formal credit.

Diverse Borrowing Patterns Across India’s Income Groups

Borrowing patterns of various income groups differ vastly where the crème is catered by traditional banks followed by digital lenders and NBFCs in the middle income groups.

Now, let’s take a detailed look at how different income groups in India are borrowing:

- The Affluent: Households earning over USD 25,000 or INR 20 lakhs annually have high credit penetration rates. They mostly stick to traditional banks which offer a wide range of credit products tailored to meet their diverse financial needs.

- Middle Income: These households, are credit-active but prefer to keep it flexible and use both traditional and digital lending services. Instant personal loan platforms and BNPL services are popular here.

- Low Income: Often underserved by traditional banks, this group is turning to digital lenders for their ease of access and convenience. The less affluent groups, classified as credit-worthy but underserved, rely increasingly on digital lenders due to their accessibility and convenience.

- Non-bankable: Earning less than INR 2.8 lakhs per annum, this segment remains largely untapped but holds huge potential for growth.

Overall, India offers rising new to-credit (NTC) customers with intent and eligibility for credit but lacking credit history.

The Digital Lending Boom

Although our study shows that traditional banks still rule the roost among the wealthy, digital lenders are quickly making their mark. Instant personal loan services are becoming popular with younger borrowers as these platforms offer instant loans through easy online processes, making them a hit with tech-savvy Gen Z and millennials.

The data from FY 22 to FY 24 highlights a significant growth in digital lending, which has increased from 1.8% to approximately 2.5% of the total retail loans disbursed. And it’s not stopping there—by FY 28, digital lending is expected to make up about 5% of the market, growing at a whopping 40% CAGR.

This rapid growth is driven by a digital push from the players leading to increased adoption across all age groups. Gen Z, in particular, along with millennials shows a higher penetration in digital lending compared to older age groups. They favor digital solutions for their financial needs due to the convenience and speed offered by the new-age players.

Now, Let’s examine the entire retail loan market: Gen Z contributes INR 3.5-4 lakh crore to retail loan disbursals, millennials account for INR 25-28 lakh crore, and the remaining disbursals total INR 28-30 lakh crore

Borrowing Patterns in Gen Z and Millennials

GenZ are often overlooked by traditional lenders and categorized as less attractive as they are new to credit and lack credit history. However, digital lending has made significant inroads with this demographic, offering tailored financial products and achieving notable disbursals.

Comparing Borrowing Habits: Personal Loans and Credit Card Preferences in Millenials and GenZ

- Personal Loans: Personal loans make up about 40% of their borrowing, often used for things like travel and technology upgrades. Millennials on the other hand make up only 21% of personal loans, reflecting a lesser reliance on this category compared to Gen Z. This can be attributed to the different life stages and financial needs of the two cohorts.

- Credit Card Spends: For millennials, credit card spending accounts for approximately 30% of their retail loan disbursals, marking it as a substantial segment in their financial portfolio. In contrast, while personal loans dominate for Gen Z, credit card spending constitutes a significant category

- Diverse Financial Needs: Interestingly, the ‘Others’ category, encompassing loans like gold loans, education loans, agriculture loans, and more, holds significant importance for millennials, comprising a notable share of their loan portfolio. This diversity can be attributed to varied educational pursuits and career stages among millennials.

Gen Z’s Digital Borrowing Surge Signals a Bright Future

Let’s look at this comparison here. The value and volume penetration of digital loans is significantly higher for Gen Z compared to millennials and other demographics. The substantial volume of digital loans underscores the fact that more Gen Z individuals are embracing this convenient and accessible financial solution.

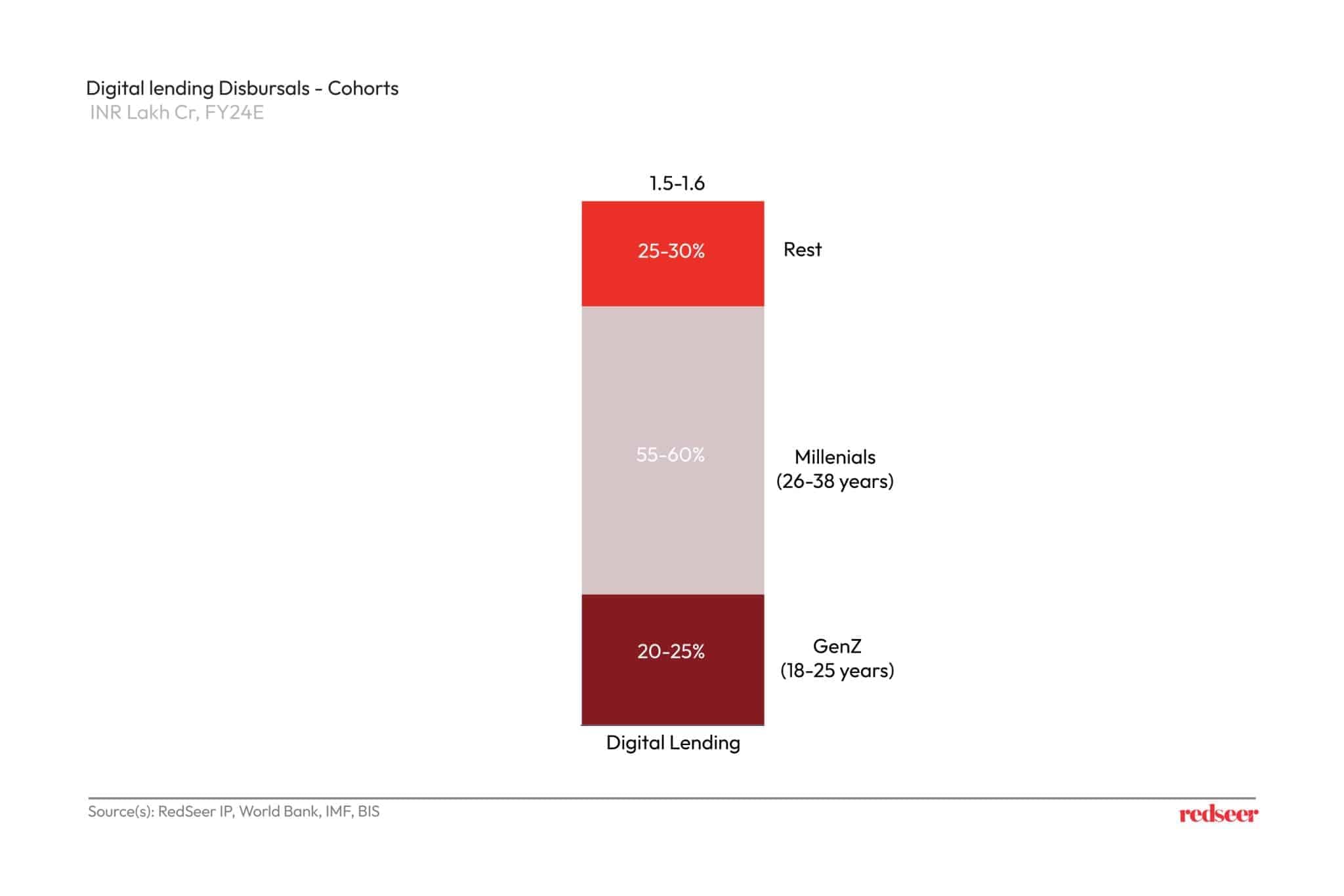

Even though Gen Z individuals are not the largest borrowers, they still comprise 20-25% of the loans disbursed through digital lending platforms.

Unlocking India’s Gen Z Credit Potential

The proportion of credit-active Gen Z individuals in India (15-20%) has room to rise significantly, offering substantial growth potential compared to other economies like South Africa (35-40%), China (40-45%), and the USA (75%). This means that there is significant growth potential for India’s credit-active Gen Z segment to adopt financial lending services. There is ample opportunity to expand and deepen the penetration of lending products among India’s Gen Z population. As this demographic matures and gains financial autonomy, there is potential for increased adoption of credit products, thereby fostering growth in the retail lending market.

The Future of Retail Lending

Gen Z in India is already reshaping lending dynamics with a preference for experiences over possessions, often borrowing for travel and related expenditures, emphasizing experiential consumption trends. This shift highlights the potential for growth in the retail lending sector.

As Gen Z continues to mature and millennials advance in their careers, the demand for diverse credit products will likely expand. The younger generation’s familiarity with digital platforms will drive further innovation and competition in the lending market.

For example, a recent graduate might initially rely on digital lenders for smaller personal loans to manage everyday expenses or purchase electronic gadgets. As they progress in their careers and their income stabilizes, they may seek larger loans for significant life events, such as purchasing a home or starting a business. This progression underscores the need for lenders to offer tailored products that evolve with borrowers’ changing financial needs.

Moreover, the increasing integration of AI and machine learning in digital lending platforms will enhance the customer experience, making loan approvals faster and more accurate. This technological advancement will further boost the appeal of digital lending among tech-savvy consumers.

As the market adapts to these changes, the future of retail lending in India looks promising, with digital innovation leading the way.

Are you looking to explore or capitalize on these trends? Connect with our leading industry expert, Jasbir S Juneja, and subscribe to our newsletter today for expert insights on other markets as well. Get the latest trends and analyses delivered straight to your inbox!

Written by

Jasbir S Juneja

Partner

Jasbir is a Chemical Engineer with a bachelor's in technology from the Indian Institute of Technology. Jasbir has worked with numerous high-profile clients in every industry to develop result-delivering strategies at Redseer Strategy Consultants.

Talk to me

UAE Ramadan 2026: Steady mood, sharper channel choices, and community-led influence

Meeting India’s Protein Goals: Lessons from the Branded Egg Market

The Sorted Generation: Gen X as India’s Hidden Consumer Powerhouse