Accelerated Digitization in India Internet Post COVID- Part 2

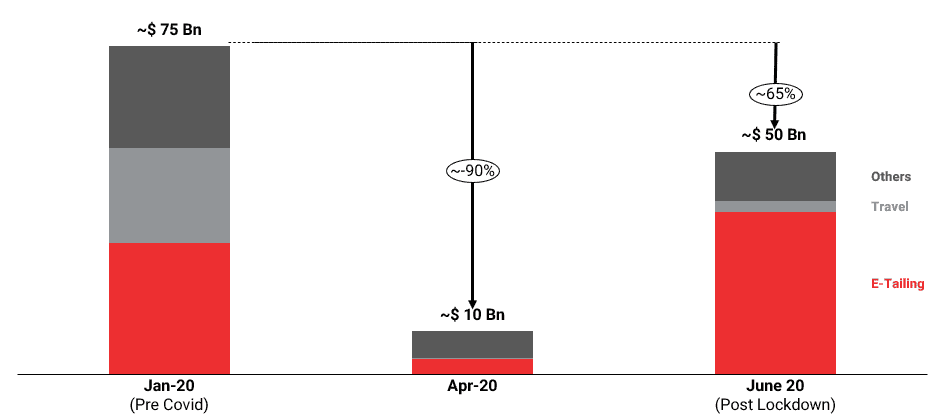

1. India Internet has shown a strong recovery in June- led by E-tailing sector

India Consumer Internet- Overall Market

Category Wise Mix, USD Bn (Monthly GMV, Annualised)

Note(s):

- Others includes Food Tech, Fintech (ex payments), Stay, mobility, EdTech and Classifieds

- Fintech (ex. payments) includes lending, insurance, and wealth management. It excludes Digital Payments such as wallets, UPI and other digital transactions

Contribution of E-Tailing to India Internet spiked massively as the category reached a USD 36 Bn Annualized GMV in June, +30% vs Jan.

However, other India Internet mainstays pre-COVID like travel sector will likely take a significantly longer time to recover as consumers are still wary of returning to their usual travel patterns.

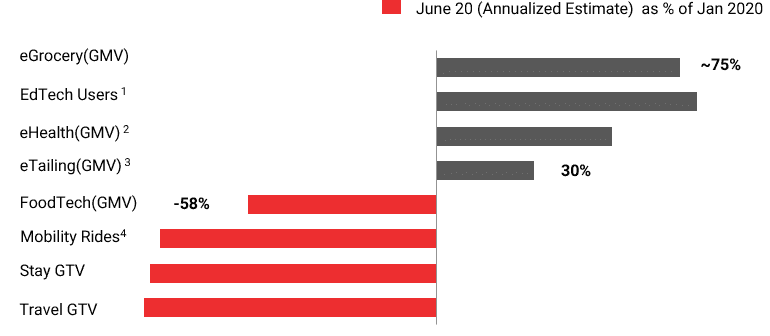

2. India Internet sharp recovery led to steep rise in digitization across sectors in June

India Consumer Internet- By Key Category

June’ 20 vs Jan 20 Estimate

Note(s):

- Free + Paid users for K12 EdTech

- Includes ePharma, eConsultation and eDiagnostics

- Includes all B2C eCommerce categories

- Only includes shared mobility

Online Penetration by Sector ($ value penetration)

As % sector total

Interesting pattern of sectoral recovery has been observed for India Internet in June. With biggest beneficiaries being eGrocery, Edtech and eHealth, followed overall E-tailing.

While the foodtech, travel and stay related sectors continue to struggle- although they are on recovery path.

Basis strong online growth for some of these sectors, online % total sale has spiked- most significantly in non-grocery retail category which is not reaching unheard of penetration levels owing to offline shutdowns. Definitely something for offline brands to pay close attention to.

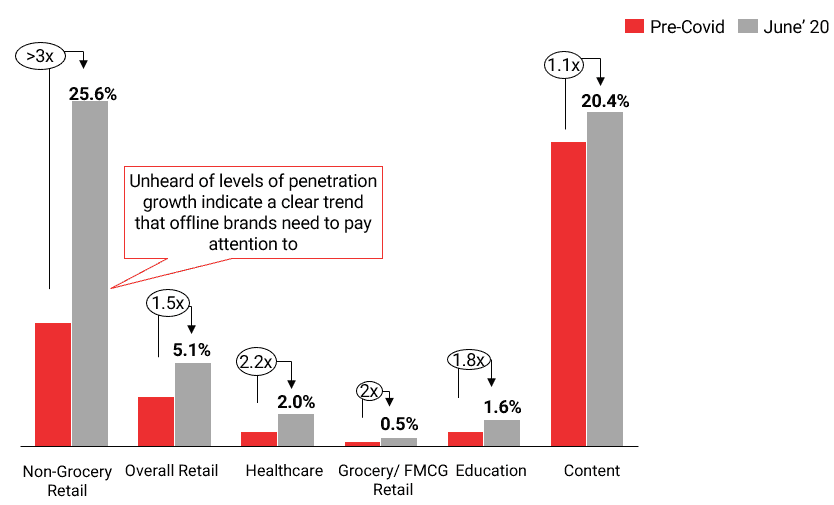

3. eHealth to be a strong COVID beneficiary- with business remaining sustainably higher than pre-COVID in June

eHealth: GMV – Recovery Curve (Indexed to 100)

Jan to 29 June’ 2020 (Jan 2020 = 100

Note(s):

- The curves represent the GMVs of various categories within eHealth, indexed to Jan 2020 levels

eHealth sector saw a slight correction in Apr-May, post sector GMV peak in March. Many of the acute first users didn’t stick as much.

Despite this overall correction, sub-category level trends in eHealth generally bullish. For example eConsultation remains on a dream run while eOTC is expanding rapidly.

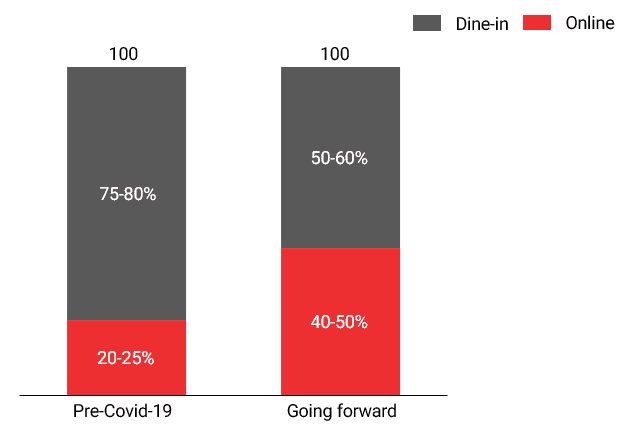

4. Even sectors like foodtech which are negatively hit by COVID will benefit from longer term digitization wave

Sales for restaurants by channel (online vs. offline)1

Restaurant owner interview

Note(s):

- As per RedSeer estimates for restaurants who deliver online as well as have dine-in facilities

Foodtech sector took the brunt of the COVID lockdown and associated challenges and has been massively impacted in short term.

However, longer term story is much more positive- owing to consumer concerns and restrictions around offline dining, online will become a significant business generator for restaurants post COVID.

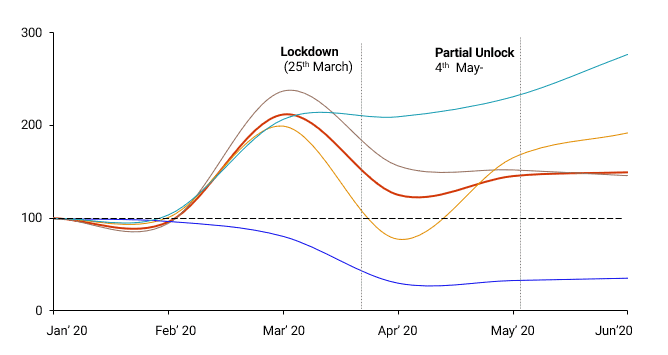

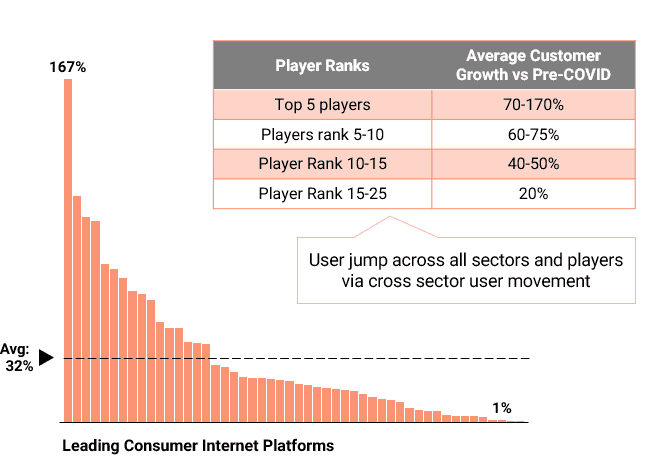

5. India Internet recovery was driven by high organic cross platform user growth- creating super-app opportunities

Growth in new users – by consumer internet players

During COVID, For ~50 players, ~8000 consumer surveys

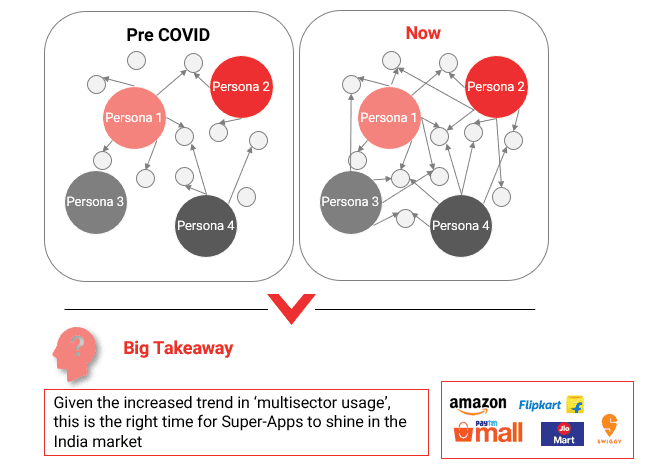

Leading to creation of more serious/holistic internet users who are using multiple sectors

Note(s):

- Each dot represents a consumer internet sector, whereas the bubble represents a consumer persona

Along with sector level benefits and recovery, the broad overall trend in India Internet during COVID is around existing online users becoming more serious or using many categories- thus driving up growth for multiple categories like eHealth and grocery.

We believe this indicates a tipping point of sorts for India Internet, a deepening of the ecosystem and an overall indicator of increase in ecosystem maturity. As a result, perhaps for the first time, ever the much-touted super-app strategy will become a viable one in the Indian context.

Written by

Rohan Agarwal

Partner

Rohan Agarwal has been a part of the Redseer Strategy Consultants journey for over six years. He is an expert in digital strategy for traditional corporates and start-ups.

Talk to me