Consumers Are Hoarding E-Waste—Because They Don’t Know Any Better

What happens to your old smartphone once you replace it with the latest model? Chances are, it’s sitting in a drawer, along with a tangled mess of chargers, earphones, and other outdated gadgets. Multiply this across millions of households, and the scale of India’s e-waste problem becomes evident.

Despite being one of the world’s largest producers of electronic waste, India lacks a well-established e-waste management system—a reality underscored by Redseer’s latest report, Recycling or Ruin? India’s E-Waste Future | Redseer Strategy. Our previous research highlighted that India’s e-waste generation has doubled from ~2 MMT in FY14 to ~4 MMT in FY24, fuelled by urbanization, rising disposable income, increasing digital adoption, in this study, we reveal that while e-waste continues to pile up in Indian households, a combination of limited awareness, systemic inefficiencies, and the lack of economic incentives is preventing its proper disposal.

The Awareness Gap: Many Consumers Don’t Know What E-Waste Is

Want to get strategic guidance?

Even with growing reliance on electronic devices, a staggering 60% of surveyed consumers report having limited to no understanding of e-waste. Worse, 18% have never even heard of the term.

For most consumers, e-waste is synonymous with mobile phones and laptops. However, the category extends far beyond these—refrigerators, air conditioners, televisions, and even household appliances like microwaves and irons contribute significantly to India’s mounting e-waste problem. The lack of awareness about what constitutes e-waste directly impacts how consumers store, discard, and recycle electronic items.

Why E-Waste Piles Up in Indian Homes?

Nearly 60% of Indian households have unused or broken electronic items lying around, with an average of three devices stored per home. The most commonly hoarded items? Consumer electronics—laptops, smartphones, and desktops—which 85% of households hold onto.

Moreover, 1 in 5 households that store e-waste at home, have stockpiled large appliances and temperature exchange devices, such as refrigerators and air conditioners, despite the fact that these bulky items occupy considerable space. This continues to happen even though exchange programs are widely available, making it easier for consumers to trade in or recycle these appliances.

But why do consumers hold onto e-waste items? Two key reasons stand out:

- Lack of Economic Incentives – Many consumers continue to hold onto e-waste primarily because they do not find sufficient economic incentives to dispose of it. They often assume that old electronic items can be reused or resold, leading them to store them indefinitely. However, the low resale value of individual devices discourages them from making the effort to sell. Additionally, some consumers prefer to accumulate multiple items and sell them in bulk, further delaying disposal. The perceived lack of financial gain makes holding onto e-waste a more appealing option than actively seeking ways to discard it.

- Systemic Deficiencies – Beyond economic factors, systemic inefficiencies also contribute to e-waste hoarding. Many consumers are unaware of proper disposal methods, making it difficult for them to take responsible action. Concerns over data privacy and security further discourage them from discarding old devices, as they fear potential misuse of personal information. Moreover, the disposal process itself is often seen as time-consuming and inconvenient, leading people to postpone it indefinitely. These systemic barriers reinforce the tendency to store e-waste at home rather than properly recycling or disposing of it.

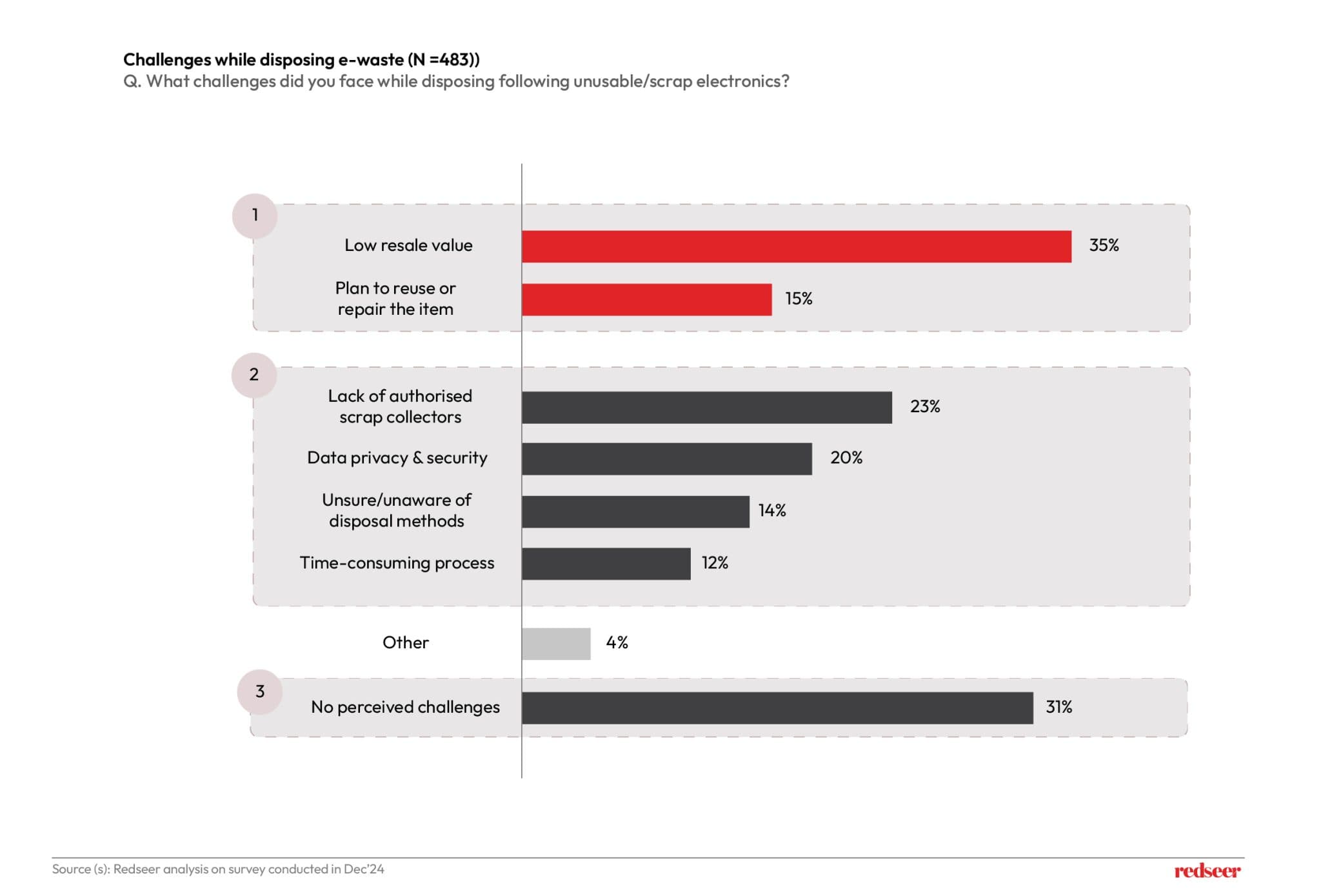

Disposal Remains a Challenge

Discarding e-waste remains a significant challenge for many consumers. Nearly 50% of the consumers, who disposed of e-waste in the past 1 year, reported the process of disposing ofg e-waste as not easy. This was more pronounced for the consumer electronics category, in particular, where 3 in 4 households disposing of it found the process uneasy.

A combination of factors makes e-waste disposal inconvenient across all categories:

1️. Low Perceived Value: Many consumers don’t see the economic benefit in recycling, leading to prolonged storage at home.

2️. Unavailability of Formal Collection Networks: 1 in 4 consumers cite the absence of authorized e-waste collectors as a major hurdle. The lack of doorstep collection services further discourages responsible disposal.

3️. Lack of Knowledge on Disposal Methods: One-third of consumers report no challenges in e-waste disposal, not because the process is smooth and convenient, but because they are unaware of proper e-waste management practices and environmental impacts.

The Informal Sector Dominates E-Waste Management

With limited awareness and formal recycling options, the informal sector has become the go-to channel for e-waste disposal. Consumers prefer exchanging old electronics when purchasing new ones, but this does not ensure responsible recycling. Instead, it often leads to improper handling, increased environmental hazards, and loss of valuable recoverable materials.

Awareness about recyclers that directly collect e-waste from consumers is extremely low—only 18% of consumers are aware that such services exist, and many can name just a single brand. Selsmart (by Attero) was one of the prominent players that consumers mentioned. The lack of visibility and accessibility of formal e-waste collection services remains a glaring gap in India’s e-waste management landscape.

Bridging the Gaps: The Way Forward

The scale of India’s e-waste challenge presents a significant opportunity for businesses, policymakers, and recycling firms to reshape the country’s approach to e-waste management. A multi-stakeholder strategy is crucial, with four key focus areas:

- Raising Awareness: Companies and regulatory bodies must launch targeted campaigns to educate consumers on what e-waste is and how to dispose of it responsibly.

- Building Economic Incentives: Offering attractive buyback programs and monetary rewards for recycling can encourage consumers to part with old devices.

- Expanding Formal Collection Networks: Establishing widespread, accessible drop-off points and D2C pickup services will drive higher engagement in formal recycling.

How can Redseer be a part of your E-Waste journey?

At Redseer Strategy Consultants, we don’t just analyze industries—we help shape them. Whether you are a consumer electronics brand, retail giant, or recycling startup, our data-driven insights and strategic expertise help you develop scalable solutions that align with India’s evolving regulatory landscape and consumer expectations.

From understanding market dynamics and identifying growth opportunities to building sustainable business models, we specialize in providing data-driven insights that empower businesses, policymakers, and industry stakeholders to navigate sector challenges and turn them into opportunities. Through commercial due diligence, market analysis, and strategic advisory, we enable our clients to drive growth, scalability, and long-term success.

The e-waste challenge is not just an environmental issue—it’s a business opportunity waiting to be unlocked. Let’s build a future where sustainability and profitability go hand in hand!

Written by

Jasbir S Juneja

Partner

Jasbir is a Chemical Engineer with a bachelor's in technology from the Indian Institute of Technology. Jasbir has worked with numerous high-profile clients in every industry to develop result-delivering strategies at Redseer Strategy Consultants.

Talk to me

Why Is India Losing $770 Million in Recyclable Metals Every Year?

Recycling or Ruin? The High-Stakes Battle for India’s E-Waste Future

Dancing with Dragons: Southeast Asia’s Guide to Competing and Collaborating with Chinese Giants