Digital First Companies Driving IPO Momentum in MENA

2024 was a pivotal year for MENA IPOs, marked by both continuity and change. Digital-first companies took center stage, with a notable increase in both the proceeds and the number of IPOs compared to 2023.

In this newsletter, we explore some key trends shaping the MENA IPO market in 2024. Read on to learn more:

1. Digital Companies contributed 32% of IPO proceeds, driven by an increase in deals and the marquee Talabat listing

Want to get strategic guidance?

In 2024, digital-first companies in the MENA region solidified their growing prominence in the IPO market, capturing 32% of total proceeds—a significant leap from 13% in 2023. Their share of IPO volume also climbed, rising from 10% in 2023 to 15% in 2024.

This remarkable growth was underscored by the landmark listing of Talabat Middle East, which alone accounted for 20% of the total IPO proceeds. The digital-first sector’s ability to capture nearly double the value relative to its volume highlights strong investor confidence in the scalability and resilience of these businesses. With such momentum, the digital-first sectors are poised to play an even greater role in shaping the region’s capital markets in the years ahead.

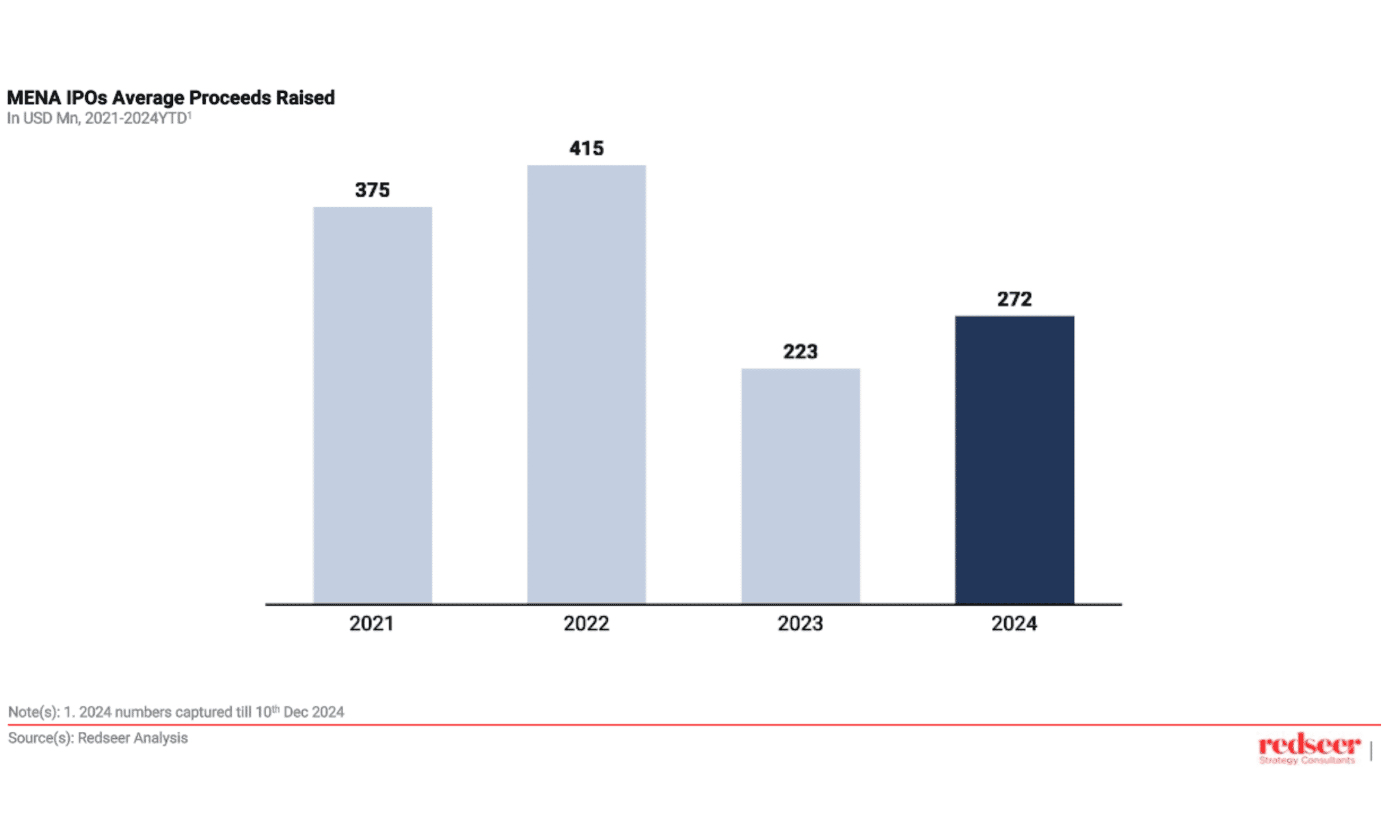

2. Deal sizes are trending smaller, reflecting stronger business models that are enabling faster IPOs

In recent years, the MENA region has experienced a shift in IPO dynamics, with deal sizes trending smaller. This evolution highlights the region’s growing maturity, where businesses are prioritizing efficient growth strategies over aggressive capital accumulation. With quicker timelines to IPOs, firms are signaling a shift from raising large sums to optimizing for long-term sustainability. The trend underscores an emerging confidence in the region’s market fundamentals and the ability of companies to thrive with leaner, more strategic funding.

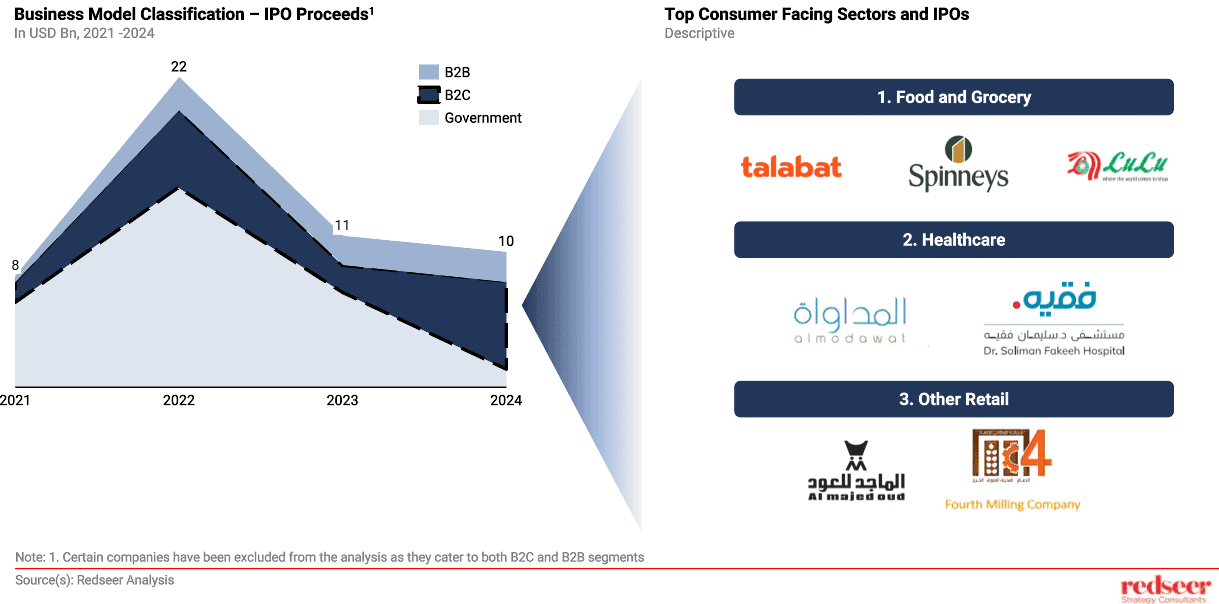

3. B2C sectors are on the rise, with Food & Grocery, Healthcare, and Retail as top sectors

The B2C sector in MENA is witnessing significant growth, propelled by the region’s ongoing efforts to diversify its economy and expand consumer-facing industries. A notable rise in workforce participation, especially among women and younger generations, has led to higher disposable incomes, creating a more vibrant consumer market. At the same time, the increasing availability of leisure and entertainment options is transforming consumer behavior, sparking demand for innovative products and services across the region.

2024 has paved the way for an exciting 2025, with the MENA IPO pipeline shaping up to be strong. Digital-first and B2C companies are poised to maintain their strong momentum. Stay tuned for our predictions for MENA IPOs in 2025 and beyond!

We hope you found these insights useful. Feel free to reach out to us for a more detailed conversation.

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me