Digital Rhino’s to drive >30% of IPOs in the region

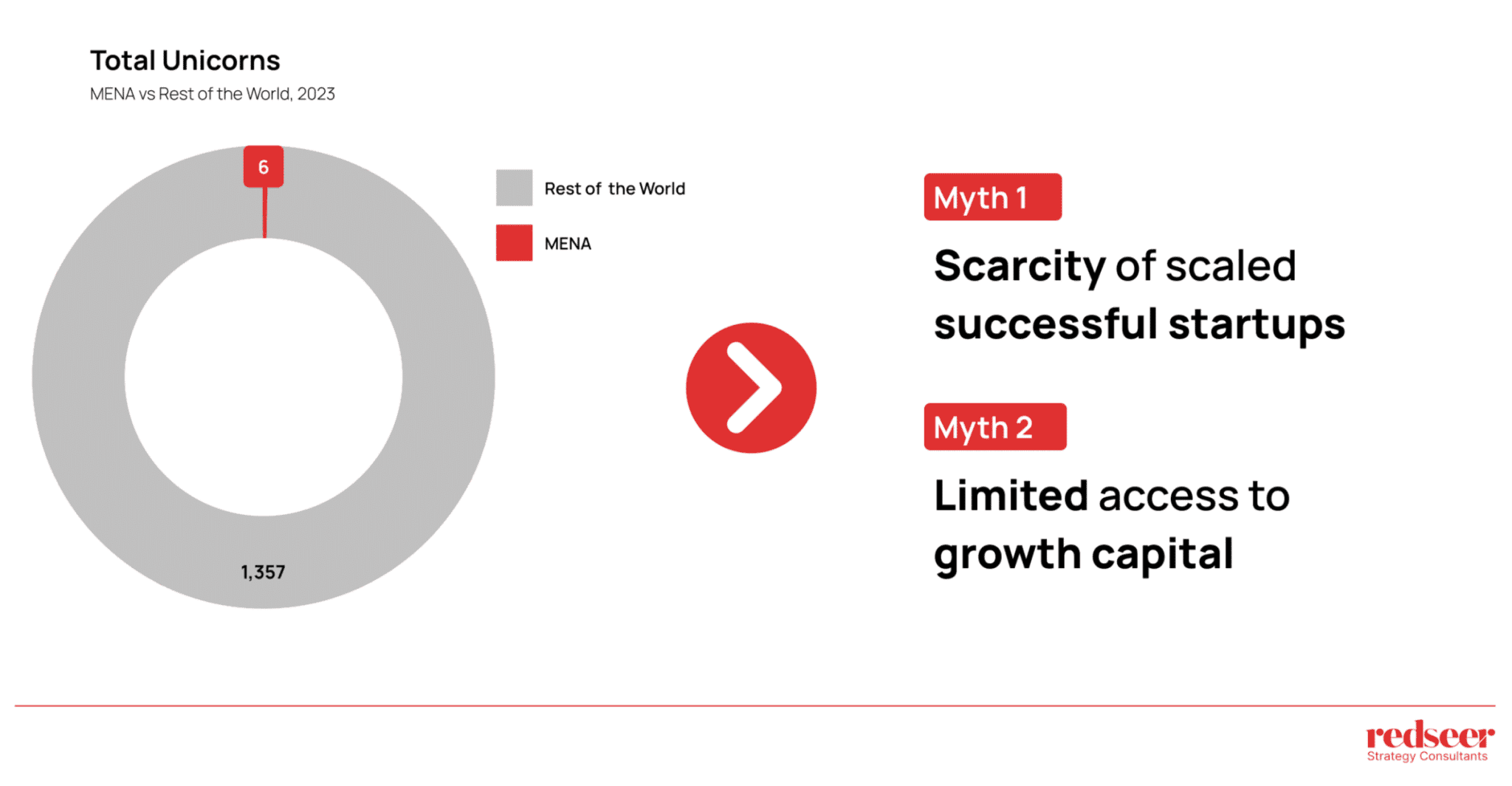

In recent discussions about the MENA region’s digital economy, two common notions emerge: the perceived scarcity of unicorns and the limited availability of growth capital. The idea that MENA lacks unicorns—companies valued over $1 billion—has been frequently highlighted and is partly true.

This article aims to challenge these misconceptions. Here’s what to expect:

- Debunking myths surrounding the MENA IPO landscape

- Introduction to “Rhinos”—businesses with realistic valuations, sustained growth, and profitability

- The future of IPOs and how Rhinos are driving the IPO economy

1. There are two popular IPO myths about MENA region – scarcity of scaled, successful startups & limited access to growth capital

Want to get strategic guidance?

The absence of unicorns in MENA doesn’t signify a lack of viable business opportunities. Instead, the region has focused on nurturing businesses that prioritize sustainable growth.

MENA is developing a strong pipeline of companies that value profitability and long-term stability, contrasting with the global trend of chasing rapid scaling at the expense of viability. This dispels the myth of a shortage of successful startups.

Moreover, MENA leverages innovative financing methods that diversify funding sources, such as government-backed funds, venture debt, and strategic partnerships. These mechanisms not only bridge the funding gap but also strengthen financial stability, debunking the notion of limited growth capital.

Thus, the perceived scarcity of unicorns and growth capital fails to reflect the region’s evolving business landscape.

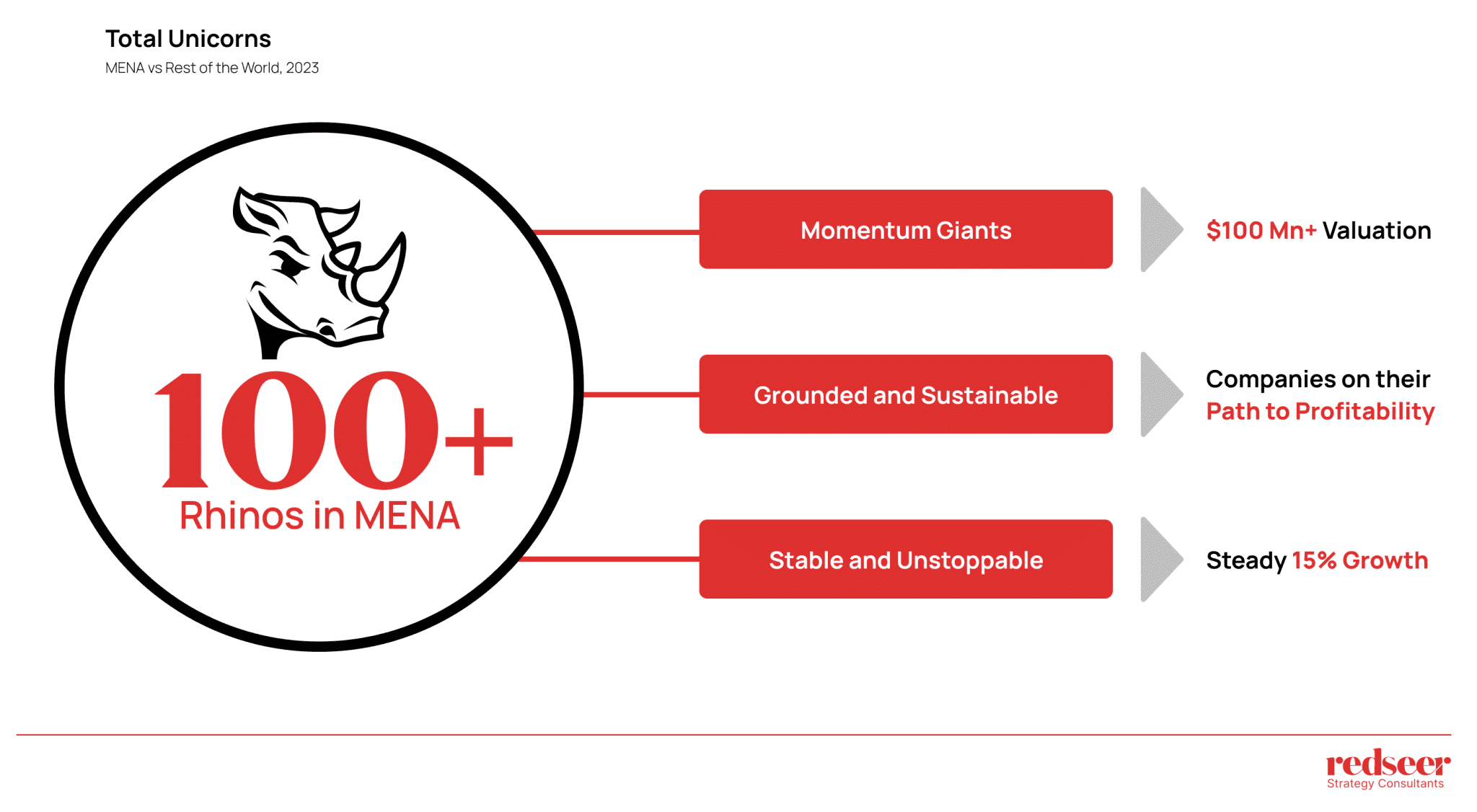

2. …However, while the world is chasing elusive unicorns, the region is quietly nurturing Rhinos

While the global market chases unicorns, MENA is cultivating its own grounded businesses, or as we called them- “Rhinos”. Rhinos represent a category of businesses with significant but more grounded valuations, sustained growth, and profitability:

- Momentum Giants: Holding valuations of $100 million or more.

- Grounded and Sustainable: Clearly on the path to profitability, focusing on long-term viability.

- Stable and Unstoppable: Demonstrating steady annual growth rates of 15% or more.

Rhinos are not merely about high valuations; they represent resilient, sustainable businesses that are pivotal to the region’s economic stability and growth

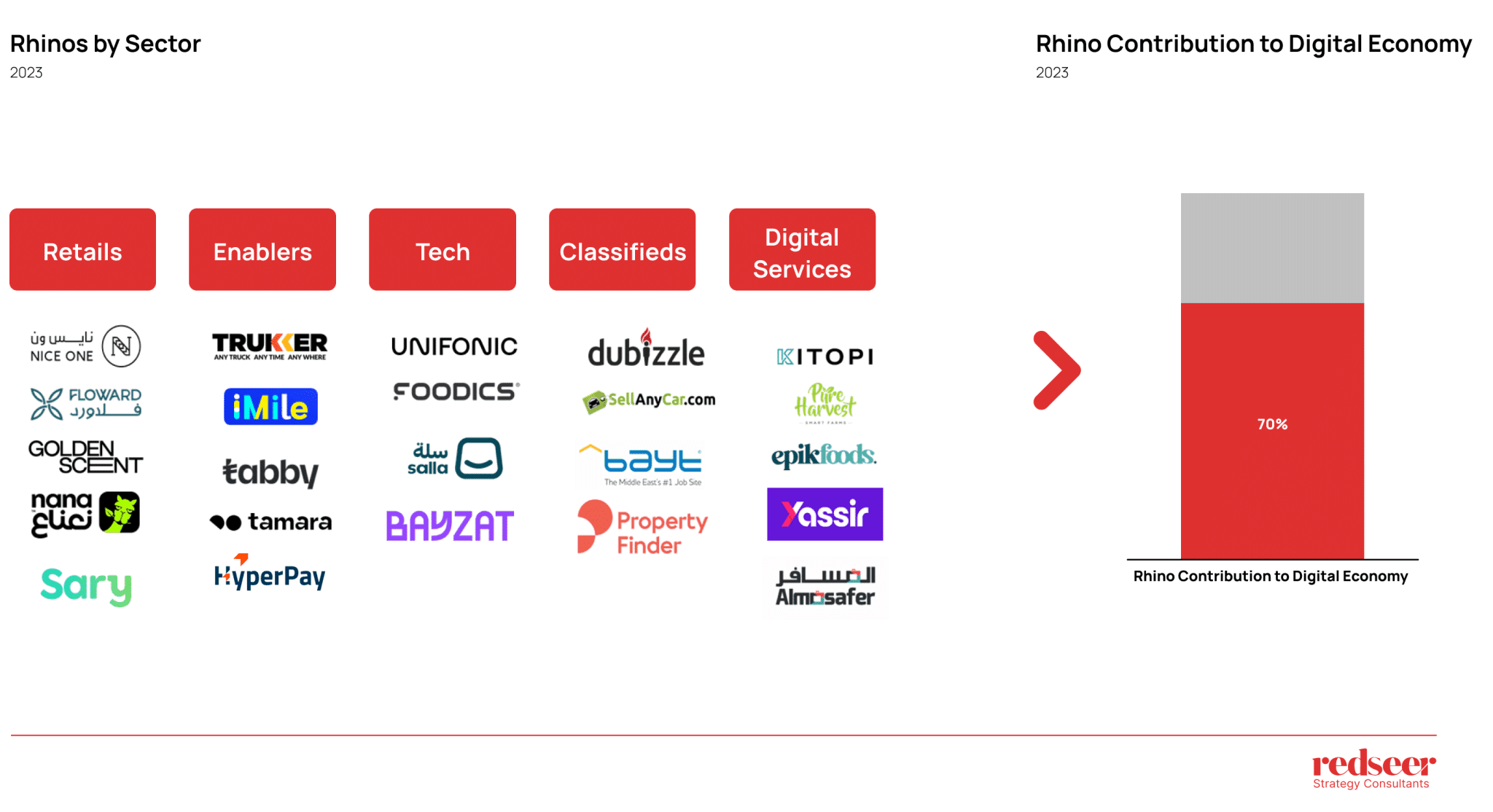

3. These Rhino’s exist across sectors and power ~70% of MENA’s Digital Economy

MENA’s digital economy is significantly powered by top Rhinos across five key sectors: retail, enabler, tech, classified, and digital service. The leading players in these sectors collectively contribute approximately 70% to the region’s digital economy.

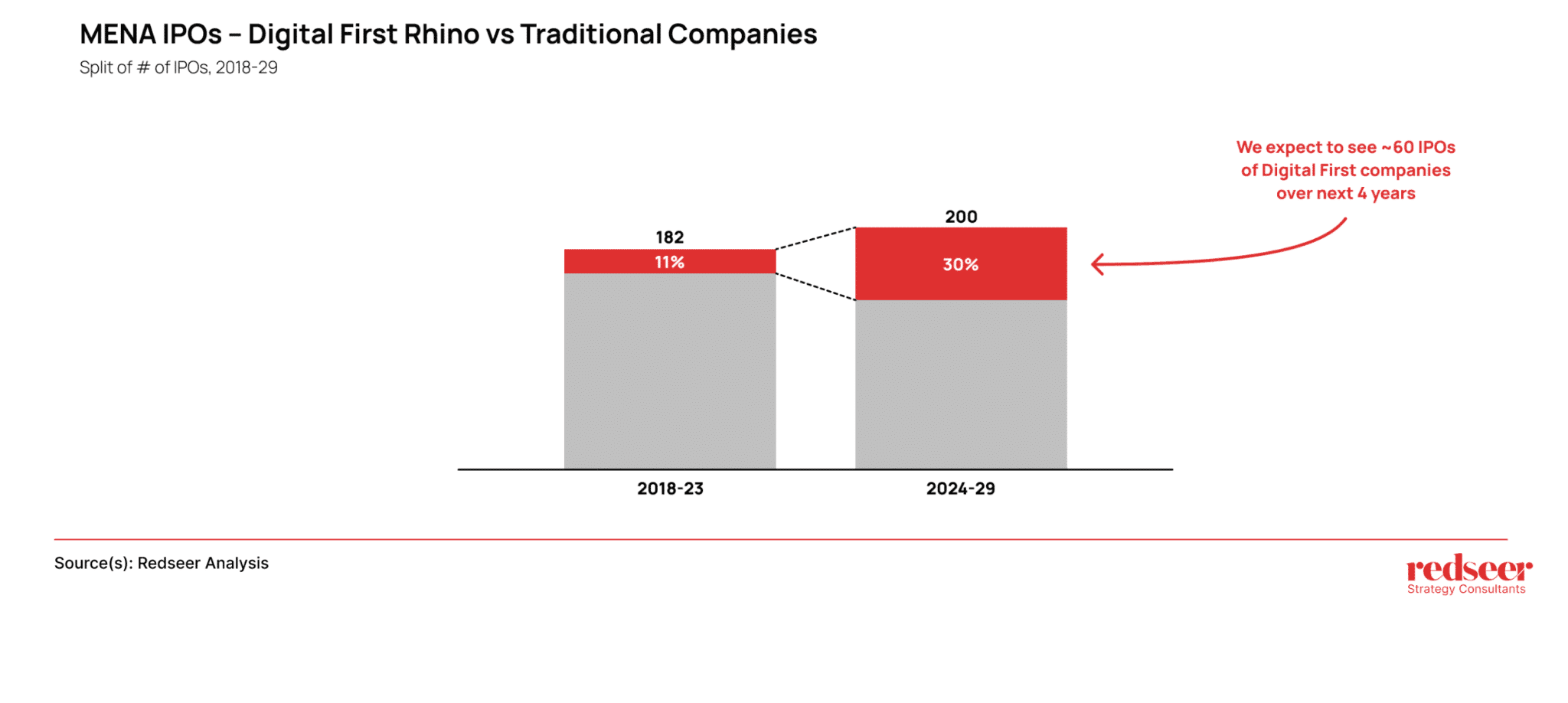

4. The region saw a surge in IPOs over last 5 years, We expect the momentum to continue, with Digital Rhino’s driving >30% of IPOs in the region

The dramatic increase in IPOs in MENA in the past can be largely attributed to substantial government privatizations, which have laid a solid foundation for a thriving market.

From 2018 to 2023, digital-first Rhinos accounted for only 6% of IPOs. However, projections for 2024 to 2029 indicate that this share will rise to 30%, translating to approximately 200 IPOs of digital-first companies over the next four years. The anticipated increase in digital-first IPOs underscores a growing investor appetite for technology-driven companies with sustainable growth models. This shift signifies a broader recognition of the value and potential of digital businesses, which are now expected to dominate a significant portion of IPO activity

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me