India’s E-Commerce Festive Performance: Growth Driven by Tier 2+ Cities, Shopper Spending, Fashion

India’s e-commerce sector has been seeing spurts of growth in recent years, especially during the festive seasons, as consumers increasingly turn to online shopping. This year, the festive season achieved a milestone, reaching approximately $14 billion in Gross Merchandise Value (GMV). But the significance of this season goes beyond just higher sales figures—it highlights a broader shift in what consumers value, with convenience, accessibility, and a mix of premium and value products driving demand. Tier 2+ cities were at the forefront of this growth, showing steady spending patterns and a strong interest in the expanding choices available online.

Want to evaluate new investment and M&A opportunities?

As e-commerce became more established, engagement rose across a wide range of categories, from fashion and electronics to quick commerce and beauty products. This festive season highlighted the strength of online retail in India, not only in large urban centers but also in smaller towns and cities, where spending growth reached new levels.

With deep expertise in emerging and high-growth sectors, Redseer Strategy Consultants are well-positioned to help companies understand and make the most of India’s expanding e-commerce market. Our insights and strategies enable businesses to tap into this momentum, drive meaningful growth, and respond to the changing preferences of Indian consumers. Let’s look at the findings from the 2024 festive season to explore the trends and growth areas that shaped India’s e-commerce landscape.

Festive 2024 E-Commerce: New Trends in Consumer Spending

With 12% GMV growth over the last year, the 2024 festive season was filled with evolving shopping behaviors. It allowed for more consumer engagement, enabling shopping at a flexible pace and leading to broader participation. Notably, 51% of the GMV was generated in the first 11 days, underscoring the impact of early-bird sales and illustrating how both brands and consumers are now strategically aligning with early festive timelines. This early surge not only boosted revenue but also emphasized how brands can leverage early momentum to capture more consumer attention.

Key Drivers of Festive 2024

Three major trends shaped the 2024 festive season:

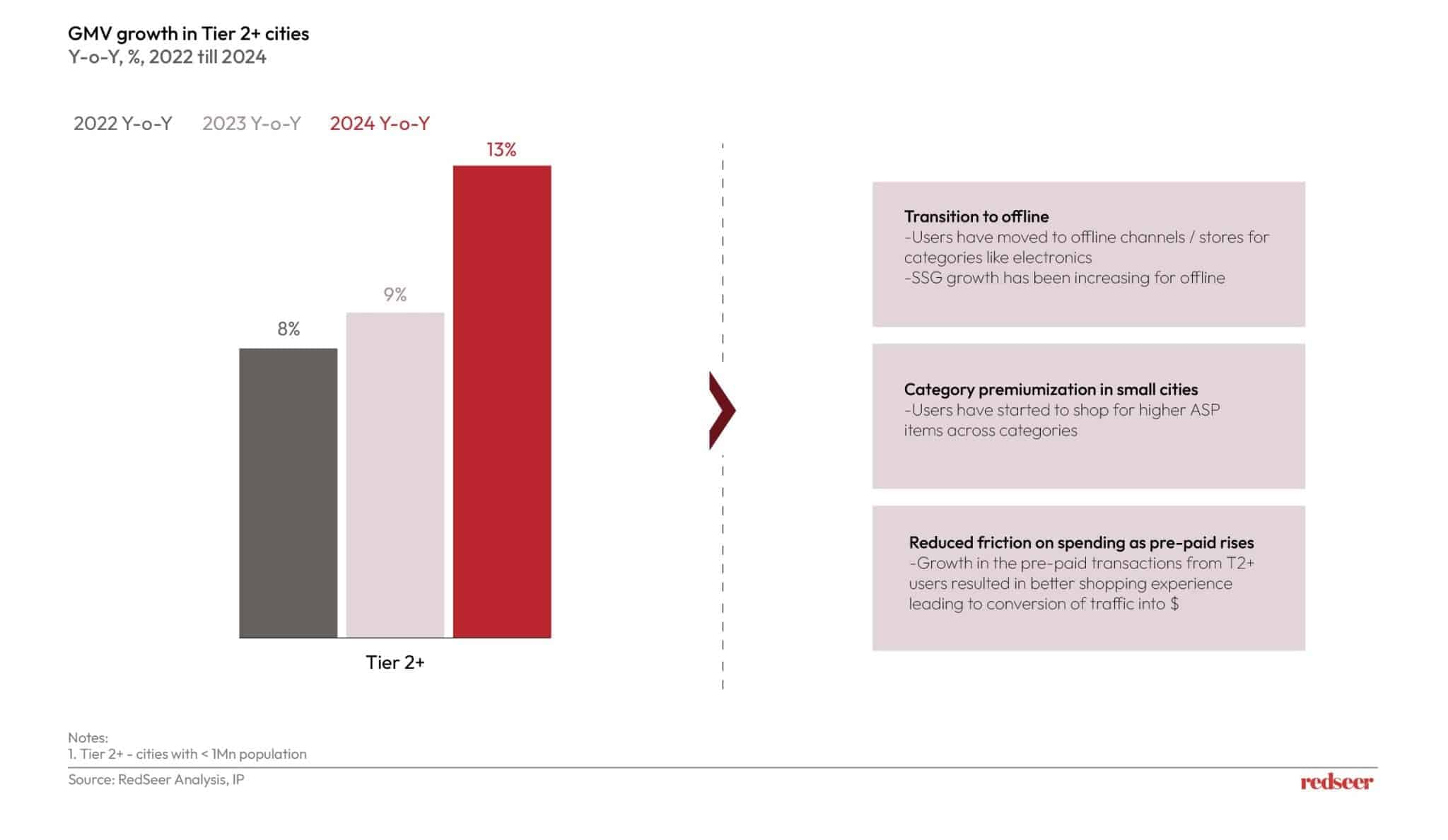

- Growth in Tier 2+ Cities:

Tier 2+ cities saw a 13% rise in spending, outpacing metros and Tier 1 cities. Smaller cities embraced e-commerce, demonstrating growing comfort with online platforms. Consumers in these areas are also willing to spend on high-ASP categories such as electronics and appliances, if offered at competitive price-points. - Higher Spend per Shopper:

While the pace of acquiring new shoppers slowed, spending per shopper increased by 5-6%. Consumers, particularly in metros, opted for larger, premium items within electronics, reflecting a maturing consumer base that’s prioritizing quality over quantity. - Fashion Dominates:

Fashion saw a threefold increase in sales compared to growth in the last 6 months, driven by ethnic wear, sports footwear and accessories. Unbranded ethnic apparel, jewelry, and accessories saw significant growth in T2+ cities, while Tier 1 cities saw a rise in premium and international fashion brands.

Tier 2+ Cities Lead Growth

In 2024, Tier 2+ cities emerged as key drivers of festive e-commerce growth, recording a 13% increase in spending, up from last year’s 9%. This growth reflects the increasing influence of smaller cities in India’s online retail landscape. Consumers in these areas are now embracing higher-value purchases, particularly in electronics and appliances, signifying a shift toward premium products. Prepaid payments have also gained popularity, streamlining transactions and improving conversion rates. This trend highlights the growing sophistication of online shoppers in smaller cities, where the range of available products continues to expand.

Meanwhile, consumption in metro and Tier 1 cities grew at a relatively slower pace, partly due to a shift back to offline channels for high-value items like electronics. This shift emphasizes that the urban e-commerce market could be maturing (or moving towards quick-commerce, which continues to grow rapidly), with smaller cities becoming the engine of growth ahead.

Expansion of shoppers’ online wallet

While the pace of acquiring new shoppers slowed in 2024, existing consumers increased their spending by 5-6%. This could be indicative of the future market growth profile as well, wherein growth will be primarily driven by cross-selling more categories and offline to online wallet transition, among the existing shoppers.

Within electronics, premium products like vacuum cleaners have been sold more in metro cities, while large appliances like air conditioners and refrigerators grew due to extended summers. Interestingly, even Tier 2+ city consumers have spent on products like air conditioners, indicating shift towards willingness to adopt life-comforting products.

Non-electronics categories, however, witnessed relatively higher spends. Categories like fashion, beauty and personal care saw more users and heightened purchase frequency, especially through quick commerce platforms, which are low-ticket purchases compared to electronics and mobile. While the overall ASP has increased a bit across categories, the volume of transactions for fashion, BPC, and general merchandise has been much higher. This has resulted in overall ASP to come down for online retail festive. This frequent, smaller purchases signals a shift in consumer behavior, highlighting the broader and more varied shopping habits of Indian consumers.

These shifts in shopping behavior reflect a broader trend seen in the rising demand for premium products, especially in categories like, electronics, and beauty, where consumer expectations continue to evolve.

Fashion Takes Center Stage: Ethnic Wear, Accessories, and D2C Brands Lead the Charge

Fashion dominated the 2024 festive season, with sales growing threefold compared to the yearly average. Ethnic wear and accessories were the driving forces, particularly in Tier 2+ cities. Unbranded ethnic apparel saw strong demand, alongside jewelry and accessories, especially among women. This underscores the theme of rising consumer inclination towards exploring the latest fashion trends at affordable prices, irrespective of the associated brand. Men’s accessories also grew well, reflecting a broader trend of increased interest in fashion items beyond apparel. The sector’s growth in smaller cities indicates a strong market for affordable fashion options, fueling the wider trend.

At the same time, metro cities saw a surge in demand for premium and international fashion brands, particularly through Direct-to-Consumer (D2C) channels. Online platforms like Instagram helped boost brand visibility, with customers seeking both luxury and convenience. D2C brands in apparel, luggage, and footwear flourished, benefitting from digital-first marketing strategies. As consumers move toward a hybrid shopping experience, combining ethnic and premium preferences, the fashion sector continues to experience dynamic growth across both established and emerging trends.

Apart from fashion, other small ticket size categories also saw impressive growth, indicating that the demand for premium and branded products extended well beyond the traditional apparel sector.

Strong Performers Beyond Fashion: Electronics, Quick Commerce, and More

Apart from fashion, several categories saw impressive growth during the festive period. Premium electronics, such as air conditioners, refrigerators, and gaming laptops, saw strong demand, with metros showing increased interest in high-end products. Home décor items like wallpapers, lamps, and sanitaryware also experienced significant growth, while the toys category saw branded toys outperforming in urban areas. Quick commerce platforms expanded their offerings, introducing electronics, appliances, and non-grocery products, with extended delivery hours and higher incentives for delivery executives during the festive days.Beauty and personal care (BPC), particularly makeup and skincare, continued to see high demand, with premium brands in metros and more affordable options in Tier 2+ cities.

Beyond the Festivities

The festive season of 2024 has acted as a strong indicator of what lies ahead for India’s e-commerce sector. As consumer preferences shift towards a more nuanced blend of premium and value-driven purchases, the landscape is evolving rapidly. It’s clear that the future of e-commerce won’t just be about attracting more shoppers but about understanding and catering to their changing needs with precision and agility.

At Redseer Strategy Consultants, we’re closely tracking these shifts to help businesses adapt to this evolving landscape. By using data-driven insights, companies can align themselves with the latest market trends, enhance their customer reach, and ensure sustained growth. As India’s e-commerce continues to mature, the key to success lies in anticipating the next wave of consumer demands and crafting solutions that resonate with the diverse and increasingly sophisticated shopper base.

Unlock the growth potential of India’s e-commerce market. Connect with our team for in-depth insights, or explore our latest report for a comprehensive analysis of emerging trends and opportunities within the sector.

Written by

Kushal Bhatnagar

Associate Partner

Kushal has worked with funds as well as corporates across the eHealth, Hyperlocal, eGrocery, Fintech and beauty & personal care verticals. He gained immense experience in global healthcare consulting and has been able to bring that knowledge to build the digital healthcare practice here.

Talk to me

Festive 2024: Unveiling India’s Grand Consumption Revival

Saudi Q-com Regulations: Ending the Subsidy Era?

Quick Commerce Finds Its New Normal with Scale, Mix, and Momentum