India’s New Age IPO Gold Rush: Who Will Win This $1 Trillion Race?

The global IPO landscape had been marked by turbulence, with macroeconomic pressures and high interest rates leading to a subdued market. However, with over 330 listings in 2024, accounting for over 30% of global IPO volumes, India has demonstrated remarkable resilience and investor confidence.

Build new product innovation and market strategy.

India’s IPO performance stands out due to a combination of regulatory enhancements, strong domestic participation, and economic stability. This underscores India’s growing importance in global capital markets, positioning it as a key destination for investors seeking high-growth opportunities.

But while opportunities are massive, success in the IPO landscape isn’t guaranteed. The next wave of market leaders will be those who master industry positioning, regulatory preparedness, and post-listing performance—elements that now define the difference between IPO success and stagnation.

That is exactly what we will be discussing at Ground Zero 10, one of the coveted industry events in Bengaluru, investors, CXOs, and digital leaders will unpack the complexities of navigating the IPO journey—what it takes to get there and, more importantly, how to sustain and thrive post-listing. As public markets evolve, understanding the right timing, financial discipline, and strategic positioning is crucial for businesses aiming to go public.

At Ground Zero 10, we will specifically focus on emerging IPO opportunities, high-growth sectors, and the key strategies that separate success stories from cautionary tales, helping businesses chart a course for long-term value creation.

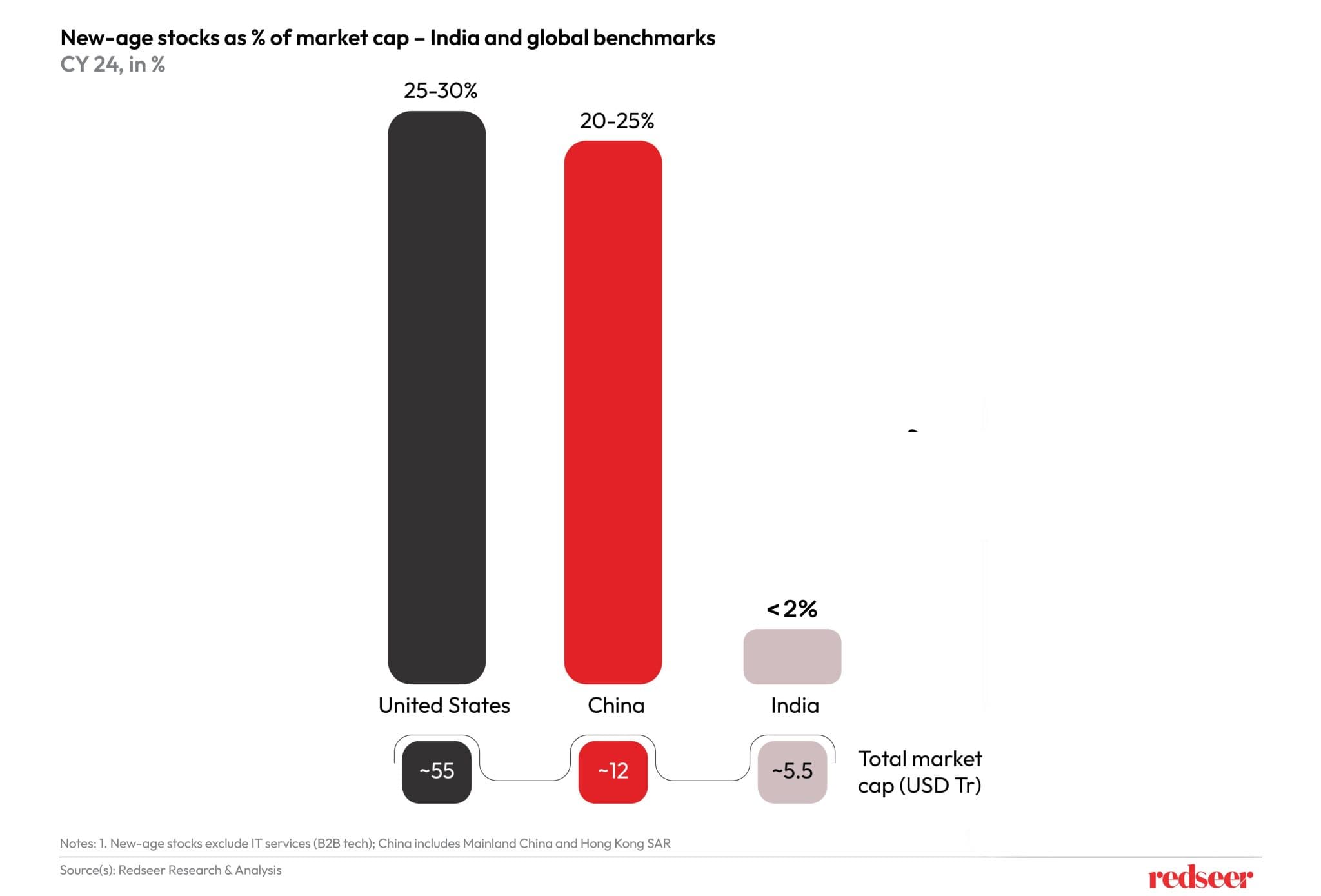

The $1 Trillion New-Age Market Cap Opportunity

New-age companies are expected to play a crucial role in India’s IPO boom. Currently, there are ~30 listed new-age companies with a market cap of <$110 billion, with the top 15 accounting for $80 billion. However, this is just the beginning. By 2030, India is projected to witness its new-age market cap reach $ 1 trillion, driven by the growing pool of IPO-ready new-age companies, a robust regulatory environment, and continuous domestic investment flows.

Success Factors for a Winning IPO Strategy

While India’s IPO market presents immense opportunities, achieving a successful listing requires strategic planning and execution. Redseer’s extensive experience in guiding companies through IPOs highlights four key success factors:

- Industry Positioning & Business Performance: Companies must establish clear market differentiation and showcase robust business fundamentals. And draw insights from global IPO trends can enhance investor confidence and valuation prospects.

- Regulatory Preparedness: Compliance with evolving regulations and a streamlined listing process are essential.

- Post-IPO Performance & Investor Relations: A well-defined strategy post-listing ensures long-term value creation and market credibility.

Why this matter? IPOs are more than just financial milestones; they are a testament to a company’s credibility and future potential. Well-crafted claim statements can be game changers, showcasing sectoral strengths and driving investor confidence. Through our experience, we’ve built robust processes to ensure impactful prospectuses and strategic positioning.

Whether it’s preparing companies years in advance or supporting them post-IPO, the right insights can make all the difference. The journey to going public is complex; hence, having a trusted partner with proven expertise ensures you stay ahead.

That was the very conversation we delved into at Redseer Ground Zero 10 — one of Bengaluru’s most anticipated industry events. Investors, CXOs, and digital leaders came together to decode the complexities of the IPO journey — not just what it takes to go public, but more critically, how to sustain momentum and create long-term value post-listing.

As public markets continue to evolve, the discussions underscored the importance of timing, financial discipline, and strategic positioning for businesses eyeing a successful debut. Ground Zero 10 spotlighted emerging IPO opportunities, high-growth sectors, and the real-world strategies that have defined both the standout successes and cautionary tales in the space, offering a roadmap for companies looking to navigate the public market landscape with confidence.

Written by

Rohan Agarwal

Partner

Rohan Agarwal has been a part of the Redseer Strategy Consultants journey for over six years. He is an expert in digital strategy for traditional corporates and start-ups.

Talk to me

Value Retail: The Quiet Force Reshaping MENA’s Consumer Economy

India’s Defence DeepTech Flywheel: The $6Bn Market Nobody’s Watching

Ready-to-Eat Brands Are Leaving 85% of Addressable Consumers on the Table