Resilience or Dry Spell in MENA’s Startup Funding Ecosystem?

As we step into 2024, we’re excited to share insights into the trends that defined the past year and the signals shaping the landscape ahead. In our latest article, we delve into the resilience of the MENA startup ecosystem amidst global funding challenges.

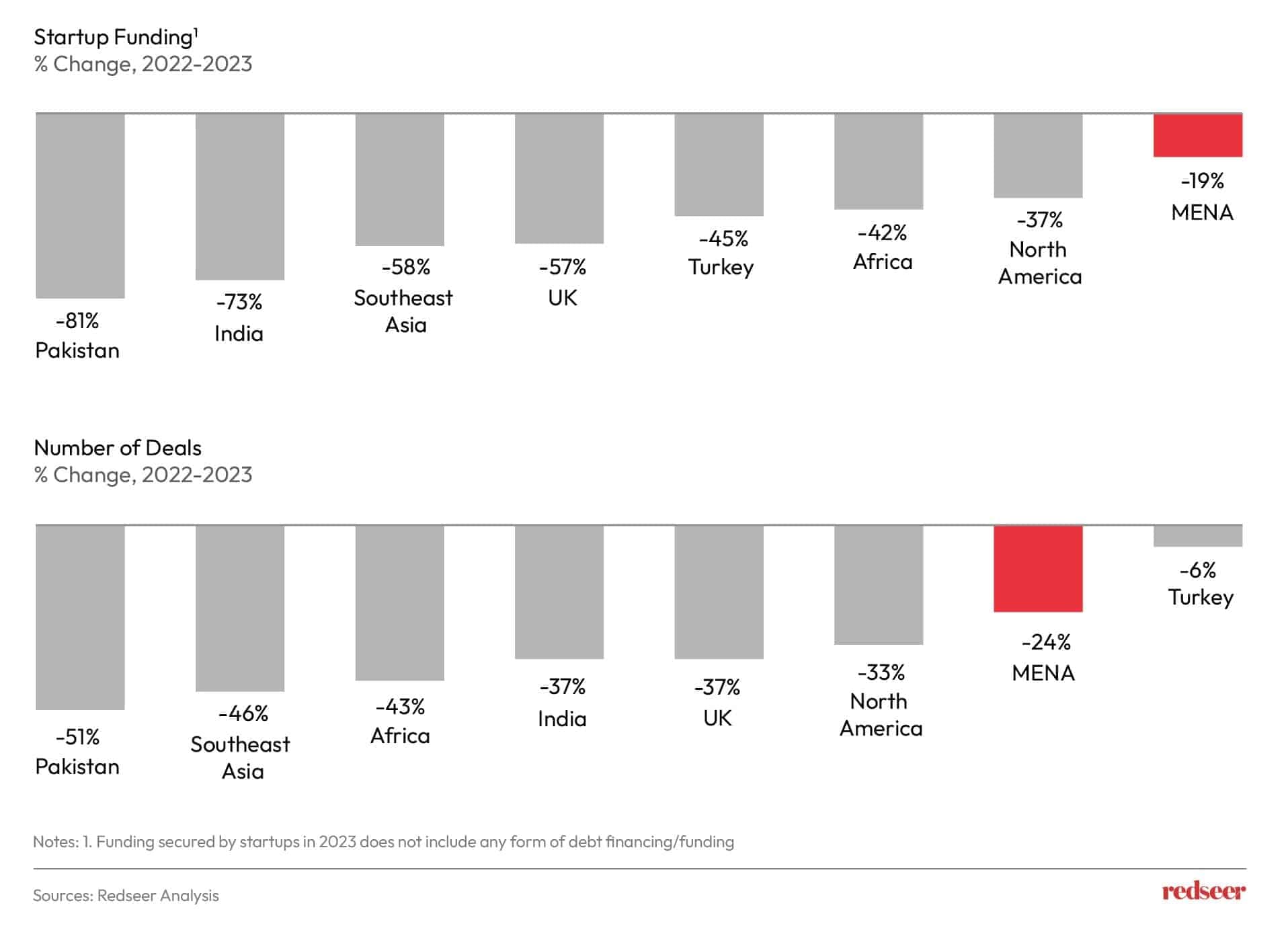

1.Globally, startup funding has been difficult, however MENA has been impacted lesser…

Have a question?

Our experts are just a click away.

On a global scale, the macroeconomic environment grappled with challenges and investors remained cautious amid persistent economic uncertainties and market volatility. Across industries, startups faced challenges in securing capital, reflected in a decline in both deal value and volume worldwide.

However, the funding landscape in the MENA region has proven resilient. This resilience can be attributed to stabilized valuations, sustained consumer demand, and steadfast support from key players such as sovereign wealth funds (SWFs), corporations, and family offices.

Further, there was a silver lining in the form of debt funding. When considering total startup funding, including debt, MENA region accounted for $4 Bn in 2023 compared to $3.95 billion in 2022.

It’s worth noting that FinTech’s funding, particularly BNPL players, played a significant role in this stability, with asset-backed debt funding constituting the majority of the overall debt funding in the region.

2.But why has the region`s startup funding been relatively more resilient when compared to global markets?

- Market Valuations are comparatively more normalized in MENA

Valuations in the MENA region, for both publicly listed and privately held companies, have shown a trend towards normalization.

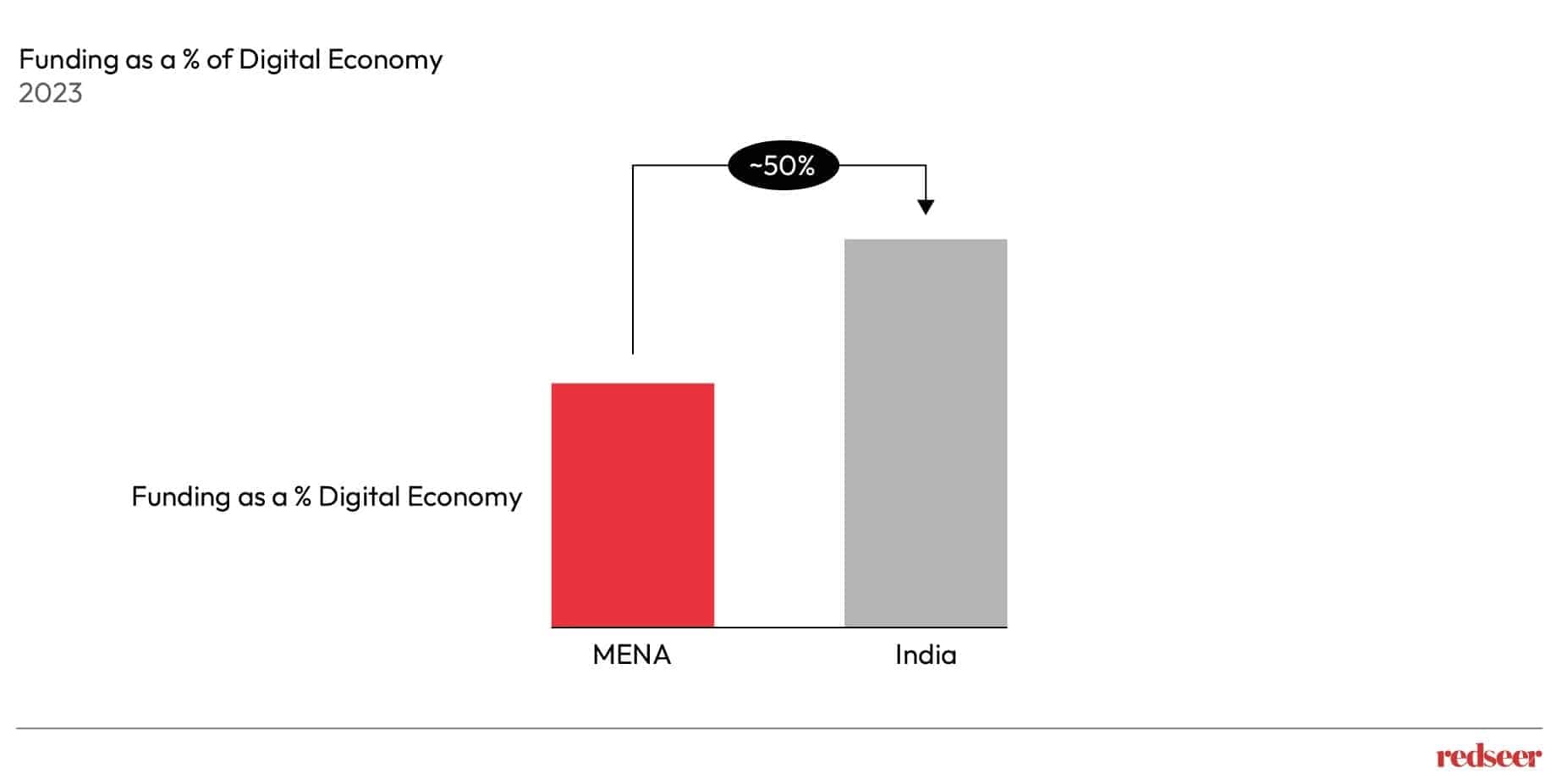

Even when we assess the scale of the digital economy and the startup investments made in 2023, the mismatch is evident and points towards the potential of growth in the MENA region.

- Consumer demand has been intact

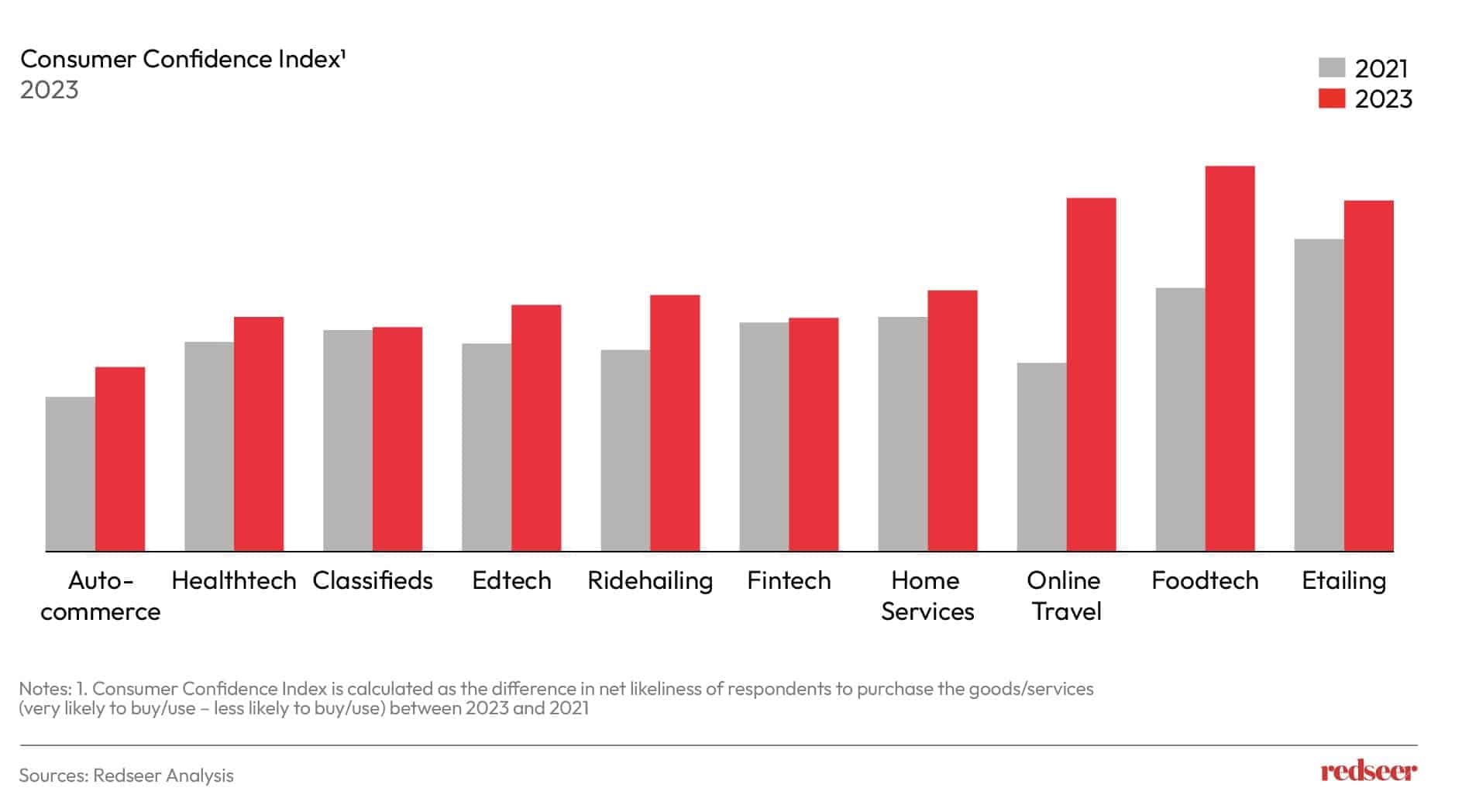

MENA narrative is compelling and comprises of an intact consumer demand.

The region’s intact consumer demand substantiates its economic vibrancy, reflecting positive consumer confidence and a notable willingness to spend across various sectors.

Further, Key markets such as UAE & KSA aim to increase population and attract high value expats. For instance, Dubai aims to double its population by 2040. Similarly, Riyadh is targeting a transformation into a 15-million-person city by 2030 from its current 7.6 million.

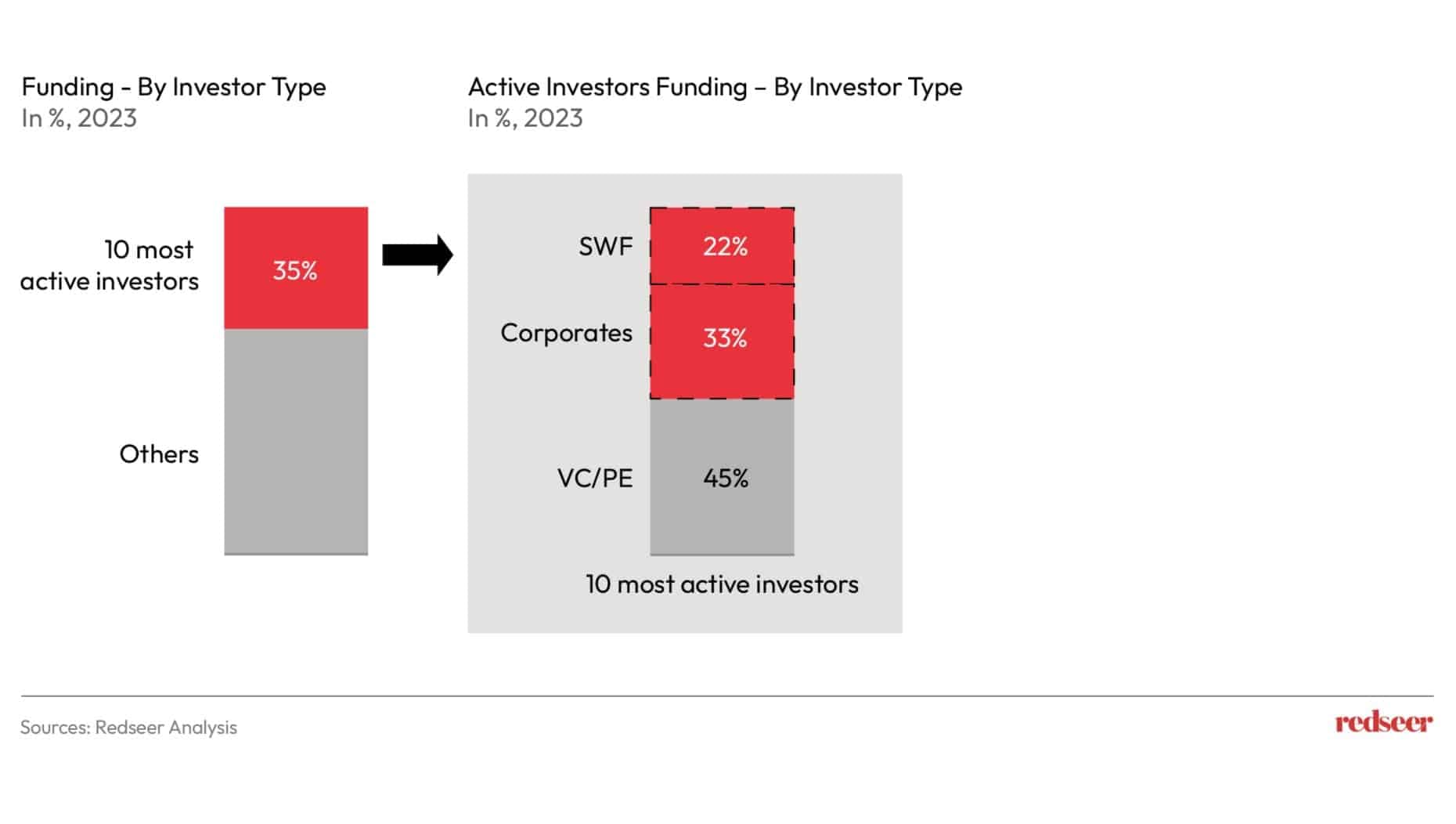

- Additionally, robust backing from sovereign wealth funds (SWFs), corporations, and family offices has been instrumental in propelling funding

MENA startups enjoy a unique advantage with the active involvement of sovereign wealth funds, corporations, and family offices in the funding ecosystem.

The vibrancy of the broader entrepreneurial scene becomes even more pronounced when you look at the investments from corporations into established entities, exemplified by E& investing in Careem.

3. What lies ahead for the region, and what are the preliminary signs suggesting?

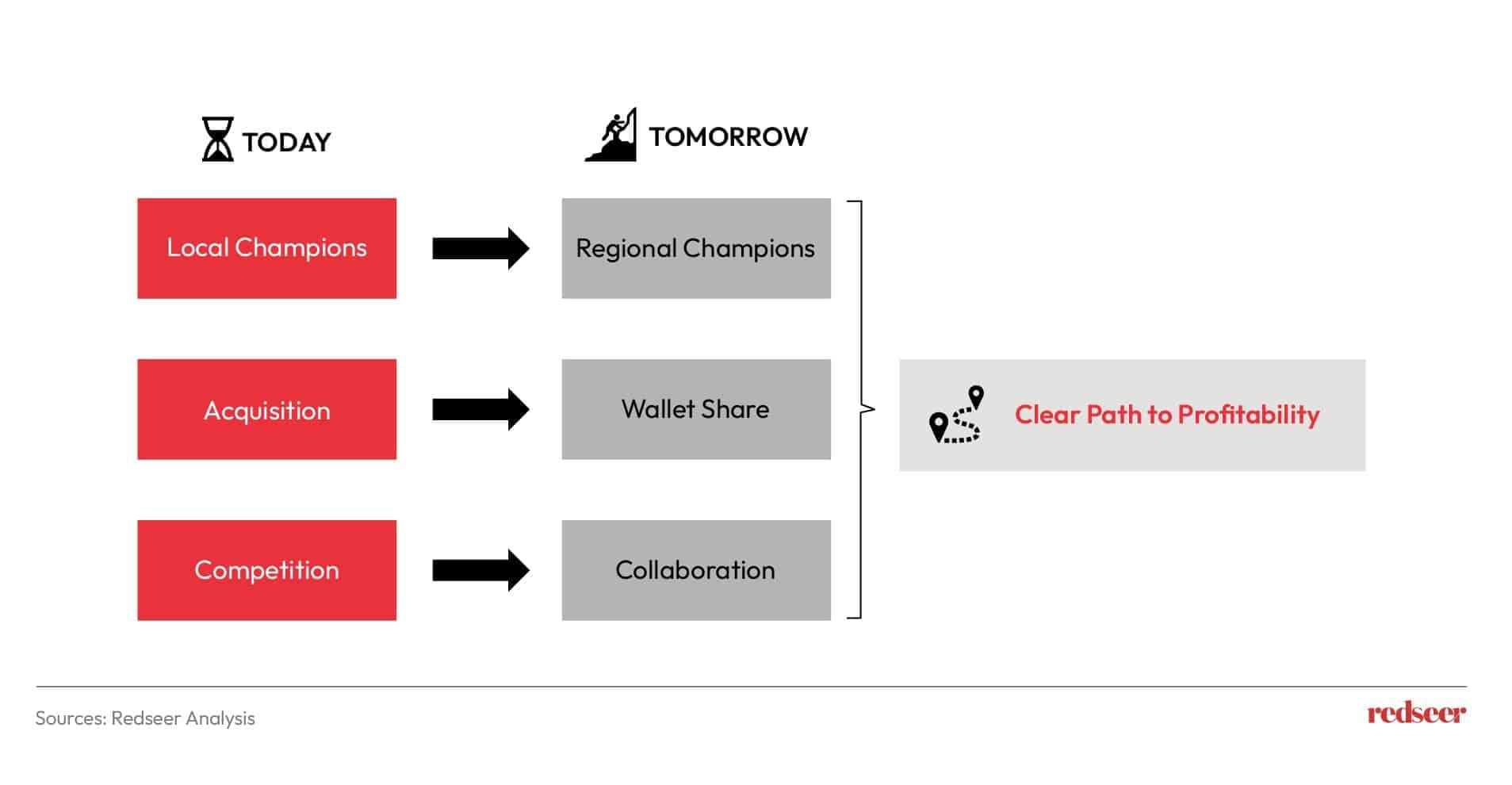

Three pivotal shifts in brand strategies are poised to shape the trajectory for MENA businesses:

- Local to Regional: MENA brands have a significant opportunity to evolve from local to regional champions. The unfolding trend is evident, examples include Jahez’s expansion across the GCC and UAE’s Brand for Less venturing into KSA in 2022. Early indicators point to a palpable shift towards regional expansion, marking a strategic move for brands aiming to capture larger audiences.

- Acquisition to wallet share: Brands will move away from pursuing growth at any expense to prioritize profitable growth. This shift signals an era of consolidation, with businesses aiming not just for market share but a more sustainable share of consumers’ wallets. Foodtech players, for instance, are exemplifying this trend through initiatives like loyalty programs and venturing into quick commerce.

- Competition to Collaboration: The traditional strategy of “doing it all” is giving way to a more focused approach, where brands concentrate on their core offerings. This shift has led to strategic collaborations, exemplified by partnerships such as Lulu teaming up with Amazon. This trend, emphasizing a clear path to profitability, is expected to attract investor confidence.

Despite the prevailing global macro and geopolitical risks, the outlook for 2024 appears promising. Early signs and groundwork laid across industries indicate the potential for substantial value creation. The acceleration of investments, a growing openness to talent, and the region’s increasing allure as a talent magnet will collectively contribute to an optimistic trajectory.

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me

The Body Lotion Opportunity in Indian E-Commerce

Christmas Vs New Year’s Eve 2025: Redefined Value Creation Across India’s On-Demand Economy

2026 and Beyond: The Next Exit Cycle for MENA’s Digital Leaders