Scaling Through Synergy: M&A Upswing in 2025!

Mergers and acquisitions (M&A) activity has been slow in Southeast Asia’s Consumer Internet sector in the last three years. However, 2025 promises a revival, driven by:

- Overseas companies looking to enter the region.

- Local companies seeking business resiliency through partnerships, spanning borders and industries.

- Sector consolidation delivers much-needed profitability boost.

Have a question?

Our experts are just a click away.

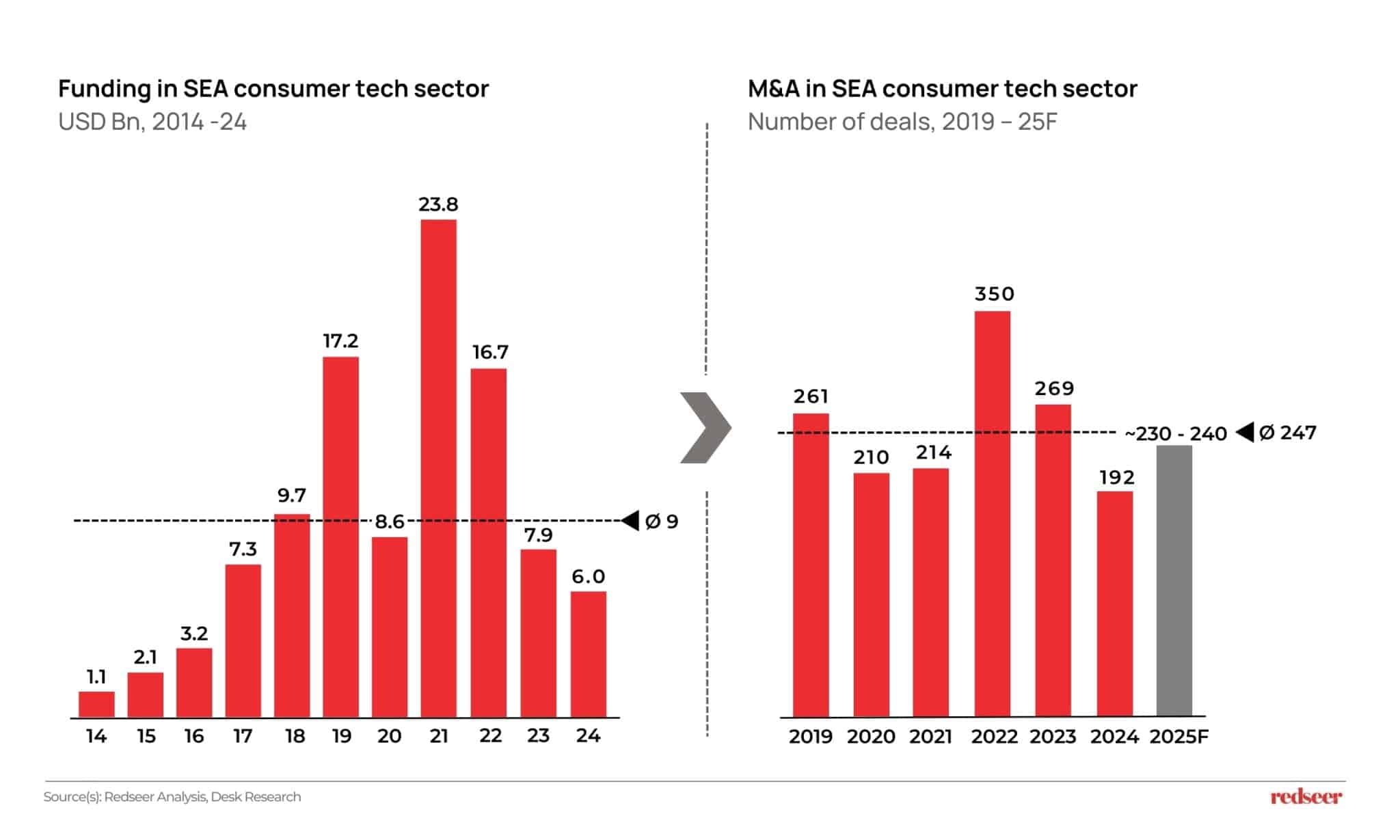

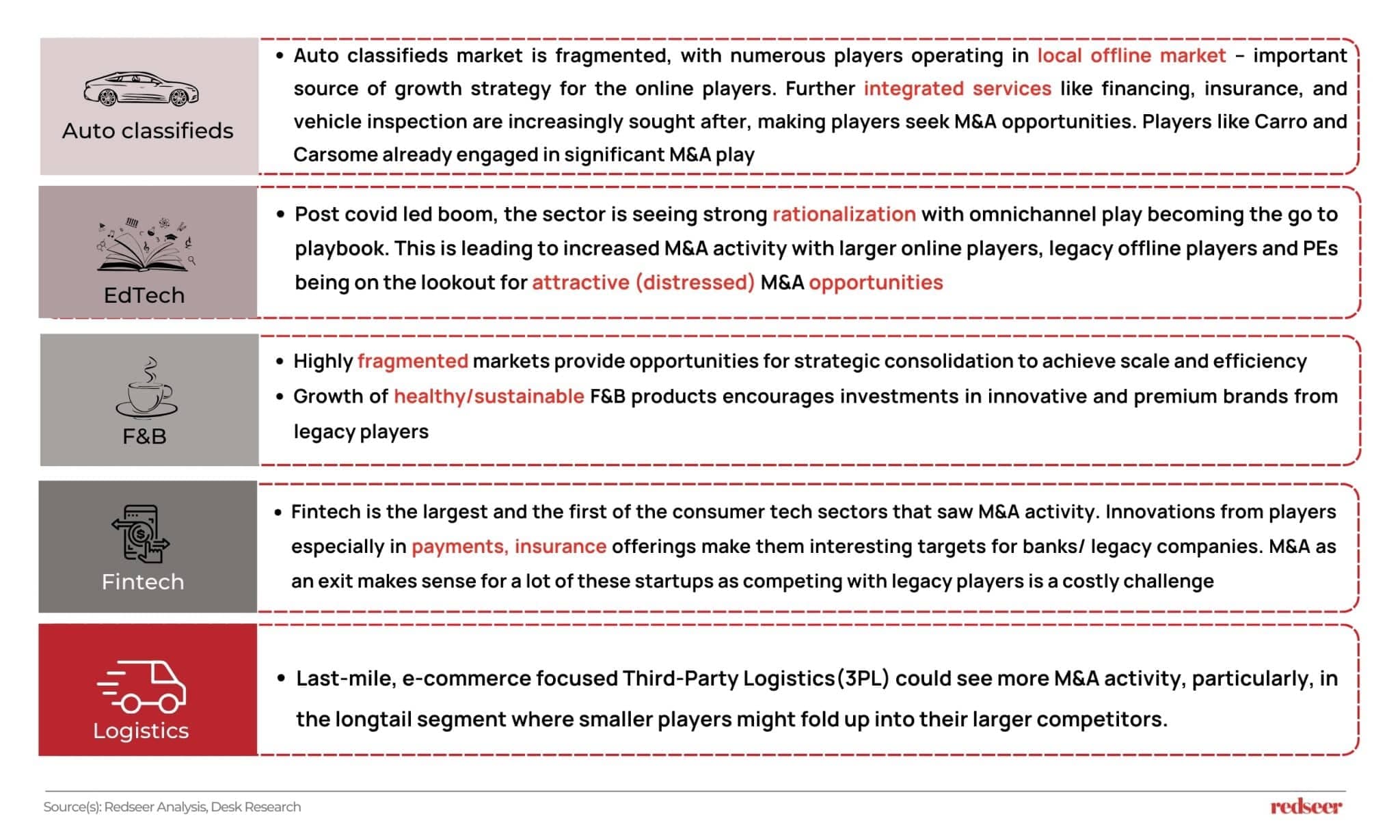

We expect Auto Classifieds, EdTech, FinTech, F&B, and Logistics to lead this consolidation wave. Overall, we estimate ~230 – 240 M&A transactions to happen in the coming year.

Alongside an expected revival in the IPO market (IPO Turnaround in 2025), overall private market activity in the consumer internet sector is poised for a turnaround this year. Keep reading to learn more on SEA startups M&A prospects !

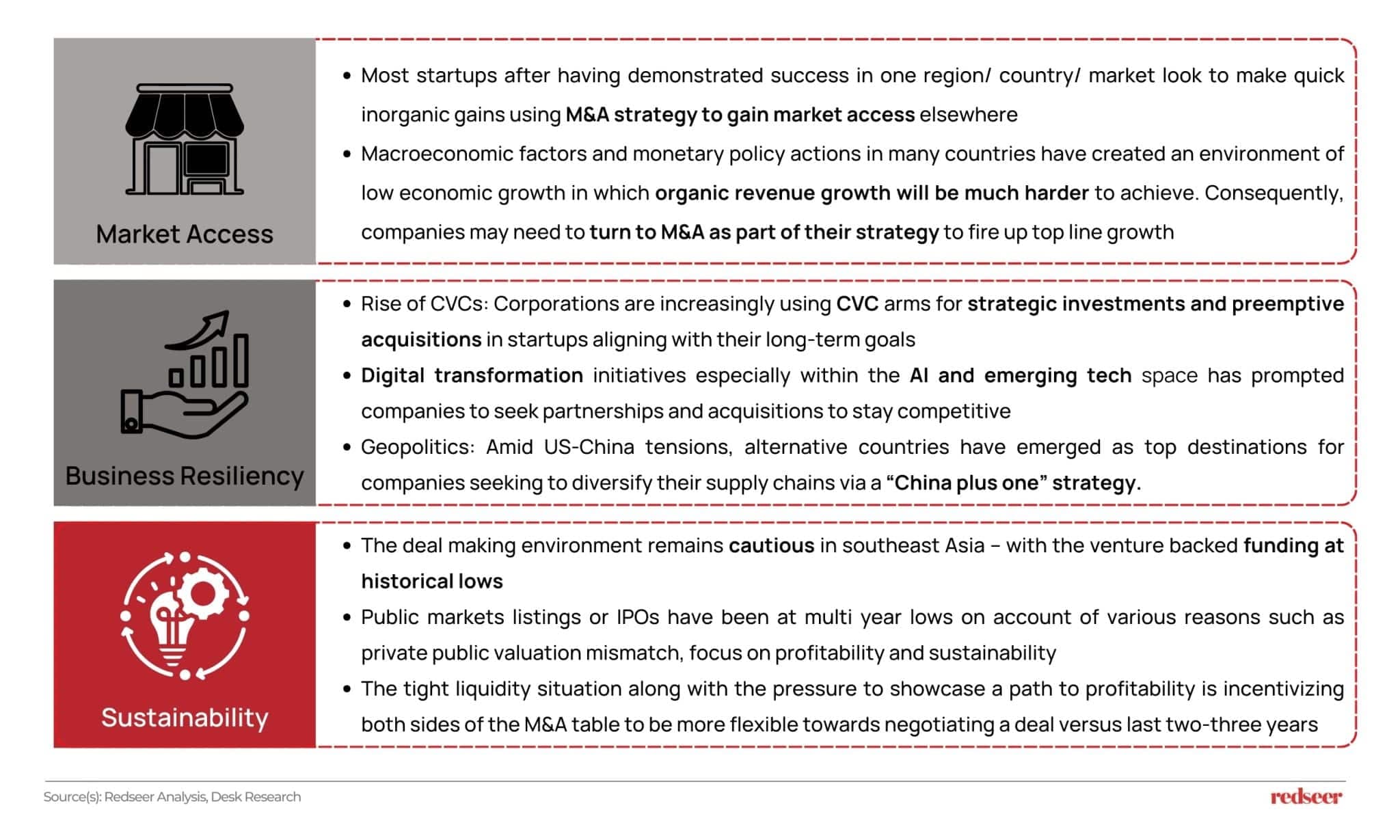

1.What will be driving M&A in Southeast Asian consumer internet landscape? Key learnings from global trends

The Southeast Asia startup ecosystem will be primarily driven by market consolidation, access to strategic resources and newer markets/ pursuit of geographical expansion amidst a competitive landscape focused on sustainability.

2. The M&A landscape in southeast Asia is following a trajectory similar to what we are seeing in the private funding space

M&A activity in Southeast Asia, consumer Internet has trended lower since 2021, and figures in 2024 ended well below the last 6- year average. We see the deal count improving in 2025, as favorable catalysts kick-in during the year

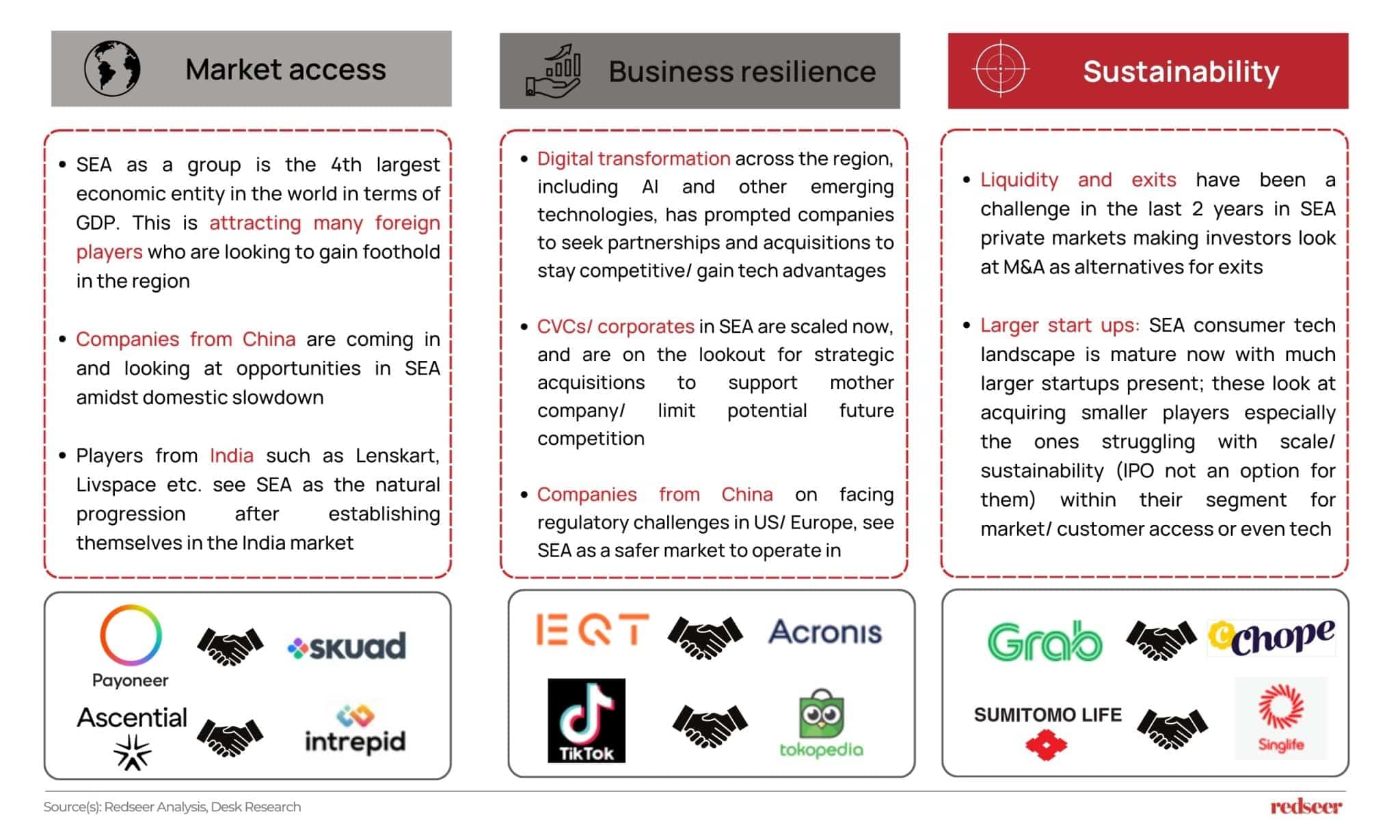

3. And in terms of the drivers, the following trends and examples can be observed in Southeast Asia

SEA is attracting global players as they leverage growth opportunities. Rapid digital transformation, driven by AI, fuels competitiveness, while corporates scale via partnerships and acquisitions. Amid private market liquidity challenges, M&A is emerging as a key exit strategy, with larger startups acquiring smaller players to enhance scale and market access, showcasing a maturing consumer tech ecosystem.

4. Consumer internet sectors (illustrative) in Southeast Asia offering attractive M&A opportunities

The above 5 sectors are expected to see strong traction on the startup M&A side. So, what does this all mean for the industry participants?

- The ecosystem would become more profitable and sustainable.

- Leaders in each sector can be on the lookout to acquire smaller players and further consolidate their market positioning.

- Investors open to M&A can be hopeful of positive opportunistic events that can help them crystalise greater value on existing investments .

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me