‘‘Wonderful Indonesia’ – it has something for everyone!

Greetings from the enchanting archipelago of Indonesia! As we reflect on our nearly year-long journey in this diverse and vibrant country. We were struck by the immense travel offerings that the country has.

From the famous beach escapes of Bali to the rich cultural history of Yogyakarta and multiple hidden gems in the form of innumerable diving spots, volcanic hikes & even forest reserves.

This further prompted us to look into the Travel & Tourism business in Indonesia. This article is just a short teaser into a much deeper report that we look to publish soon.

1. Indonesia’s travel market while recovering, lags pre-covid levels – however rapid recovery is expected

Want to evaluate new investment and M&A opportunities?

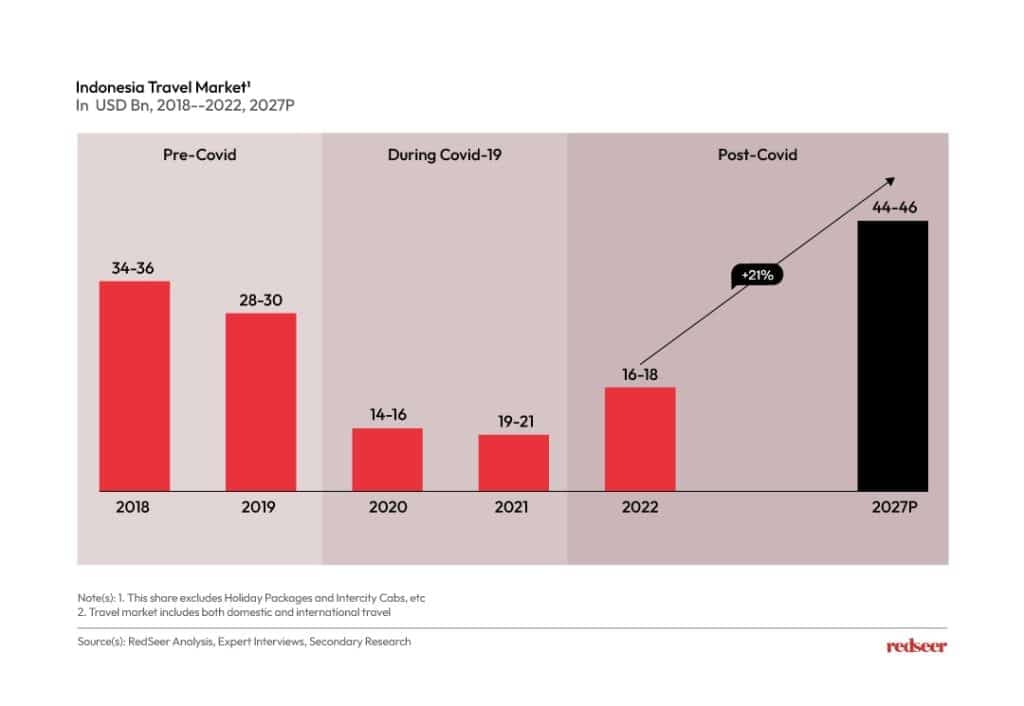

Tourism contributed ~4.8% of overall Indonesian GDP in 2019, consistently growing since 2015. Post COVID however, the industry has been struggling. However, we expect the market to recover to pre-COVID levels by 2024.

Driven by increased interest from International as well as higher domestic travel combined with government efforts to develop tourist hubs outside of Bali (which interestingly accounts for ~43% of all international arrivals). The industry is expected to grow rapidly to reach ~USD 45 Bn by 2027.

The government has already set into motion to develop ’10 new Bali’s’ and has committed to spend ~USD 275 Mn on 108 projects immediately. 5 key priority destinations wherein significant development has taken place are Lake Toba, Borobudur, Mandalika, Labuan Bajo, and Likupang. Do give them a visit next time you plan to travel!

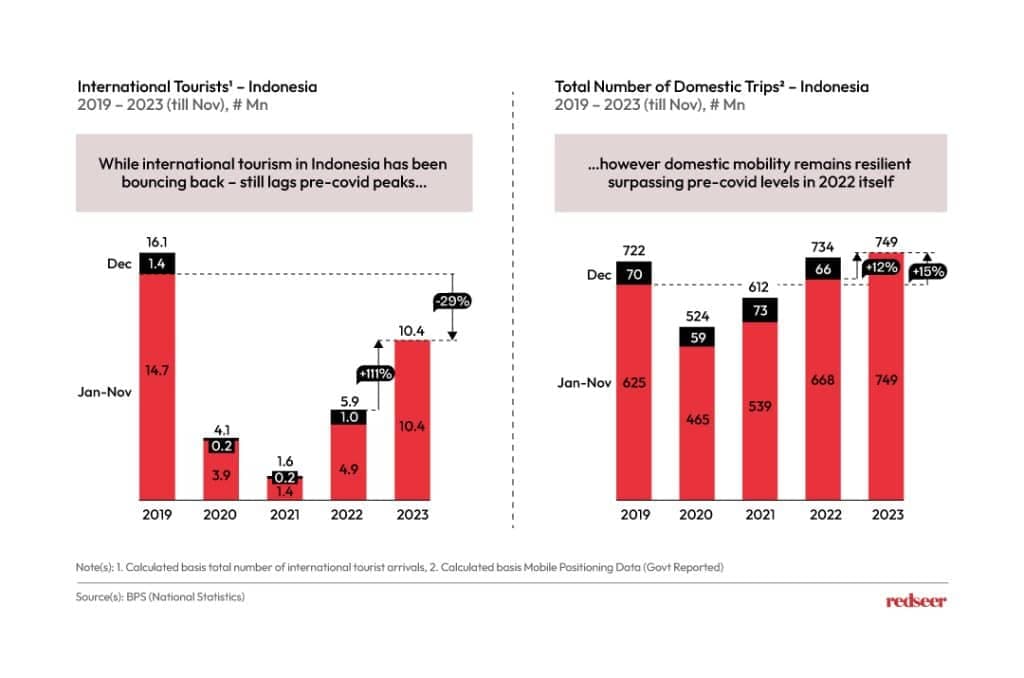

2. While domestic mobility has surpassed pre-COVID levels, international tourism is yet to recover

With higher airfares and hotel prices combined with economic pressures, International tourism has struggled to be back to Pre-COVID levels across the world. However, it’s not much far off – according to the latest UNWTO – 2023 is expected to end with ~90% recovery in international travel.

While in terms of absolute numbers of tourists, longer stays and higher spending has enabled the recovery in terms of value to be better. In fact, the Bali Tourism Board claims that Bali is seeing ~88% recovery.

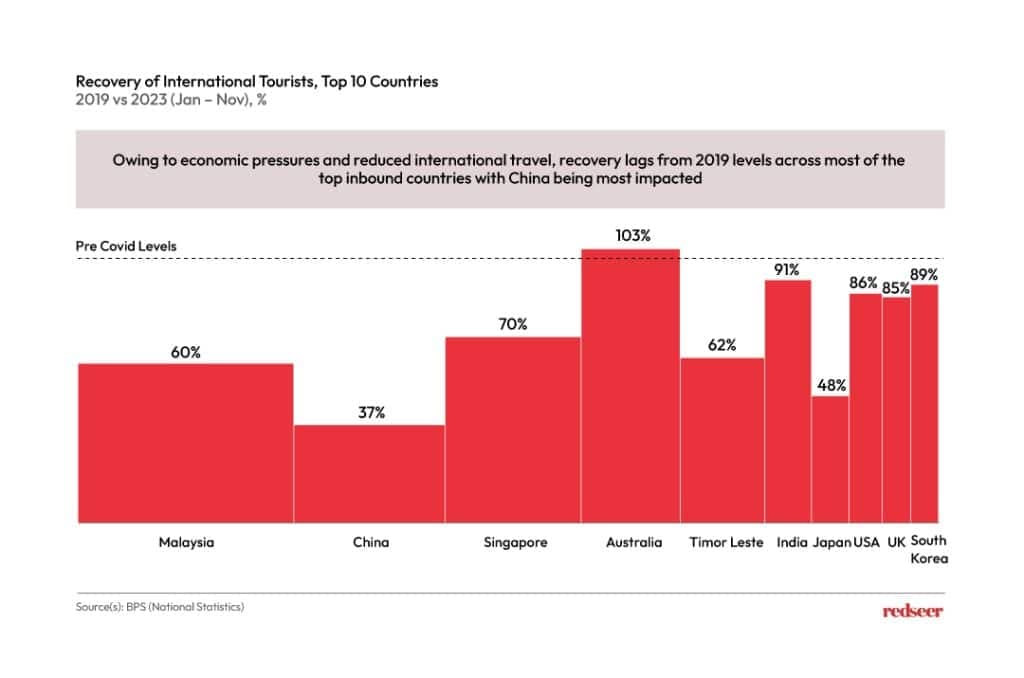

3.As most top inbound countries apart from Australia are yet to get too pre-covid levels

Looking at the top inbound countries, pressures from Malaysia, China & Singapore which combined accounted for ~43% of overall international tourists haven’t recovered yet. While Indonesian government has been actively trying to incentivise travel – initiatives like Indonesia, Malaysia, Thailand growth triangle could potentially help.

Tourism from Malaysia & Singapore is expected to bounce back more rapidly as these tourists generally take shorter vacation to areas like Batam. China on the other hand may take some time to recover owing to economic pressures back home along with passenger flight capacity also not reaching pre-covid levels.

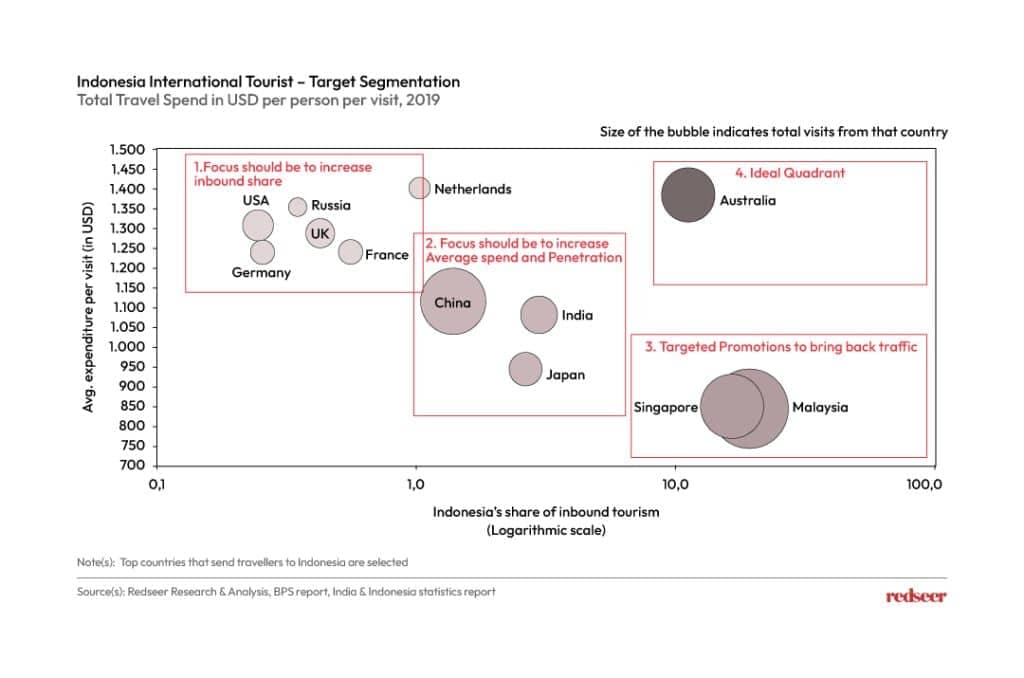

4. Attracting tourist from right sphere can help drive the tourism market. Countries with high average spend and low penetration could be focused

For Indonesia, Australia has been one of the best tourism partners – with 4th largest inbound share and one of the highest spending tourist cohort. They haven even surpassed their pre-COVID levels.

Strategic marketing initiatives by the government could help extract the maximum value out of various inbound consumer cohorts.

There has been a significant rise in remote works from European & North American countries, while direct flight connectivity from countries like India has also boosted inbound travel.