Unlocking the Next Wave of MENA E-commerce Growth

Summary: MENA’s digital economy has driven 20% of consumption growth over the past five years while accounting for 10% of consumption expenditure. Online retail is a key pillar within the digital economy that has been powering this, and our region is home to a uniquely democratic online retail market, where no single player truly dominates.

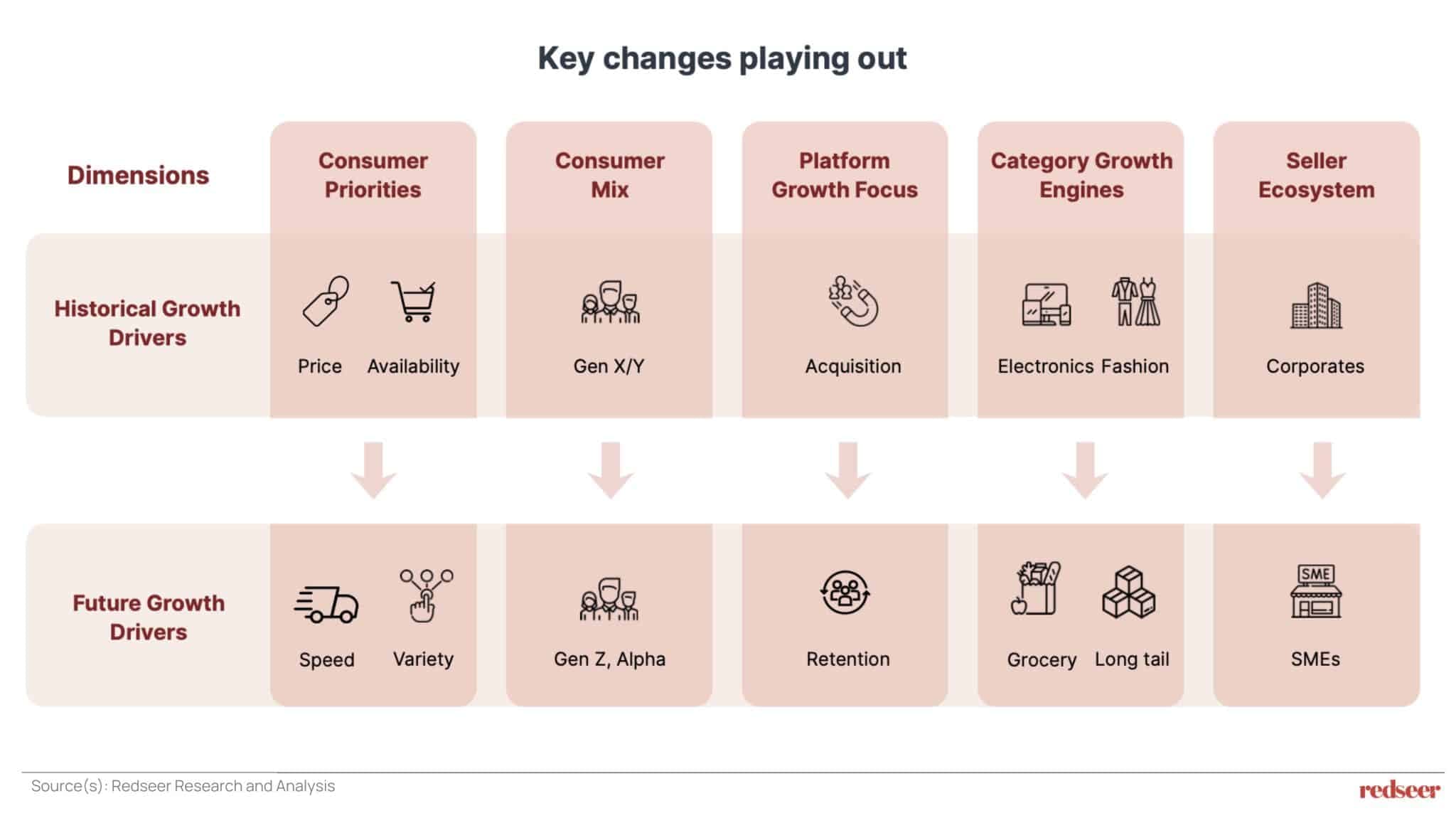

The next wave of growth will be powered by a different set of engines: shifting from electronics to grocery and long-tail categories, from Gen X to Gen Z consumers, and from acquisition-focused strategies to retention and convenience. This report unpacks the structural shifts redefining MENA’s online retail landscape and reveals where the biggest opportunities lie for platforms, brands, investors, and enablers through 2030.

MENA’s online retail penetration is expected to grow from 9% in 2024 to 16% by 2030 – within a broader $750 billion retail landscape expanding at 6% CAGR, nearly 1.5 times the global average. This growth is fuelled by a digitally fluent, young customer base and an evolving logistics network that continues to mature across the region.

However, online retail penetration is still in the mid-teens for leading markets like the UAE and KSA – far below the 30%+ benchmarks in China and South Korea. As e-commerce in Middle East and North Africa enters its next growth phase, the region is at a critical juncture, where strategic bets today will compound into market leadership tomorrow. Our report on Unlocking the Next Wave of MENA E-Commerce Growth provides the strategic intelligence decision makers need to navigate the region’s rapidly evolving digital economy. Drawing on comprehensive market analysis across GCC countries, Egypt, Morocco, Iraq, Tunisia, Algeria, and Jordan, this report identifies the specific engines driving the next phase of regional growth, along with the role of under-tapped segments and ecosystems that enable broader digital participation across consumers, merchants, and small businesses.

Key Takeaways

- The shift from acquisition to retention: In the UAE, 80% of future growth will come from wallet expansion, not new users. Platforms must evolve from discount-led to convenience-led strategies, targeting Gen Z and Alpha consumers who seek content-driven, experiential commerce.

- MENA’s uniquely democratic digital market: The top three platforms control less than one-third of online retail, far lower than other regions. Fashion leads the category mix, and omnichannel players drive over one-third of GMV, creating space for diverse business models to thrive.

- Five growth engines reshaping the landscape: Online grocery, quick commerce, and social commerce are the next key frontiers. These, in turn are creating an unprecedented demand for urban fulfilment structures (logistics) and SME enablers.

Who This Report Is For

- Platform operators scaling across MENA markets

- Investors, brand leaders and traditional retailers evaluating digital commerce strategies

- Logistics and fulfilment providers enabling the quick commerce revolution

- Fintech and enabler platforms supporting SME digitalisation

Download the full report to access detailed market sizing, competitive landscapes, and strategic levers for the next phase of MENA digital growth.

Written by

Akshay Jayaprakasan

Associate Partner

Akshay brings over a decade of experience across consulting and technology, with deep exposure to India, Southeast Asia and the Middle East. He has delivered multiple keynotes, served on industry panels, and is frequently quoted by leading Middle East media on the digital economy.

Talk to me