Bali To Bangkok: Travel Pulse SEA

With 138 million international tourists projected in 2025, Southeast Asia (SEA) has not only recovered from the pandemic’s lows, but it’s also entering a new growth phase. Occupancy rates tell a compelling story: In Q1 2025, regional hotels reported an average occupancy of ~69%, a 9% YoY surge. And with summer peaks hitting 77–80%, high-season travel is back in full swing. Revenues are keeping pace, too. Average daily room rates are up 6% YoY, with luxury destinations posting the sharpest gains. Meanwhile, flight seat capacity is at 95% of pre-pandemic levels, setting the stage for a high-growth second half of the year.

Build new product innovation and market strategy.

Yet the revival isn’t just in volume but also in variety. Wellness tourism, eco-driven travel, and niche local destinations are seeing a spike, supported by leisure and MICE segments.

In this issue, we unpack the latest trends shaping the region’s tourism resurgence. We also spotlight the most dynamic players riding this rebound across Southeast Asia

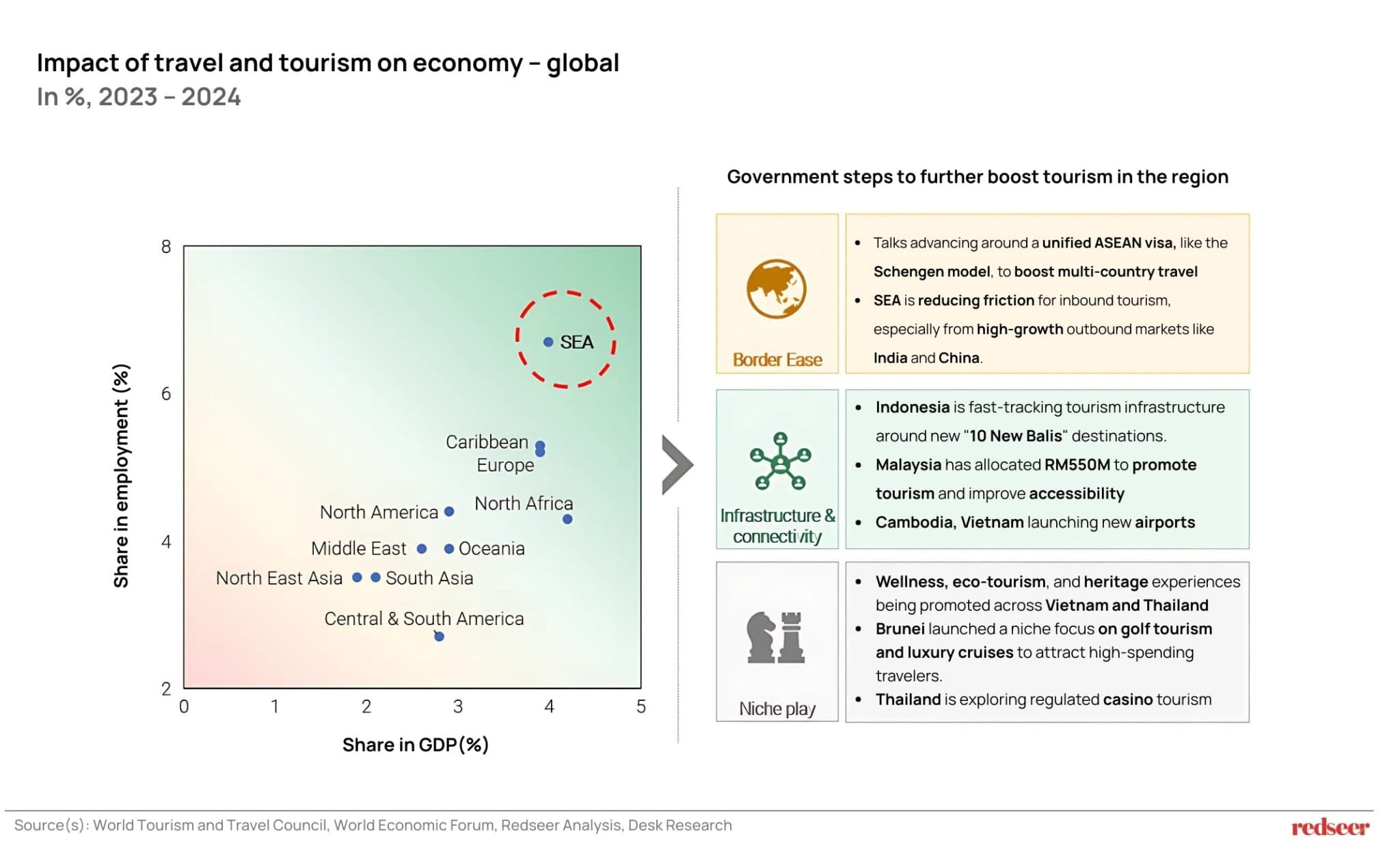

1. SEA is the world’s most tourism-leveraged economic region, prompting proactive, region-wide government interventions and initiatives

In 2024, the travel and tourism sector contributed ~4.5% of SEA’s GDP, amounting to USD 180–200 billion, and supported 7% of total regional employment, over 22–25 million jobs. This makes SEA the most tourism-dependent region globally in terms of direct economic impact.

Recognizing this strategic importance, governments across the region are actively investing in initiatives to sustain momentum and unlock further growth, making tourism not just a recovery story but a long-term pillar of economic development.

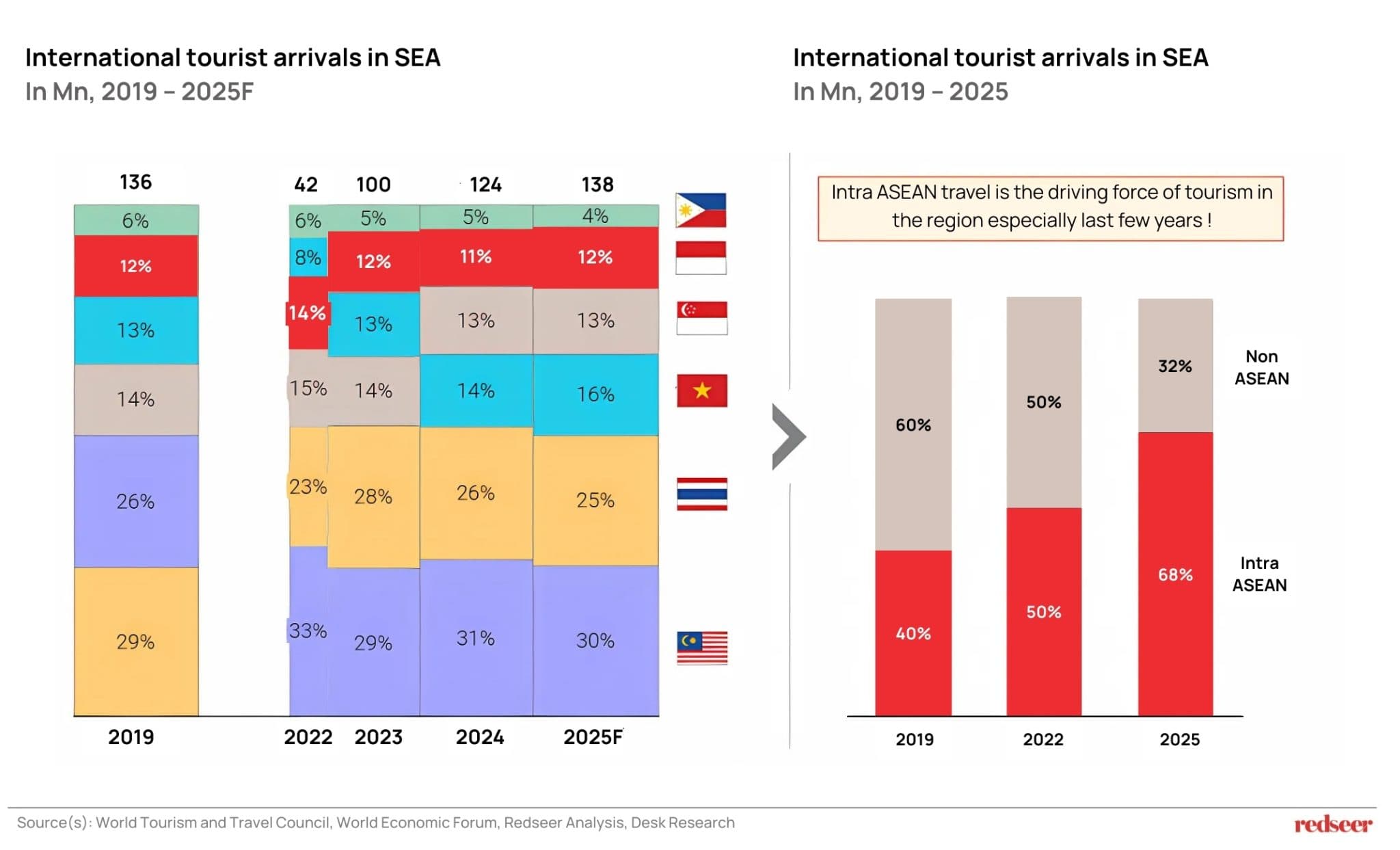

2. This proactiveness has ensured the bounce back in SEA tourism, with tourist numbers for 2025 expected to exceed the levels seen pre-pandemic (2019)

Destinations like Malaysia and Vietnam are emerging as top choices for tourists, driven by visa relaxations, improved international connectivity (flights and high-speed rail), and the development of new attractions. China remains the largest source of inbound tourism for SEA, while India, Japan, and Australia are showing strong growth as rising origin markets.

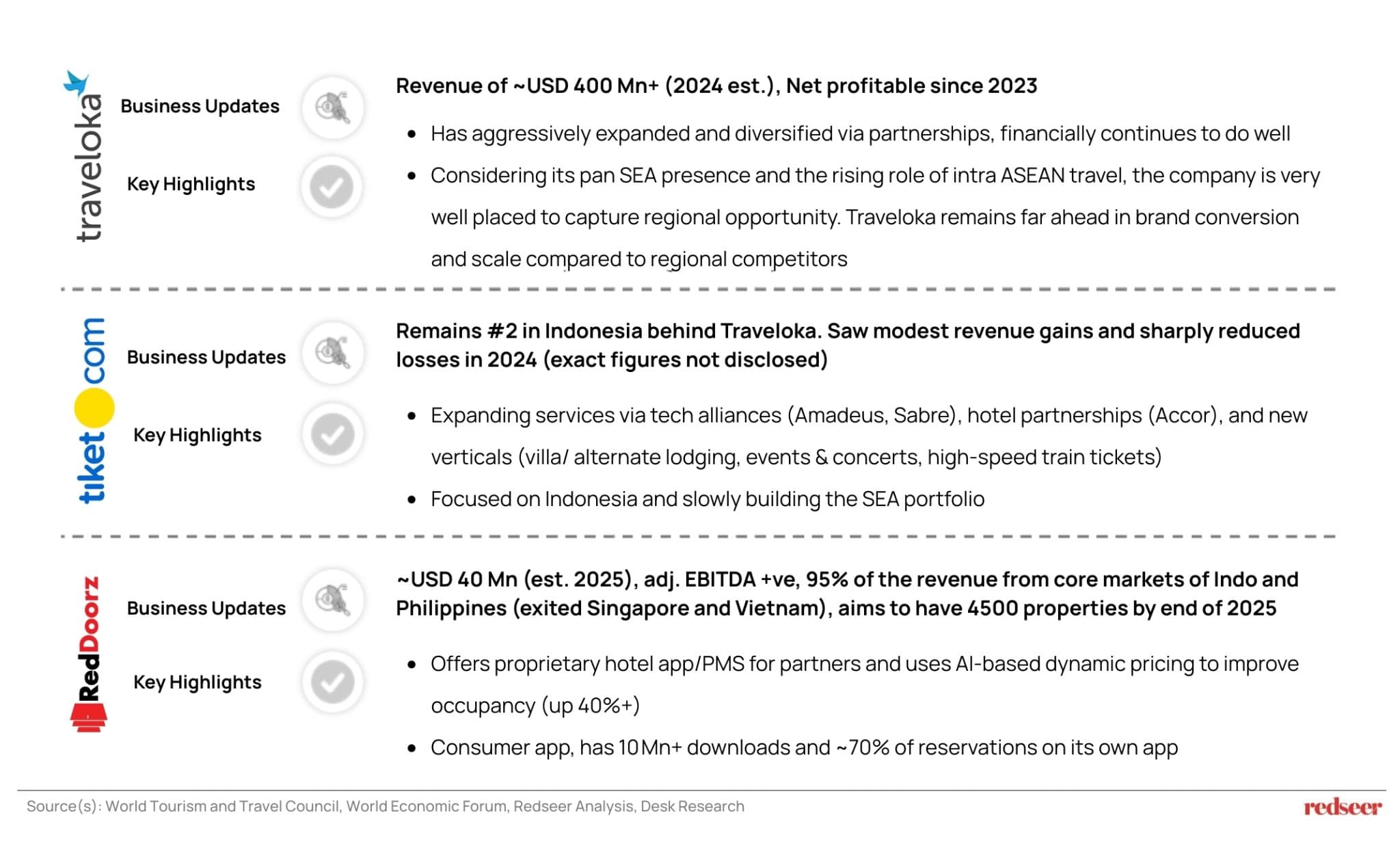

3. The tourism rebound has sparked a resurgence for leading regional travel players, boosting profitability, scale, and innovation

Southeast Asia’s leading travel platforms are prioritizing distinct strategic paths: achieving profitability through scale, expanding into high-value ancillary services beyond core offerings, and leveraging proprietary tech to enhance partner value and consumer engagement. While some pursue pan-regional dominance, others focus on deep market penetration in key countries with specialized segments, all capitalizing on the robust recovery of inter-ASEAN travel.

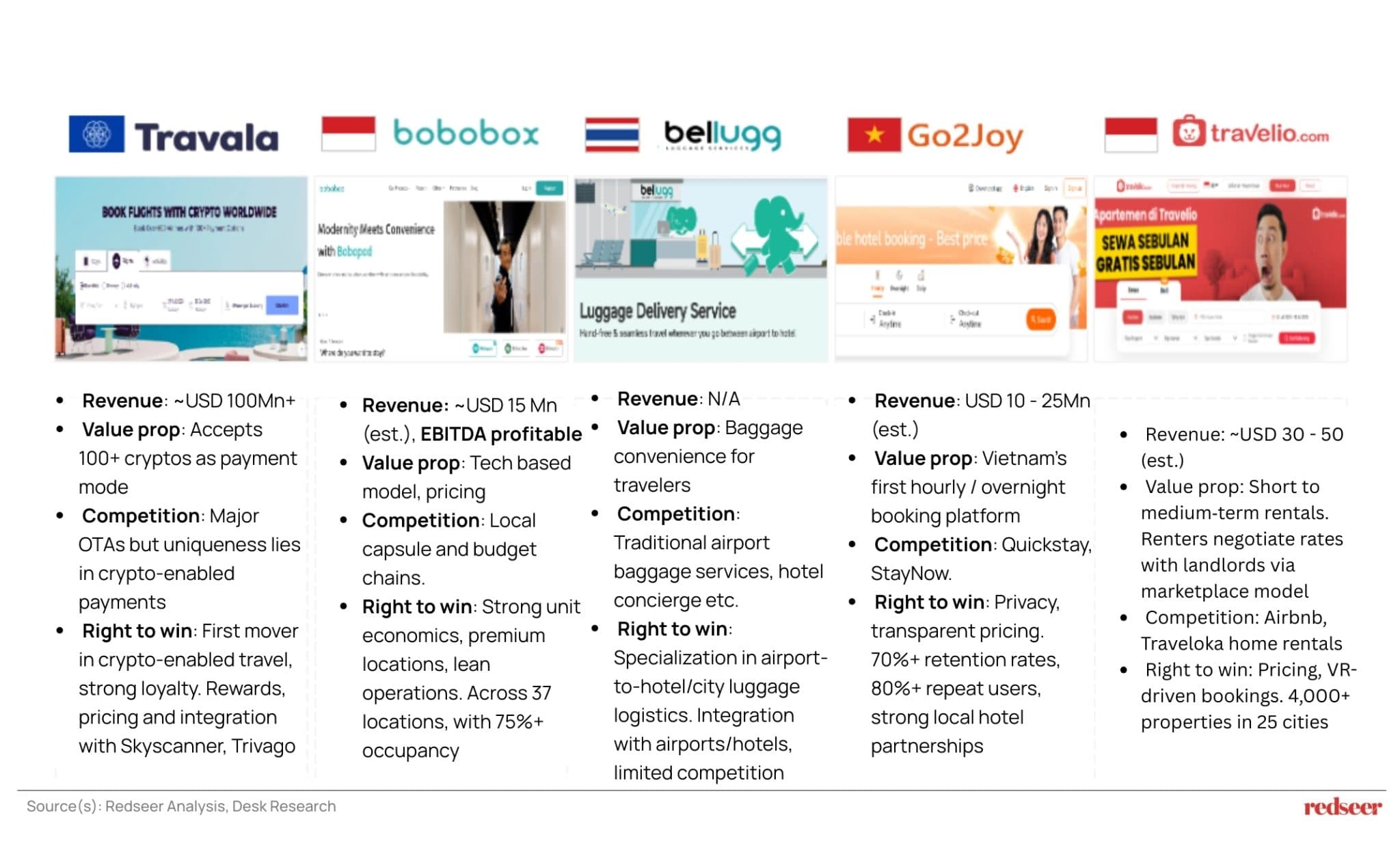

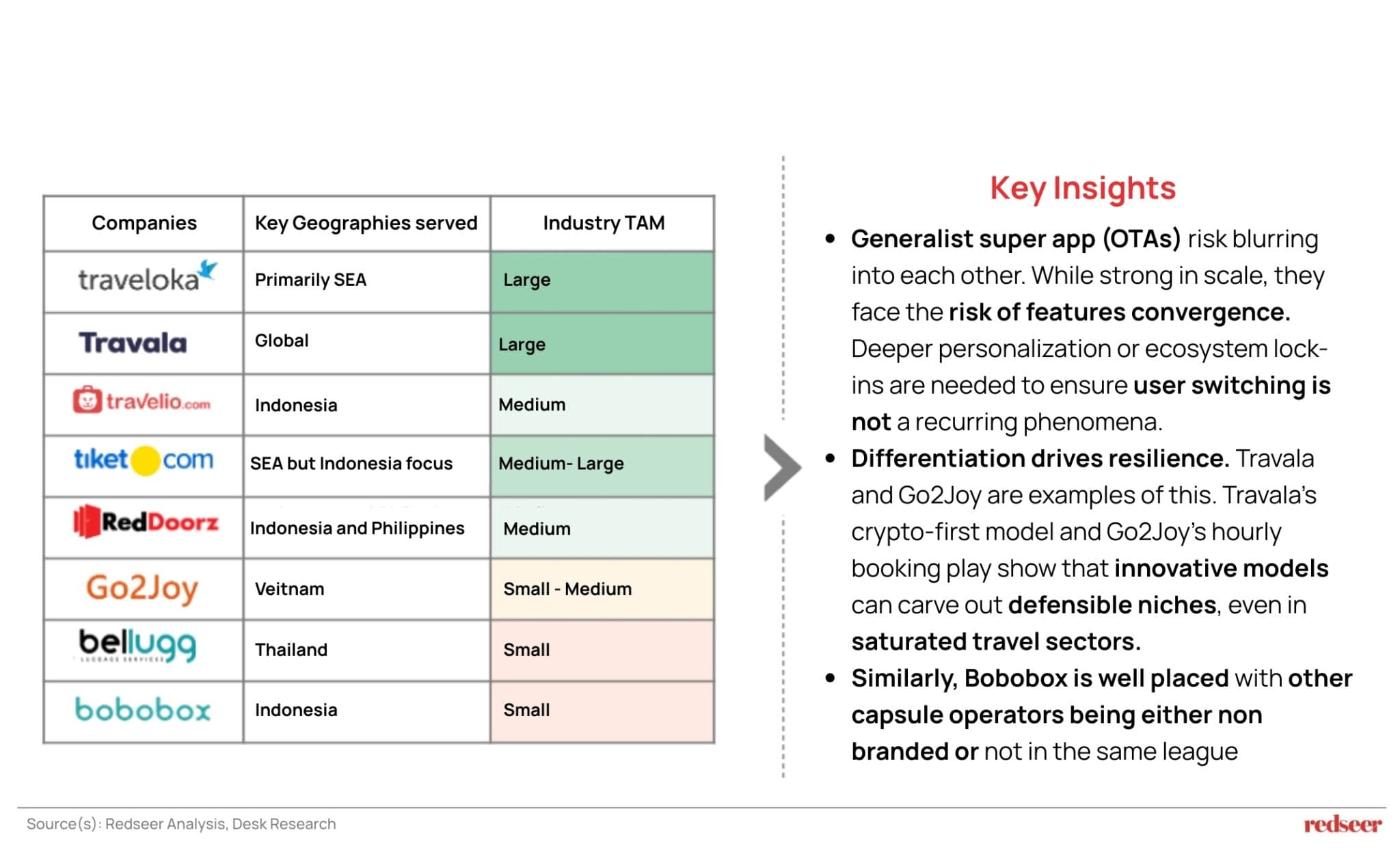

4. Apart from the larger incumbents, there are other emerging startups that are redefining customer experience with their unique value adds

A new wave of SEA startups is targeting niche frictions in the travel journey, ranging from crypto payments and micro-stays to luggage logistics. Rather than compete on scale, these players are winning via vertical depth, localized partnerships, and asset-light monetization.

Several are already profitable or showing strong repeat metrics, indicating viable business models in underserved segments.

5. Innovation-led differentiation is an important metric to stand out in the overall travel landscape

SEA’s travel landscape is polarizing. While scaled OTAs compete in a commoditized space, niche innovators are carving resilient footholds. Players must balance novelty with replicability across markets and segments. Winning models are either “scale and integrate” super apps or “hyper-focused” vertical specialists.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me

Viet-Nomics: Southeast Asias Rising Economic Star

USD 30 Bn Market in Motion: New Revenue Models Shaping Mobility & Delivery in SEA

KSA and UAE Tourism – A $250+ Bn Opportunity by 2030