India’s $130+ Billion Appliances Market Opportunity

Executive Summary:

India’s $130+ billion appliances market is on the cusp of a tectonic shift, fuelled by rising incomes, aspirational younger cohorts, wellness-driven consumption, and the rapid adoption of digital-first lifestyles. But this isn’t just another consumption play. It’s a high-stakes play on category creation, channel reinvention, and innovation velocity. Brands that decode what India wants, before the consumer asks for it, will win. This article unpacks the emerging whitespace, what’s driving premiumisation at scale, and the channel strategies needed to lead in this high-growth, high-complexity market.

We solve the strategy behind scale!

India’s appliances market isn’t just growing – it’s transforming. The overall appliances and electronics market is set to nearly double from $75 billion in 2024 to $130-150 billion by 2029 – a robust 12-15% CAGR. Let’s explore the drivers of this growth.

By 2029, over 50% of Indians would be Gen Alpha and Gen Z, while more than 40% of households would be upper middle class or above (Annual income over $9,600/household). This demographic dividend of rising incomes and a large young consumer base is reshaping the way India consumes.

Four winds of change that are driving premiumization:

- Convenience-first lifestyle has become the new normal. Urban consumers increasingly value ease, enabled by online discovery, quick commerce access, and hassle-free usage. It’s not just about the product anymore – it’s about the entire experience.

- Health and wellness consciousness is driving the growth of formerly niche categories. Rising awareness across age groups is driving demand for healthier appliances like air fryers, juicer-grinders, and purifiers.

- Brand-led premiumization is shifting purchase preferences. Aspirational branding, influencer marketing, and digital storytelling are driving consumers toward mid-premium products that offer both functionality and status.

- Affordability through financing is democratising premium products. EMI offers, online discounts, and easy discovery via marketplaces are making high-end appliances accessible to a broader audience, accelerating trade-ups across segments.

The aspirational and premium segments now command nearly half of the appliances and electronics market in India, which is further expected to grow to ~58% by 2029, as Indian consumers are increasingly willing to pay a premium for quality and features.

Whitespace Alert

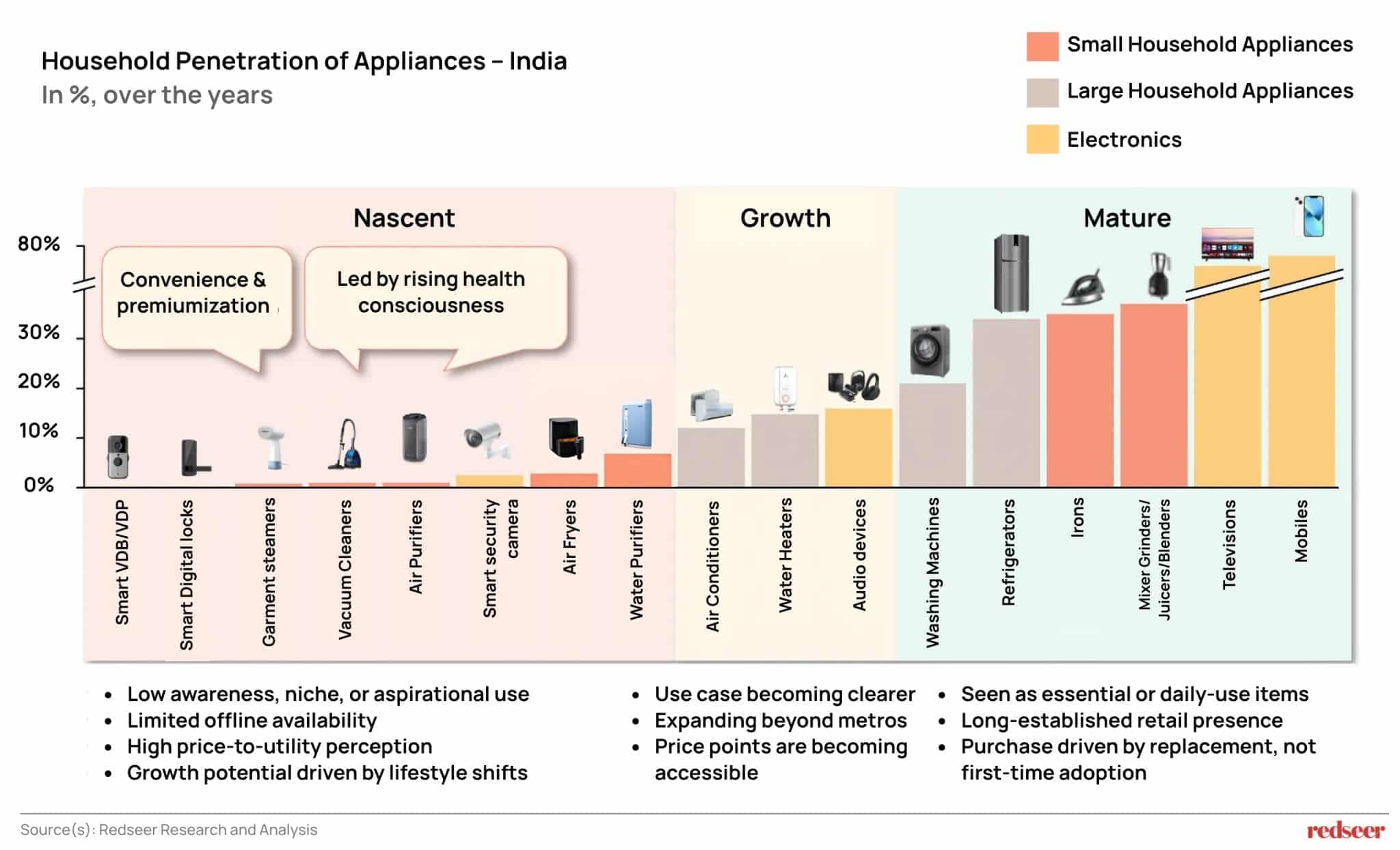

While a few appliances and electronics like mobiles, televisions, mixer grinders, irons, refrigerators, and washing machines have achieved decent penetration, most other appliances remain underpenetrated with single-digit or double-digit household penetration.

Despite low awareness and a perception of niche or aspirational use at present, several appliances, particularly in categories linked to health, hygiene, or premium living, are poised for significant growth. Limited offline availability and a high price-to-utility perception have historically constrained their adoption. However, rising health consciousness, growing demand for convenience, and lifestyle upgrades among urban consumers are beginning to shift these perceptions. As these products become more mainstream, especially with better distribution and value communication, the category’s underpenetration presents a meaningful whitespace opportunity.

Channel revolution: From General Trade to Quick Commerce

The route to market for appliances and electronics is evolving rapidly, with both traditional and modern formats playing pivotal roles. General trade still accounts for ~40% of the market, underpinned by its deep penetration across the country, including Tier 2+ towns and rural areas. This channel comprises of local appliance shops and small retailers, and continues to thrive due to strong consumer trust, proximity, and personalised service. For many first-time buyers and value-seeking households, especially beyond metro cities, the familiarity of these stores remains a key decision factor.

Meanwhile, organized channels, both offline and online, are expanding aggressively. Large format retail (LFR) stores, including multi-brand outlets, exclusive brand outlets, and modern trade formats such as hypermarkets and department stores, are extending their presence into smaller cities. These stores offer a superior shopping experience through a wide product assortment, hands-on product trials, and assisted commerce via trained brand representatives. In parallel, online platforms are driving digital adoption by solving for convenience, affordability, and selection. While online sales dominate in electronics like mobiles and accessories, appliance penetration remains lower, especially in categories requiring touch-and-feel interaction or installation. However, quick commerce is showing promise for small appliances and smart home products, with early pilots indicating incremental demand from urban consumers seeking immediacy. Compared to other emerging markets like China, India’s organised online appliance retail has significant headroom for growth, both in depth and breadth of penetration.

Winning in India: Regional GTM Plays + Omni-Channel Execution to capture this opportunity.

Top brands now span 10+ categories, moving beyond their traditional strongholds to capture cross-category demand. They understand that product innovation is key to category creation. Their product teams mine social media chatter for unmet needs, then sprint from concept to shelf via contract manufacturers in Noida or Sriperumbudur. Shorter tooling cycles and modular platforms let them launch three versions where legacy players release one. We can witness these developments across categories:

- Air fryers are getting dual-basket technology, app integration with guided recipes, and premium positioning through exclusive retail partnerships.

- Garment steamers are focusing on powerful continuous steam, sanitisation features, and smart-flow technology for all fabric types.

- Mixer grinders are incorporating advanced motor technology for efficiency and durability, along with specialised jars for different grinding needs.

- Smart appliances such as smart home cameras, smart video doorbells, and smart locks are rapidly incorporating features as AI-detection, multiple entry modes, and visitor profile management.

Innovation is speeding with faster S-curves

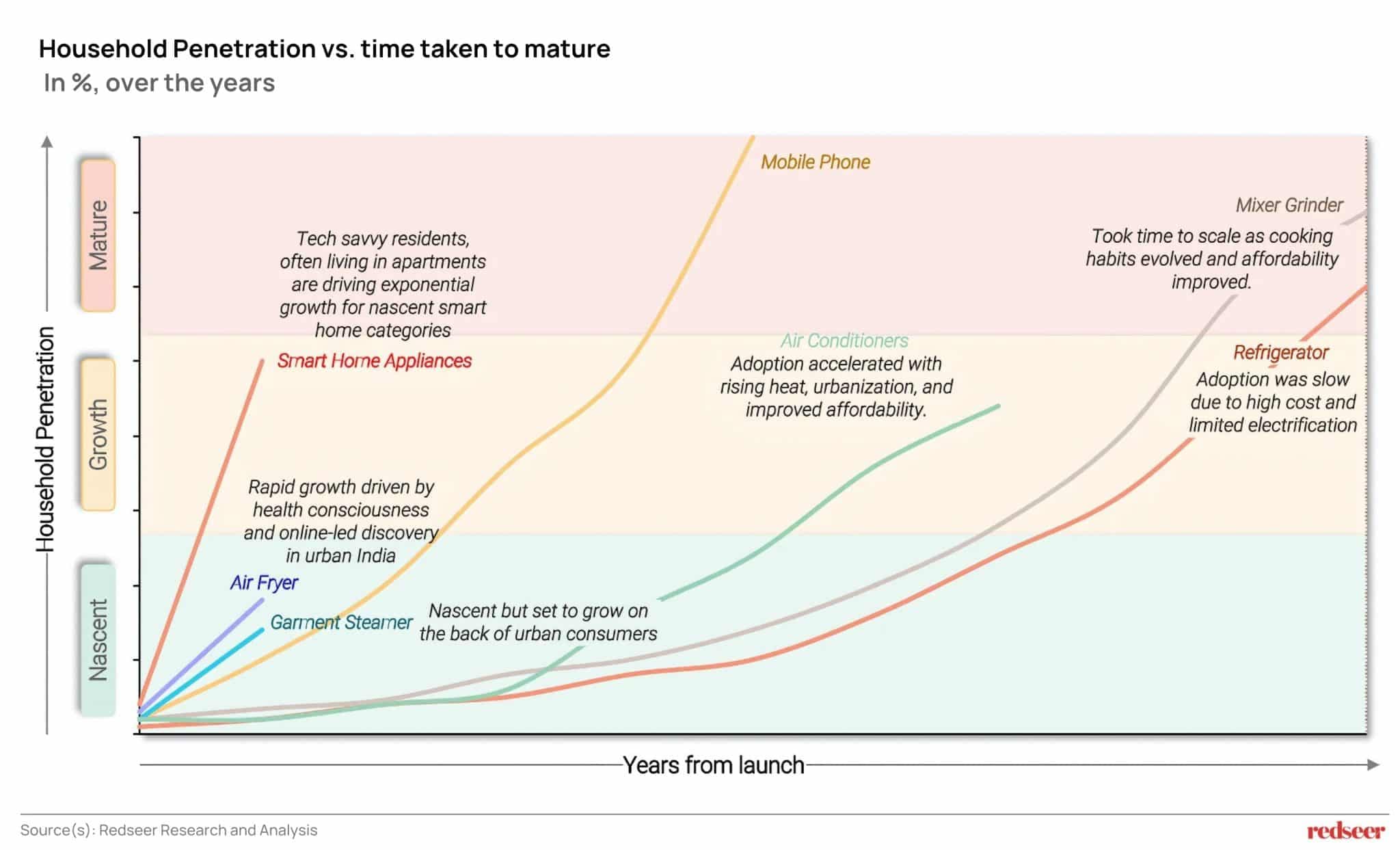

Perhaps the most remarkable development is how quickly new categories are scaling. Adoption S-curves are now faster than before, thanks to urban demand, online discovery, and lifestyle upgrades.

Unlike traditional appliances that took decades to mature, modern small appliances are achieving significant scale within years of launch. This rapid adoption is driven by health consciousness and online-led discovery in urban India.

Leading players are capitalising on this through aggressive product innovation and category creation. Take mixer grinders, for instance; leading brands are introducing IoT connectivity, juicer-grinder hybrids for health-conscious users, and specialised technologies like micro-grind capabilities.

The Rise of Smart Home Ecosystems

The convergence of demographic dividends, rising incomes, channel evolution, and faster innovation cycles is creating an unprecedented opportunity in India’s appliances market.

Smart home devices are at the forefront of this transformation, moving from standalone novelties to integrated ecosystems that enhance convenience, security, and energy efficiency. Nascent categories such as smart home cameras and smart locks are growing at a 40–50% CAGR from 2024-29, driven by rapid product innovation aimed at category creation. This momentum is further fueled by rising urbanisation, a growing share of premium housing, and narrowing price gaps that are making smart devices more accessible to the aspirational middle class. New-age players are capitalising on the opportunity by offering AI-enabled features, building interoperable tech stacks, and tapping into digital-first consumer journeys. As discretionary spending on home improvement rises, smart appliances are increasingly shifting from aspiration to reality in the modern Indian household.

Capturing this opportunity, however, will require more than just presence; it requires precision. Brands need to tailor offerings to distinct customer segments, balance reach with relevance across both traditional and emerging channels, and stay ahead of rapidly evolving consumer expectations. The winners will be those who can navigate the complex channel landscape, innovate at the intersection of health and convenience, and execute omnichannel strategies that reach consumers wherever they are – from large format retail in Tier-2+ cities to quick commerce in metros and everywhere in between.

Conclusion: Navigating a Market at the Cusp of Transformation

India’s appliances sector is entering a defining phase, where growth is no longer just volume-driven, but led by value, innovation, and rapid shifts in consumer expectations. As categories blur, channels diversify, and product cycles shorten, the market demands sharper strategic choices from all stakeholders.

For brands, the imperative is to move beyond traditional strongholds by rethinking product portfolios, introducing innovations, tailoring regional strategies, building agile distribution models, and penetrating the buyer cohort with omnichannel marketing tactics and unique messaging that align with evolving customer journeys.

For start-ups, success will hinge on identifying whitespace early, designing for emerging lifestyle needs, unique innovation, sharper messaging, and building brand trust, and scaling with discipline, especially as premiumisation meets affordability at scale.

For investors, this market offers significant headroom but requires careful evaluation and due diligence of players, category dynamics, margin structures, and channel performance to back the right models at the right inflection points.

“In India’s appliance market, speed and segmentation are the new strategy. Brands that win will be those that decode regional demand, scale omni-channel faster than the category, and innovate ahead of consumer intent — not in response to it.”

Mrigank Gutgutia, Consulting Partner, Redseer

“We Solve for New and What’s Next” – For companies at the edge of innovation, Redseer helps define the future, not just respond to it.

Here is an example of how we enabled Titan with a clear strategic fit and a roadmap to help it evolve its wearables into active health companions for Indian consumers, with a strong partnership with CueZen.

Want to solve:

- Which subcategories and formats are likely to become the next ₹1,000 Cr+ opportunities?

- Designing your product roadmap to meet emerging lifestyle-led use cases

- What regional and channel-specific strategies should you prioritise for maximum ROI?

- Analysing your GTM stack and optimising it for Tier 2+ cities and rising digital-first buyers

- Which partners would be the right fit to accelerate growth?

Let’s discuss how we can accelerate your growth story.

Written by

Mrigank Gutgutia

Partner

Mrigank leads business research and strategy engagements for leading internet sector corporates at Redseer Strategy Consultants. He has developed multiple thought papers and is regularly quoted in media and industry circles.

Talk to me