Ready-to-Drink (RTD) Beverages – India’s Next Lifestyle Megatrend

From sparkling to stills, from shelves to screens, this is the playbook for winning in India’s evolving drinks market.

Executive Summary:

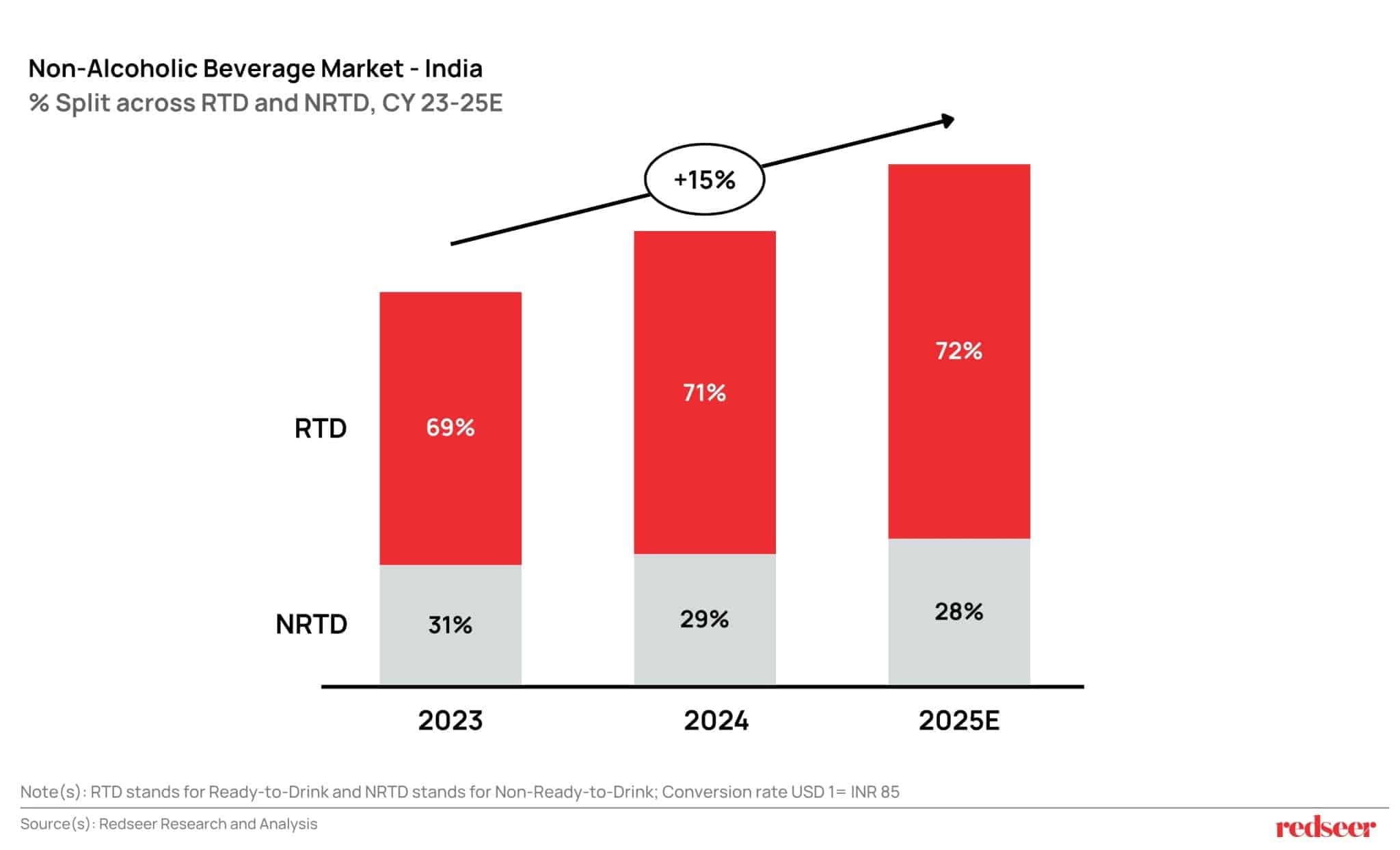

India’s Ready-to-Drink (RTD) beverage market is experiencing a pivotal transformation. Now accounting for ~70% of the non-alcoholic beverages category and growing at a CAGR of 18%, RTD is no longer a seasonal trend; it’s becoming a year-round lifestyle choice. This growth is driven by shifting consumer preferences toward health, convenience, and experimentation, particularly through digital channels like quick commerce. With juices and value-added dairy outpacing category averages and online consumption behaviour diverging from offline norms, brands and investors alike must recalibrate their strategies. This article explores how the RTD category is scaling with depth and direction, and what it takes to stay ahead in a dynamic, digitally charged market.

The New Beverage Mandate: Healthier, Faster, and Always-On

Have a question?

Our experts are just a click away.

The non-alcoholic beverage industry in India is at an inflection point. While the sector has long been associated with seasonal demand and carbonated formats, consumer behaviour is evolving faster than legacy assumptions. Health-conscious choices, the demand for functional ingredients, and digital-first convenience are redefining ‘what’ and ‘how’ India drinks.

As Ready-to-Drink (RTD) products rise to become the dominant format, brands are no longer competing just on flavour or price; they’re competing on purpose, positioning, and placement. The category is shifting from refreshment to relevance: from on-the-go hydration to functional wellness, and from impulse buys to lifestyle alignment. This is not just growth, it’s structured reinvention. The brands that understand these shifts early and design their products and marketing strategies accordingly will own the next chapter of India’s $30B+ beverage story.

India’s non-alcoholic beverages market stood at $28 billion in 2024, growing at 15% CAGR from 2023 and expected to exceed $32 billion by the end of 2025. The Ready-to-Drink (RTD) market itself comprises 70% of the market and is growing at a faster CAGR of 18%, as it is increasingly gaining momentum in the evolving lifestyles of Indian consumers across seasons, rather than just being a summer-dependent phenomenon.

Health and Functionality Are Redefining Ready-to-Drink (RTD) Preferences

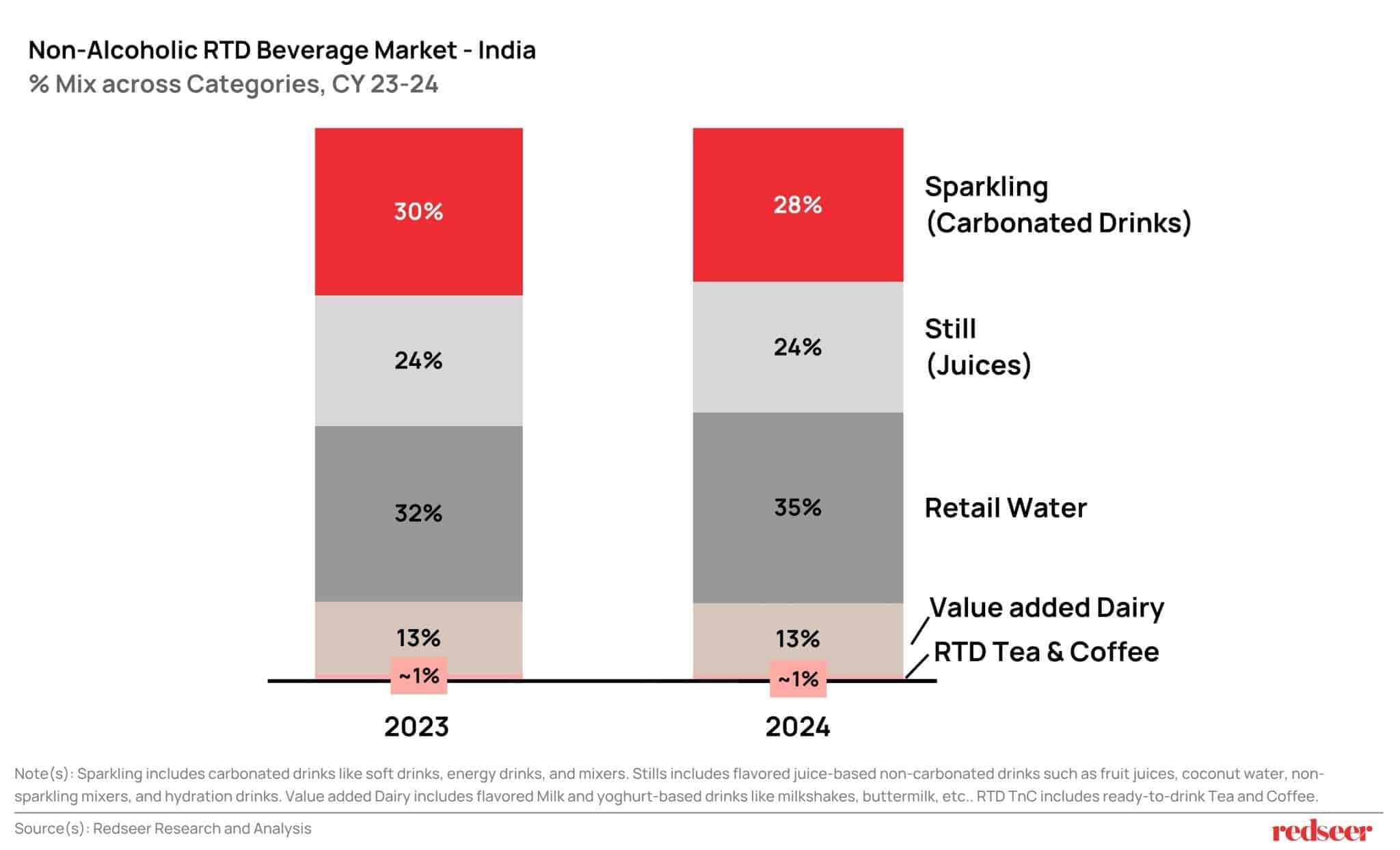

While carbonated drinks remain popular, their relative share is plateauing due to growing ingredient scrutiny and health concerns. In contrast, juices and value-added dairy are accelerating. Innovations like cold-pressed juices, flavoured coconut water, and dairy-based protein drinks are creating stickier, health-forward use cases, reflecting evolving consumer preferences.

What’s changing?

- Consumers are becoming more health-conscious and aware of the product ingredients, evident by the reduction in sparkling beverages’ share, which has also observed a lower than industry growth. Similar trends are being observed across other categories.

- The juices market is steady in share but has been growing at 1.1x the industry growth. Brands are launching new novel flavors and organic variants (such as cold-pressed juices, flavored coconut water, etc) to drive differentiation.

- New categories like cold-pressed juices and packaged coconut water have been introduced by both traditional and new-age brands, and have observed the highest growth rate in the still category, driven by its health benefits and urban consumption.

- Value-added dairy, though still a small segment, is growing at a 20% CAGR, outpacing overall RTD growth. This is driven by launches that combine nutritional benefits (protein, calcium, vitamins) with ready-to-drink convenience, appealing to evolving consumer lifestyles.

Are Online Channels becoming a Category-Creation Engine?

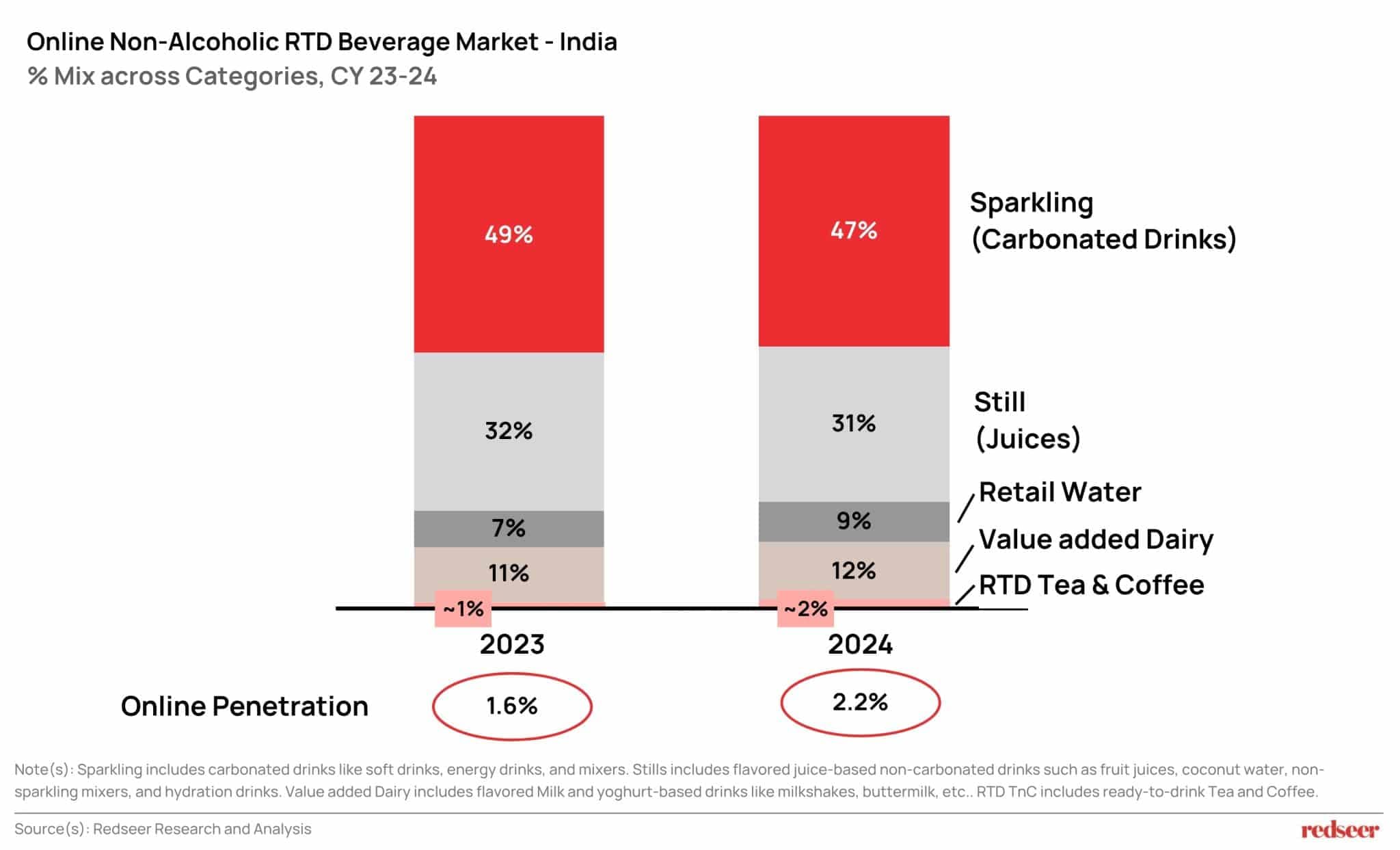

RTD’s (Ready-to-Drink) digital story isn’t just about convenience, it’s about category development. Quick commerce is expanding reach, enabling trial, and building new habits. Products like flavoured water, cold brews, functional dairy, and premium mixers are finding stronger uptake online due to their packaging, positioning, and premium appeal.

Following these underlying shifts in consumer behaviour, the channel landscape is also evolving, and 2 structural shifts are being observed:

- Online is unlocking the next leg of growth: Online penetration in the non-alcoholic ready-to-drink market increased from ~1.6% to 2.2% in 2024, observing a 4x CAGR compared to the overall RTD market. This explosive growth is being driven by quick commerce, which grew by 120% from 2023 to 2024 and contributed to 60%+ of the online RTD market. The online penetration is further expected to grow to 2.7% by the end of 2025, contributing to ~$0.6 billion in the overall market.

- Online channel observing a different consumption pattern than the offline: Online consumption is skewed toward visibility-led, premium, and impulse categories, as quick commerce is playing a major role in driving trial and convenience-based use cases.

- Sparkling beverages lead online baskets as in offline, which is supported by high visibility and impulse appeal

- Stills (Juices) command 30%+ share in online RTD sales, higher than offline – Driven by consumer preference for functional and flavoured variants

- Value-added dairy also punches above its offline weight, indicating a digital-first audience for premium, health-aligned beverages

“Online sales are projected to hit ₹5,000 Cr ($0.6B) by 2025, powered by 2.7% market penetration.”

Strategic Advisory: Implications for Brands and Investors

There is a visible shift in how online is shaping not just access but also discovery and experimentation in the RTD category. It’s becoming a testing ground for newer formats, cleaner labels, and niche offerings that may not scale as quickly offline.

Brands need to design for relevance, scale with online

- Health-first is not a niche; it’s the new baseline. Rethink ingredient sourcing, claims, and label transparency across your portfolio.

- Treat online as a launchpad. Quick commerce is a discovery engine, not just a delivery channel. Innovate pack formats, test premium SKUs, and build digital-native brands that can transition offline.

- Balance premium with precision. With premiumisation gaining traction, especially in still and dairy categories, brands must align pricing with clear functional benefits and credible storytelling.

Investors need to bet on behaviour, not just brands

- Monitor segment-level velocity. Stills RTD’s and value-added dairy are not just fast-growing, they’re aligned with long-term lifestyle shifts.

- Back brands that enable repeatability. Growth lies not just in new categories but in the ability to create loyalty through habit formation, especially across digital channels.

- Look beyond volume to viability. The RTD space will reward companies that blend functional innovation with supply chain efficiency and scalable unit economics.

Closing Note

India’s RTD market is no longer chasing summer spikes; it’s building enduring consumer relevance across health, convenience, and daily rituals. For brands and investors alike, the opportunity lies in decoding demand ahead of time, designing for digital, and delivering value that lasts beyond the first trial.

Written by

Mrigank Gutgutia

Partner

Mrigank leads business research and strategy engagements for leading internet sector corporates at Redseer Strategy Consultants. He has developed multiple thought papers and is regularly quoted in media and industry circles.

Talk to me