Ready-to-Eat Brands Are Leaving 85% of Addressable Consumers on the Table

Ever since instant noodles delivered on the promise of tasty and easy cooking to working women in the 80s, the ready-to-eat/ready-to-heat (RTE/RTH) category has become a fixture on Indian shopping carts. With growing urbanisation, rising incomes, and urban Indians’ willingness to pay for convenience, RTE/RTH foods have a 70-80 million-strong market ripe for capture.

And yet, our survey of over 670 respondents revealed that less than 15% of them consumed RTE/RTH foods regularly. The reason? The food is not tasty or healthy enough.

This is a massive strategic opportunity hiding in plain sight. However, capturing this market demands that brands uncover the primary incentives and deterrents for RTE consumers.

The Illusion of Addressability

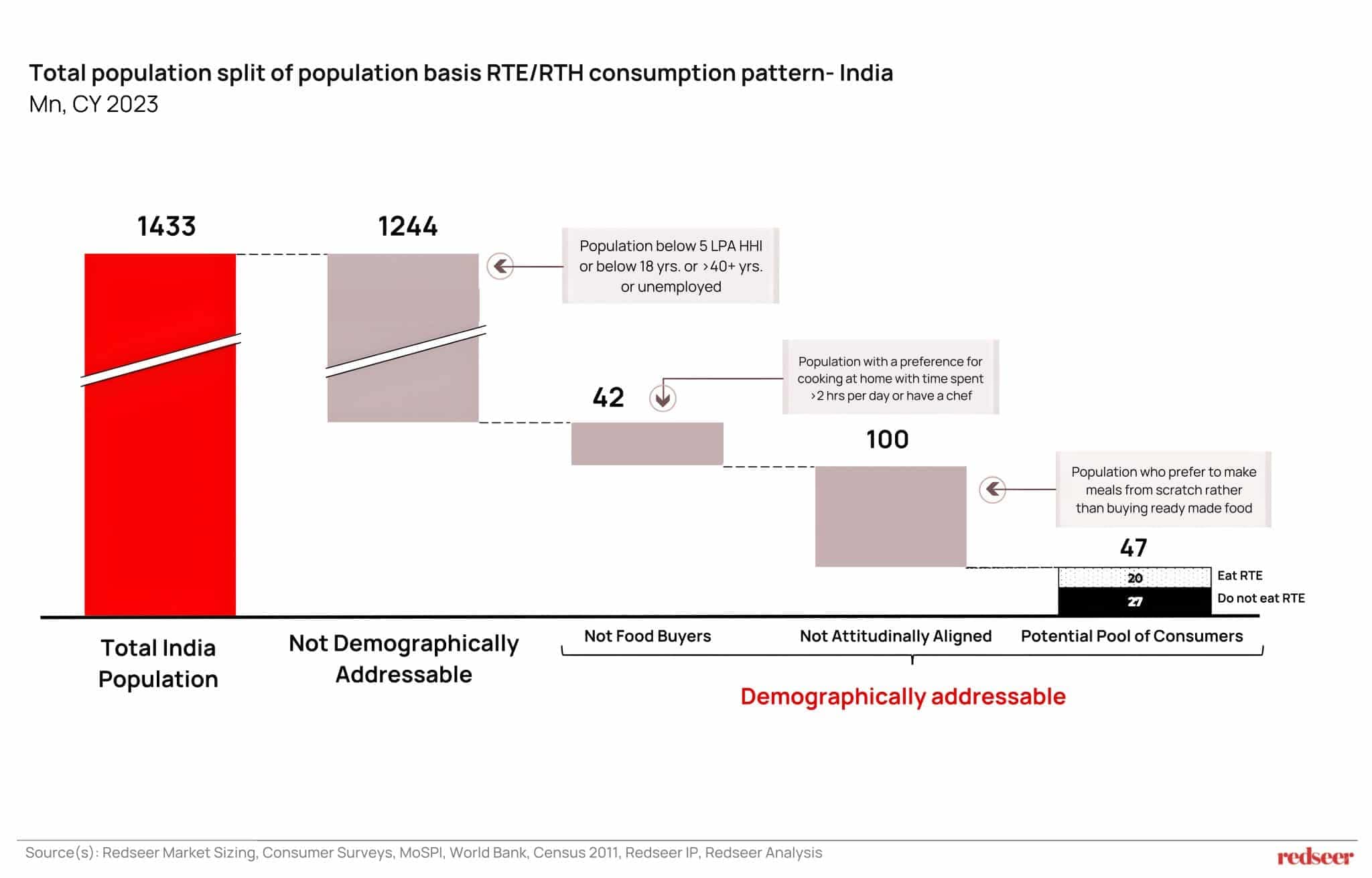

The addressable market for RTE foods was about 50 million in 2023. With the rapid uptake of quick commerce in metro/Tier 1 cities, we estimate this base to have expanded to 70-80 million (2025). This segment is open to experimentation and variety in its meal rotation. But not all customers are primed for conversion.

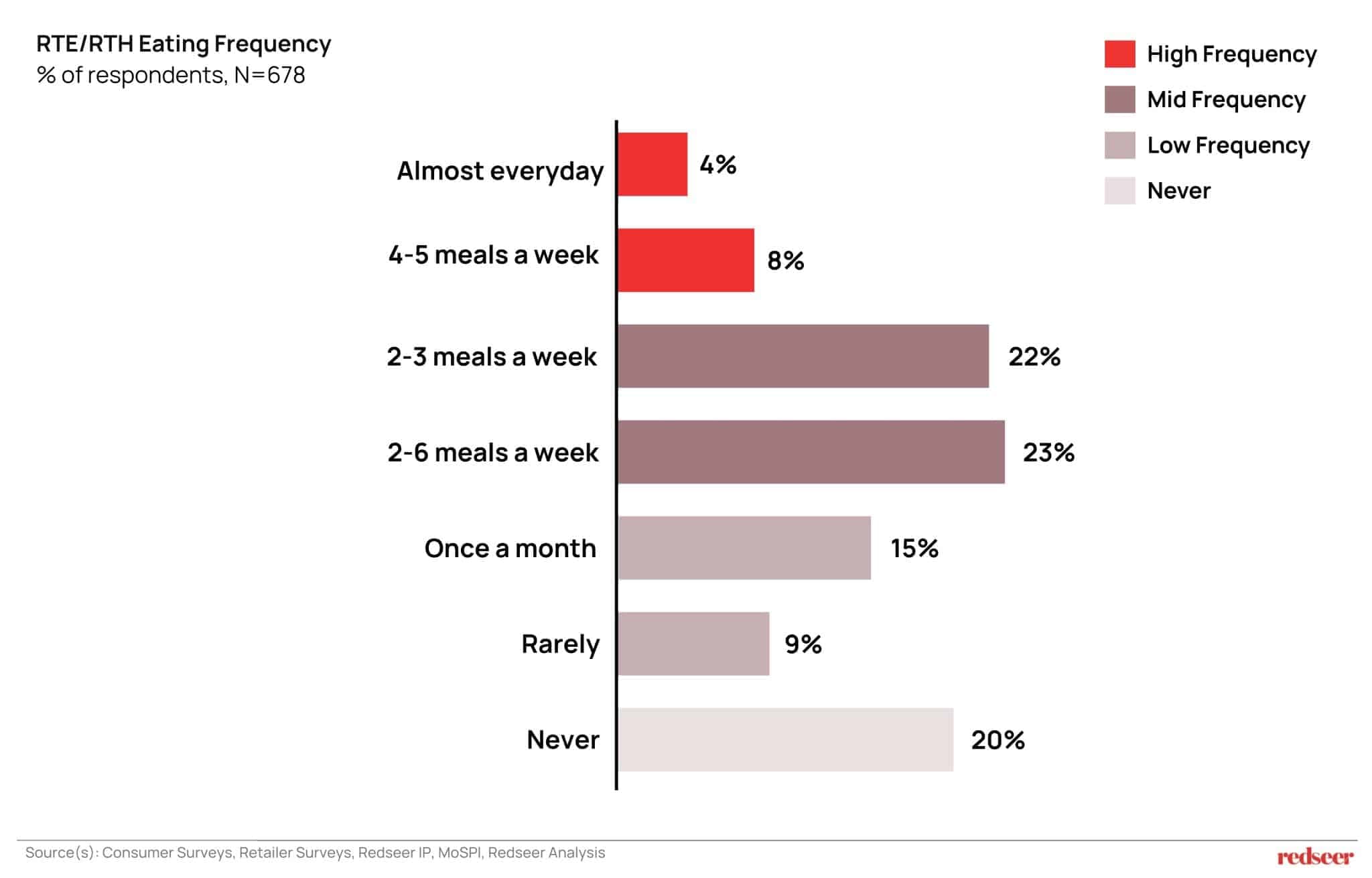

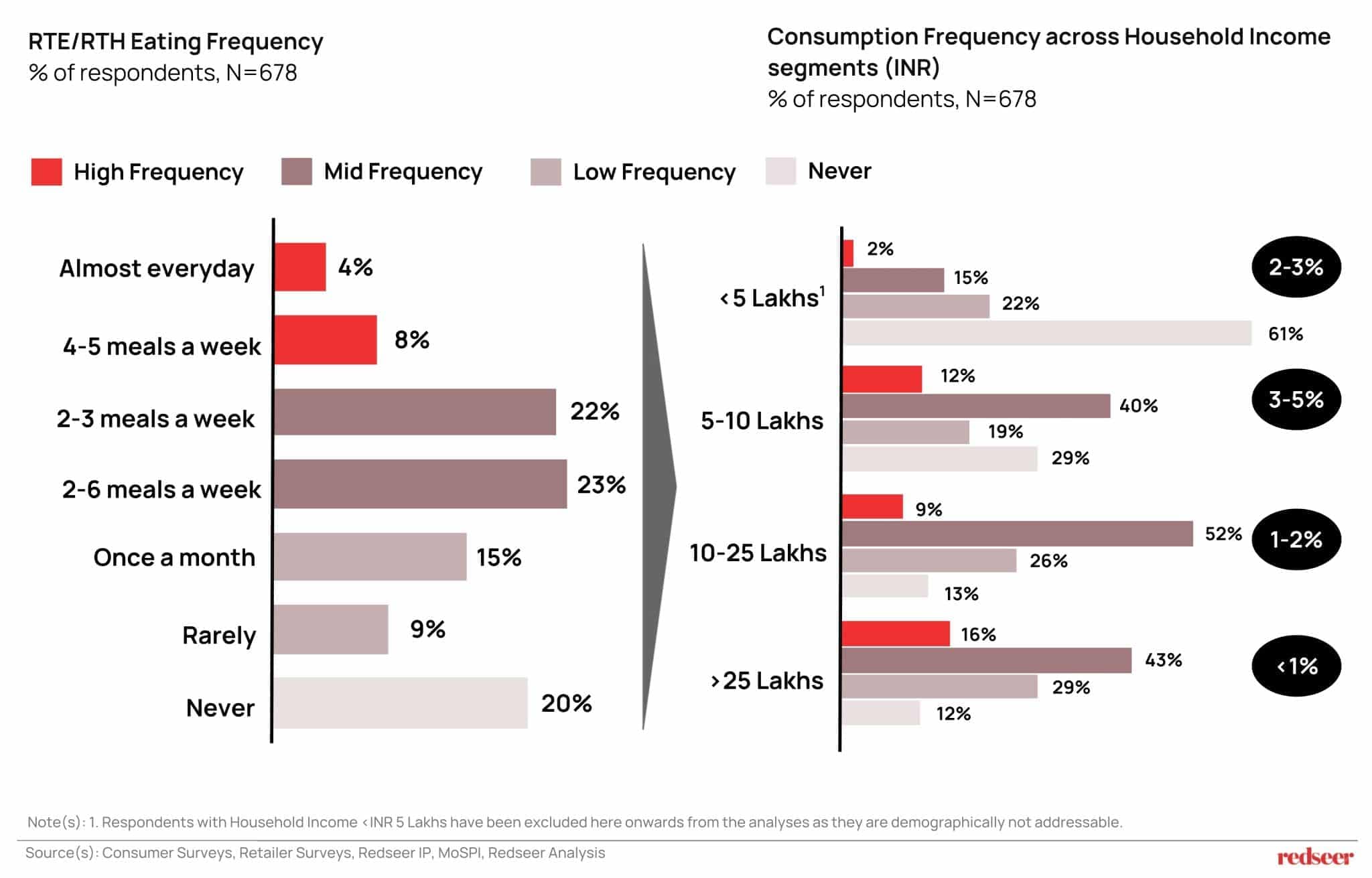

Our research reveals stark frequency tiers. High-frequency users, who consume RTE meals at least several times a week, represent just ~12% of the addressable market. Mid-frequency users clock in at ~45%, while low-frequency buyers account for ~15%. The remaining ~29% of the total addressable market rarely or never purchase these products, despite matching the demographic and lifestyle profile perfectly. This reveals a significant desirability misfit.

Our consumer ratings across leading RTE brands reveal consistent gaps in the attributes that matter most. Brands score poorly on nutritional value, with “unhealthy products and low nutritional value” cited as a major barrier by non-users. The perception of RTE foods as preservative-laden appears to act as a significant deterrent.

Taste presents an equally considerable hurdle. Even mid-frequency users, that is, consumers who actively want convenience, report disappointing experiences. Value for money amplifies these concerns. When products fail to deliver on health or taste, price sensitivity intensifies. Our analysis shows mediocre scores across mass and premium segments on value perception, leading to a vicious cycle where consumers feel they are paying a premium for compromise.

The clear takeaway here is that Indian consumers want both convenience and health. Most brands are solving for one, or neither.

The Category That Cracked the Code

Batters offer a compelling case study in getting convenient eating right. The category has scaled to approximately INR 30 billion with a whopping 20% quick commerce penetration. Three factors contribute to this:

- Short shelf life drives frequent top-ups, for which quick commerce is the best format.

- Unplanned, immediate need for meal preparation aligns with instant delivery; and

- Urban nuclear households adopt quick commerce for convenience over bulk retail.

The success of this category is a testament to the convenience-health-quality matrix that other RTE brands need to fit into.

Winning the non-users over

Consumers have clear non-negotiables when it comes to switching to RTE/RTH foods. Regionally favoured cuisine is also an area where this category could grow. Offering a “homestyle” assortment of packaged foods could go a long way in forming a loyal consumer base for RTE brands. With these aspects outlining the gap between non-adoption and habit formation, success in this market requires fundamental strategic clarity. Brands need to ask the following questions:

- Market attractiveness: Are you targeting the right frequency tier, or chasing low-propensity segments? Understanding which tier you can realistically convert determines your total addressable market.

- Right to win: Which differentiator will you own: freshness assurance, cold-chain reliability, digital shelf visibility, or repeat purchase stickiness? How do these compare across leading players, and where do you stand?

- Execution economics: Spoilage, ingredient costs, cold chain investments, packaging are among the many factors that affect break-even fundamentally. Among the levers of dynamic pricing, assortment curation, and micro-fulfilment, which ones could improve profitability?

- Premiumisation: Where can clean-label positioning, functional health claims, or regional authenticity justify price realisation?

- Investor roadmap: Where can you allocate capital (cold chain infra, digital merchandising partnerships, or exclusive product tie-ups with retail platforms) to create sustainable competitive moats?

Eighty-five percent of addressable RTE/RTH food consumers remain unconverted. This represents one of India’s largest white space opportunities in FMCG. Brands that win in this space will be the ones that decode the dichotomy of convenient, but nutritious and delicious foods for a highly discerning consumer base.

Redseer helps brands move from market sizing to market winning through our strategic guidance and actionable consumer insights. To explore how your brand can lead categories and disrupt markets, speak to our experts today.