Exploring Bharat: How Regional Content Drives SFV Platforms’ Growth in India

While we have been discussing Indian Short Form Video(SFV) Apps for quite some time now, central to this growth are Tier-2+ cities—collectively known as “Bharat”—which now account for 63% of SFV engagement and staggering 74% of overall user base on user-generated content (UGC) platforms. These regions are the key to the growth and expansion of the SFV ecosystem with relatable, regional content that resonates with local audiences.

We solve the strategy behind scale!

Now for brands and platforms alike, Bharat presents a golden opportunity: how can they tap into these users’ growing appetite for local content?

At Redseer Strategy Consultants, we’ve been closely tracking the rise of short form video platforms since 2019, when India first started getting hooked to bite-sized content. The 2020 ban on TikTok and other Chinese apps left a significant void in the market—one that these homegrown apps quickly stepped in to fill. While we have earlier talked about their rise, the acceleration of their growth and finally their monetization models, revenue streams, and user acquisition, this year’s annual report “From Likes to Monetizing Millions” mainly talks about how SFVs have now come out of their infancy and that the monetization models are no longer in an experimental stage.

To understand what’s driving these monetization models and their success, in this piece, we will explore the pivotal role of Bharat as a growth engine for India’s SFV platforms, reshaping how content is created, consumed, and monetized.

The Bharat Growth Story: Driving India’s SFV Transformation

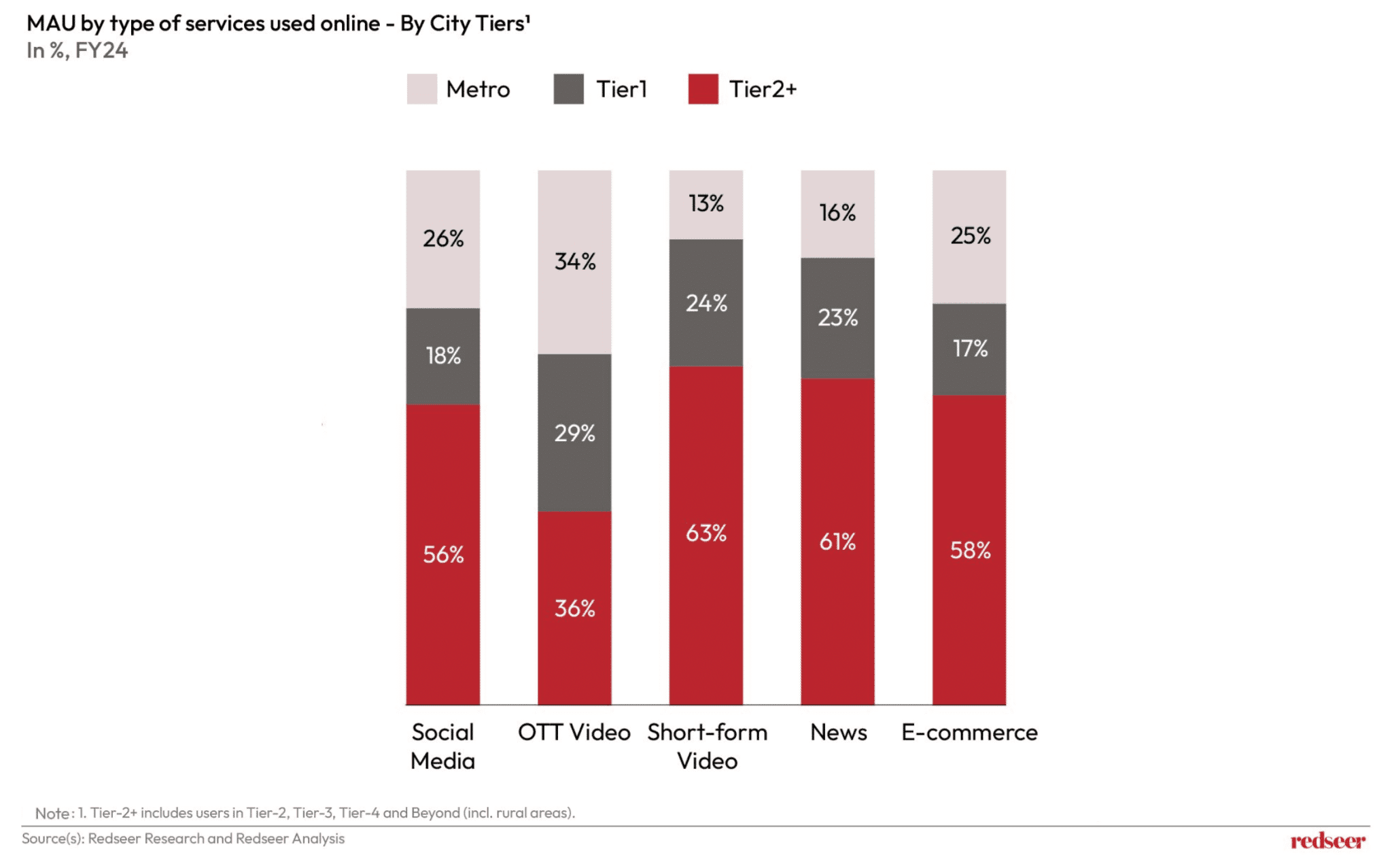

Bharat users account for a significantly larger share of engagement compared to Tier-1 cities and metros. While Tier-1 cities contribute 24% of the monthly active users (MAU), and metros account for just 13%, Tier-2+ cities show much higher engagement, highlighting the growing influence of Bharat in driving the SFV ecosystem. These users are shaping digital trends across social media, OTT video, and SFV, while also contributing to 70% of all online transactions in India.

Affordable smartphones and low-cost data have been the major factors behind this contribution, with users spending an average of more than 30 minutes daily consuming short video content. Their demand for relatable, culturally aligned content underscores their growing influence, making them critical to the evolution of India’s SFV ecosystem.

The connection between cultural identity and content consumption is clear: Bharat users gravitate toward videos that reflect their everyday lives, making regional and vernacular content the cornerstone of engagement on Indian SFVs.

Filling the Void: A Post-TikTok Evolution

When these homegrown SFV platforms rapidly came in to fill the void created by the ban of Tik Tok and other Chinese apps, they registered a 3.6x increase in daily active users (DAU) and a 2x growth in monthly active users (MAU) since 2020, surpassing TikTok’s original user base in India.

Their success can be attributed to robust creator programs, influencer partnerships, and, most importantly, their focus on regional content. By aligning content strategies with Bharat’s consumption behaviour, these platforms have cultivated a loyal user base that spends ~30 minutes daily on SFVs

Regional Content: The Winning Formula

From Kannada in Bengaluru to Punjabi in Ludhiana, regional languages have a firm grip on SFV audiences. Approximately 42% of Bharat users prefer consuming content in regional languages such as Tamil, Telugu, Bengali, and Malayalam, compared to 35% in metro and Tier-1 cities. This preference is reinforced by creators who use their local dialects and contexts to connect with audiences.

Platforms like Josh and Moj have championed this movement, offering hyper-localised content libraries that align with the cultural ethos of their users. This strategy has not only enhanced user stickiness but also driven up average daily time spent on these platforms. A user from Bengaluru aptly sums it up: “Watching Kannada content is more enjoyable than English; it feels like it belongs to me.”

Archetypes Shaping Bharat’s SFV Consumption

Indian SFV platforms cater to a wide range of user archetypes, each with unique preferences and engagement patterns:

- Value Seekers: Casual viewers looking for regional content and quick entertainment.

- Household Stewards: Homemakers who find relaxation in relatable, bite-sized videos, typically in regional languages.

- Digital Innovators: Young professionals and students in Tier 2+ cities who enjoy trendy, influencer-driven content, often engaging with fashion and music videos.

- Career Mavens: Professionals consuming content for networking and skill-building and casual entertainment.

The majority of these archetypes, especially Value Seekers and Household Stewards, reside in Tier-2+ regions, driving up engagement rates significantly. These archetypes illustrate the diverse but predominantly vernacular-driven nature of India’s SFV user base, with over 50% of users falling into monetizable categories.

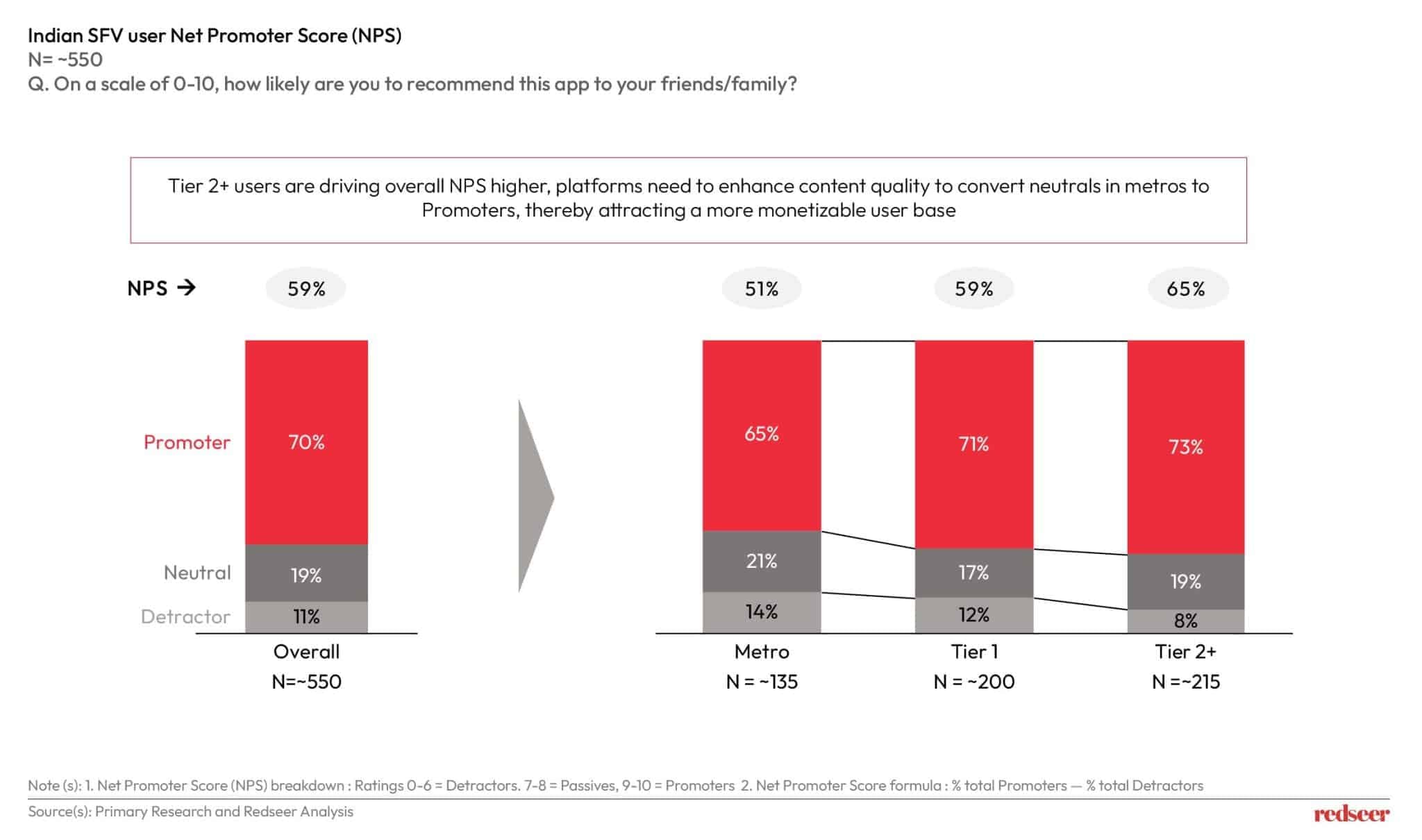

The localized approach of Indian short video apps contributed to impressive Net Promoter Scores (NPS) of 65% amongst Tier-2+ users, reflecting strong trust and loyalty. While Indian SFV platforms perform well in most areas, there is still room for improvement to further refine content across all genres. As the platforms continue to scale and evolve, enhancing content across different categories will be essential to broaden their reach and maximize engagement.

Regional Content as a Monetization Catalyst

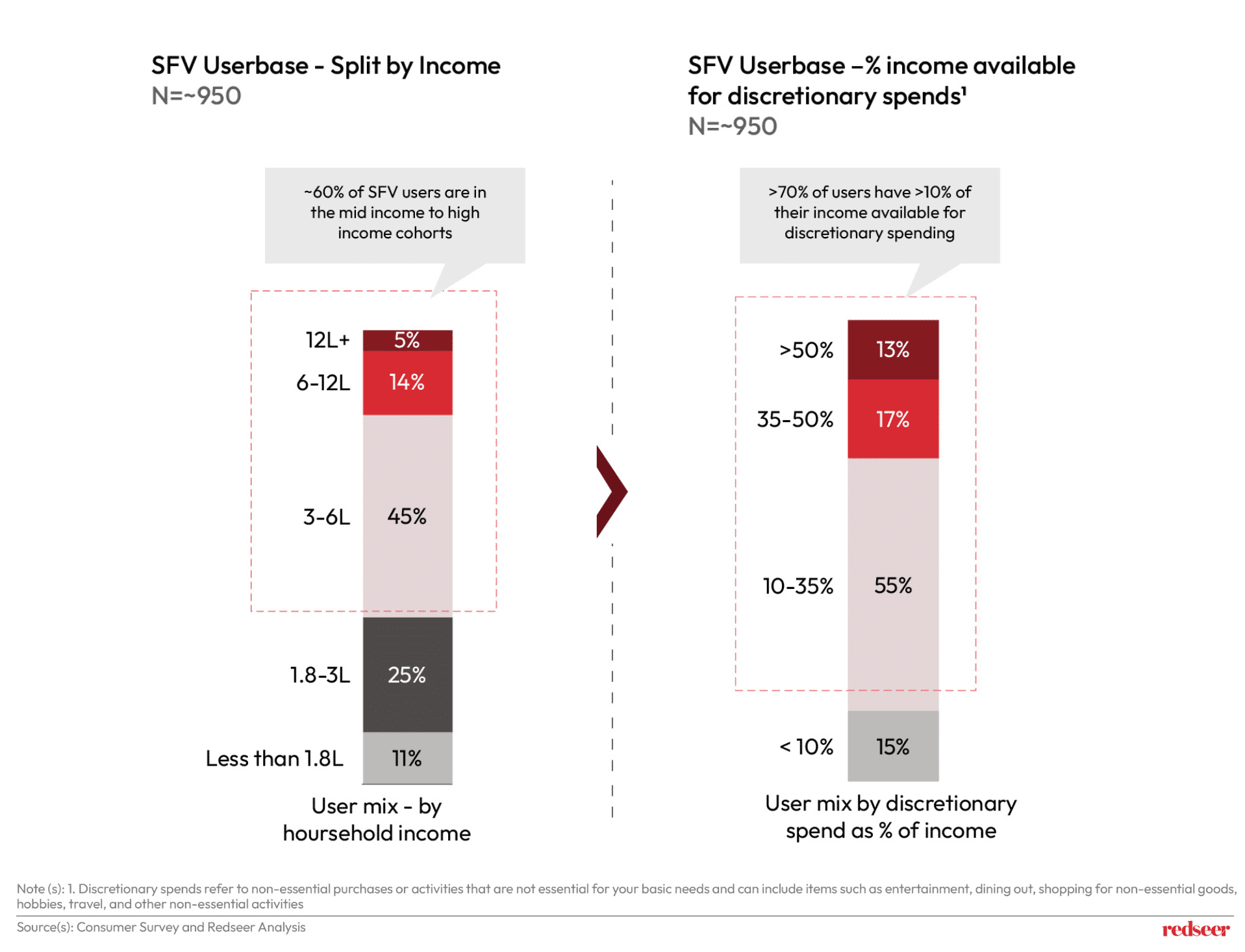

Bharat’s dominance in the SFV ecosystem is not just about engagement; it’s also a significant driver of monetization. Bharat users are increasingly contributing to the monetizable user base, with close to 60% of SFV app users belonging to mid-to-high-income households. Regional content has helped platforms unlock multiple revenue streams, including influencer marketing and advertising tailored for Tier-2+ users. Brands are also recognizing the unique value of regional content in reaching Bharat audiences.

Campaigns leveraging regional influencers often achieve strong engagement, as these influencers have niche follower clusters in local communities. For instance, a Holi-themed campaign using Hindi-speaking influencers generated 28 million views and over 750 user-generated videos.

The Path Ahead: Building on Bharat’s Digital Momentum

Indian SFV platforms are uniquely poised to lead the next wave of digital engagement by doubling down on regional content. Key priorities include:

- Expanding Content Libraries: Increasing investment in vernacular content to cater to untapped regions.

- Empowering Local Creators: Offering training and incentives to regional creators to enhance content quality.

- Enhancing Personalization: Leveraging AI to deliver hyper-personalised feeds based on regional preferences.

- Driving Ad Localization: Encouraging brands to adopt region-specific campaigns to maximise relevance and impact.

Bharat’s Voice, India’s Digital Future

With a user-first approach that prioritises cultural relevance and inclusivity, Indian SFVs have slowly gained traction among Tier 2+ city audiences.The focus is now to reach to Metro and Tier-1 cities, bridging the gap between urban and non-urban audiences.

As these changes unfold, the need for actionable, data-driven insights has never been more critical. At Redseer Strategy Consultants, we have been at the forefront of decoding India’s digital landscape, providing a comprehensive understanding of user behaviour, platform dynamics, and monetization opportunities. Our extensive research into the SFV ecosystem equips businesses with the knowledge needed to tap into Bharat’s potential and drive impactful growth.

Download our report or connect with us for tailored strategies that align with your goals. Together, let’s navigate the opportunities in this dynamic sector and shape the future of India’s digital revolution.

Written by

Mukesh Kumar

Associate Partner

Mukesh is a go-getter with an analytical approach who enjoys solving challenging business issues. He has worked extensively in the retail, TMT, public policy, and private equity sectors and specialises in research and growth initiatives.

Talk to me

From Clicks to Cash: Navigating the Monetization Potential of India’s Short-Form Video Market

Demystifying India’s SFV platforms

Who’s Winning in India’s Dating & Matrimony Market—and where are the opportunities for Platforms and Investors