The Hidden Giant: KSA’s SAR 83 Billion B2B Wholesale Market Opportunity

1. Wholesalers form the backbone of KSA’s traditional value chain…

Saudi Arabia’s traditional FMCG and HoReCa value chain runs through a five-tier structure, where wholesalers play a vital intermediary role connecting brands and distributors to the fragmented base of retailers and restaurants. Starting with manufacturers and brand-linked distributors, the chain flows into independent wholesalers who operate without exclusivity, offering unmatched geographic reach, particularly in rural and underserved areas. These wholesalers link the value chain’s middle to its retail endpoints, serving as the last scalable node before goods reach small retailers, HoReCa outlets, and end consumers.

2. …but face challenges across the value chain, revealing a growing need for transformation

Have a question?

Our experts are just a click away.

Despite its scale, the traditional wholesale value chain in KSA is riddled with inefficiencies that impact both buyers and sellers. Retailers and HoReCa operators face limited price transparency, often paying inflated rates without access to competitive benchmarks. Tight working capital further restricts their ability to purchase sufficient inventory, leading to frequent stockouts and missed sales. Their product selection is also constrained, with limited access to diverse SKUs, forcing dependency on nearby wholesalers. Procurement itself is burdensome; many buyers must close their shops just to visit physical markets.

On the other side, brands contend with equally pressing issues. They lack visibility into downstream sales, hampering demand planning and forecasting. Trade promotions rarely reach the intended end retailers, often getting absorbed by intermediaries. As a result, even leading brands struggle to reach more than 50–60% of the retail universe. Persistent stockouts at the point-of-sale lead to lost revenue, while weak pricing oversight downstream undermines margin control. These structural gaps signal an urgent need to modernize the B2B wholesale ecosystem across the kingdom.

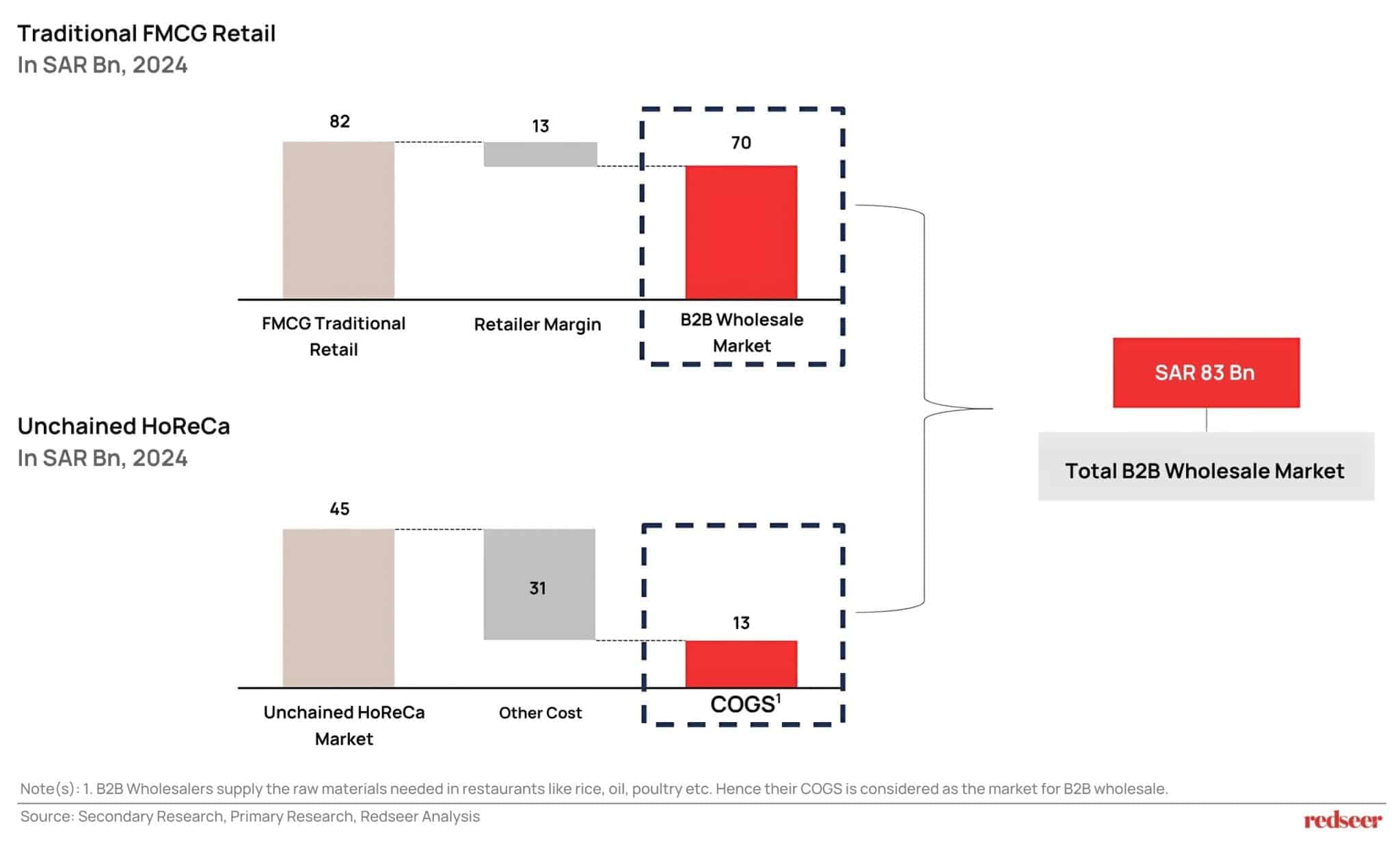

3. This represents a SAR 83 Bn opportunity, waiting to be disrupted

KSA’s B2B wholesale market, valued at SAR 83 billion, is now on the cusp of digital disruption. This sizeable market is fueled by two key segments: traditional FMCG retail, where wholesalers handle SAR 70 billion of goods, and the unchained HoReCa sector, which contributes another SAR 13 billion in wholesale raw materials sourced. Together, they represent a vast and essential ecosystem powering grocery shelves and restaurant kitchens across the kingdom.

Yet despite its scale, the market remains deeply fragmented, with the top 10 players capturing just 15 to 20 percent of the total share. This lack of consolidation, combined with persistent inefficiencies, has created a ripe opportunity for disruption. Players like Sary are leading a new wave of digital platforms that modernize the wholesale ecosystem by supporting wholesalers, brands, and retailers across the value chain. By bringing transparency to pricing, simplifying procurement, enabling credit, and expanding product access through technology, Sary enhances the role of traditional intermediaries rather than replacing them. It digitizes the relationships between all players, including wholesalers, and strengthens the overall supply network. The shift is still in its early stages, but the direction is clear: the future of wholesale in KSA is more connected, efficient, and digital.

Conclusion

KSA’s SAR 83 billion B2B wholesale market stands at a critical inflection point and is ripe for digital transformation. While traditional wholesalers continue to dominate through established relationships and geographic reach, the emergence of digital players like Sary signals the beginning of fundamental change. As these tech-driven platforms address longstanding pain points, from price transparency and inventory management to streamlined procurement, they are positioned to drive disproportionate value in a market that is highly fragmented, and the largest traditional player holds merely a 2-3% share. The next phase of this industry’s evolution will likely see accelerated digital adoption as businesses seek efficiency gains, driving massive upside potential for tech-enabled platforms.

Please reach out to us for a more detailed discussion if this is a sector of interest.

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me