The Next Battleground: Winning India’s Intracity Logistics Market Through Trust, Tech & Transparency

While digital platforms have made impressive inroads in the logistics space – growing rapidly across metros with promises of transparent pricing, real-time tracking, and reliable service – the vast majority of SMBs still rely on local fleet contractors and nakkas for their daily logistics needs.

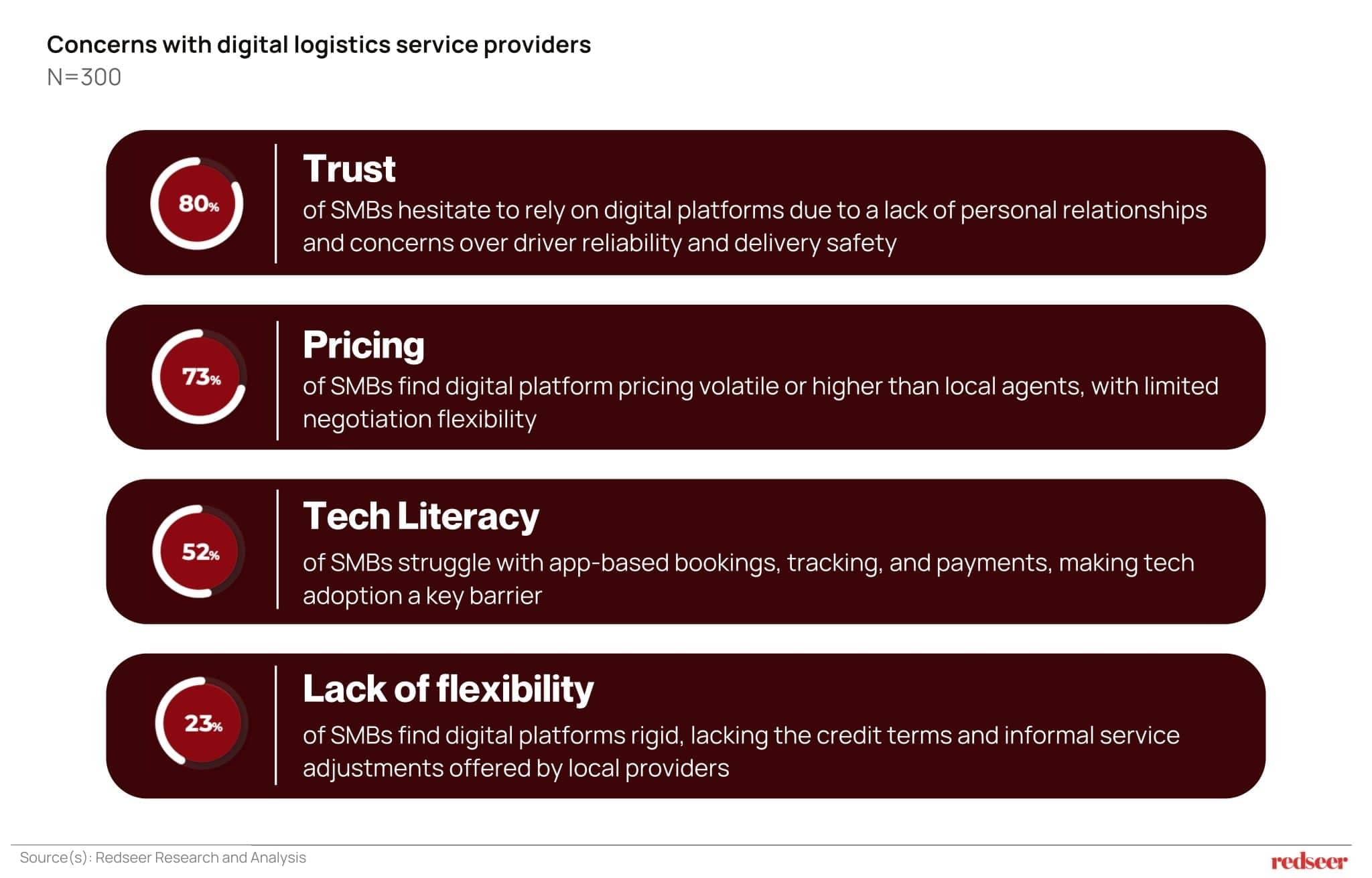

Why? Because 80% of SMBs cite low trust in platforms and drivers. 73% believe that platform pricing is volatile, or higher than local agents, with little room to bargain. Meanwhile, over half of them struggle with app-based bookings, tracking, and payments.

“India’s intracity logistics market stands at $15 billion, yet 70% of it remains unorganized, with local truckers and small fleet owners dominating.”

This report, based on primary research with 300+ SMBs and platform operators, reveals micro-market dynamics, competitive intensity, and cohort-level insights that will determine who wins in India’s next logistics battleground.

In this report:

- Growth in Intracity Logistics – intensifying competition across cities

- Market in a state of early digital maturity – most of the TAM is unorganised

- Implications for investors and operators in the sector’s next growth phase

Who Is This Report For

- Intracity Logistics Operators seeking to understand competitive positioning, improve city-level profitability, and design cohort-based acquisition strategies.

- Investors and PE Firms evaluating opportunities in last-mile logistics, conducting due diligence on platform plays, or assessing market sizing and growth potential for portfolio companies.

- Policymakers and Government Bodies seeking to use festivals as instruments of local growth, tourism, and cultural preservation

- Fleet Aggregators and Traditional Logistics Players looking to digitise their operations, understand where digital platforms are winning, and identify white-space opportunities in LCV freight and micro-warehousing adjacencies.

- SMB-focused Platforms that want to understand the logistics pain points of their customer base and explore embedded logistics as a value-add or revenue stream.

“New-age logistics platforms – distinguished by multimodal, full-stack, tech-based solutions – have grown to $700 million and are projected to reach $2+ billion by FY30”

Want to discuss how these insights apply to your specific market position? Download the report and schedule a strategy session with our team.

Written by

Mrigank Gutgutia

Partner

Mrigank leads business research and strategy engagements for leading internet sector corporates at Redseer Strategy Consultants. He has developed multiple thought papers and is regularly quoted in media and industry circles.

Talk to me