Baking the USD 14Bn opportunity in Southeast Asia

The bakery sector in Southeast Asia is rising fast on the back of changing consumer lifestyles, urbanization, and the growing café culture. Investor appetite is strong, with multiple PE/VC-backed plays and global benchmarks proving scalability and exit potential. Regional players have demonstrated how local tastes can be blended with modern retail formats to capture market demand. Investors are taking note with private capital backing expansion and supporting product innovation with differentiated bakery models.

Globally, bakery chains have seen notable exits and listings, underscoring the potential for SEA to create its own investment success stories. Successful players are those who can manage the strong top-line growth with related cost pressures from real estate, supply chain, and labor.

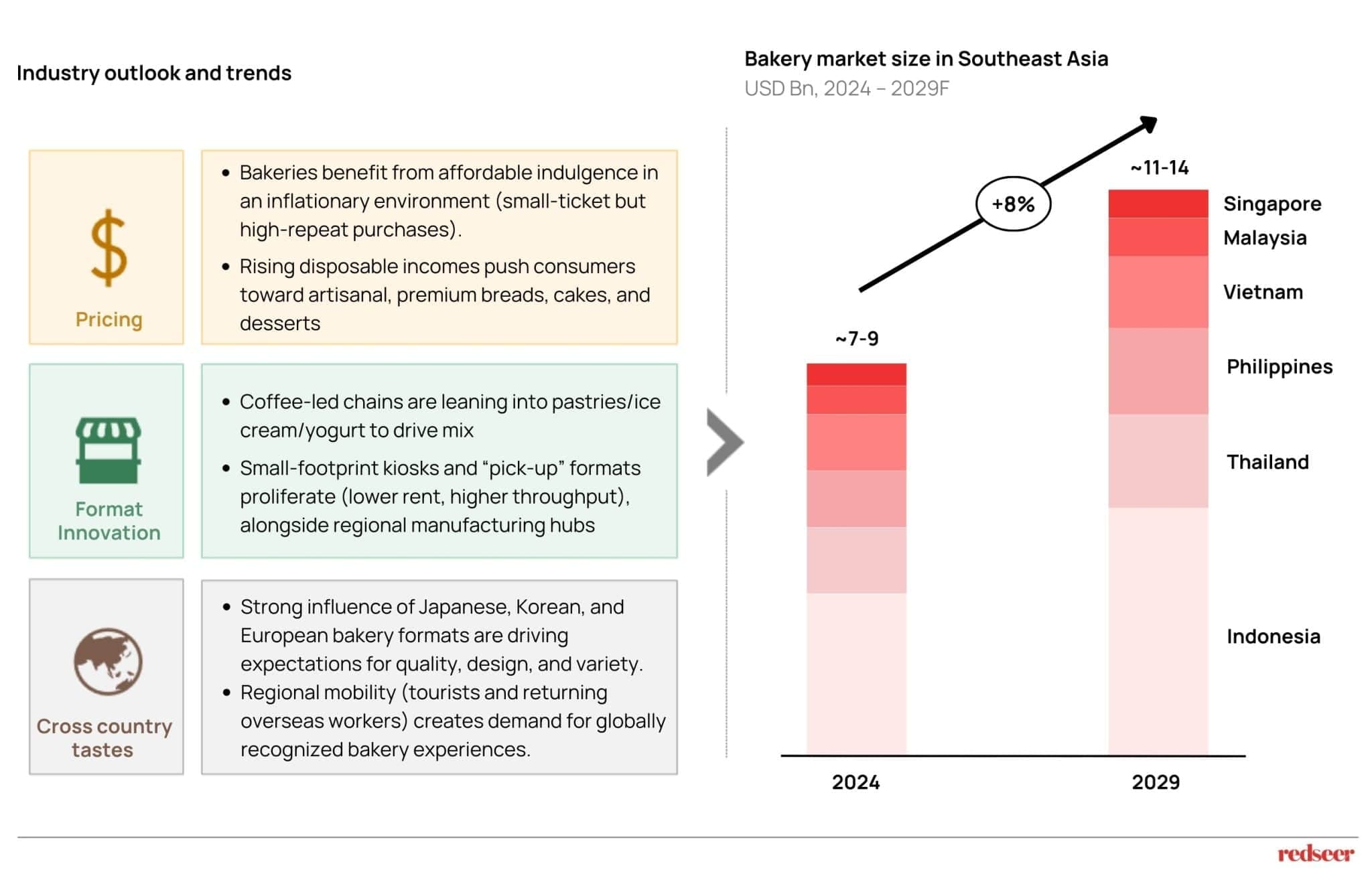

The Southeast Asia bakery market is projected to grow robustly at a CAGR of 8%, reaching up to USD 14 Bn by 2029

The Southeast Asia bakery chain market is poised to find itself in a sweet spot underpinned by affordable indulgence as consumers trade up to artisanal and premium baked goods. From fresh breads to indulgent pastries, bakeries are no longer just neighborhood shops but evolving into scalable chains with strong brand equity.

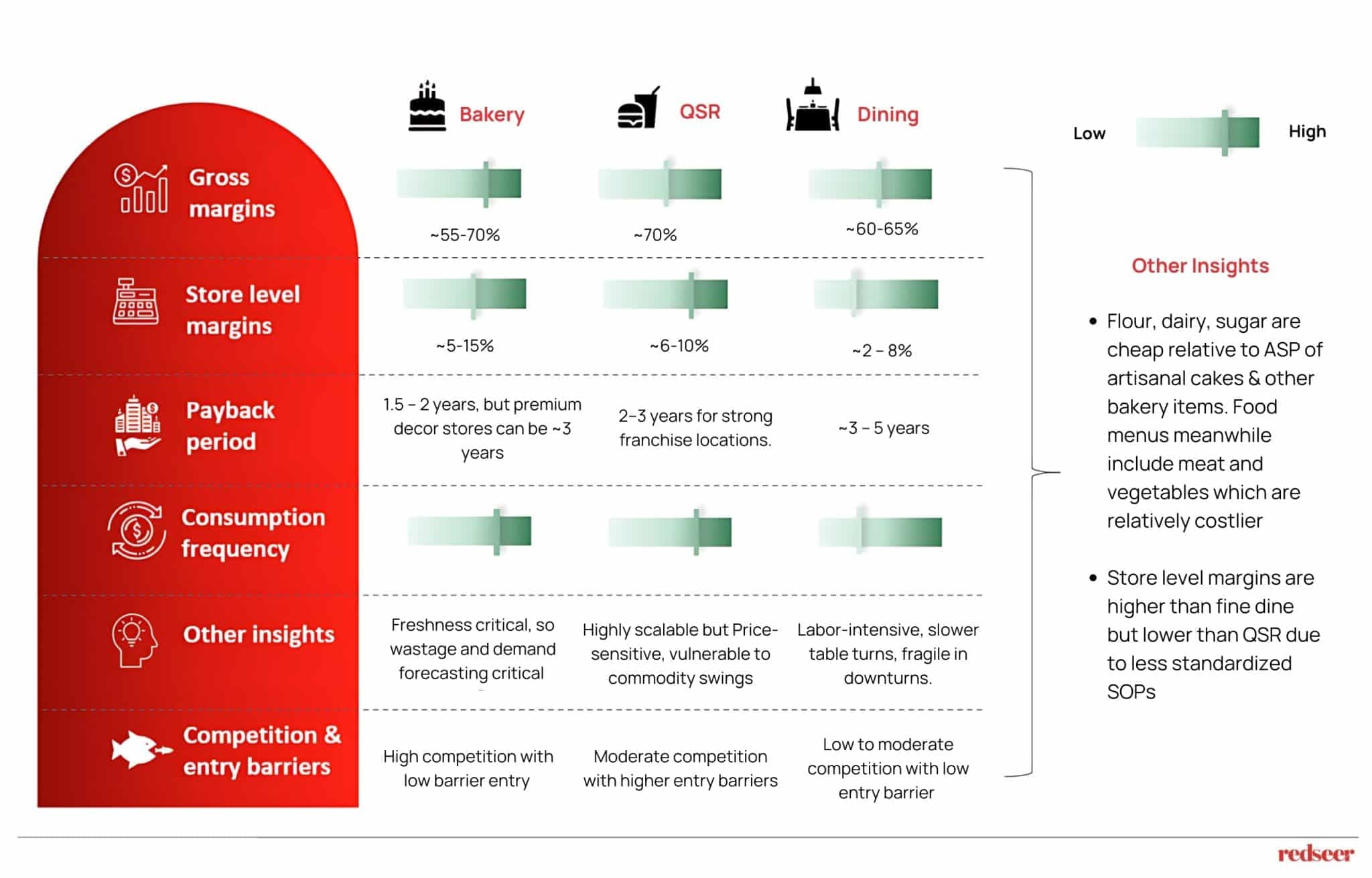

Bakery offers a unique sweet spot for investors, combining QSR-like scalability with premium dining margins and faster payback

Bakery cafés sit between QSR (scalable, efficiency-driven) and casual dining (experience-driven). They can deliver QSR-like repeatability with casual-dining-like premium positioning, which explains why PE/VCs like them. The “sweet spot” is franchise-light capex bakeries

Select bakery chains in Southeast Asia are seeing traction (1/2)

The ASEAN bakery café market is witnessing differentiated growth strategies across players. The Harvest dominates Indonesia with scale and premium mass positioning, attracting institutional investor interest. Jim’s Recipe exemplifies a franchise-driven, asset-light model with rapid international rollout. Meanwhile, Wildflour has carved a niche as Manila’s category-defining premium café, leveraging private equity backing to drive sustainable EBITDA-positive growth

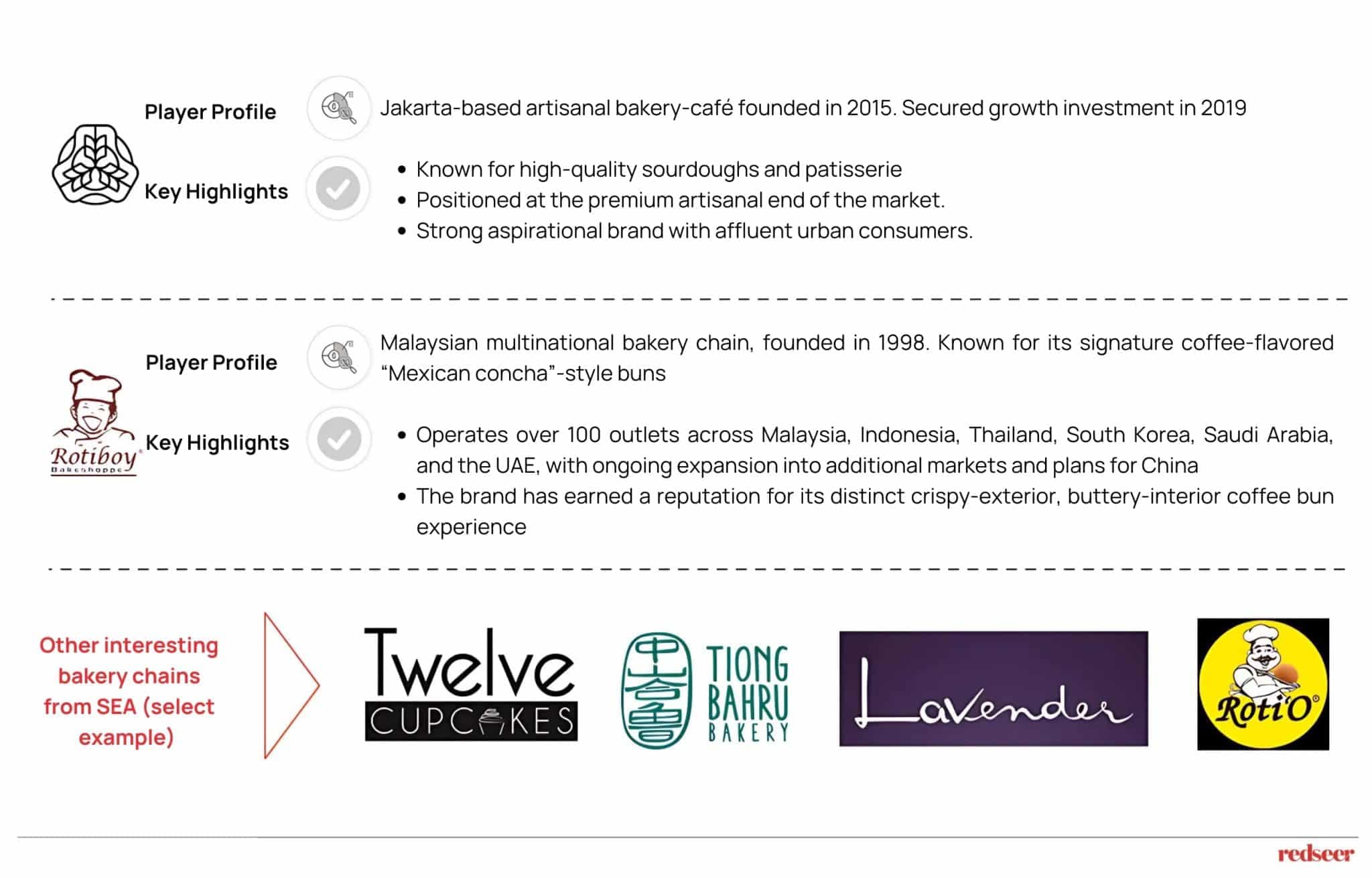

Select bakery chains in Southeast Asia are seeing traction (2/2)

Want to get strategic guidance?

The above two case studies (Beau Bakery and Rotiboy) demonstrate the various ways in which bakery players in Sea are tasting success. While one model emphasizes brand aspiration and artisanal quality, the other demonstrates the power of product-led international scalability. Together, they reflect SEA’s diverse pathways to building bakery café success.

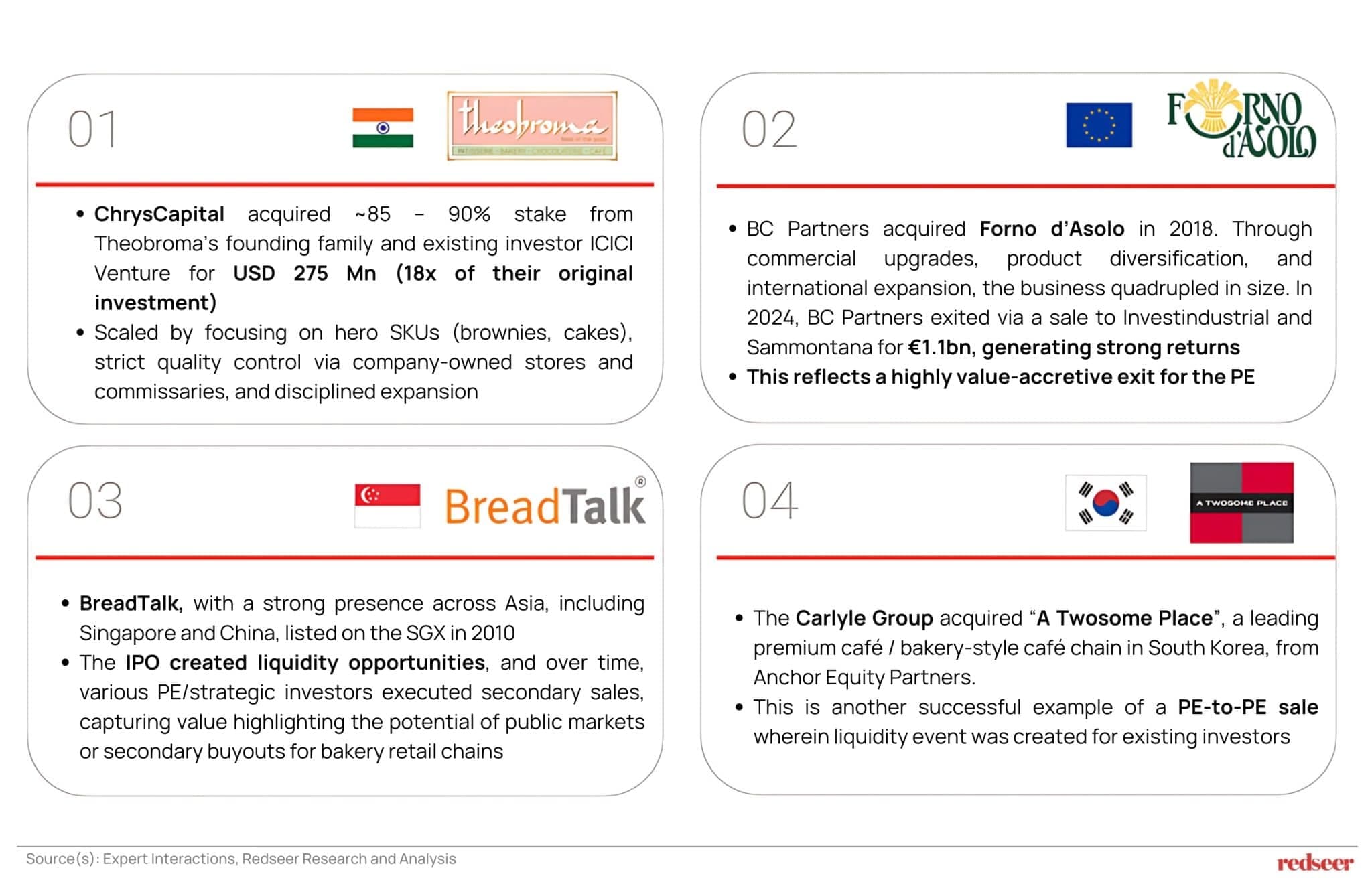

Globally, there are many examples where investors have seen exits with various types of liquidity events

There are many instances of investors acquiring bakery chain assets and then exiting them at great multiples through various types of liquidity events. The slide below captures some of the select examples.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me

Viet-Nomics: Southeast Asias Rising Economic Star

USD 30 Bn Market in Motion: New Revenue Models Shaping Mobility & Delivery in SEA

The Rise of Convenient Eating: How Urban India Balances Speed and Health