As per our report, InsurTech in Indonesia is estimated to grow fourfold during 2021-26 and reach a multi-billion-dollar gross premium size. This will be driven by rising awareness of the need for insurance, rising digital penetration, wider product offerings and other factors. The note also provides some colour on consumers’ preferences for InsurTech offerings.

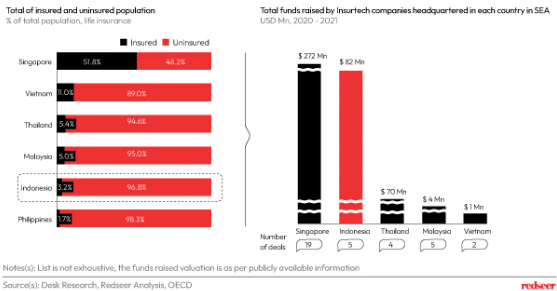

Here’s a highlight of the structural opportunity for InsurTech players in Indonesia.

1. InsurTech players set to tap into the under-insured population in Indonesia

Indonesia’s InsurTech market holds significant growth potential on the back of rising awareness, the emergence of price-competitive offers and efficient distribution channels. Accordingly, the sector is set to strong growth trends from the relatively low penetration (~3% of the population) levels going forward.

InsurTech companies that offer full-stack and/or innovative products are poised to gain traction. Investors’ interest is likely to sustain and support a structural uptrend.

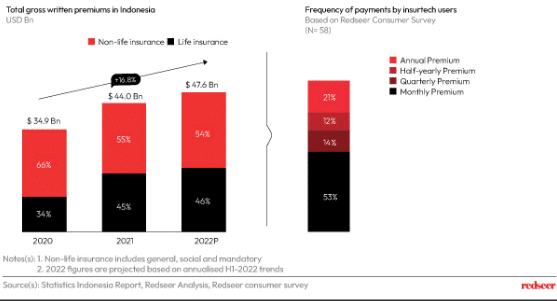

2. Steady growth in the market is expected to accelerate due to improving economic conditions paired with digitization; the market currently stands at ~USD 44 Bn

Indonesia’s gross insurance premiums are estimated to grow at ~17% CAGR during 2020-22. Within this, the share of the non-life premium segment is expected to rise.

Younger population segments are likely to drive the growth of insurance products. Further, we notice that Digital payments have reduced payments-related friction, led to higher user satisfaction and helped in the growth of the insurance industry.

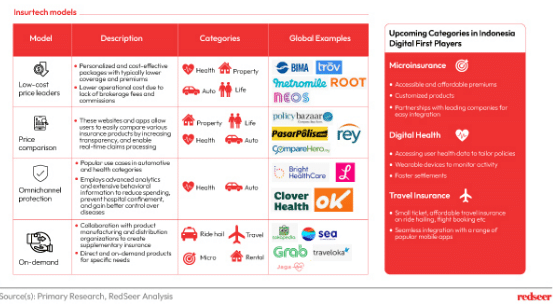

3. Insurtech companies are providing innovative solutions for consumers to easily access traditional insurance policies

The health insurance market was positively impacted by Covid-19 in 2020 and 2021. Accordingly, we see investors’ continued interest in the digital health insurance sector.

Apart from health, microinsurance and travel insurance categories are also expected to grow in the next 5 years. The rise of smaller ticket insurance products and the partnerships with popular super apps offer suitable tailwinds for the sector.

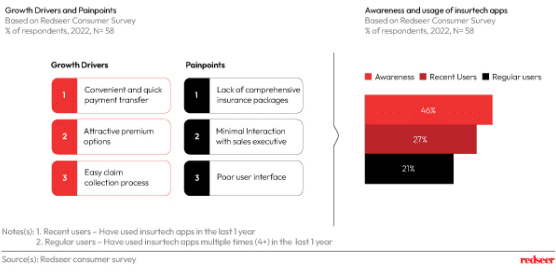

4. Near-term growth to be underpinned by customers getting fast, price-competitive and convenient services from InsurTech players

As per our consumer surveys, people using InsurTech services are highly satisfied with the convenience that it offers along with the ease of completing payments quickly. In addition, price-competitive premium payment options and an easier claim collection process emerge as key growth drivers.

On the other hand, the lack of comprehensive and customizable products is proving to be a major roadblock for InsurTech adoption.

Overall, while only ~46% of the surveyed consumers were aware of various InsurTech players, half of them actively used those services. Further, ~27% of the consumers have become regular users. This indicates an early success for the InsurTech players to retain their active users through value-added services.

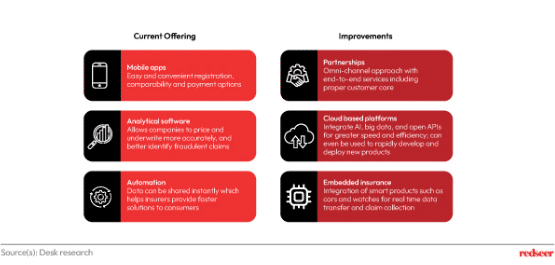

5. Players can improve their capabilities via partnerships, cloud-based services and integration with smart products

While the current offerings bring down operational costs through automation, they can further be enhanced to boost user acquisition. InsurTech players can also expand their addressable market by partnering with offline players and taking an omnichannel approach.

InsurTech companies also have a significant opportunity to leverage data through embedded insurance. For example, auto insurance can be charged on the mile driven. When usage can be monitored and insured in real time, the claims collection process will also become faster.