UAE’s Next Frontiers of Online Retail Growth

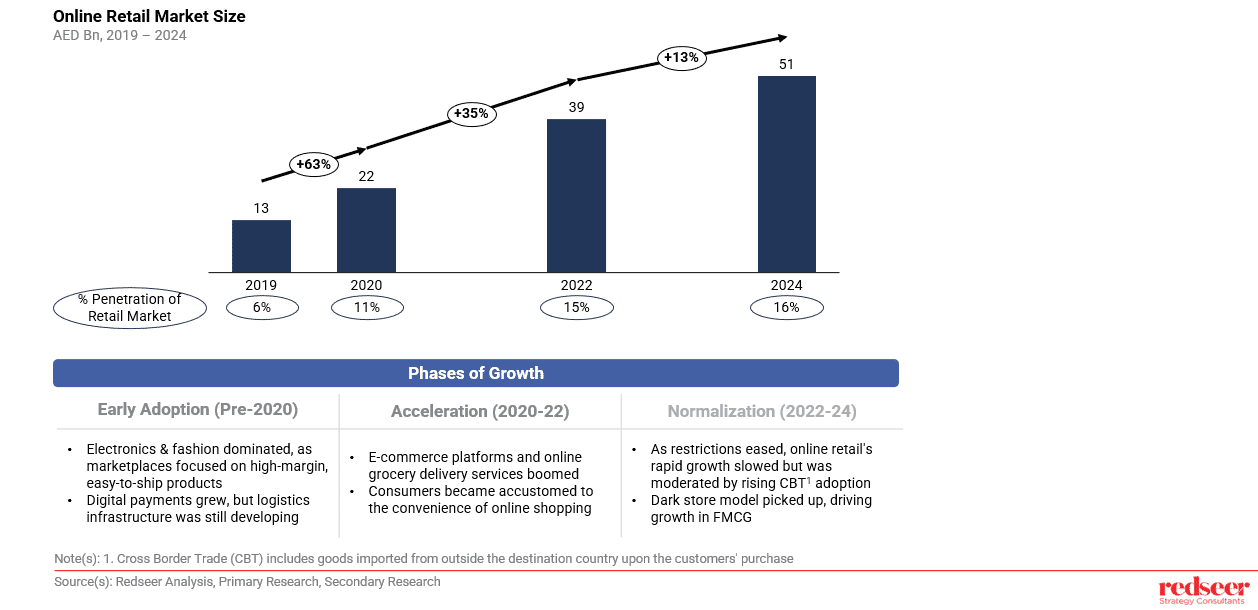

The UAE’s online retail market has grown tremendously over the past 5 years, quadrupling in size and surpassing AED 50 Bn in 2024. Online penetration now exceeds 15%. However, the next wave of growth is just beginning. In this edition, we explore what the future growth drivers would be for the online retail market in the UAE in 2025 and beyond. They include:

- The rapid rise of quick retail and its growing influence

- How underserved regions hold the key to market expansion

- The untapped potential of SMBs in online retail

Quick Retail – A Key Growth Engine

Want to get strategic guidance?

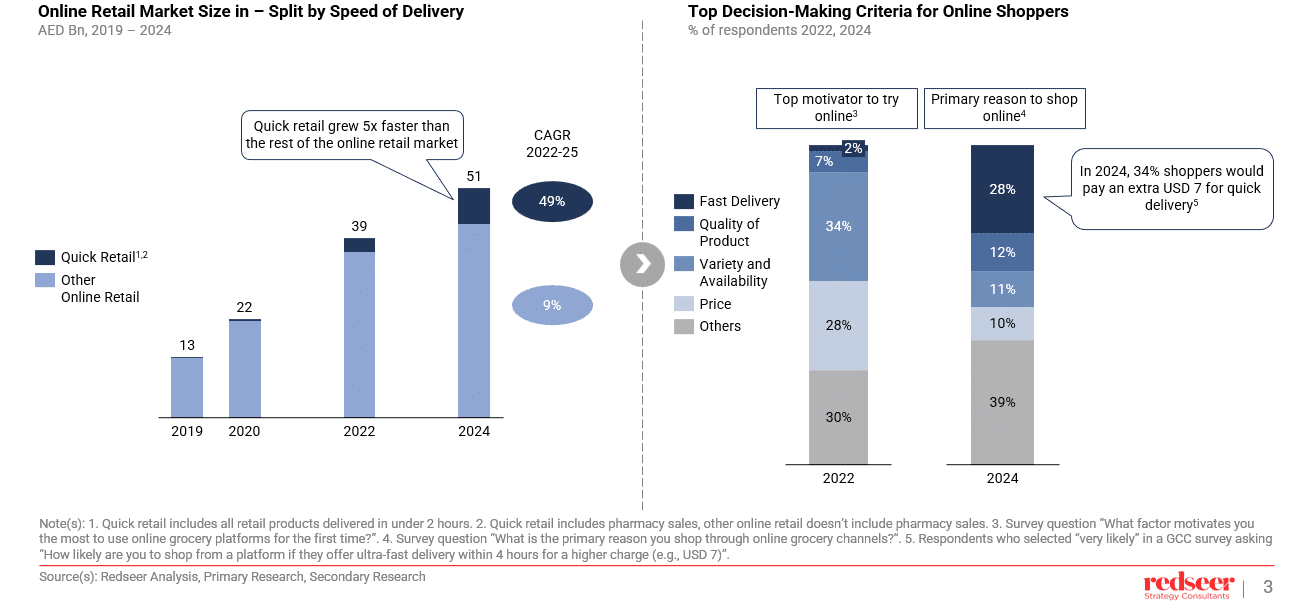

Convenience is reshaping online shopping behavior, and quick retail (deliveries within two hours) has been at the forefront of this shift. In 2024, quick retail grew 5x faster than the rest of the online retail market, now making up a double- digit share of online retail.

Why does this matter? Consumer expectations are shifting, with 34% of shoppers willing to pay extra for ultra-fast delivery. Players investing in quick retail capabilities are winning on consumer preference and loyalty. As demand grows, businesses must optimize last-mile logistics, inventory placement, and pricing strategies to maintain profitability while meeting speed expectations.

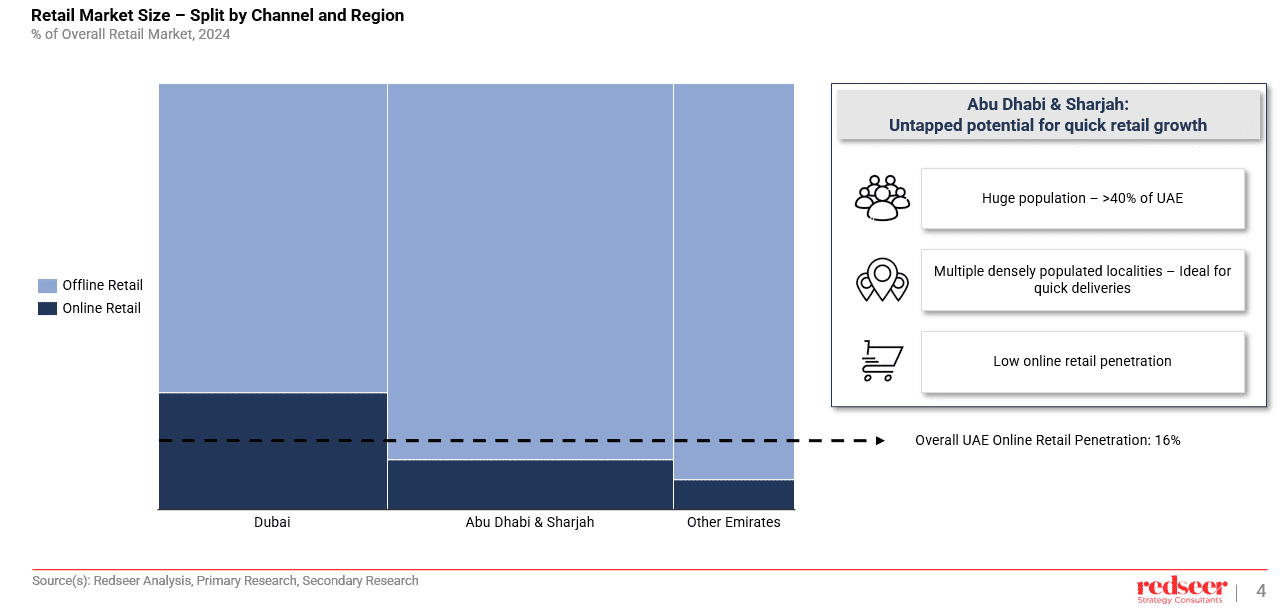

Underserved Regions – The Next Growth Frontier

While Dubai has been the hub for online retail, Abu Dhabi and Sharjah, home to over 40% of the UAE’s population, remain largely untapped, with just 12% online penetration. These regions represent a massive opportunity for retailers willing to invest in localized fulfillment centers and logistics networks.

With high purchasing power and increasing digital adoption, unlocking these markets could define the next phase of e-commerce expansion in the UAE. Retailers need a hyperlocal strategy, optimizing supply chains and last-mile delivery to cater to regional consumer preferences.

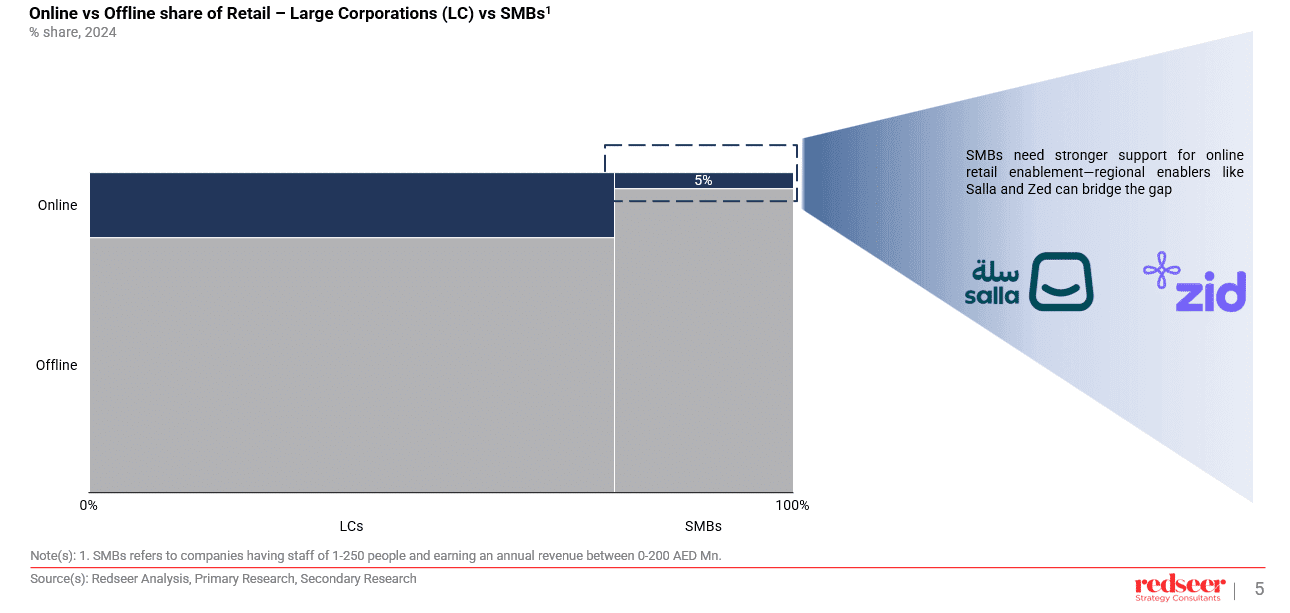

SMBs – The Digital Gap & Growth Potential

SMBs contribute over 20% of the UAE’s retail market, yet their online penetration remains at just 5%. This gap signals a major opportunity for digital transformation, with significant upside for platforms that help SMBs transition online.

Platforms like Salla and Zid are regional enablers that offer affordable e-commerce tools, logistics support, and payment solutions. They are helping SMBs bridge the digital divide by providing tailored solutions for businesses to quickly set up and scale their online presence. These platforms offer SMBs the tools they need to digitize operations, from website creation to payment integration and inventory management, enabling them to tap into the growing online consumer base.

To fully unlock this segment, businesses need better access to affordable e-commerce tools, streamlined logistics partnerships, and integrated digital payment solutions. As consumer trust in online shopping grows, SMBs that embrace digital transformation will be well-positioned to scale and thrive in the evolving retail landscape

The UAE’s online retail sector is poised for rapid growth, driven by the expansion of quick retail, underserved regions, and the digital enablement of SMBs. Retailers who focus on speed and regional expansion, alongside SMBs leveraging online channels, will be at the forefront of this growth in 2025 and beyond.

We hope these insights help you stay ahead of the curve. For a deeper discussion on how to navigate these trends, feel free to reach out to us!

Written by

Sandeep Ganediwalla

Partner

Sandeep is the Partner with 20+ years of experience in consulting and technology. He has expertise in multiple sectors including ecommerce, technology, telecom and private equity.

Talk to me