How D2C Beverage Brands are Transforming the Online Market for Powders & Syrups

Navigating today’s evolving consumer landscape, where digital transformation and shifting preferences dictate market success, is increasingly challenging. One of the most significant shifts we’re observing is the growing openness of consumers to explore new brands, with direct-to-consumer (D2C) companies leading this change. These agile, innovative players are not just gaining market share—they are redefining the standards for success in an intensely competitive environment.

Want to get strategic guidance?

Today, as we discuss the beverage market, particularly across categories such as coffee, tea, and health drinks, D2C brands are gaining significant traction challenging long-standing incumbents by enhancing household penetration and leveraging quick commerce for rapid growth. At Redseer Strategy Consultants, we recognize the complexities of these market dynamics and how businesses can capitalize on these trends to fuel growth. Our previous article on Ready to Drink Evolution: How Q-Commerce is Redefining Refreshment in Ready to Drink Beverage Market, discussed the remarkable surge of the RTD beverage market and how Q-Commerce and slotted deliveries drive RTD beverage growth. In this article, our analysis delves into the key shifts in the beverage powders and syrups (BPS) market, offering strategies to help companies stay ahead by adopting innovative approaches and boosting their online presence.

The Rise of Quick Commerce and Convenience

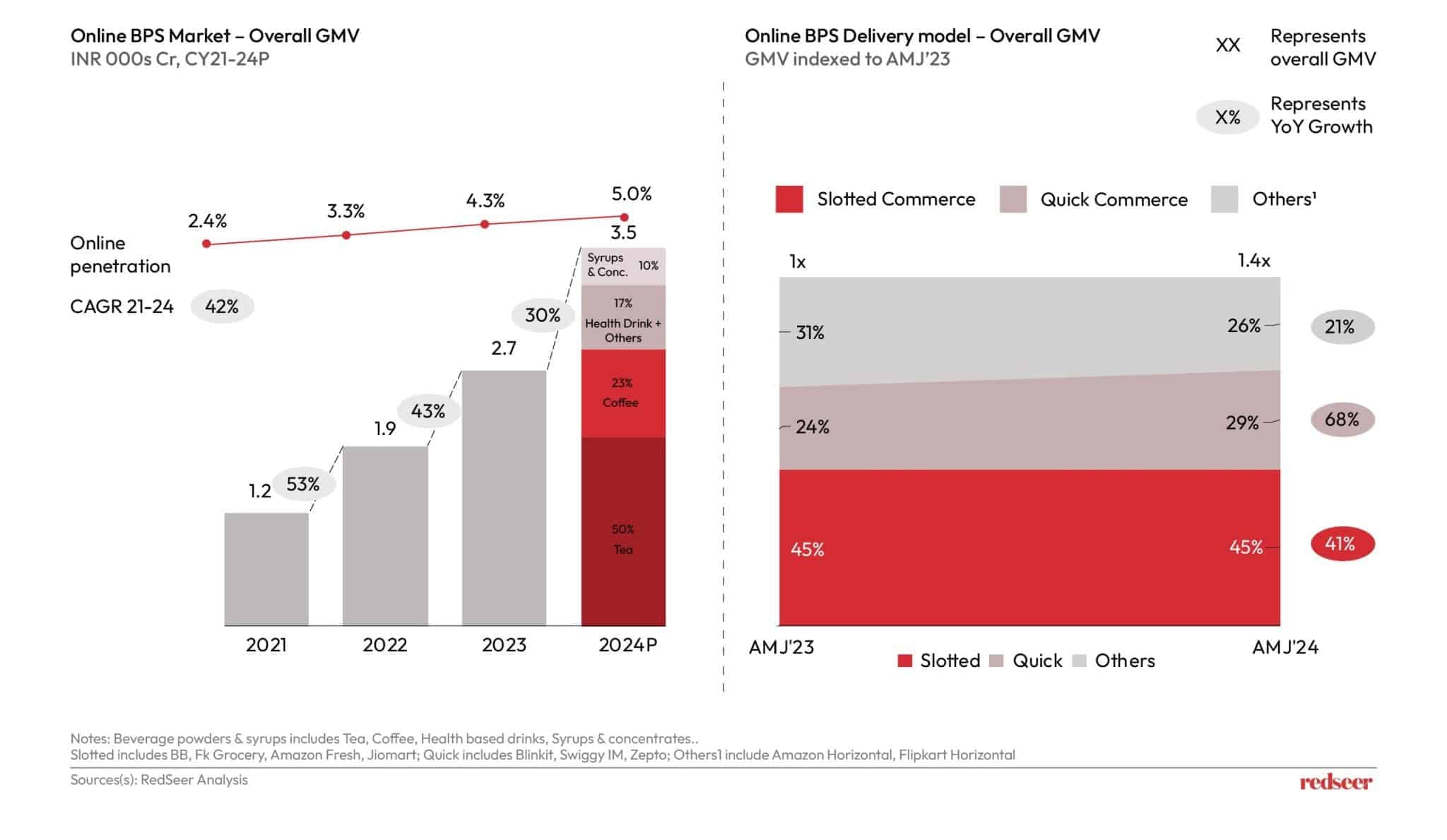

The online beverage powders and syrups market is witnessing a consistent upward trajectory, growing from INR 1.2K Cr in 2021 to a projected INR 3.5K Cr by 2024. This impressive growth, with a Compound Annual Growth Rate (CAGR) of approximately 42%, is primarily driven by the increased penetration of e-commerce and a rapidly expanding user base across grocery platforms.Products like coffee, tea, health drinks, and syrups, once predominantly sold via traditional channels, are increasingly being purchased online.

This shift from offline to online, in particular, has proven to be an excellent channel for D2C brands to flourish, allowing them to reach consumers more effectively. By leveraging digital channels, these brands effectively engage with a growing base of consumers who prioritize convenience and innovative offerings. Except for coffee, ‘Slotted’ & Others’ together contribute ~75% in other categories with larger share coming from T2+ market. In the larger cities, there is a shift among all the other FMCG categories where Quick comm has picked up share of pie from other delivery formats. We expect share of slotted to reduce and move to quick commerce in the next few quarters across the categories.

D2C Brands: Innovation as a Differentiator

2C brands (new-age consumer brands) have been particularly successful in the coffee market in India, with approximately 33% of the GMV contribution coming from them. Their success stems from their ability to innovate rapidly—whether through new coffee formats like cold brews and personalized blends of speciality brands and changing consumer preferences.

Furthermore, the rise of quick commerce has been a significant driver of growth of the coffee market, particularly benefiting new-age D2C brands. Quick delivery options make it easier for consumers to try innovative products, further boosting the market share of challenger brands. Urban consumers are slowly gravitating towards these innovative offerings, associating coffee with a modern, aspirational lifestyle-it has become a lifestyle choice, a symbol of sophistication, and an expression of individuality.

These new-age D2C brands have successfully leveraged innovation, agility, and a deep understanding of consumer preferences to outperform established names and are reshaping the market with offerings that cater to a wide spectrum of tastes and price points. These brands are launching products across various price segments, each tailored to meet the diverse needs of the modern consumer.

- Premium-price Segment: For the discerning coffee enthusiast, D2C brands in this category are offering artisanal, high-end brews. They appeal to a niche group of coffee connoisseurs who are willing to pay a premium for a more luxurious coffee experience.

- Mid-price Segment: This is where D2C brands offer specialty coffee at accessible price points. These brands are winning over consumers who are looking to explore more refined options without breaking the bank. They deliver high-quality products that strike a balance between affordability and exclusivity. This segment is a gateway for many consumers transitioning from basic coffee options to more premium offerings.

- Low-price Segment: This category is still largely controlled by legacy brands that provide coffee at highly competitive prices. It appeals to cost-conscious consumers who want their daily caffeine fix without the frills. While traditional brands dominate this space, some D2C players are beginning to make inroads.

The most notable D2C brands in the online coffee market include several that have rapidly scaled due to their focus on innovation. According to our analysis of ~100 brands in the BPS space, out of top 20 performing brands, 80% are D2C, and these brands have captured 5-6% of the market share previously held by legacy brands within a single year.

Brand Cohorts

In our analysis of the above chart, we categorized brands into cohorts based on their growth trajectories, identifying “Leaders”, “Challengers” and “Laggards”. “Leaders” are brands that achieved more than 60% year-on-year growth, “Challengers” recorded growth between 30% and 60%, and “Laggards” grew below 30%.

These brands (“Leaders”) have strategically leveraged innovation and maintained a consistent presence across emerging digital channels, enabling them to outperform traditional competitors. Meanwhile, brands that have not adapted to these shifts fall into the “Laggards” or “Challengers” categories, struggling to keep pace with the market’s rapid evolution.

The Role of E-commerce in Driving Growth

As e-commerce continues to emerge as the dominant purchasing channel, brands must prioritize their online presence to effectively convert customers. The shift towards online shopping has not only accelerated growth for D2C brands but also created new opportunities for traditional players to reevaluate their strategies. As the BPS market is projected to experience significant growth, online penetration remains crucial for expanding reach and capturing a larger consumer base.

Brands operating in tea, coffee, and health drinks must now think beyond traditional distribution models and focus on engagement through online platforms.

One Step Up

The shift towards D2C models in the beverage market is a transformative movement that will continue to reshape consumer behavior and industry dynamics. As consumers become more open to trying new brands, and prioritize convenience, companies must innovate and adapt to these changing preferences. The rise of quick commerce, coupled with the success of D2C brands, offers a blueprint for how businesses in other sectors too can thrive in the digital age.

For companies looking to navigate this shift, Redseer’s insights and competitive intelligence offer a strategic advantage. By tracking brand performance at a granular level and building growth strategies grounded in real-time data, we deliver actionable recommendations to enhance your brand’s visibility, market penetration, and operational excellence. We help D2C brands get strategies for success and stand out in a crowded market, positioning them as true differentiators in an increasingly competitive landscape.

By tracking brand performance at a granular level and building growth strategies based on real-time data, we provide actionable recommendations to enhance your brand’s visibility, penetration, and operational excellence. Reach out to us for deeper insights into the Beverage Powders and Syrups (BPS) market and subscribe to our Newsletter for regular trend updates.

Written by

Ujjwal Chaudhry

Partner

Ujjwal has expertise in multiple sectors including e-commerce, healthcare and fintech. He has helped large corporates enter into new products and categories.

Talk to me