In today’s bustling marketplace, where customers roam across multiple platforms before making a purchase, D2C (Direct-to-Consumer) brands are uniquely poised to redefine retail landscapes. However, capturing and retaining customer attention in this saturated environment demands a strategic embrace of omnichannel marketing, for D2C brands, which control every aspect of their production, marketing, and sales process, omnichannel offers a direct line to enhanced customer insights and a stronger brand relationship. By integrating multiple sales and marketing channels, D2C brands can deliver personalized experiences that not only engage but also convert both offline and online.

India’s online retail market is estimated to achieve unprecedented growth, reaching a market value of US$ 150-200 Bn by 2030. But this is just the tip of the iceberg representing 10% of the broader retail market spends during the same period. While this shows that a bulk of the spending are happening offline, a careful analysis of consumer behavior shows stark evolutions of which brands need to be cognisant. For example, consumers might search and get information about the products online, but they might shop offline. Or, consumers’ first purchase can be offline while subsequent purchases, post the trust is built, may happen online. Depending on the product categories and the maturity of the consumers, the choice of consumer touchpoints is mission-critical. Therefore, having a well-thought-out omnichannel or multi-channel approach that caters to consumer behavior across their journeys is the way forward for consumer brands and platforms (brands and platforms are referred to as players henceforth)

In the last decade, new-age consumer players traveled the extremely taxing journey of showcasing the viability of online as a scalable channel. Now, some of these players have matured and are already crafting well-thought-out omnichannel strategies. We at Redseer, teamed up with Accel Partners and Fireside Ventures to share some of the key learnings from the journeys of these players, that may be helpful to thousands of newer brands that are coming up in the Indian D2C landscape. Here is the link to the full report. However, below are some of the key takeaways.

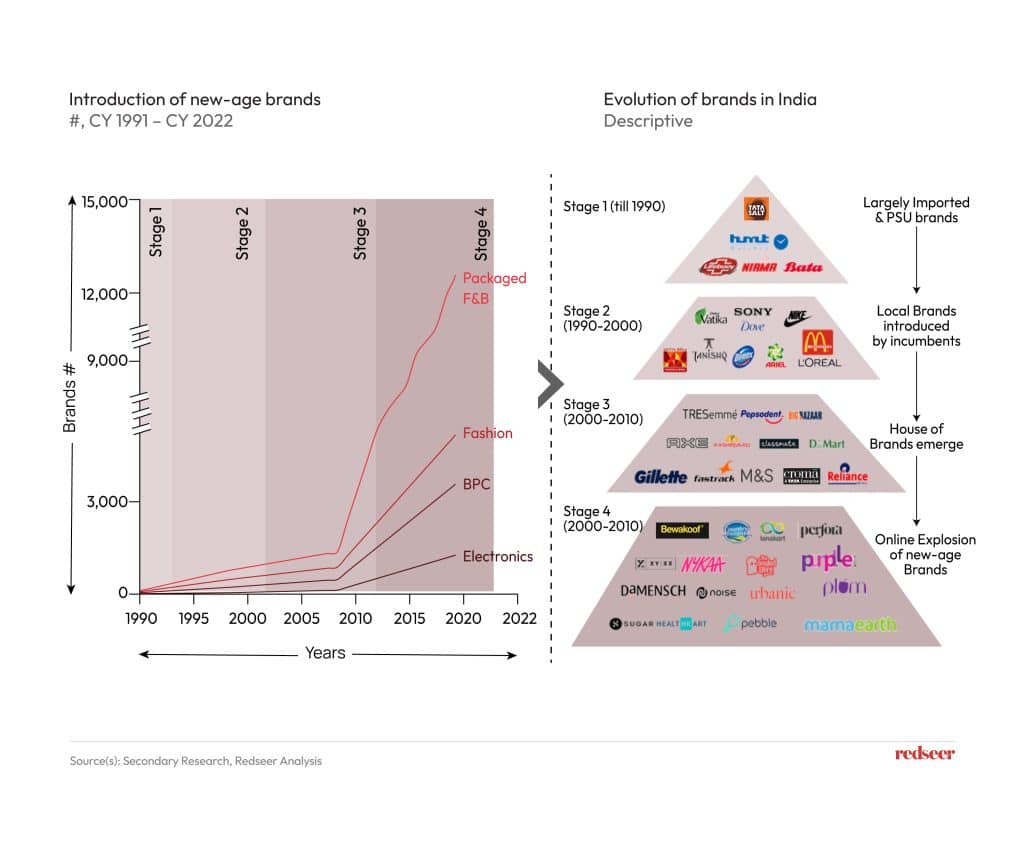

1. India’s brand creation journey is at an inflection point where the number of brand creations is growing multi-fold with most of them preferring online mode to start out

Over the last 3-4 decades, India has seen a massive transformation in consumer brands – from only a few large foreign or public sector undertaking brands across retail categories before the 1990s to having several thousand brands within each retail category. And with the success of online as a channel for retail consumption, most of these brands are online D2C. Online has clear advantages of being more accessible/cheaper (easy to be onboarded on eTailing platforms, low inventory requirement, etc.), of reaching consumers easily (through social media, online ads), and getting instant customer feedback amongst others. Therefore, India will see the number of brands growing exponentially with most of them starting out with online as a preferred channel.

2. However, brands must evolve to adopt an omnichannel approach as they scale, to tap the larger Indian retail market

India will be a US$ 2 Tn+ retail market by 2030 yet 90% of it will be offline. Hence, new-age consumer-focused players need to think of this large opportunity. Below are some interesting facts shared by some of the most prominent D2C brands in India that highlight the importance of thinking of both online and offline as channels to reach consumers where they are.

- Omnichannel shoppers spend 2.5x of single-channel shoppers

- 95% of holiday shoppers researched online before visiting a store

- 63% of the people confirm online for stock availability before going out to buy

Above is a heatmap that showcases the expected prominence of omnichannel in consumer behavior by 2030. Especially in touch-and-feel-oriented categories like BPC, Fashion, and Home & Living, serving consumers across multiple channels and providing a seamless omnichannel experience will be a necessity to a certain degree. For others such as foods and electronics, probably the massive adopters (10% of Indian households who are the most sophisticated shoppers) will lead the demand for omnichannel while the rest of India follows gradually. Hence, brands across categories need to have careful long-term plans with this evolution in mind.

3. There are 5 key building blocks for online-focused new-age consumer players to think about their omnichannel strategies

- Timing to go offline – The key here is to gauge the consumer franchise being built to be monitored through clearly defined metrics. The first phase is when a player is trying to gain awareness, typically measured by views/impressions, search engine visibility, etc. At this phase, building awareness online is the way to go. In the second phase, as engagement rates improve, assisted or direct channel offline presence can be considered. When the brand becomes mature enough as measured through CAC, cart-to-purchase conversion, etc., there are clear indicators of consumer franchises getting built and the right time to scale offline.

- Choosing the right offline channel – Mass market channels like general trade are generally preferred for lower involvement products where prices are also lower. However, in categories or price points where the shoppers’ mission becomes more prominent, there needs to be clear communication to the consumer about the brand value proposition, in which case assisted channels and multi-brand stores are relevant. However, when price points are high enough where the purchase is highly involved and/or providing the right experiences is mission-critical, direct channels like exclusive brand outlets are preferred.

- Kickstarting offline channels (Pilots) – To build out the pilot, focus on the assortment mix, average selling price, effort to build footfalls, etc. The playbook needs to be concretized through clear decisions on location/format strategy, media mix acquisition and retention, P&L models, and supply chain operations. With carefully piloted rollouts and constant monitoring scaling decisions can be made subsequently based on performance across the metrics, organization capabilities, degree of depth of clusters, etc.

- Powering omnichannel marketing to drive scale – Both channels must feed off of each other’s capabilities when it comes to driving consumer awareness acquisition and retention, with specific KPIs associated with each. For instance, the online channel, measured via the velocity of customer awareness and acquisition, can be used to build the brand identity, create communities and level up the consumer experience through seamless returns/ exchanges, etc. On the other hand, the offline channel, measured by sales and brand franchise, adds credibility to the brand, helps build differentiation, and builds a layer of trust when needed.

- Setting up organizational capabilities to enable omnichannel expansion – The key steps here involve setting up an offline team, building an omnichannel culture (common lingo, data-backed processes, training, and hands-on leadership involvement), setting the right incentives, integrating functions such as HR, marketing, supply chain, etc. as much as possible, and setting up the right practices (measuring the right metrics, building quick decision-making SOPs, etc.).

This gives a high-level understanding of the direction that D2C founders and operators need to think of as they evolve and embrace omnichannel. But we understand your urge to look at how these suggestions/recommendations translated into real brands. For that, the report has more details on the above points with concrete examples and case studies from some of the largest Indian D2C brands. We hope this has been helpful for you. Please feel free to touch base with me (Rohan Agarwal) to discuss these ideas further, exchange notes, or brainstorm more related ideas. Check out the report for more details