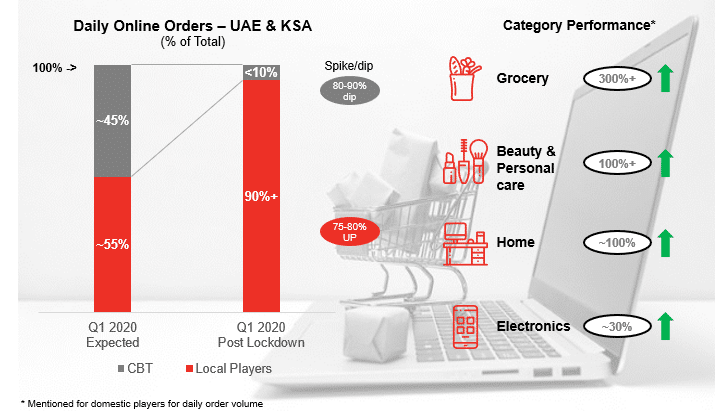

1. E-tail is observing ~80% spike in daily order volume to cater to the retail needs of the consumers

UAE and KSA used to observe a daily order volume of ~300K orders per day of which 55% orders are fulfilled by local players. Post restriction on cross border trade, local players have grown to capture 90%+ of this space with ~80% increase in daily order volume. The overall daily order volume the region is observing has increased ~10% overall.

Retail landscape of the region post lockdown has completely changed where E-tail is the only channel of trade for end consumers (except grocery and pharmacy). Customers across age group, ethnicity, income segment and genders are learning to use e-tail applications and can be expected to continue post the lockdown situation gets over.

Local E-tailers are facing shortage of logistics personnel and are hiring newer staff. Internal alignment of manpower is also seen across businesses, where employees are transitioning to supply chain department. Food service players who are currently observing a slump have come in help of the E-tail players by offering the support of their delivery fleet.

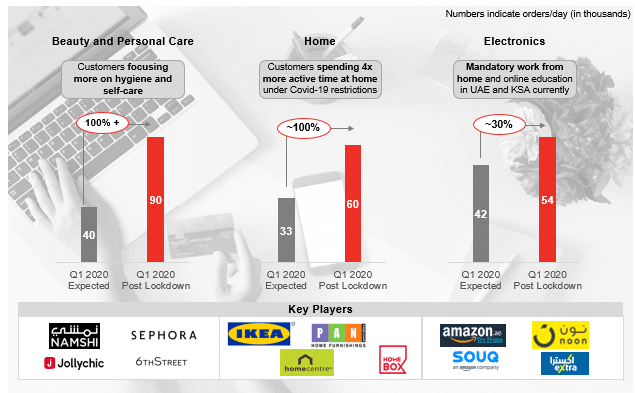

2. Work from home or study from home pushing up all retail categories online

A lot of people are working from home or studying from home in region. 1mn+ students in UAE itself are taking online classes. This has created a significant spike in sales for tablets, laptops and home entertainment devices.

Restriction in outdoor activities is pushing people to look for home entertainment. Increased cooking at home and people taking up newer hobbies has pushed up the demand for products across retail categories.

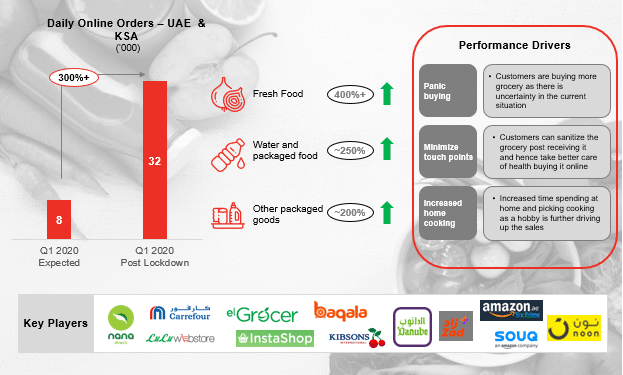

3. Grocery is the hottest category with 300%+ jump in daily order volume

Daily order volume for grocery is 300%+ up when compared with its average performance of 8-10K orders per day. This spike is majorly driven by panic buying by customers. All leading players such as Nana Direct, Carrefour, Lulu, InstaShop are facing challenges in fulfilling the orders. Sector neutral delivery players such as Jeebly and Quiqup have come in handy to make these deliveries.

In case of Majid Al Futtaim, the leading business house has made internal alignment of its employees, where employees moved from VOX and other L&E services to Carrefour which is currently observing a spike in both its online and offline operations.

In near future we can expect investments happening in the sector; Saudi based Nana Direct raising $18mn last week is just the beginning. We would also see newer partnerships emerging which will further strengthen the supply of the e-tail players.

Noon and Amazon the large horizontal players have limited presence in grocery, however we can expect them to be a serious player in grocery segment in coming days.

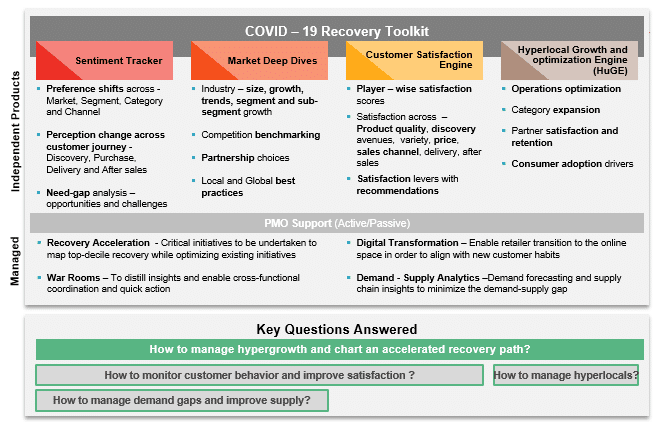

4. Agility is the need of the hour

The current situation is leading customers to create new habits and behaviors that are unprecedented. The market seems to be shifting as different categories see erratic growth trajectories. With uncertainty, come various challenges –

Demand-supply gap – Keen demand forecasting and strong supply chain needed.

Slow reaction to customer demand changes – Close contact needed with the ground zero scenario to quickly track changes in consumer behavior.

Need to capitalize/build on hyperlocal infrastructure – Last mile delivery enablement in light of higher orders to be met.

Repositioning is crucial in order to ensure top-decile growth and an accelerated recovery path.

We have created a COVID – 19 Recovery Toolkit to enable it-

Read More: