Online Childcare: Convenience and Product Quality drive purchase decisions; Lead time and Return experience needs to improve

The online Childcare market has attained enviable size in a relatively short timeframe (~$ 500mn in FY19). Given those purchase decisions in the category are partly impulsive/emotional, Online platforms have been able to address/expand the market significantly. An analysis by RSC highlights the key driver for choosing online over offline to be convenience and quality with price/discount being a distinct third. Despite the importance of convenience, customers cite room for improvement particularly in lead time/return experience. This is partly due to the impulsive nature of purchase itself and the relative lead offline stores have in proving instant gratification. RSC believes, this puts the Omni-channel verticals in an advantageous position and the future growth of the market would be highly dependent on the how judiciously players like Firstcry leverage this to their benefit.

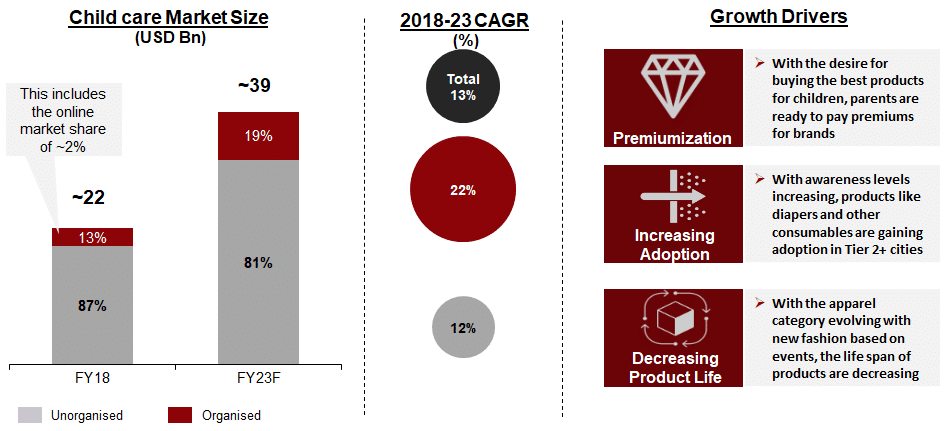

India’s child care products market in FY18 is pegged at USD~22 Billion and is expected to grow at a CAGR of ~13% for next 5 years

India’s child care market, currently dominated by the unorganised players is evolving especially with the increasing penetration of internet which is increasing the reach of the organised market to the masses and also increasing awareness of the major categories of this market. The 22% growth in the organised market is attributed to the ~50% growth in the online childcare market and the increasing adoption of brands.