The insurance sector in the GCC is entering a transformative phase, driven by rising awareness among consumers and the rapid digitization of services. Despite strong macros and growing demand, insurance penetration remains relatively low at around 3% of GDP. However, the region is now poised for steady growth, with life, health, and motor insurance lines driving the growth. This growth is being catalyzed by new digital-first players and increasing financial literacy.

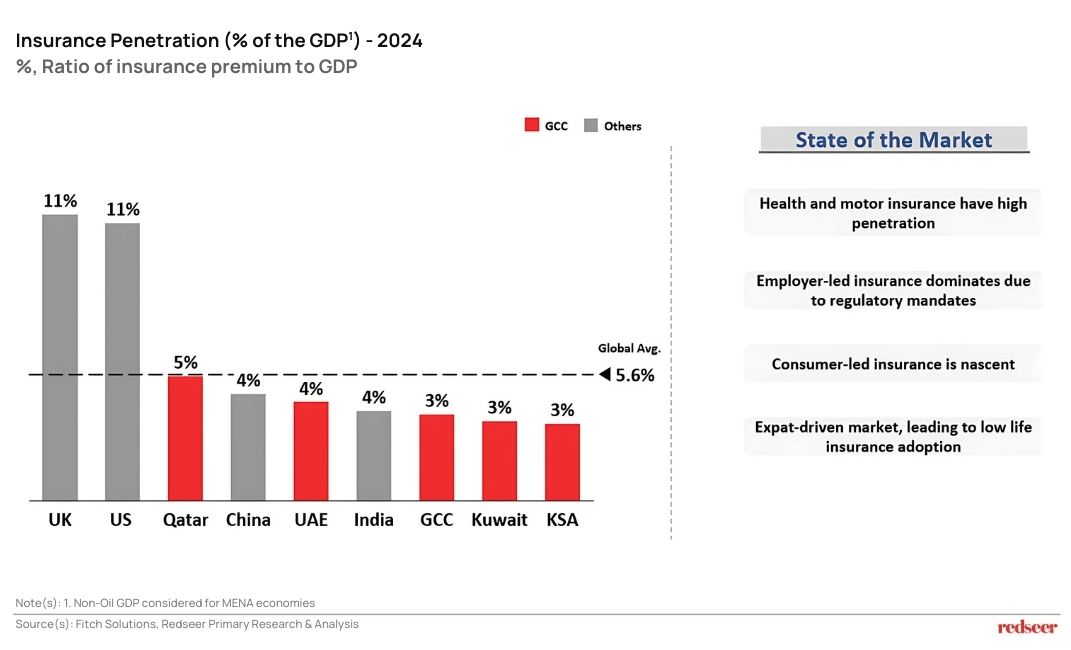

1. Insurance penetration in GCC economies is relatively nascent

GCC economies have insurance GWP penetration in the range of 3–4% of GDP, compared to double-digit penetration in the US and UK. This is primarily due to low life insurance uptake, as nearly half the population consists of expats who prefer to hold life insurance policies in their home countries. However, this behavior is gradually changing, as insurers in the region have started actively promoting life insurance products. Also, currently, the insurance market is largely employer-led, driven by mandatory health insurance.

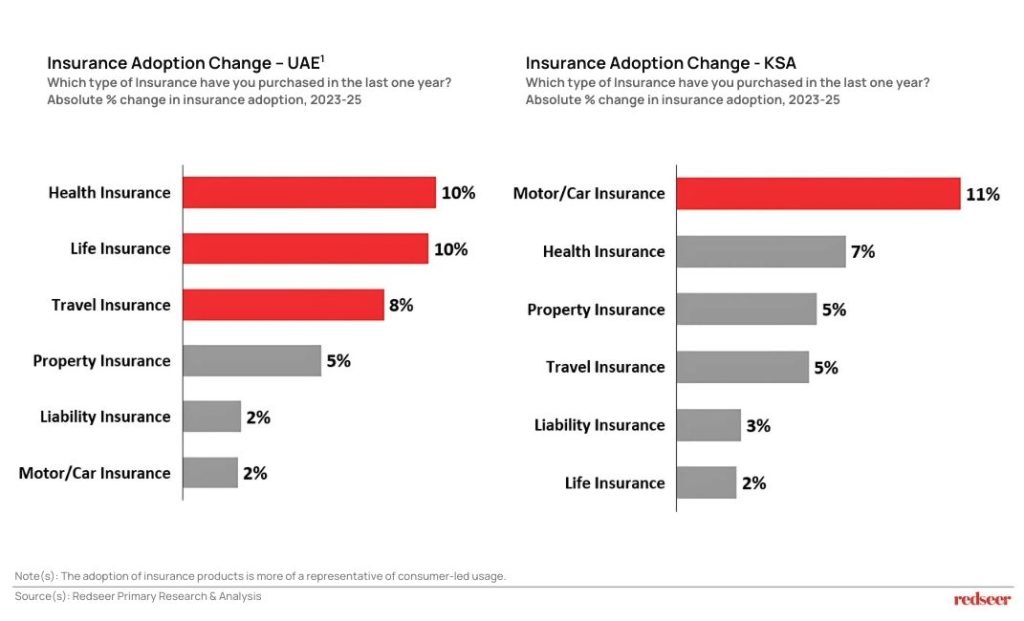

2. However, the market landscape is evolving, with consumer adoption steadily increasing

In the UAE, health insurance adoption continues to grow, driven by an increase in demand among SMEs. Additionally, as more employers opt not to cover dependent insurance, there has been a noticeable rise in consumer-led health insurance purchases. Also, with rising awareness around financial protection, life insurance adoption is gaining momentum. Meanwhile, the growth in outbound travel is fueling greater demand for travel insurance.

In KSA, motor insurance adoption has accelerated following the introduction of electronic monitoring to enforce compliance in 2023. This trend is further supported by an increase in new vehicle registrations, contributing to the overall growth in adoption of motor insurance.

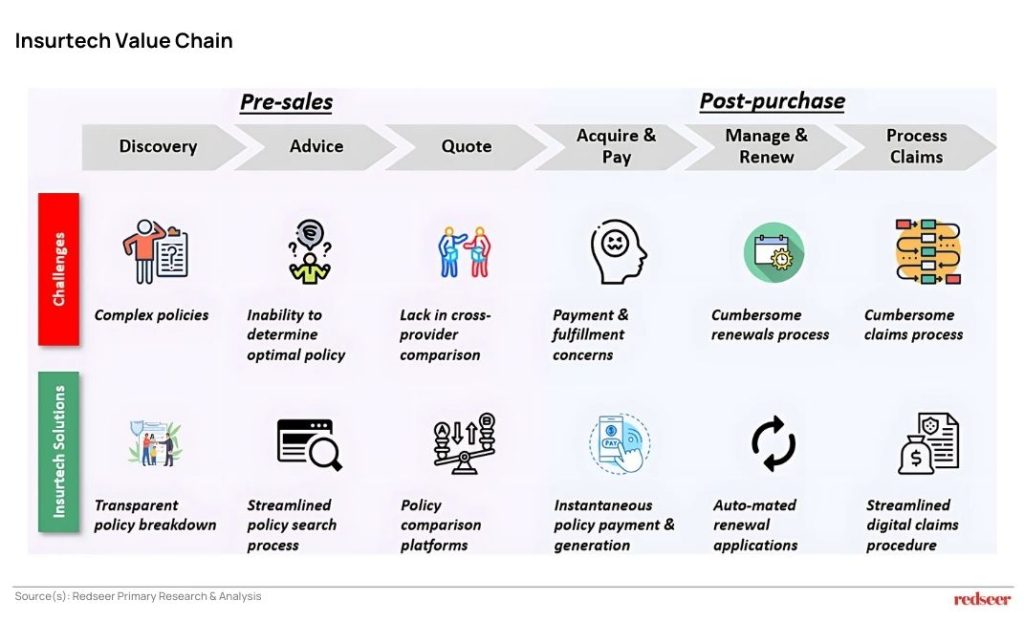

3. For the next wave of growth, Insurtech can play a vital role by addressing key gaps

Nearly 50% of users cite complex policies as a major barrier to availing insurance, while the majority of users also highlight the cumbersome claims process as a key pain point. Insurtech solutions are well-positioned to solve, by simplifying policy structures, digitizing onboarding, and streamlining claims, ultimately driving the next wave of insurance adoption in the region.

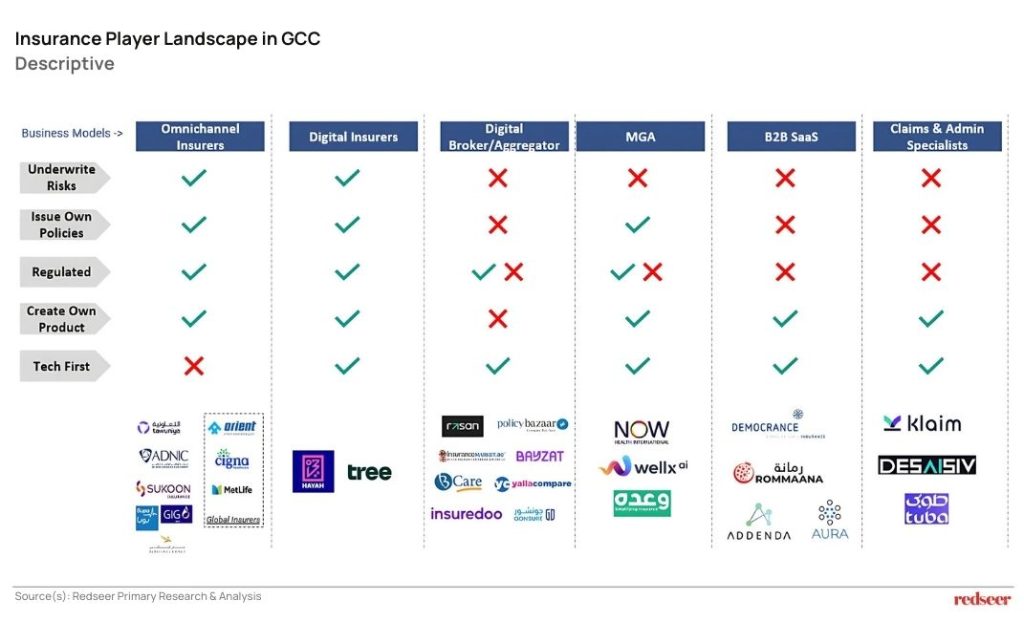

4. As a result, a diverse range of business models has emerged

Many new models have emerged in the insurance space across the region. Traditional insurers have begun offering online solutions to both employers and consumers; however, their online presence is still limited. With supportive government regulations, fully digital insurers such as Hayah and Tree have entered the market, offering a fully digital experience.

Currently, the online insurance landscape is largely driven by aggregators and brokers, primarily focused on motor insurance. Meanwhile, Managing General Agents (MGAs), which typically specialize in niche or customized offerings, remain in the early stages of development in the region.

To strengthen the broader insurance ecosystem, we’re also seeing the rise of digital enablers such as Democrance and Klaim. These players help insurers digitize their offerings, enable employers to manage group health plans more efficiently, and assist healthcare providers in faster claim settlements.

Looking ahead, as more players collaborate and adopt tech-driven models, the ecosystem is expected to become stronger, resulting in a more seamless, transparent, and user-friendly insurance experience for consumers.

We hope you’ve found these insights helpful. For a more detailed discussion or to explore how these shifts may impact your business, feel free to reach out to us!