As the much-awaited season of celebrations approaches, there’s a noticeable buzz in the air. E-commerce platforms are gearing up for what promises to be an exciting festive season. Everywhere you look, from billboards to your email inbox, there’s a sense of anticipation and excitement. The festive spirit is charged with the promise of new beginnings, joyful moments, and the thrill of finding perfect gifts for loved ones.

This festive spirit is palpable, but there’s more at play than just celebration. After weathering the macroeconomic challenges of last year, the nation is finally emerging stronger and more resilient.

With businesses bouncing back, consumer confidence soaring, and innovative ventures on the rise, the economic landscape is expected to thrive in the second half of this year. The stage is set for a season of unprecedented growth and prosperity. So what’s driving this optimistic outlook? Our experts at Redseer, led by Kushal Bhatnagar, have delved into why we expect Festive 2024 to be the beacon of hope in India’s consumption revival. Dive into intriguing insights and uncover how brands, E-commerce platforms, and consumers are poised to reap the rewards of this upcoming festive extravaganza.

A Positive Festive Outlook

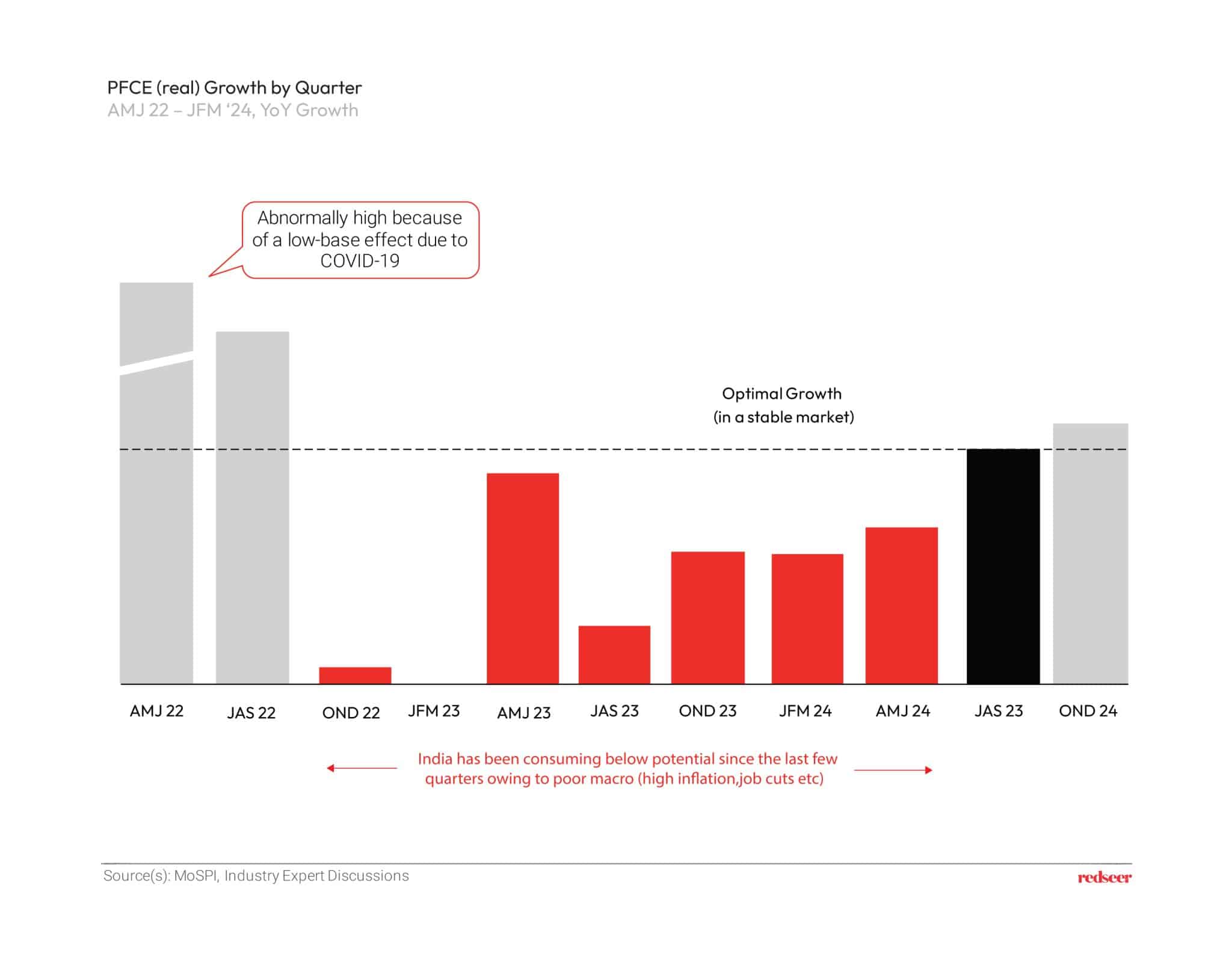

Let’s take a closer look at the trends in real private final consumption expenditure (PFCE) to understand the deeper picture.

In the first two-quarters of FY 23, real PFCE growth was abnormally higher due to a low base effect. Subsequently, for the next seven quarters, the growth in PFCE remained sluggish. Analysts point to various factors, such as a high inflationary environment (especially in terms of food prices) which impacted rural consumers who consequently delayed discretionary consumption. Further, job cuts and lower income growth amongst the urban middle class forced them to down-trade to regional brands/unbranded products. While premiumization as a theme has played out well amongst the affluent, the aforementioned points have kept India consuming below its potential.

But there’s a glimmer of hope on the horizon. Looking ahead, real PFCE growth is projected to pick up in the second half of this fiscal, suggesting that consumption recovery will coincide with this year’s festive season.

Consumer Confidence Trends: Optimism on the Horizon

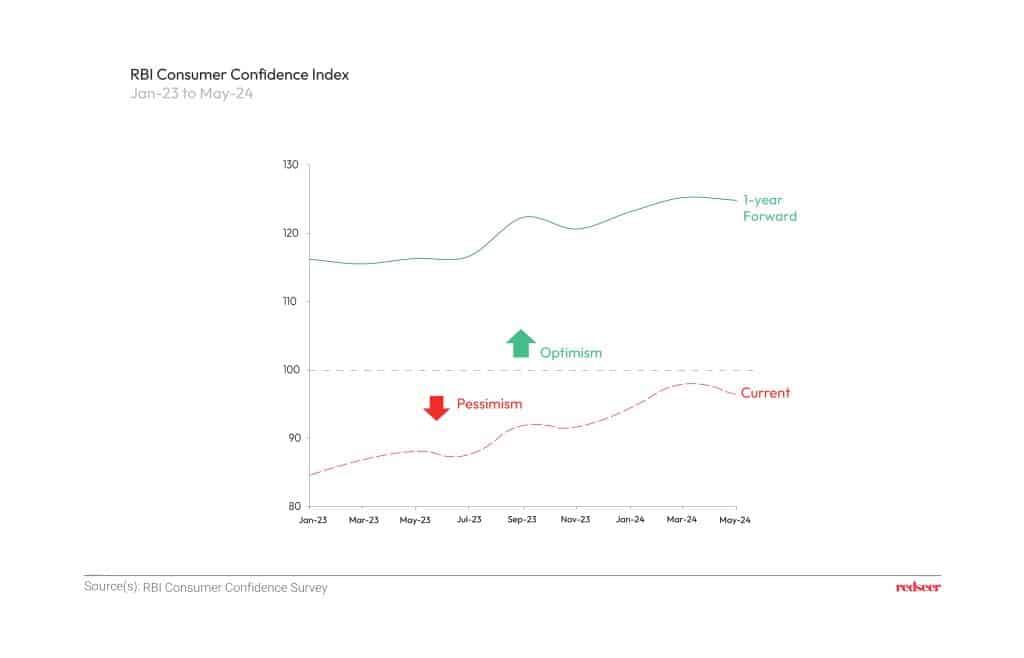

To uncover the underlying factors, we analyzed the confidence index (CCI) published by RBI. It basically measures responses from consumers & households, regarding their sentiments on the general economic situation, employment scenario, price level, income, and spending.

It is currently close to its highest peak since Jan 2023 and is expected to move into the “optimism zone” in the next few months.

Several key factors are contributing to this recovery. First, inflationary corrections are leading to a decrease in the Consumer Price Index (CPI). Then, there’s the pent-up demand from India B (Urban Middle Class – Income 5 to 12 LPA) and India C (Urban – Income below 5 LPA and Rural) segments. These groups have been holding back on spending but should be ready to splurge as the festive season approaches.

Rural consumption is expected to see an uptick, bolstered by increasing real wages and an optimistic forecast for an above-average monsoon, which means more money in the pockets of rural consumers. Additionally, there’s a lot of excitement around the new government’s inaugural budget, which aims to improve cash flow and stimulate consumer spending.

All these factors combined suggest a potential upturn in consumer confidence as we move into the coming months.

A Measure of the Market Sentiment

Leading brands and analysts are backing this optimism, as illustrated below:

“H2 will be much better than H1. We will see higher discounts this festive season, as we want to maintain the growth run rate. Especially in the masstige and premium segments,” states a Leading Consumer Electronics Global Brand.

A large FMCG Conglomerate added, “We are optimistic that with the expected normal monsoons and improving macroeconomic indicators government spending, lower inflation, demand will see a gradual uptick.”

Industry analysts also echo the optimism of brands:

“Value retailers are likely to outperform this year, especially in H2. Folks who down-traded to unbranded will likely reverse and the brandification story will continue. On the premium side of things, consumption remains bullish. ,” says an Equity Research Analyst.

“Rural consumption grew at 5-6% which was faster than urban consumption which declined by 6% in JFM 24,” states a Market Analyst.

“Festive season will be bigger this year. There is pent-up demand. Macros are lining up: rural real wages are inching up, inflation is in check, premiumization continues, the only concern is when the lower-middle-income bracket will pick momentum,” adds another Equity Research Analyst.

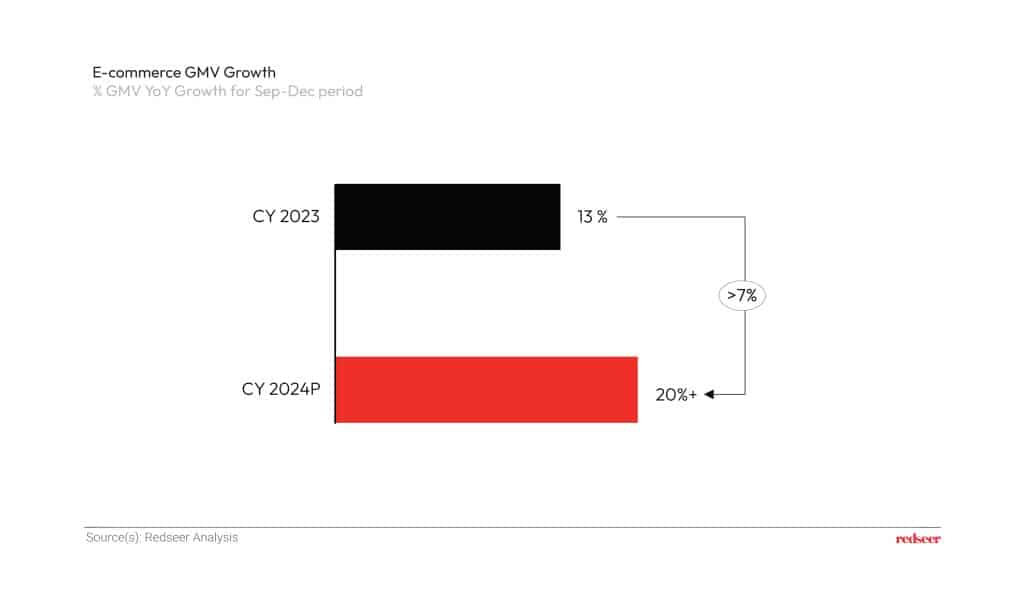

E-commerce: A Bright Spot

As a result of the above trends and the rising need for increased convenience, e-commerce has the opportunity to become one of the big winners this festive season. Compared to the 13% growth in e-commerce gross merchandise value (GMV) during last year’s festive (September-December 2023 period), e-commerce has the potential to grow at least 20% this year.

Strategies for Success

So, how can e-commerce platforms make the most of this festive boom? Here are some key strategies to boost sales:

- Boost regional selection: Given the pent-up demand in India B & C segments (largely in tier 2+ markets), doubling down on the regional products & brands could strengthen the appeal, particularly in small ticket size categories such as beauty, fashion & FMCG.

- Speed-up deliveries: With the rapid adoption of quick commerce platforms, consumers are becoming accustomed to faster access to products. Therefore, supply chain optimizations to enable faster deliveries during the festive period, could become a differentiator for platforms.

- Tap into the premiumization wave: This wave is expected to continue with the rising affluence of India A and aspirations of India B class. Getting access to their target products at unbelievable prices could drive significant demand in the upcoming season.

Gearing Up for a Prosperous Festive Season

Thus, the festive season of 2024 is expected to be a period of robust economic activity and could also revive consumption growth in India. Brands and retailers have a strong opportunity to unlock unprecedented growth and success this festive season.

Are you interested in understanding the deeper customer & competition trends for the upcoming festive season? Connect with our leading industry expert, Kushal Bhatnagar, and subscribe to our newsletter today for expert insights. Get the latest trends and analyses delivered straight to your inbox! For more in-depth insights and detailed analysis, visit Redseer.