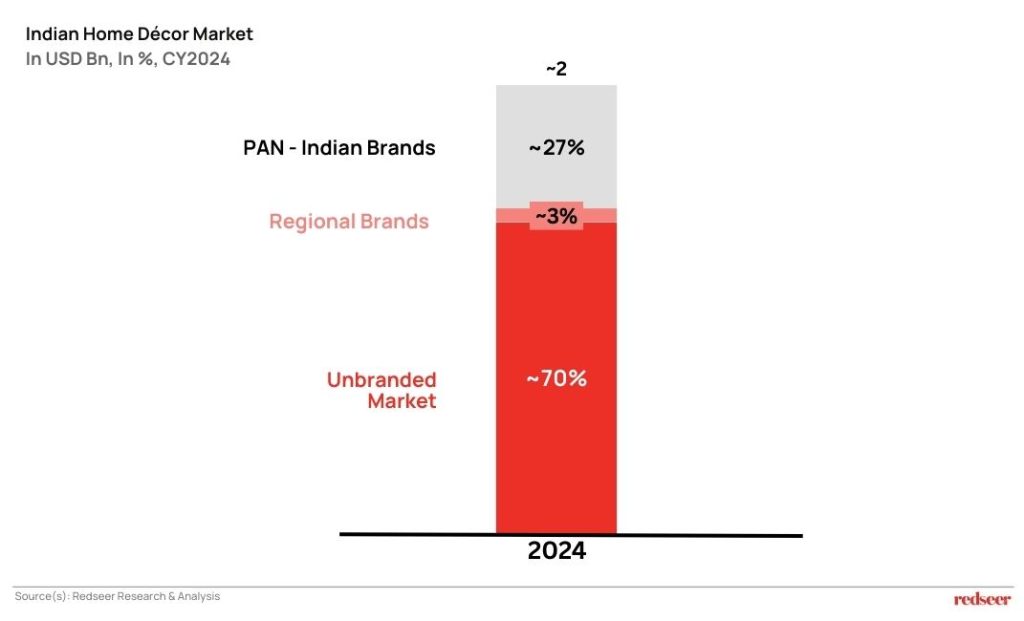

As we continue our analysis of alternative growth categories in India’s retail markets, we now turn to a category that speaks of aspiration and taste—the $2 billion home decor market.

We solve the strategy behind scale!

Just like the toys category and saree market, the home decor segment too remains structurally fragmented, with manual distribution, inconsistent merchandising, and SKU chaos. Yet, these inefficiencies offer a whitespace for those who can bring order to the disorder.

Much like the saree market, the home decor market is a high-SKU category. It’s driven by emotion, occasion, and regional taste, but sold through unstructured supply chains. Retailers face stockouts, duplication, and poor visibility into consumer demand, while shoppers struggle with product discovery, trust, authenticity, and quality assurance.

And, this is where organised national players can make a difference. The market needs a platform-driven approach, end-to-end supply chain visibility, and curated models tailored to regional nuances that meet evolving consumer demand.

Let’s now understand the friction points across the retail value chain in this segment and how a well-researched strategy can unlock a retail market opportunity.

When Fragmentation Is the First Bottleneck

While the home decor market size in India is ~$2 billion today and growing at over 10%+ CAGR, it holds bigger opportunities than many “main” categories in retail. Much of the market remains fragmented, dominated by unbranded products, local artisans, and regional manufacturing units.

Let’s unpack why the unbranded market continues to dominate:

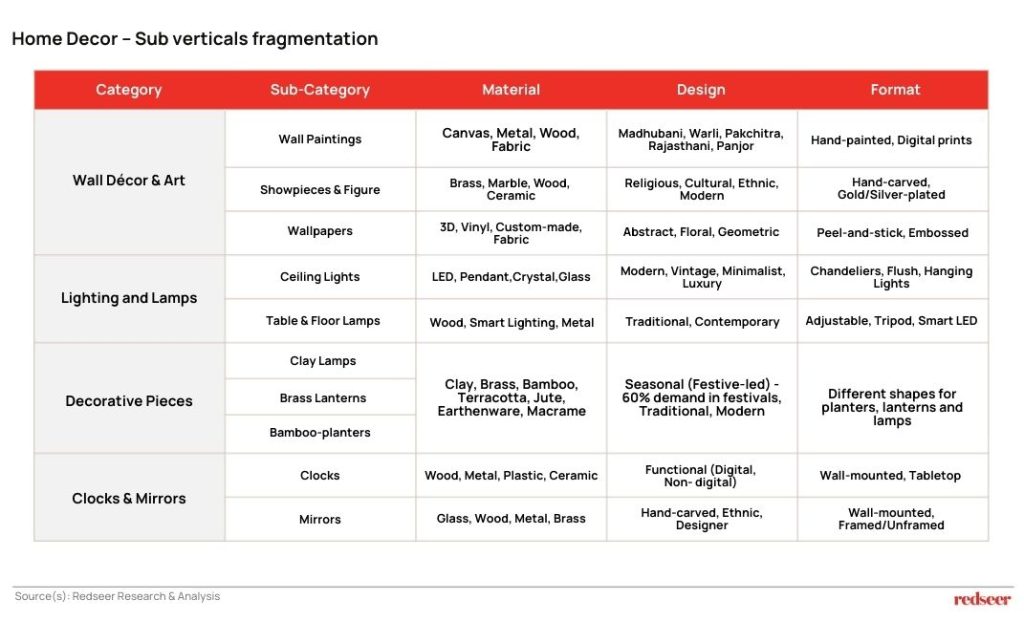

- Presence of multiple sub-categories and verticals

- Home décor includes diverse segments like lighting, wall art, and decorative pieces, each with different materials, craftsmanship, and price points. This makes brand consolidation difficult.

- Higher customisation needs

- Home décor is highly personalised, leading to an explosion of SKUs that vary in material, design, and colour. For instance, brass is often preferred for religious idols, while marble is used for contemporary art pieces.

- Dynamic regional preferences

- Consumer trends in the home decor market lean towards handcrafted, regionally inspired designs like Rajasthan’s blue pottery, Madhubani and Warli paintings, or Pattachitra and Panjor art. This regional diversity makes it very difficult for national brands to standardise.

This is where the opportunity is: If retailers or brands can solve for these constraints, they can lead. This is a category with less competition and more room to build.

Why Home Décor Is Retail’s Most Underestimated Category?

Most of the demand in this category comes from artisanal, sustainable, and locally inspired decor. As aspirations and incomes rise, consumers look for authenticity paired with aesthetics.

Secondly, unlike grocery or fashion, home décor offers high margins but low purchase frequency. That changes the rules of engagement—trust, curation, and storytelling matter more than discounts or delivery speed.

Yet, much of today’s discovery happens on chaotic marketplaces or inconsistent offline stores. SKUs aren’t structured, storytelling is basic, and the purchase experience is fragmented.

Finally, with low brand loyalty and a fragmented supplier base, this market is ripe for platform-led aggregation. Whether through marketplaces that curate SKUs by theme, region, or price or D2C brands that specialise in lighting, kitchen décor, or wall art, the whitespace is vast and ready to be owned.

From Product to Platform: The Blueprint for Scaling

To unlock this category, retailers need to start seeing it as a design-led lifestyle category. As per our research, here’s what the winning formula could look like:

- Regional Curation at Scale: Organize artisanal supply chains by region, technique, and aesthetic.

- Digitised Catalogues: Good storytelling is what makes a product worthy of buying. Products need to be branded with their stories-be it their artisanship, materials, sustainability quotient, or as a specialty of the region.

- Quality Control and SKU Structuring: Create predictability in a category where every product is currently a snowflake.

- Omnichannel Distribution: Integrate offline experience with home decor’s online platforms and gain trust like pop-up stores, studios, or hybrid cum retail formats.

- Influencer Collaboration: Consumers want inspiration. Collaborate with influencers who can help you tell your story to the world.

How Can Redseer Help You Solve This?

At Redseer, we ‘Solve for New and What’s Next’. We’ve always guided investors and players with deep insights and advice on the high-growth markets and the next wave beforehand, helping them scale at the right time with the right strategy.

Historically, we’ve seen that the ones who begin early get the time to experiment, choose their domain, and settle properly with better market understanding and less competition. If you are looking for an investment opportunity in home decor or you’re among those who want to bring a structure, story and scale in India’s Retail Market, or if you are a D2C home decor brand in India, get in touch with one of our Retail Consulting Partners, Kushal Bhatnagar, who can help you in this journey.

“The home décor market in India is unorganised but full of potential. For retailers and brands, the opportunity lies in bringing structure to supply, improving product discovery, and building trust through quality and curation. It’s not about reinventing the category — it’s about making it easier to navigate and buy.”

Download the full report, ‘India’s Got Retail’, to gain deep insights and advisory on high-growth sectors and investment opportunities.