1. Despite 30x growth, eGrocery models have been able to tap only 0.3% of the grocery market, with major presence in metros

The overall grocery spend in India is sized at $600 Bn+, as per 2019 estimates. eGrocery is disrupting this market, with entry of multiple business models.

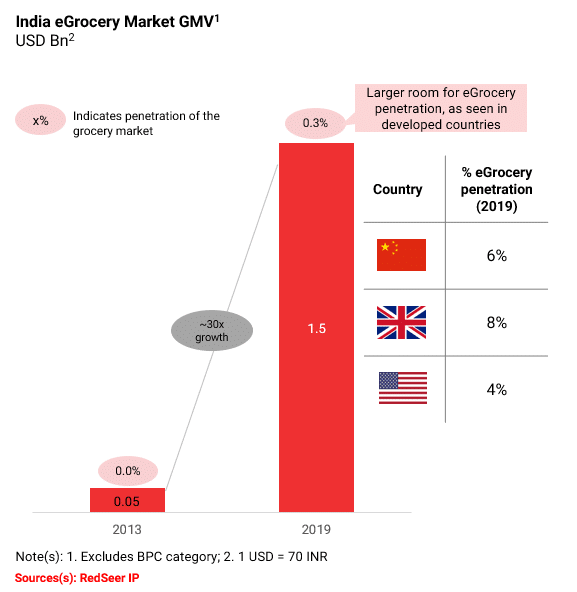

The eGrocery market GMV was mere $0.05 Bn in 2013, but has grown 30x in the last 6 years to reach $1.5 Bn GMV in 2019. Despite the humongous growth, eGrocery only accounts of 0.3% of the overall grocery spend in India i.e. significantly less compared to developed countries like China, UK and US.

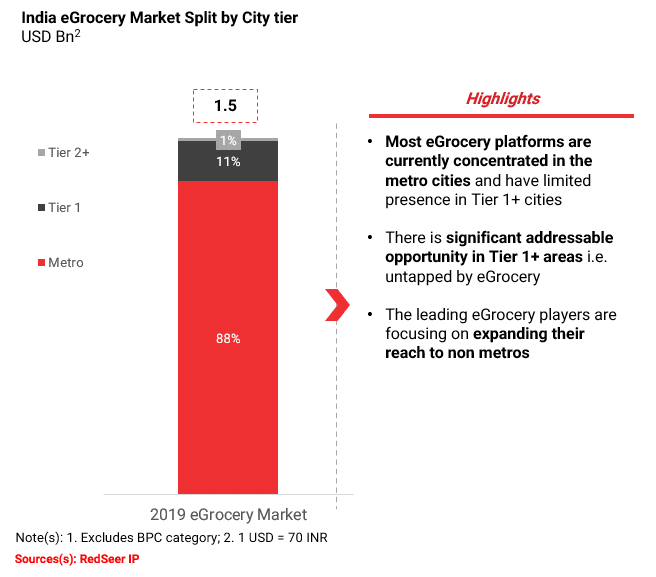

Moreover, eGrocery in largely a metro-based phenomenon with most players limited to metros and has significant untapped opportunity in Tier 2+ cities.

2. These models are classified basis value vs convenience offering & inventory levels, where value-first models have a larger base of addressable HHs

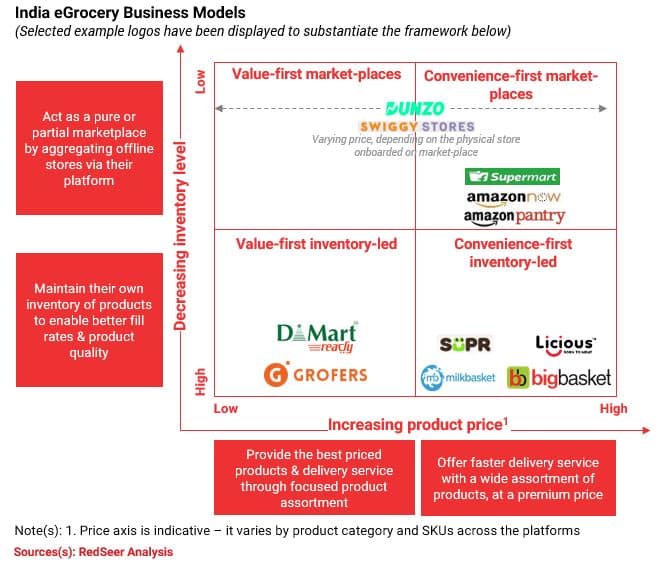

Depending on inventory level and pricing (value vs convenience offering), eGrocery business models can be classified into 4 types – value-first inventory-led, convenience-first inventory-led and convenience-first market-places.

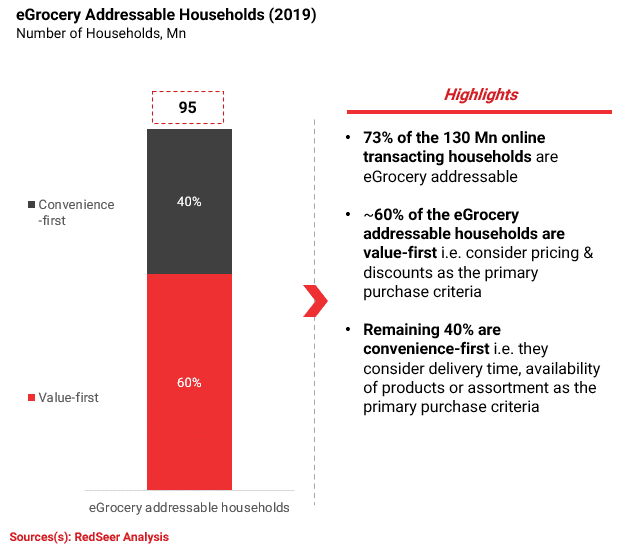

Value-first models have a base of 57 Mn eGrocery addressable households, compared to 39 Mn addressable households for convenience first models (basis the grocery purchase criteria of the online transacting households in India).

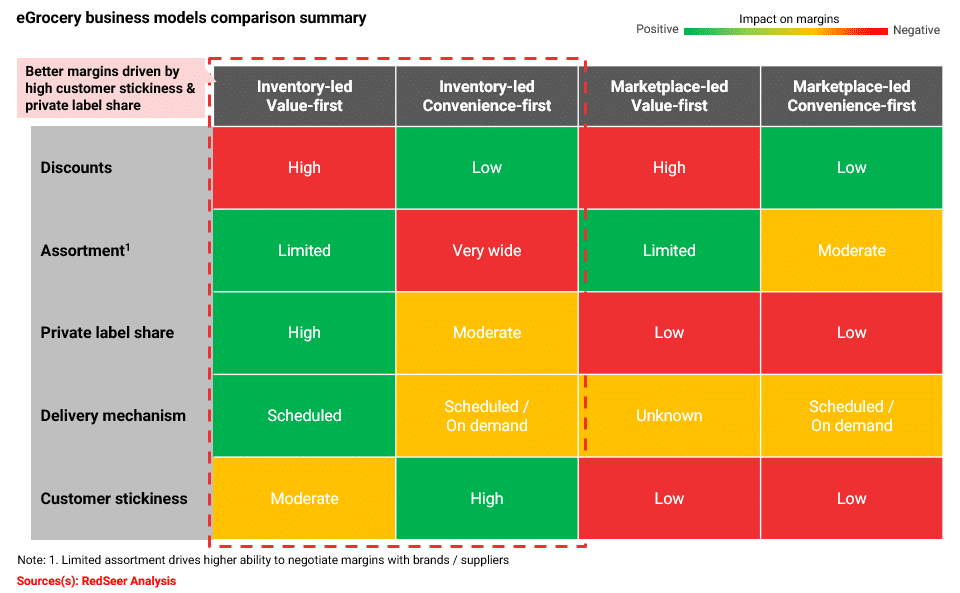

3. Inventory-led models (both value & convenience-first) operate on factors indicating better margins and are likely to be sustainable in the long run

Among the different eGrocery models, inventory-led models are better placed on margins and hence are likely to be more sustainable. This is because they’re likely to perform better on private labels and consumer stickiness.

Within inventory-led models, there’s a close play between value-first and convenience-first models. While convenience-first models obtain better margins due to low discounts & high consumer stickiness, value-first models derive favourable margins through limited assortment, high private label share and scheduled-only deliveries.