The market disruption by the COVID-19 pandemic created phases of growth and slowdowns for startups. As a result, most businesses experienced a net growth that spanned two pandemic waves. However, in CY-2022, global inflationary pressures severely impacted consumer demand. The revenue increase was driven by higher prices, as volumes remained low across the urban and rural sectors. With the macro environment challenges expected to continue, consumer demand is likely to remain subdued for the foreseeable future.

At Redseer, we studied the market trends since the pandemic and evaluated how startups can take on the challenges that are likely to persist over the next few quarters. Here’s a birds-eye view of the slowdown in consumption and the opportunity for startups to move towards profitability.

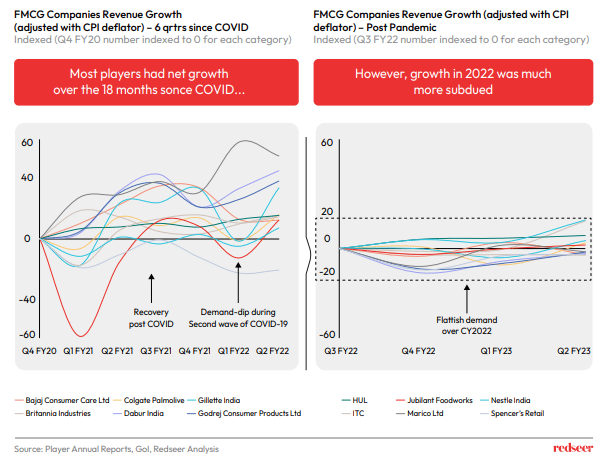

1. Consumer consumption remained tepid throughout 2022 when adjusted for inflation

The drop in demand caused by the lockdown in Q1 FY21 (Apr-Jun 2020) led to most companies experiencing a dip in growth. However, pent-up consumer demand resulted in increased order volumes in the following quarters driving recovery for the majority of players in the FMCG market. The second wave during Apr-Jun 2021 (Q1 FY22) caused another dip in demand. However, the FMCG players were better prepared for supply chain disruptions, eventually leading to a faster recovery.

Although most FMCG players reported revenue growth during CY 2022, their volumes dropped, particularly in rural areas. It suggested that the revenue growth was driven by rising prices, not increased consumption. Correcting for inflation using a CPI deflator shows almost flat revenue curves for FMCG players in CY2022- indicating low or negative growth.

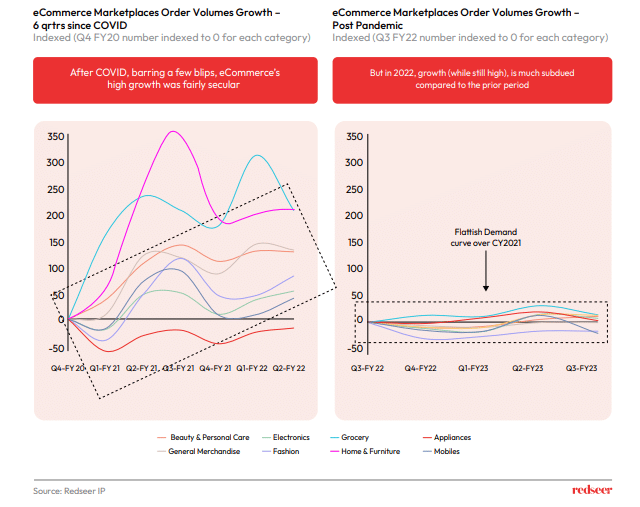

2. Similar trends were also observed in eCommerce, where consumers are less price sensitive

Growth in eCommerce during the pandemic, apart from a few minor dips, remained relatively secular due to the consumer shift towards digital channels. However, the subsequent slowdown in consumer demand led to order volumes for eCommerce being subdued in CY2022. The impact has been slightly lower compared to that on the FMCG player, as eCommerce is less reliant on price-elastic rural demand.

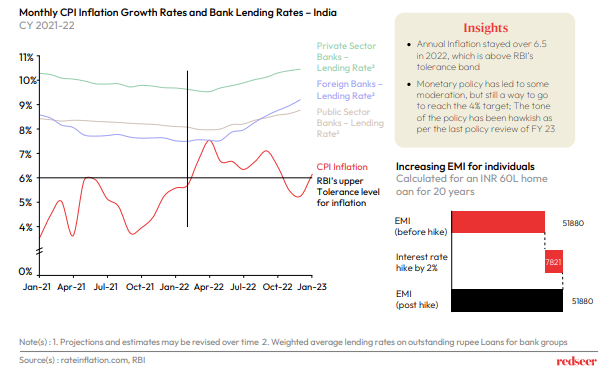

3. Inflation’s effect on household P&L continues to keep discretionary spending low

Inflation mostly stayed over 6.5% during CY2022 leading to higher prices for most products. Monetary tightening by RBI has led to an increase in interest rates, further impacting the discretionary income of consumers. The rising cost of credit pushed consumers into spending ~15% more on EMI, further reducing their ability to spend on consumption. The trends are further reflected in the expected drop in growth in real PFCE (Private Final Consumption Expenditure) from 9.4% in 2022-23 to 6.3% in 2023-24, as per RBI’s Survey of Professional Forecasters on Macroeconomic Indicators (79th edition, Dec 2022).

Consumer demand is expected to stay low over the coming quarters, with sticky inflation going over 6.5% in January 2023. There is an ongoing risk of further escalation in the war on Ukraine and the current wheat crop being impacted by hot weather conditions. Consumer perception of the general economic condition continues to be pessimistic as per RBI’s Consumer Confidence Survey of January 2023, where over 50% of consumers reported it to have worsened.

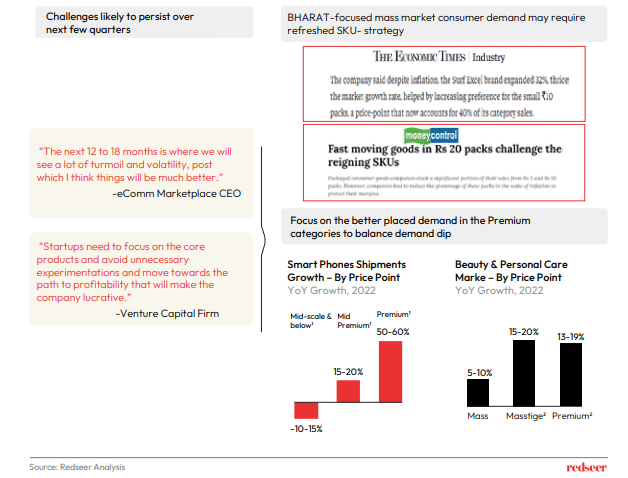

4. Macroeconomic challenges likely to persist over the next few quarters

We expect consumer demand over the near future to continue staying subdued, with high inflation, unemployment in the urban organized sector and falling real wages in the rural areas.

This comes at a difficult time for startups. They currently have limited ability to drive growth through discounts and other levers, which worked well during an easier funding environment. Therefore, startups must focus on efficient unit economics and improving profitability by sticking to their core offerings. One strategy that has worked for FMCG players in the face of shrinkflation has been the push towards smaller SKUs. Bharat-focused startups, too, need to look at revamping their SKU strategy to fit the tighter wallets of the mass-market consumers. The second strategy is to double down on the premium categories, which have lower price elasticity and have performed well against market pressures across sectors.

This is perhaps not the year to chase high growth but an opportunity to tighten the operations and shift the lens from product-market fit to profit-market fit.