In a diverse and vibrant country like India, consumer behavior varies greatly, and understanding the distinct archetypes of consumers is vital for businesses aiming to capture this vast market. With their prudent spending habits and pursuit of value-driven products, the’ Mass’ consumers are a dominant force. In this article, we delve into the characteristics and preferences of ‘Mass’ consumers and explore the potential they hold in driving the growth of the Indian economy.

1. At a high level, ‘bank for buck’ defines the Indian ‘Mass’ Consumer

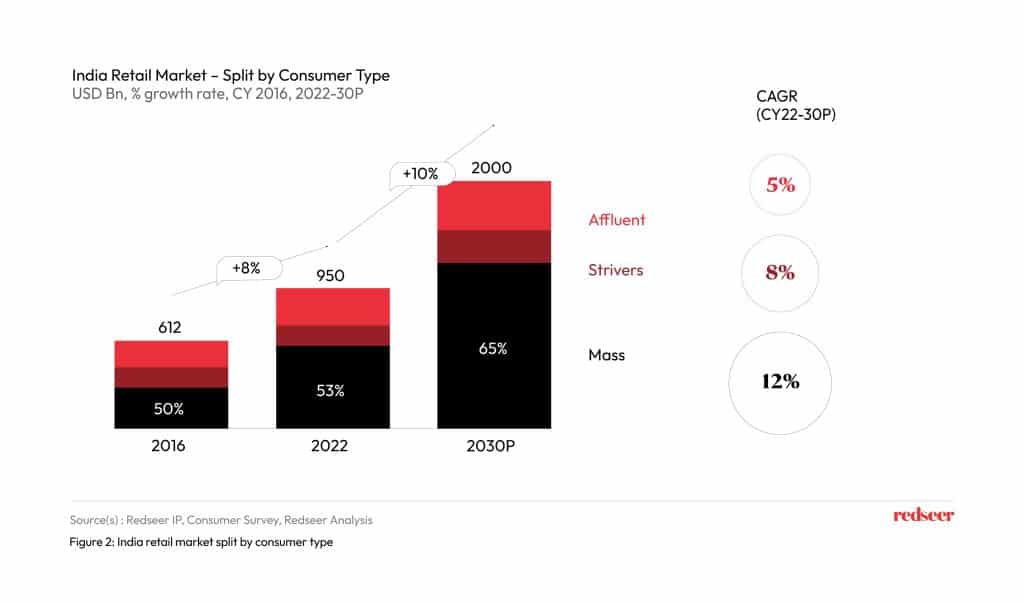

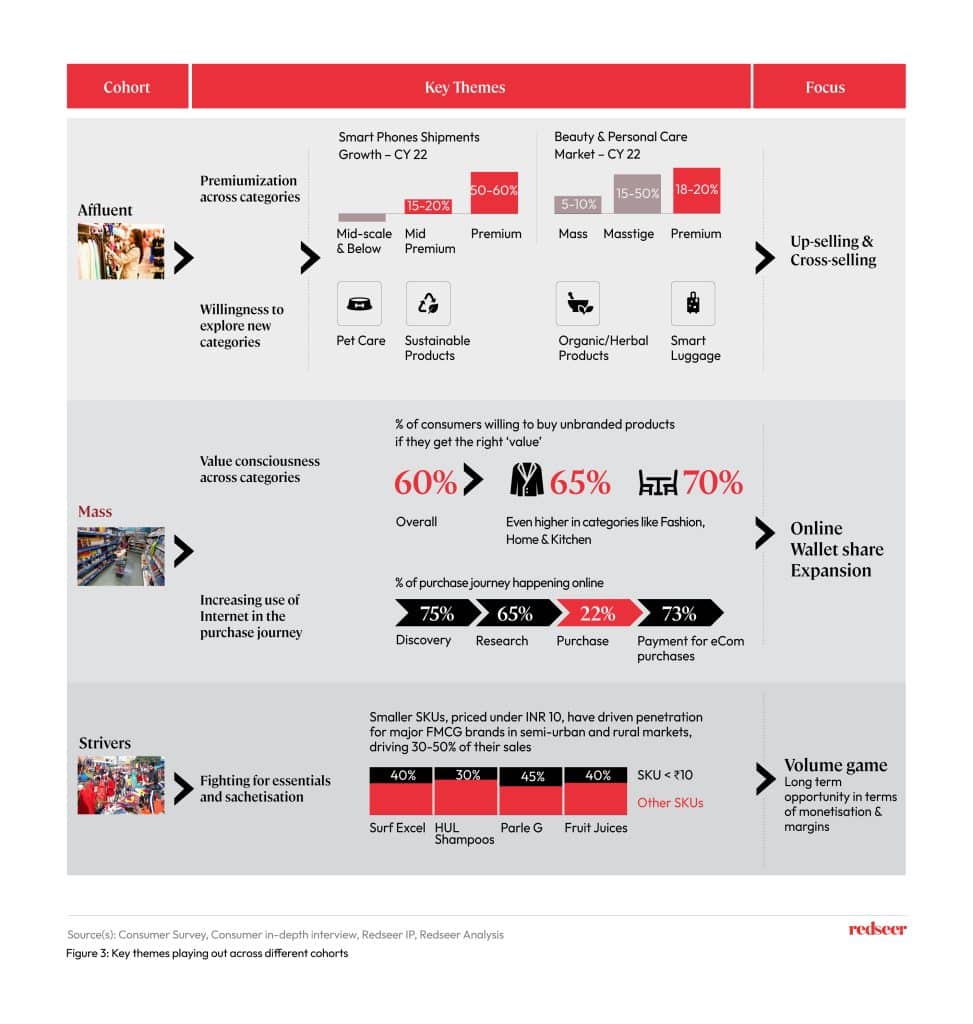

Based on their incomes and shopping habits, Indian consumers can be segmented into three distinct archetypes – Affluent, Mass and Strivers.

‘Affluent’ consumers have an annual income of more than INR 10 Lakhs and spend approximately 3x of the average Indian household on best-in-class products. These consumers constitute ~15% of India’s 319 Mn households. ‘Mass’ consumers have an annual income between INR 2.5 Lakhs and INR 10 Lakhs and look for the “bang-for-buck” products or products that offer the highest value for money. These consumers constitute ~53% of the total Indian households. ‘Strivers’ on the other hand, are consumers who have an annual income of less than INR 2.5 LPA. They spend most of their incomes on essentials and prefer unorganized/localized products. They constitute ~33% of the total Indian households.

2. ‘Mass’ Consumers will drive 65% of the Indian retail market by 2030

The Indian retail industry is projected to expand at a CAGR of 10% to reach approximately USD 2 Tn by 2030. This growth in India’s retail market will be driven by ‘Mass’ consumers, who are projected to contribute ~65% to the overall retail market by 2030, growing the fastest amongst the consumer cohorts at a CAGR of ~12%, creating a ~USD 1.3 Tn market opportunity by 2030.

3. Increasing online wallet share will be the key theme playing out across ‘Mass’ consumers

While ‘Affluent’ consumers are preferring premium products across categories and are highly willing to explore newer categories, ‘Strivers’ are focusing on essentials and sachetisation, ‘Mass’ consumers are highly value conscious and focus on optimizing price versus quality. Our survey of ~1000 ‘Mass’ consumers indicated that ~60% of these consumers are willing to buy unbranded products, provide they get the right ‘value’. The share of respondents was even higher for categories like Fashion and Home & Kitchen.

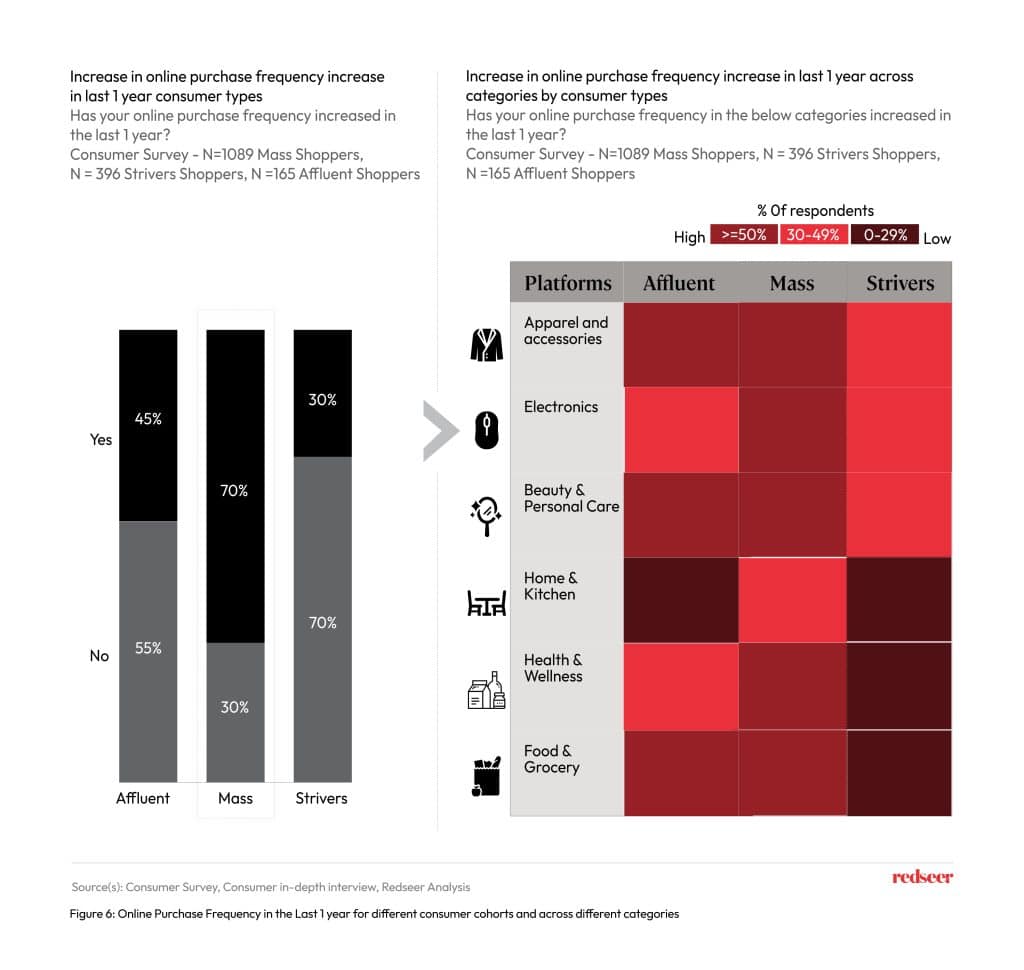

4. ‘Mass’ consumers are increasingly shopping online, across categories

‘Mass’ consumers are increasingly purchasing online across all product categories. Our survey results indicate that ~70% of ‘Mass’ consumers responded that their online shopping frequency across most categories has increased in the past one year. These consumers shopping online are comfortable with technology, increasingly willing to try newer products and brands, can afford products currently available on eCommerce websites, and are adopting digital payments for smoother transactions.

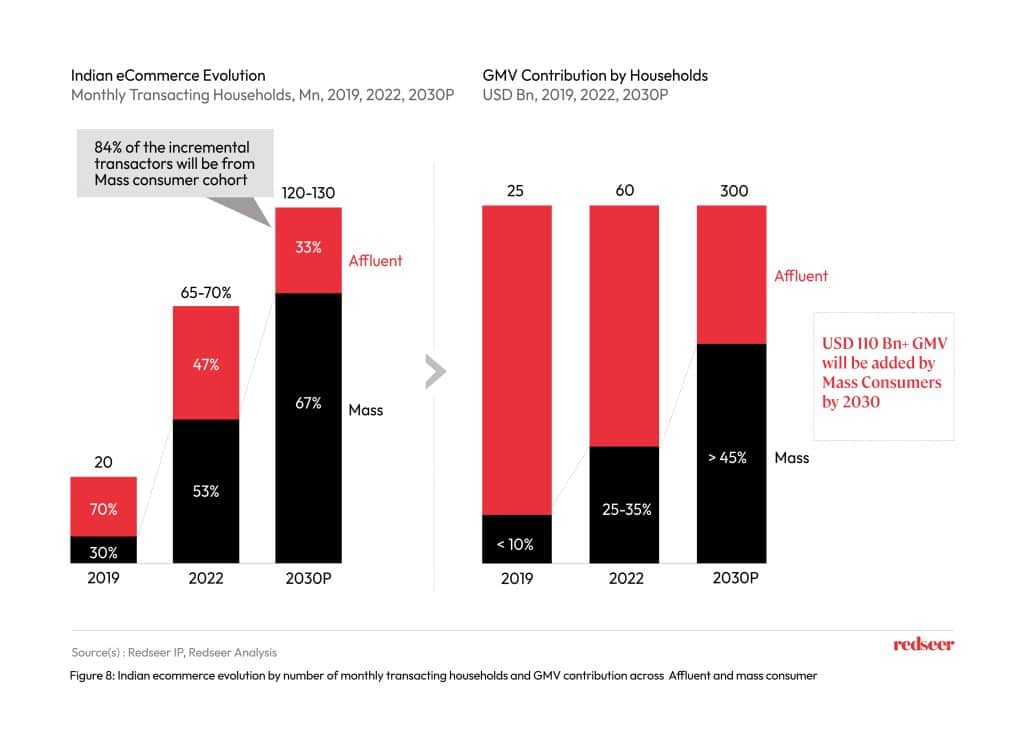

5. Hence, future eCommerce growth will be led by ‘Mass’ consumers

As of 2022, India has 65-70 Mn households transacting on eCommerce platforms monthly. This is projected to go up to 120-130 Mn by 2030 led by higher adoption amongst mass consumers, who are projected to add >80% to the incremental transacting households. In terms of GMV contribution as well, mass consumers are projected to drive >45% of the ~USD 300 Bn eCommerce GMV by 2030, potentially adding more than USD 110 Bn to eCommerce GMV between 2022 and 2030.