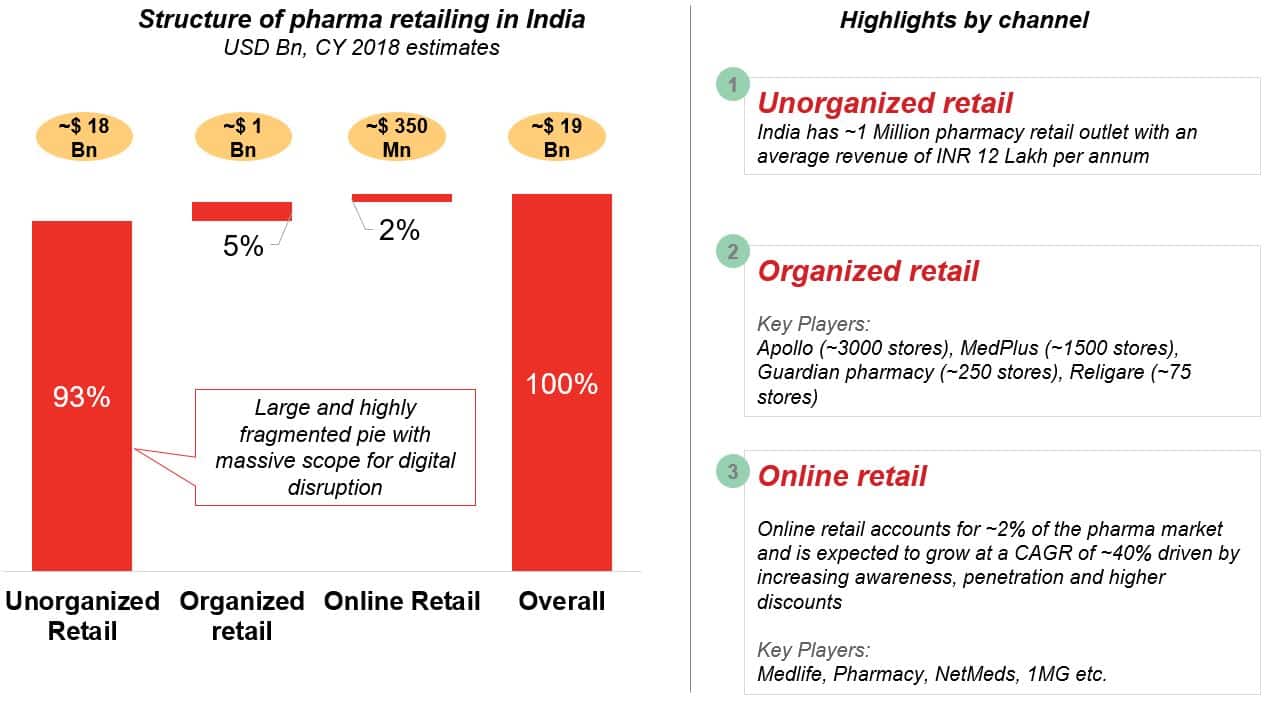

India’s USD 18 Bn unorganized pharma retailing market is ripe for digital disruption by ePharma players

Published on: Aug 2019

Summary takeaways:

- ePharma (USD 350 Mn in 2018) is <2% of the overall retail pie currently, but poised to expand at least 40% y-o-y, driving significant action from companies and investors

- ePharma continued action and attractiveness emerges from the fact that besides being a massive pie (USD 18 Bn), pharma retail is highly unorganized and fragmented and thus ripe for digital-driven consolidation

E-pharma space on track to grow at 40+% CAGR by attacking the consumer pain points from offline channels

Summary takeaways:

- Consumer experience in offline medicine purchase is broken- with poor pricing and selection unavailability being major concerns, along with long waiting times

- ePharma business models are able to directly attack each of these pain points very effectively, thus leading to massive growth potential

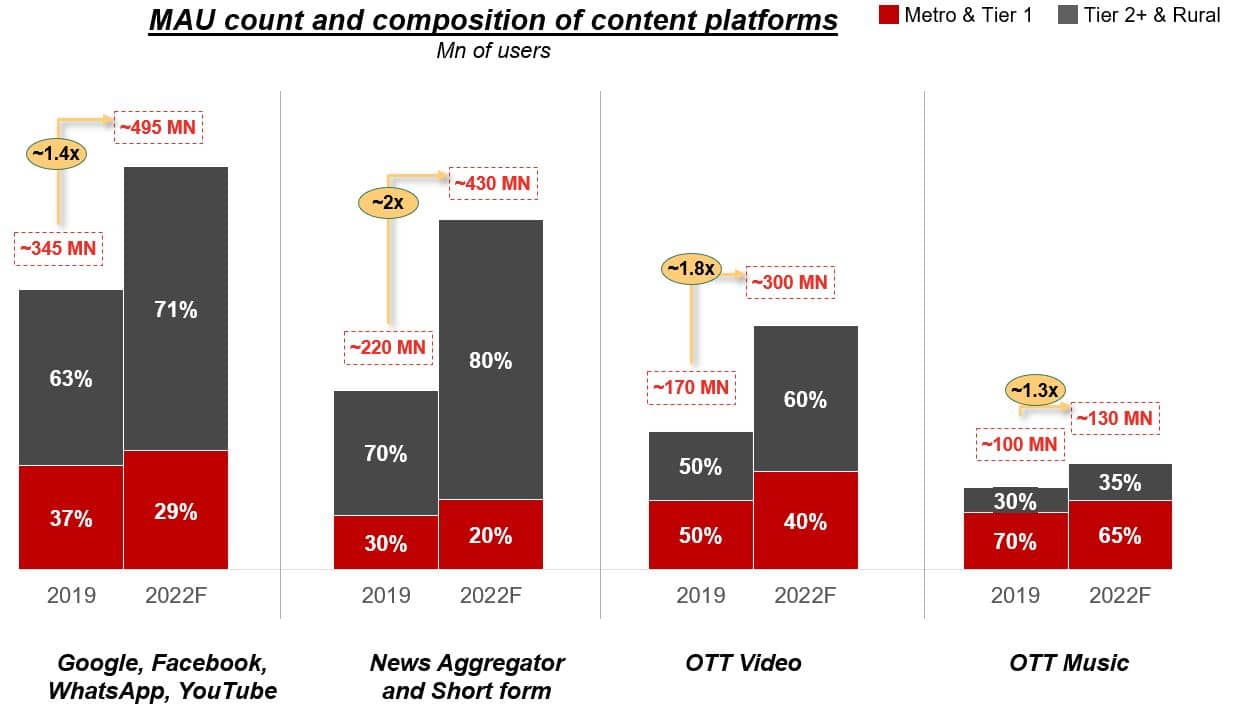

MAU for OTT Video platforms expected to grow 80% over 2019-22; platforms focused on Bharat target group are expected to grow fastest

Summary takeaways

- MAUs for OTT Video sector expected to expand from 170 Mn- 300 Mn over 2019-2022, with Tier 2+ and rural consumption to reach 80% share (vs 70% currently)

- MAUs for more mature content sectors like OTT music and social media are expected to grow at a slower pace (sub 40% CAGR) in this period- with smaller cities driving most of the growth

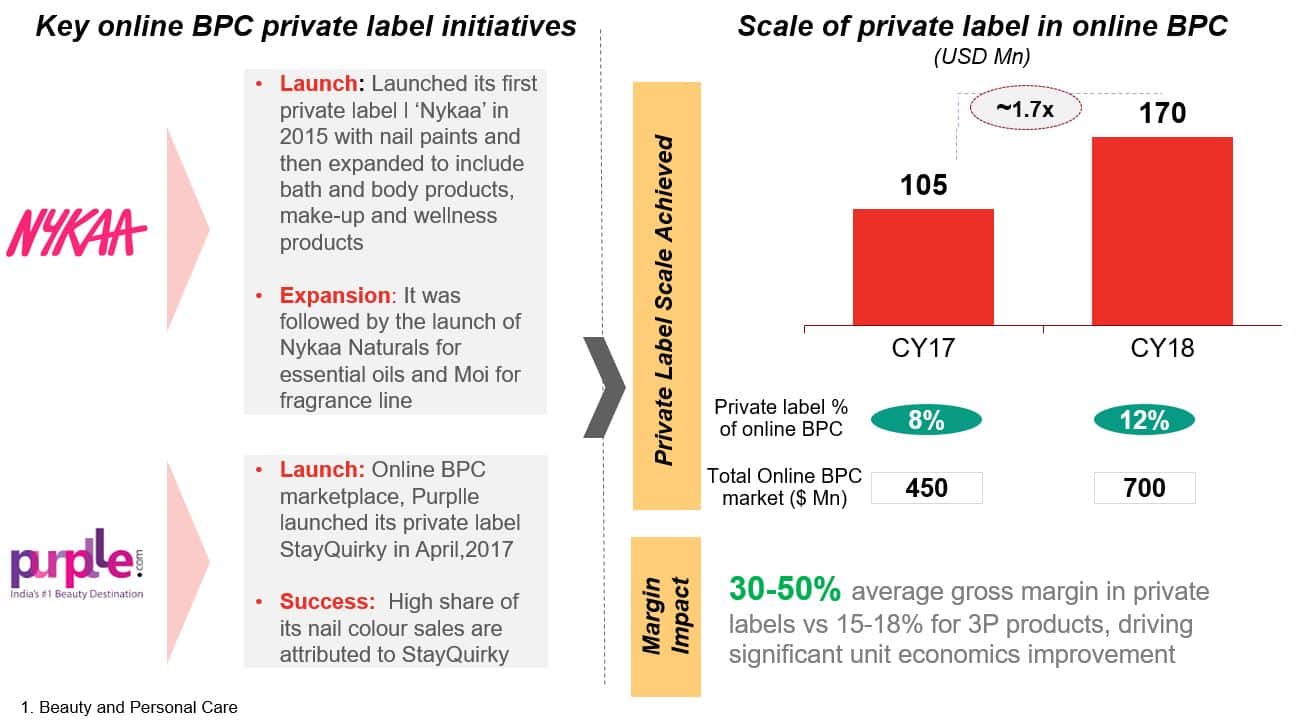

Online BPC companies saw steady growth in private label business in 2018 and in 2019 are poised to expand private labels rapidly

Summary takeaways

- Online BPC (beauty and personal care) space saw the rise of private labels in 2018, with their share reaching double digits as initiatives from Nykaa and Purple bore fruit

- We expect private labels (which generate a 30% gross margin) to account for more than 15% of online beauty GMV in 2019.