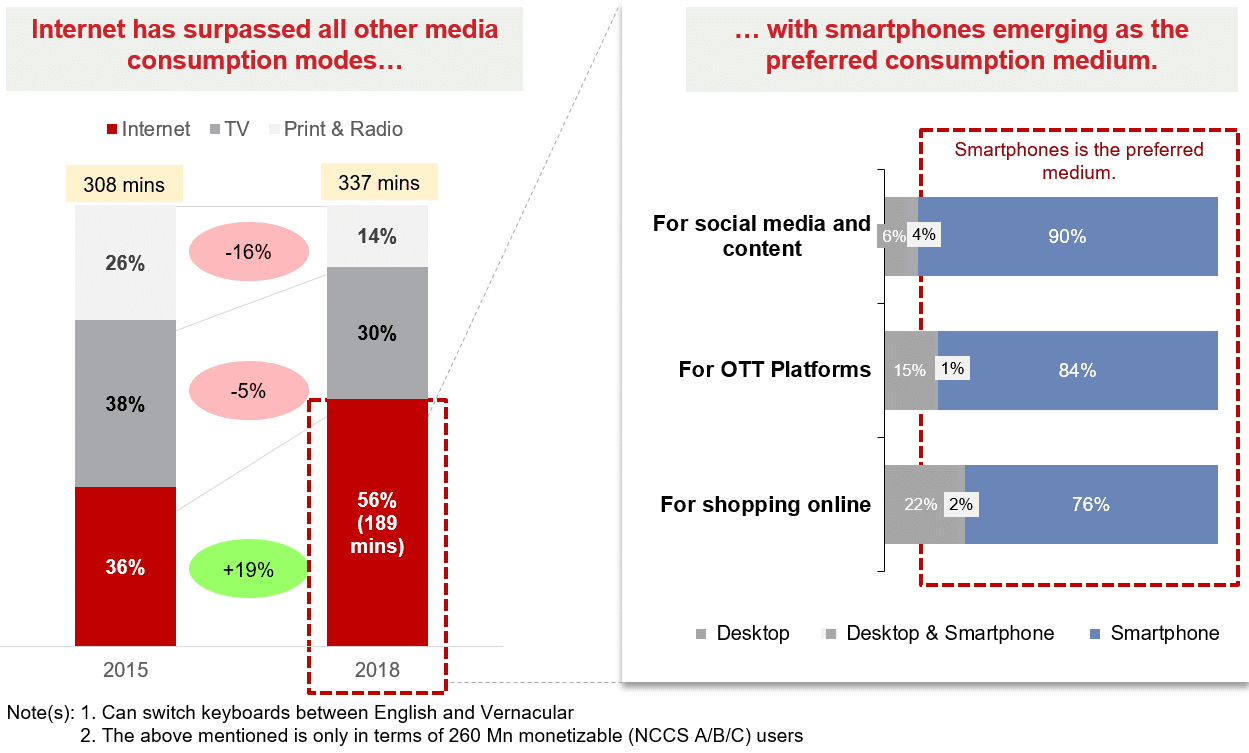

India is in the midst of a massive digital transformation of its population

Published on: Aug 2019

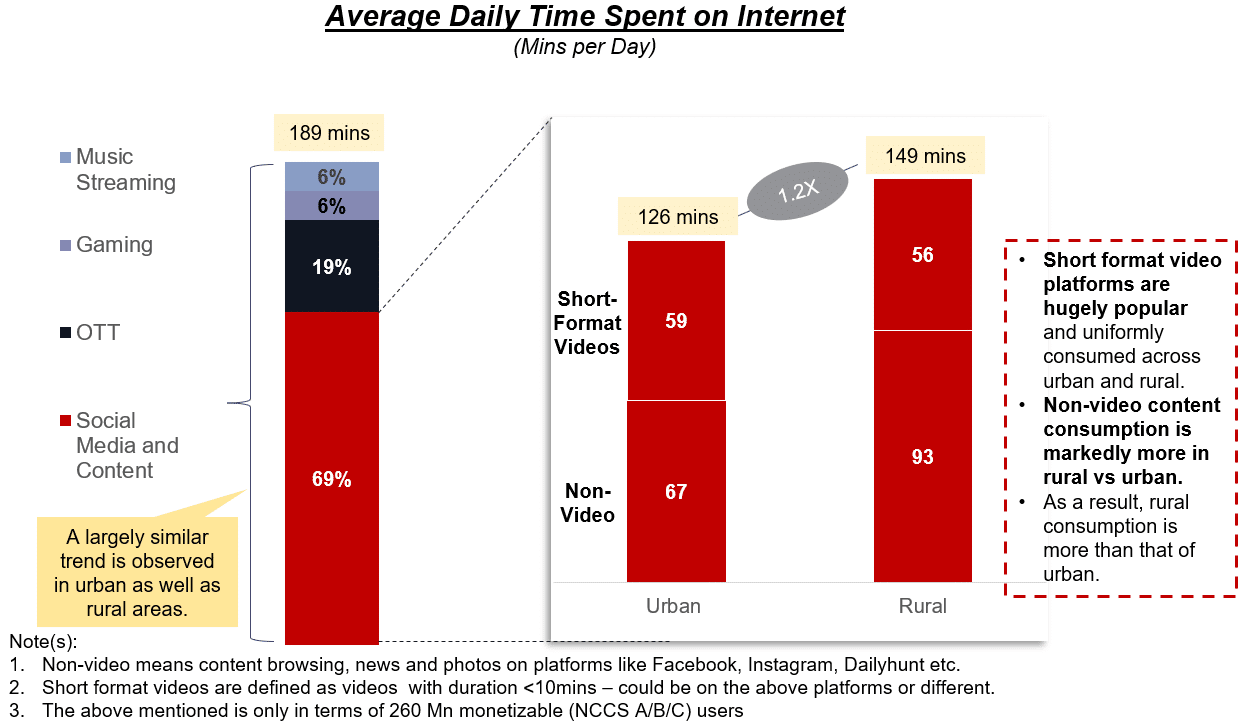

Heavy social media and content consumption underway in urban and especially rural areas

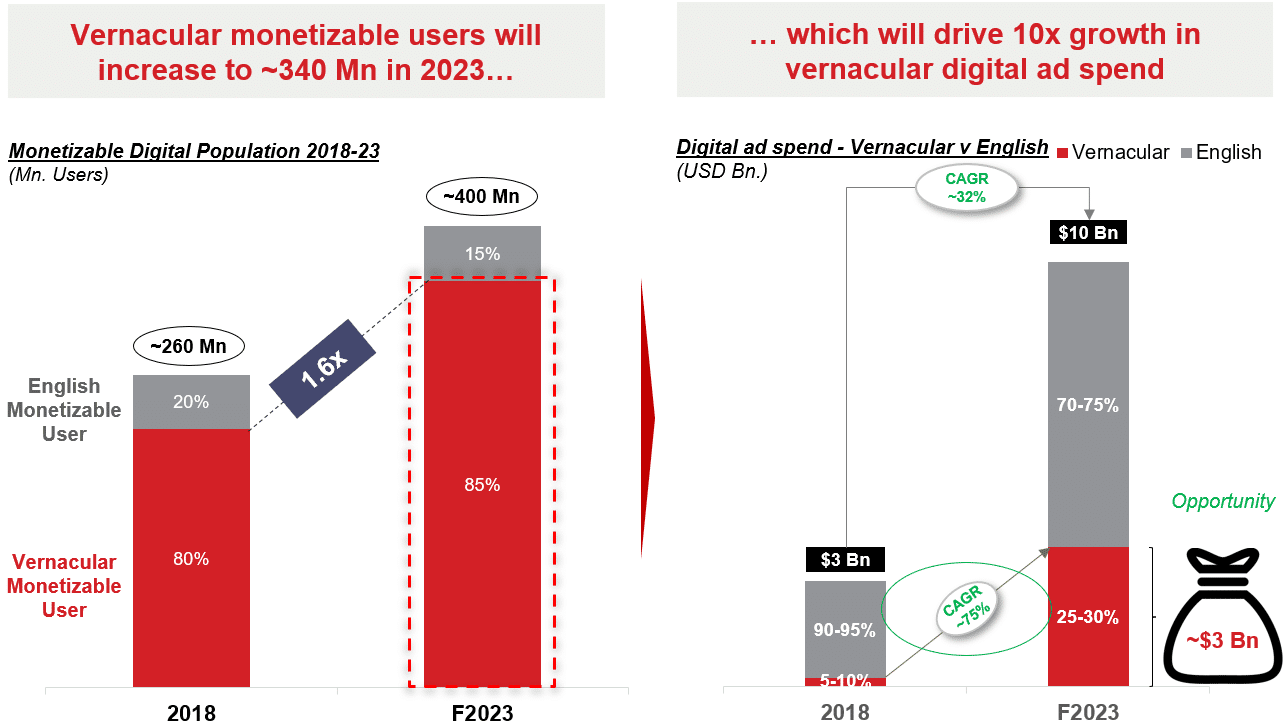

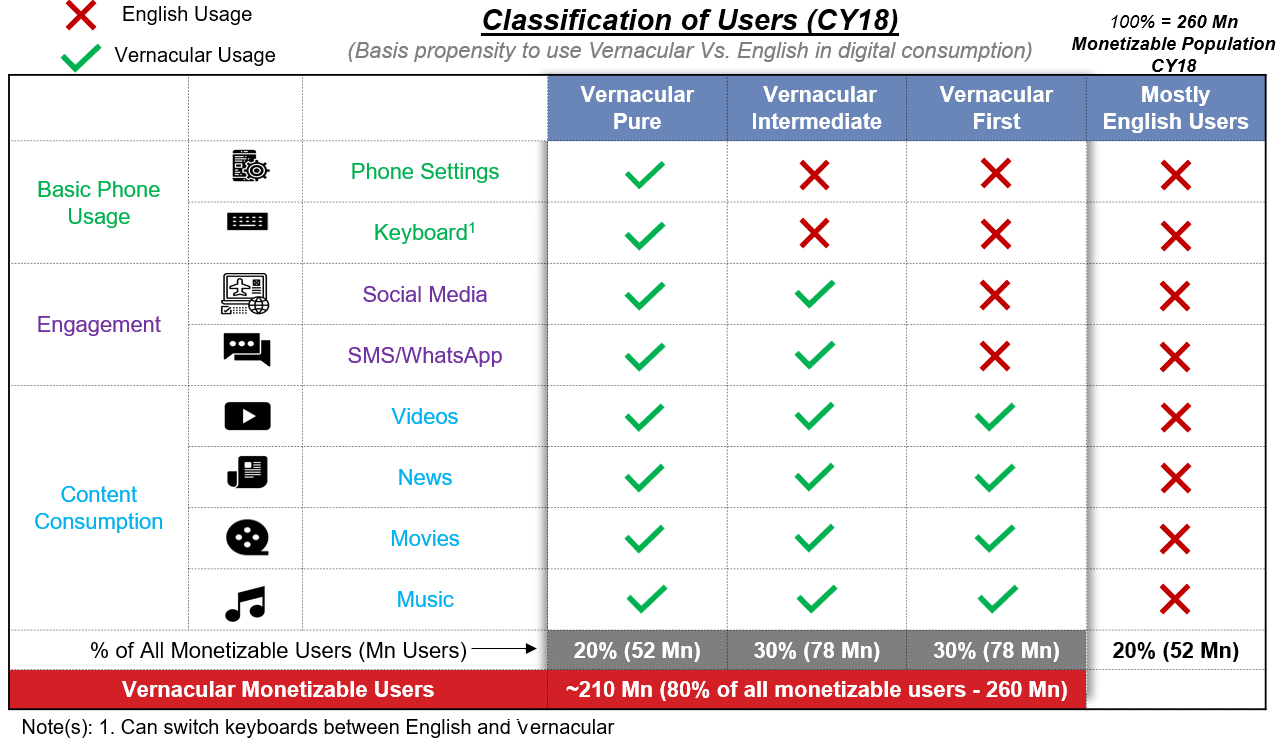

210 Mn = Current number of vernacular preferring digital consumers in India who are also monetizable

Massively growing vernacular user base to create USD 3 Bn of incremental digital ads spending opportunity over 2018-23