India’s Online

Packaged Food,

Beverages,

Personal Care and

Home Utilities

Consumer Goods

Report

India’s Online

Packaged Food,

Beverages,

Personal Care and

Home Utilities

Consumer Goods

Report

Leverage the increasing digitization trend of the Indian shopper to exponentially increase brand scale, relevance and salience amongst consumers

Why is the report important ?

- India’s digital user base is evolving rapidly and driving the online retail India has ~600 million internet users, 20% of which are active online shoppers. E-tailing market in India is expected to reach ~USD 100 Bn by 2023 from USD 24 Bn in 2018

- Online grocery is a USD 2 Bn market in 2018 and is expected to grow at a rapid pace to reach USD 5 Bn by 2020 driven by favourable demographics, adoption and policy factors

- With increasing digital adoption, demand and supply levers will converge to drive further growth within this sector. Players are realigning their business model and are increasingly focusing on strong warehousing capabilities in areas of high demand to offer better product availability and delivery experience

- It would be imperative for consumer brands to leverage multi-channel models, and garner deep understanding of the online as well as offline channel for achieving scale and sustained relevance

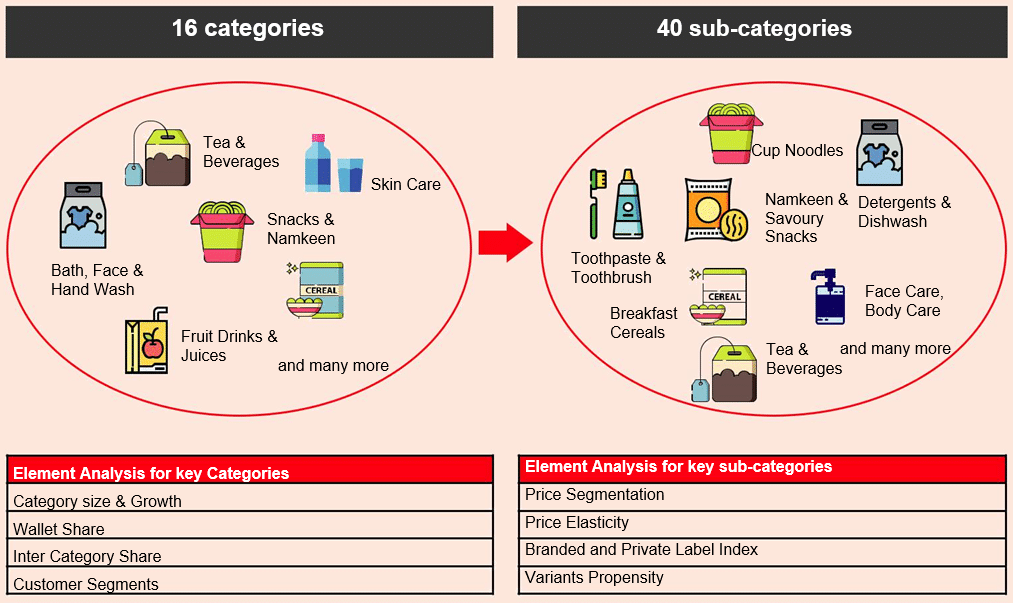

Scope

The report will cover detailed assessment of 16 key categories that mark the four categories of Packaged Food, Beverages, Personal Care and Home Utilities; further another set of 40 sub- categories comprising the above 16 categories across the following elements

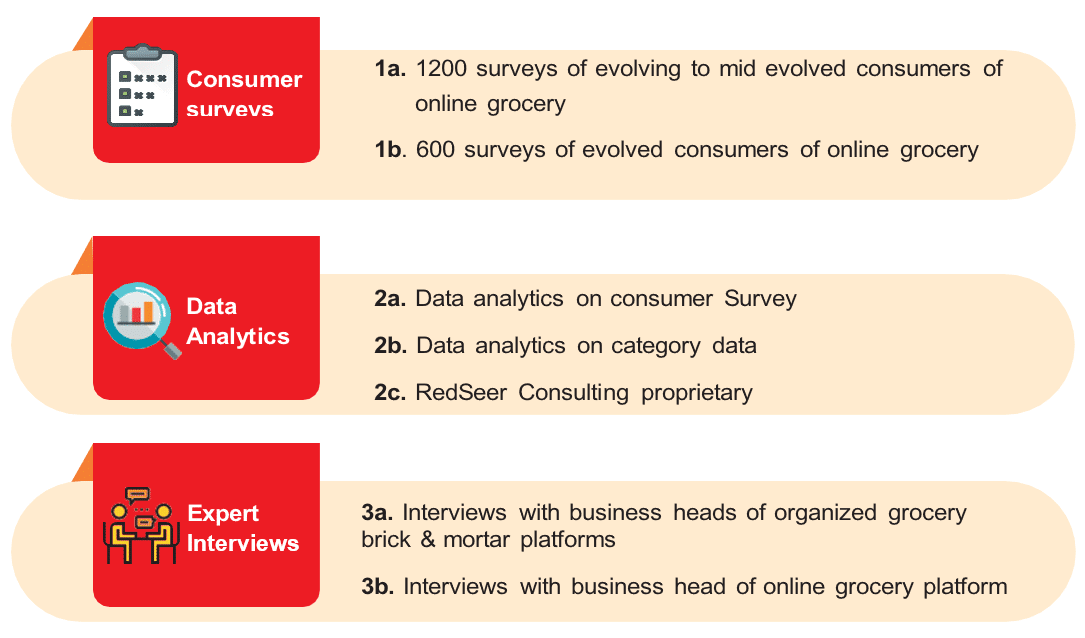

Unique comprehensive, triangulated methodology of analyses and inference across 1800 consumers, analytics & SME interaction cutting across 10 metro-centric and Tier I Indian cities

Methodology

The study will be conducted using RedSeer’s trademark integrated analysis and research approach, which involves the following:

RedSeer will synthesise inputs from the above research studies and leverage its deep understanding of retail and internet industry, and proprietary knowledge to provide a holistic view on consumer behavior and category dynamics in the online grocery & general merchandise space

Table of Contents

1. Understanding India’s Organized Penetration for Groceries and GM categories

- Overall Food & Grocery and General Merchandise Market in India and expected growth rate for next 5 years

- Channel wise breakup of this market: Traditional Retail, Organized B&M and Online Channel

- Benchmark organized penetration with global markets mature and emerging economies

- Compare growth and factors for growth of online penetration vis-à-vis Brick and Mortar organized retail

- Define key formats comprising B&M Organized Food & Grocery Market: Supermarket, Hypermarket, Convenience Store and Online

- Segmentation analysis of B&M organized formats across key metrics: store size, productivity, assortment mix: offering and revenue, branded and private label skew for these categories

2. Macro Mapping Analysis of Online Groceries & GM Shopping

- Number of HHs buying a defined basket of brands across the four categories

- Penetration of defined brands across consuming HHs

- Average consumption of HH for a said category

3. Category Deep Dive: Analysis of key sub-categories constituting these four categories for the following elements

- Category size and growth

- Price segmentation, and segment growth

- Branded and Private Label mix, and growth within customer basket

- Leading brands and share in the customer basket across categories

- Market structure of branded share i.e. fragmented or consolidated play

- Index of price elasticity at category level

- Near term emergent trends: What would the likely size of a category/sub-category be over the upcoming quarter basis analysis of cyclicity, growth achieved

- Index of variants introductions within sub-category combined with adoption for variants

4. Shopping Basket Analysis: The following elements will be covered across the four categories with focus on Online platform

- City type segmentation of the consumer sets across Metro/Mini Metro and Tier I

- Basket Size and Value: Number of items and Average Ticket Size

- Shopping behaviour key consumer segments demonstrate: frequency, app based/online, adoption of new categories/sub-categories in basket

- Category and sub-category adjacencies, brands of basket across key segments

- Customer segment index: mapping response to new variants/new brands

5. Consumer Research Analysis: Following elements will be analysed through consumer research executed each quarter with a scope of 1600 online GM shoppers

- An infographic purchase cycle from online grocery retailer

- Frequency of buying online and average spend per purchase

- Key products preferred for purchasing online

- Key factors considered for buying online, challenges with online ordering

- Awareness and popularity of E-grocers

- Response to new product launches, promotion, new product categories

- Leading brands in the customer basket by categories

- Triggers for online purchase vis-à-vis each of the four category/sub-category

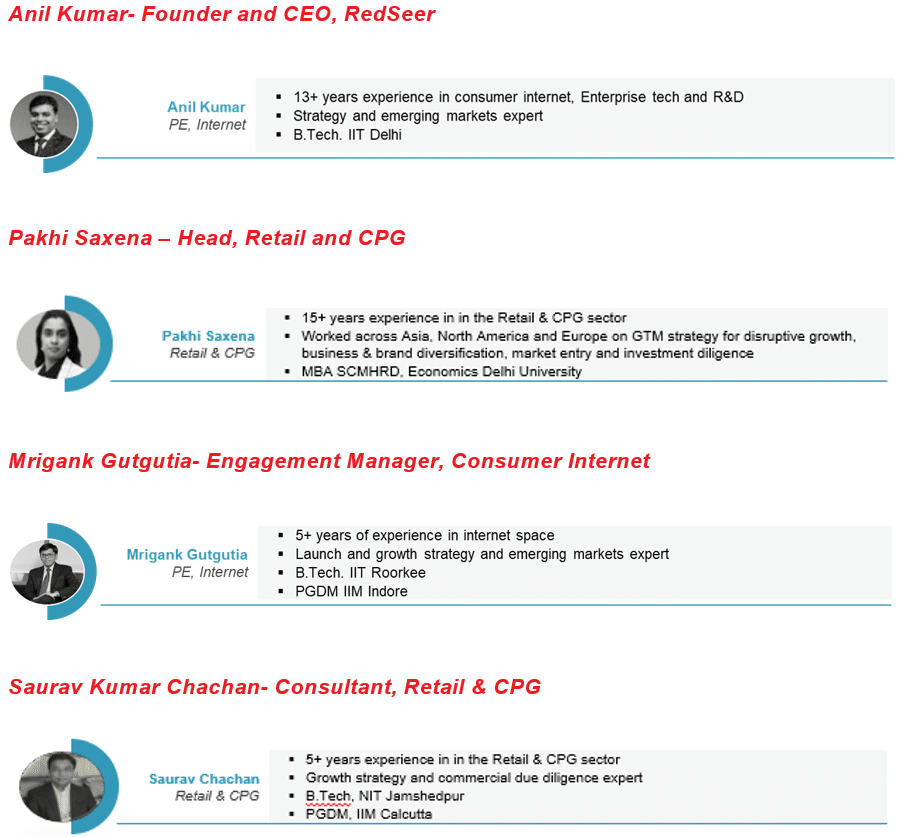

Authors