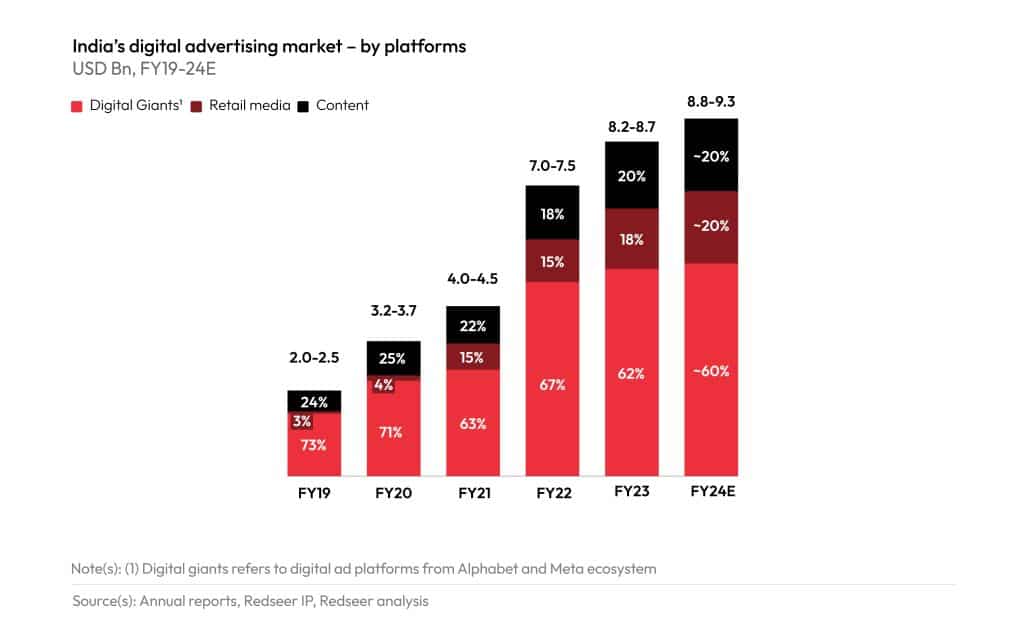

Redseer’s latest report ‘Breaking barriers: Rise of challenger platforms in the digital advertising landscape‘ reveals that FY2024 is likely to be a muted year for advertising spend with a ~6% growth. Total advertising spend is poised to reach US$16-17 Bn in FY24, heavily impacted by the slowdown in consumption observed in the last 5-6 quarters. Digital Advertising which accounted for 55-56% of total advertising spend in FY24 amounting to US$ 8.8-9.3Bn, is well on its way towards amassing a significant user base of 800 million internet users and will quickly surpass Television viewership in 1-2 years. This demographic is spending almost 1/3rd of their waking hours on the internet.

Over the course of their advertising journey, brand requirements are seen to mature, and they are on the lookout for solutions that will enable them to design and implement measurable campaigns targeted towards niche and diverse demographics. With programmatic solutions and GenAI set to make its impact on the advertising space, what can brands, advertisers, and platforms expect? Mukesh Kumar, Associate Partner at Redseer highlights a few critical findings from the report.

Retail Media platforms to increase their market share from ~18% in FY23 to ~20% in FY24 and content formats to maintain their share at 20%

Have a question?

Our experts are just a click away.

The Digital Advertising market in FY2024 is expected to remain muted at a ~6-7% growth rate and reach US$ 8.8 – 9.3 bn in the fiscal, with Digital giants set to moderate their market share from ~62% in FY2023 to ~60% in FY2024. Retail Media platforms like eTailing and Hyperlocal, on the other hand, are expected to grow at ~20% in FY2024 and increase their market share from ~18% in FY2023 to ~20%. Content-based platforms are set to continue retaining their ~20% share this Fiscal, with growth driven by Shortform Video and OTT Video.

The Report notes that Advertisers are increasing spending on Challenger platforms like Retail media and Content platforms with niche offerings owing to multiple factors like specific targeting of high-intent users, greater reach within Tier-2 audiences, and increased attention span on the platforms.

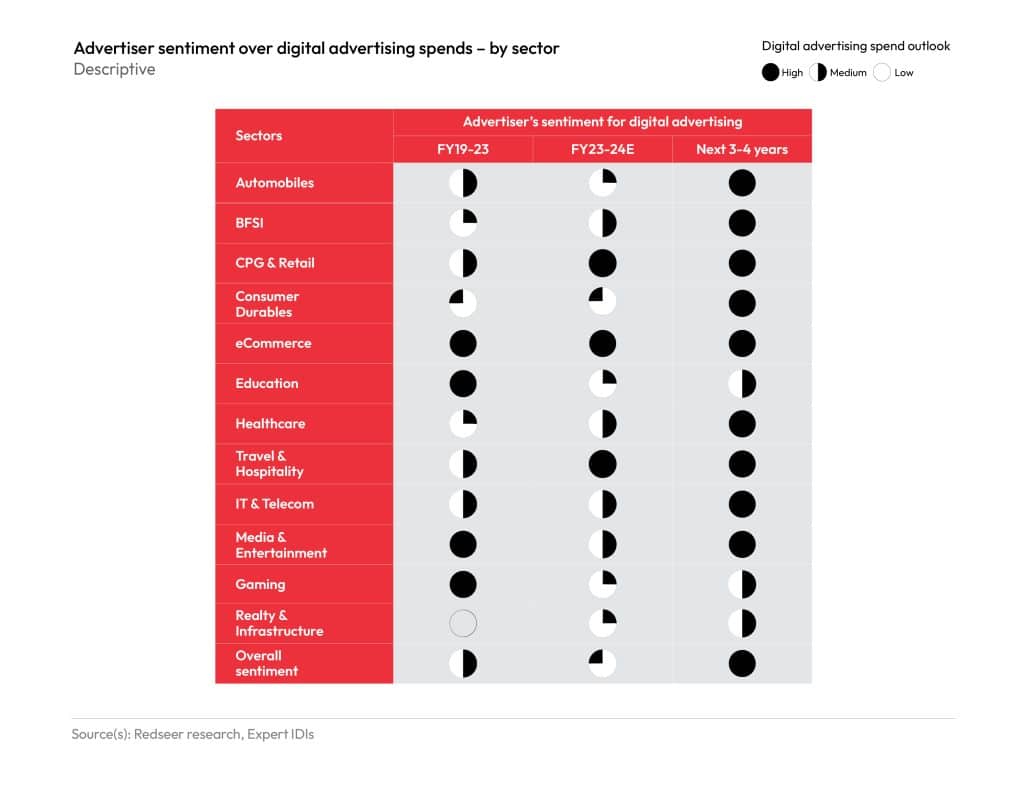

Advertisers’ sentiment for digital advertising set to improve over the next 3-4 years

Over the next 3-4 years, advertisers’ sentiment towards Digital Advertising is expected to improve across multiple sectors pointing towards increasing advertising spending. Investments in Digital Advertising are driven by multiple factors across sectors. While the BFSI sector is expected to increase advertising spending to accelerate the uptake of financial tools, sectors such as healthcare invest in digital advertising to accelerate the promotion of preventive healthcare solutions. In the CPG & Retail sector, legacy players are utilizing the medium to advertise their own D2C platforms.

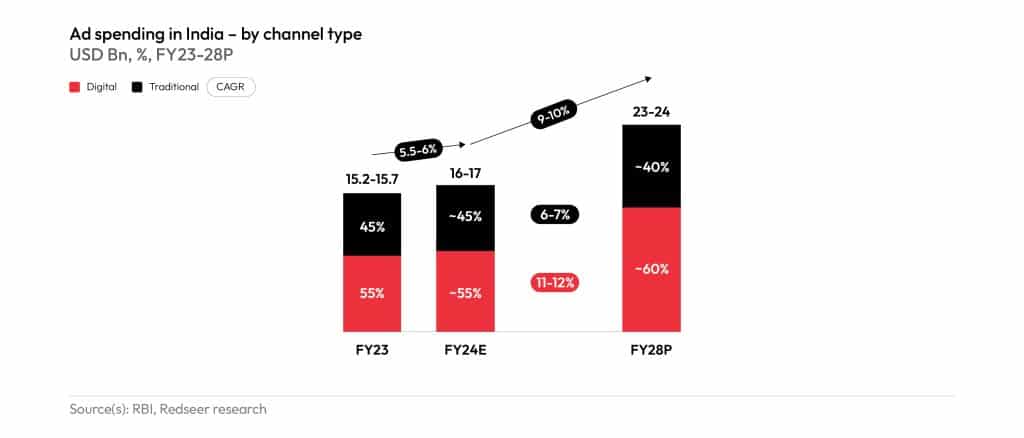

Advertising spending to grow at a CAGR of 9-10% over the next 4 years to become US$ 23-24 Bn in FY2028

The rebound in consumption and growth across sectors will be shaped by the rise in urban demand and the gradual recovery in rural demand spread across the next 12-18 months, catalyzing advertising spending at a CAGR of 9-10% over the next 4 years. This is expected to increase the penetration of organized and branded play in the market. Some of the other key trends expected to take shape over the course of the period include the growth in MSME advertising spending in tandem with their growing digital maturity, increasing investments towards building video-based and interactive advertising, and a focus on boosting the measurability of ads on challenger platforms. The report also notes that digital advertising would continue to outgrow the market growth at a CAGR of 11-12% and account for ~60% of the overall advertising market in FY2028.

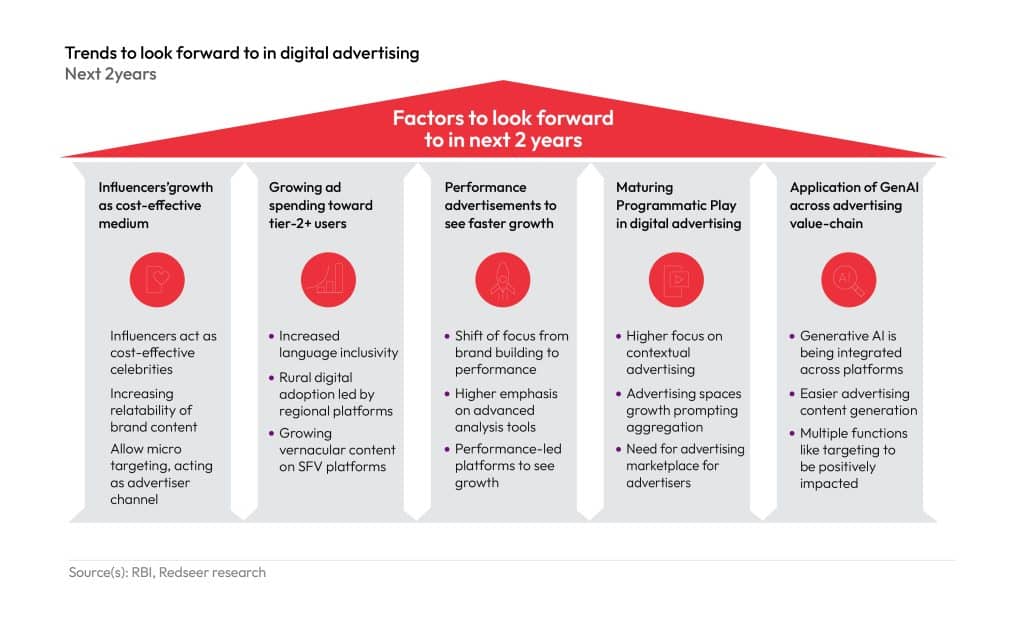

5 Key Trends that are expected to take shape in the next 2 years

As the sector looks to chart its way forward, five key trends are expected to take shape in the next 2 years:

- The rapid growth of Influencer Advertising owing to the cost-efficiency of the format

- An Increase in advertising expenditure towards Tier-2+ audiences

- The faster growth of Performance Ads supported by Analytics tools

- Maturing Programmatic Play led by a focus on contextual advertising

- The integration of GenAI across the advertising value chain

With digital natives shaping the future of advertising at large, brands have a never-before opportunity to address a much larger and more diverse consumer pool. The rise of challenger platforms has defined the growth in digital advertising in FY2024 and expected to remain so in the next years or so.