Food delivery has become a crucial part of the KSA economy, with 1 out of 5 meal orders now delivered online through aggregators. Platforms such as Hungerstation and Jahez established the model and helped build consumer habits. Now, emerging players like Keeta are trying to maximize value for consumers through differentiated offerings. These platforms are also striving to build a more balanced ecosystem that serves the needs of consumers, merchants, and drivers alike.

What does this shift mean?

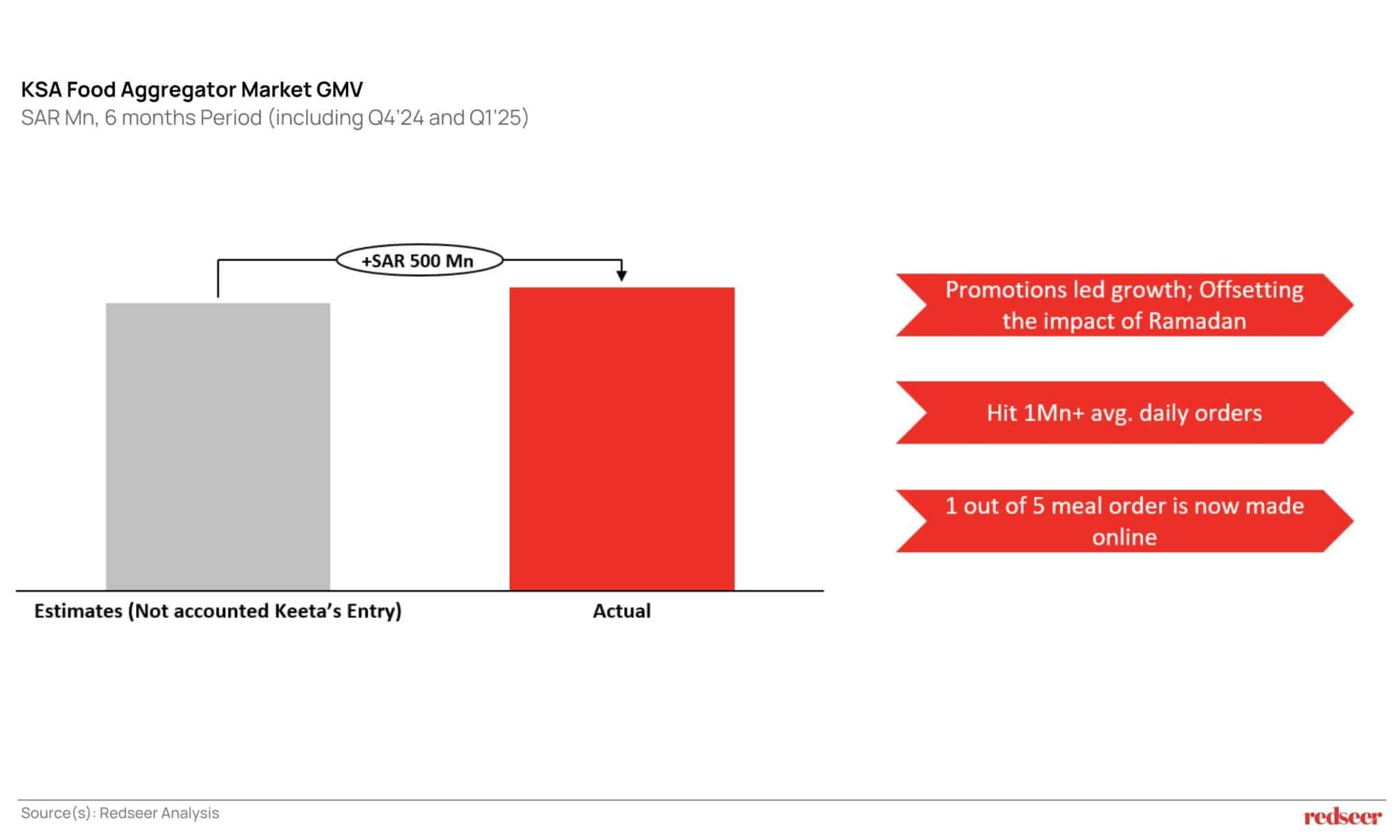

- The market is witnessing unprecedented growth, with GMV exceeding our earlier estimates by over SAR 0.5 Bn in just two quarters.

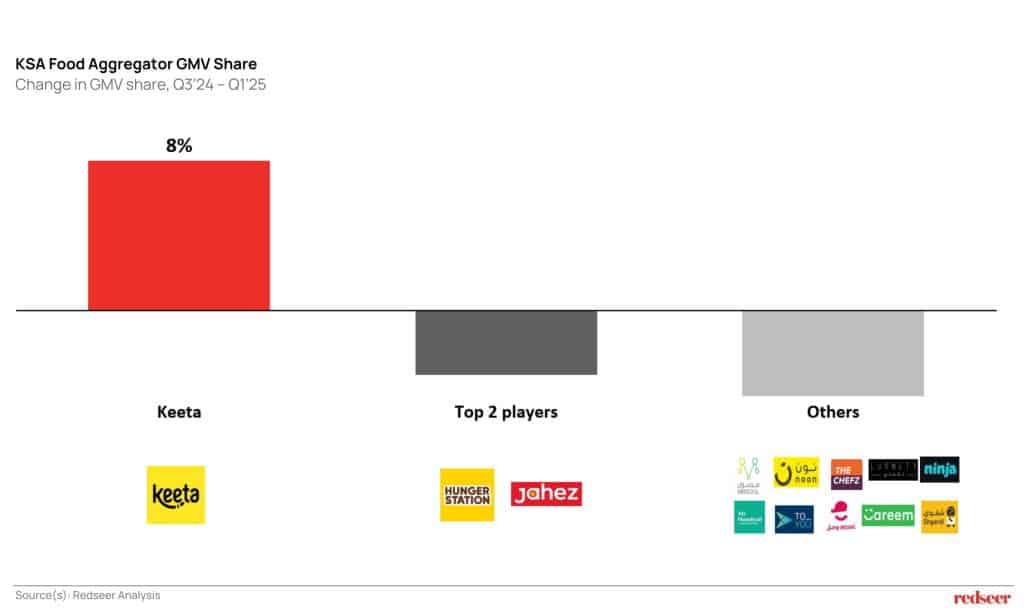

- Competition is intensifying, with new entrants capturing significant market share in record time.

- The next phase of growth may require more than promotions—ecosystem-wide value creation and operational excellence will likely determine the winners.

We solve the strategy behind scale!

Read on to see how this shift is playing out.

1. Stronger-than-expected market growth driven by heavy promotions and increased online food ordering

The food aggregator market in KSA outperformed expectations, exceeding projections by SAR 0.5 billion in GMV during Q4’24–Q1’25. Growth was primarily fueled by intensified platform promotions, including reduced delivery fees, discounted meals, and attractive subscription offers. These incentives drove higher engagement, with platforms collectively surpassing 1 Mn average daily orders. Online penetration also deepened, with 1 in 5 meal orders now placed through aggregators. Ramadan-related seasonality tempered growth slightly, but the overall market trajectory remained positive.

2. Keeta gained the most share, emerging as a key disruptor in Q1’25

Keeta captured an impressive 8% GMV share in just two quarters, becoming the fastest-growing player in the market. This rapid ascent was driven by an aggressive growth strategy that combined generous user incentives with an intuitive user experience and strong operational execution.

Leading players like Hungerstation and Jahez saw a slight dip in GMV share despite achieving record-high figures, as their growth lagged behind the overall market. Their user base remained largely intact, indicating potential for a rebound. In contrast, smaller platforms such as ToYou, Mrsool, Mr. Mandoob, and Shgardi experienced sharp declines.

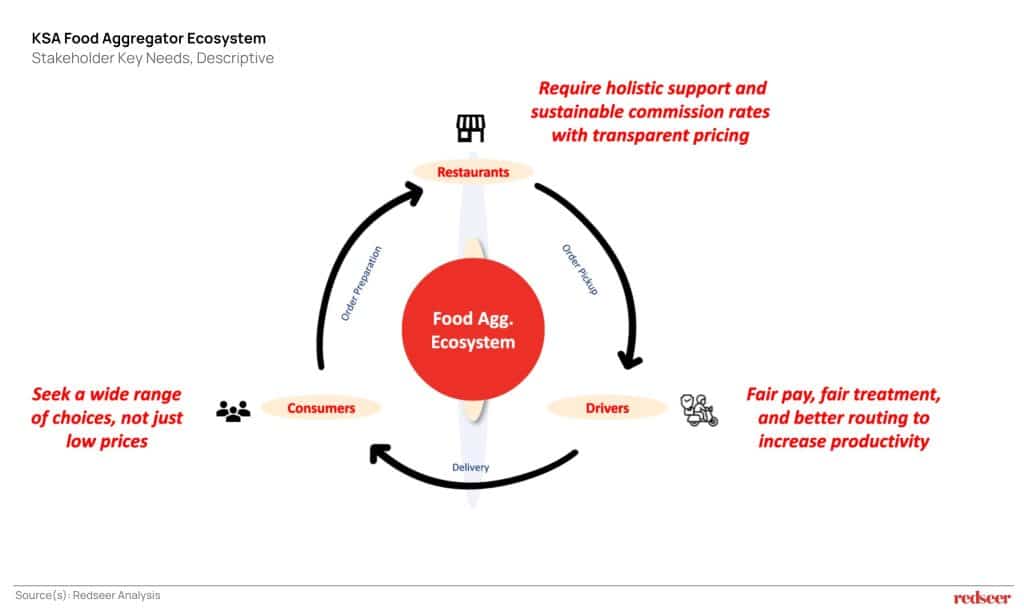

3. Sustaining growth may require more than price; ecosystem value is the next frontier

With price-led growth nearing saturation, players can differentiate through ecosystem value to sustain momentum. Multi-vertical strategies—offering groceries, non-food delivery, and financial services—are already proving successful, especially for Talabat, Hungerstation, and Noon.

On the supply side, player focus is shifting toward restaurant loyalty. Jahez is doubling down on its merchant ecosystem with PoS tools, cloud kitchens, SaaS products, and lower commissions (~15%) to retain key merchants.

Building logistics operations will also be critical, with investments in tech-enabled systems and fleet infrastructure. Jahez’s Logi, for example, aims to fulfill 60% of Jahez’s KSA orders by 2026, boosting efficiency and supporting driver livelihoods.

The KSA food aggregator market stands at a strategic inflection point. While promotional tactics have successfully accelerated growth and online adoption, the sustainability of this trajectory now depends on platforms’ ability to create differentiated value beyond price. The rapid rise of Keeta demonstrates that market share remains contestable, even in a seemingly mature landscape dominated by established players. Going forward, success will likely favor platforms that can effectively balance customer acquisition with merchant retention, while building robust operational capabilities to support multi-vertical expansion.