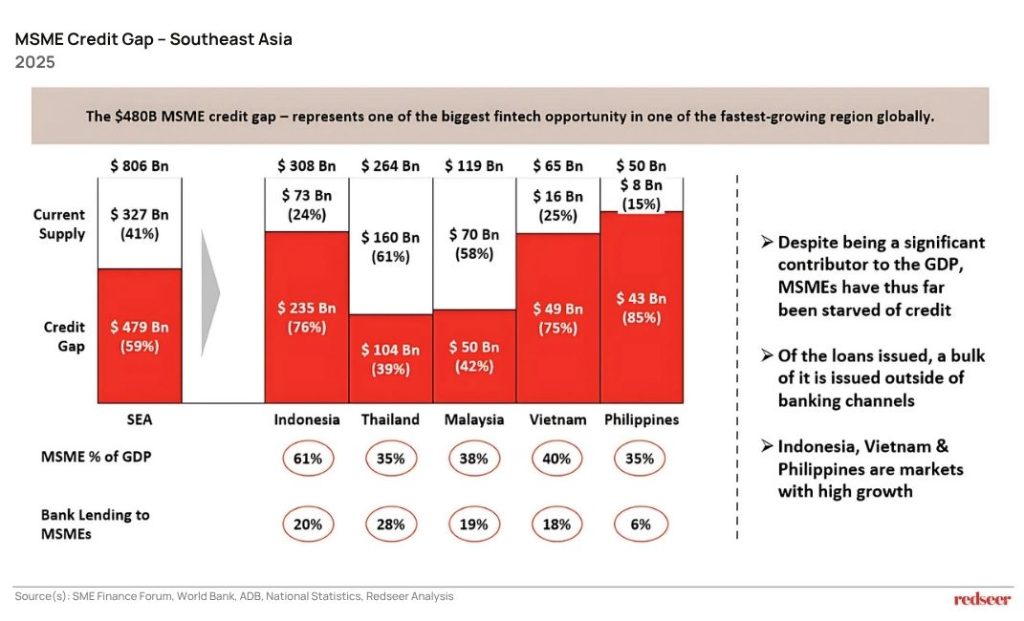

Southeast Asia’s 68 million micro, small, and medium enterprises represent the economic backbone of the region, contributing over 40% of GDP across major markets. Yet these businesses face a staggering $480 billion credit shortfall that traditional banks have proven unable or unwilling to fill.

This represents one of the largest underserved B2B financial markets globally, creating a massive opportunity for technology-enabled lenders to step into the void and unlock economic growth across Indonesia, Thailand, Malaysia, Vietnam, and the Philippines.

1. Southeast Asia’s ~68 million MSMEs, the backbone of the region’s economy, are choked by a USD ~480 billion credit gap…

We solve the strategy behind scale!

The numbers tell a stark story of financial exclusion at scale. While Indonesia leads with a $235 billion credit gap, representing 76% of total MSME financing needs, even smaller markets like the Philippines show 85% of demand going unmet.

Traditional banks have captured only a fraction of the lending opportunity across most markets, leaving hundreds of billions in economic value trapped.

This systematic market failure isn’t due to a lack of demand—it’s a fundamental mismatch between banking infrastructure designed for large corporates and the needs of smaller enterprises.

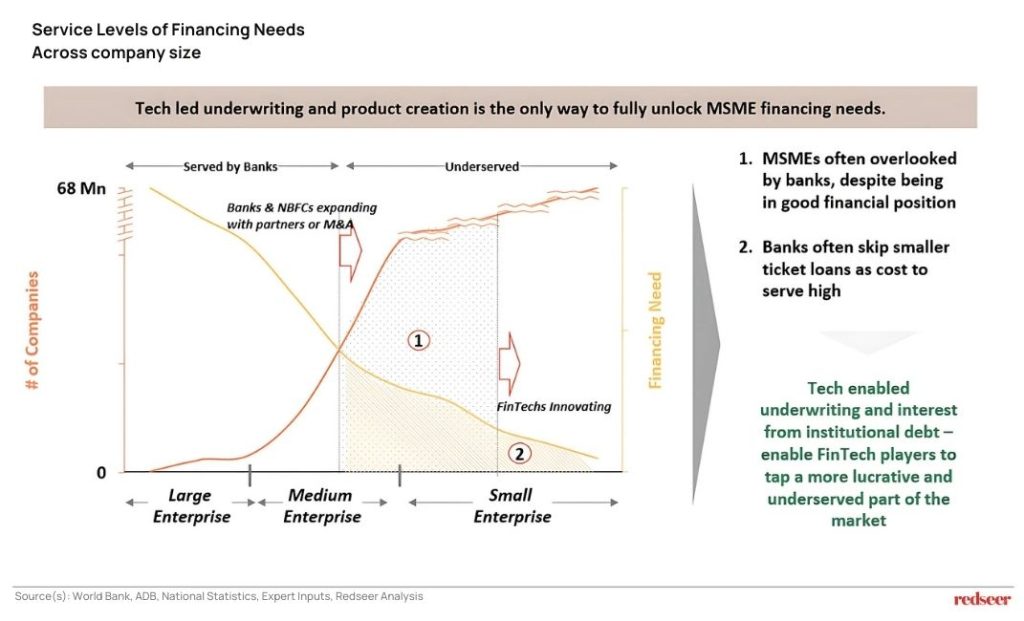

2. …and are often underserved due to smaller ticket sizes and the inability of banks to underwrite them effectively

The root cause becomes clear when examining how financial services scale across company sizes. Banks excel at serving large enterprises but struggle economically as ticket sizes shrink and operational complexity increases.

The sweet spot for disruption lies in the “underserved” segment, where traditional banks find the cost-to-serve too high relative to revenue potential.

Technology-enabled underwriting and digital-first product delivery can flip this equation, making smaller loans profitable through automation, alternative data, and streamlined operations that reduce processing costs by 60-80%.

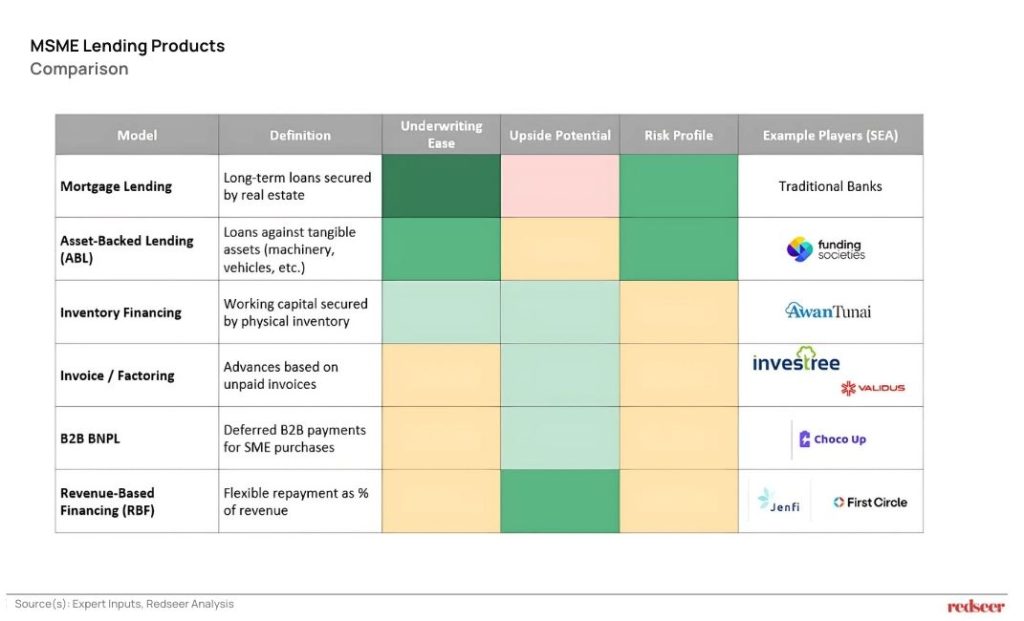

3. Multiple players have emerged, addressing MSME financing needs through distinct models, each with significant upside potential

The beauty of the MSME lending opportunity lies in its diversity—there’s no single solution but rather multiple viable entry points. From asset-backed lending and invoice factoring to revenue-based financing and B2B buy-now-pay-later, each model serves different business needs and risk profiles. Companies like Funding Societies, AwanTunai, and Investree have already proven several approaches work at scale.

4. The traditional lending market also presents opportunities for digital disruption

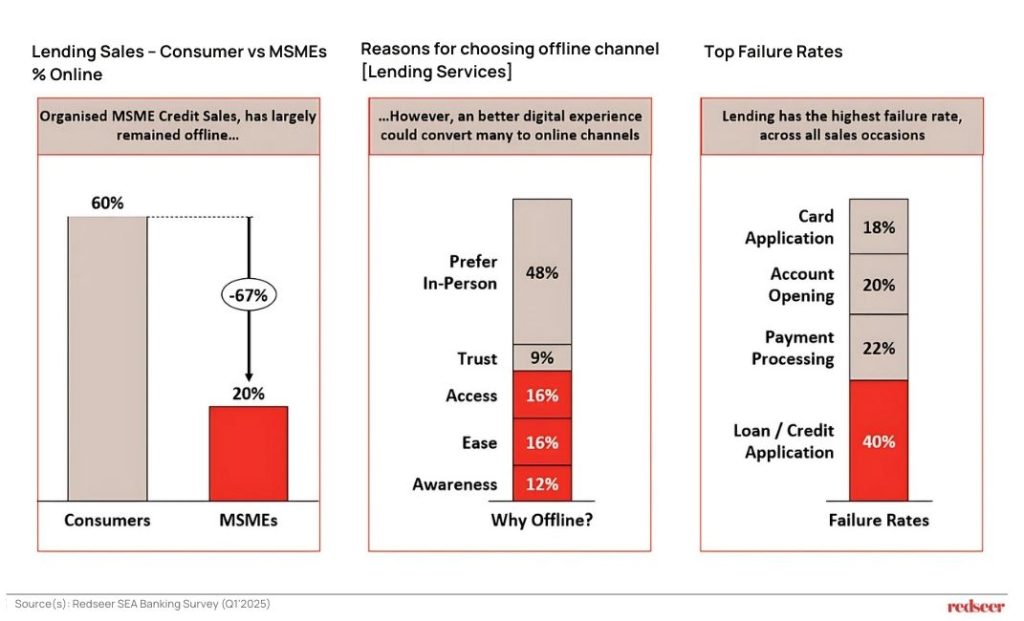

Here’s the paradox that creates opportunity: while 60% of consumers embrace online lending, only 20% of MSMEs do the same.

This isn’t because business owners are technophobic they cite legitimate concerns around trust, access, and ease of use that current digital solutions haven’t addressed.

The 40% failure rate for loan applications reveals broken user experiences that leave money on the table. The companies that solve for MSME-specific needs, like integration with accounting systems, flexible documentation, and other means to underwrite, will capture disproportionate market share.

5. AI in lending isn’t hype – it’s already unlocking scalable products and slashing costs

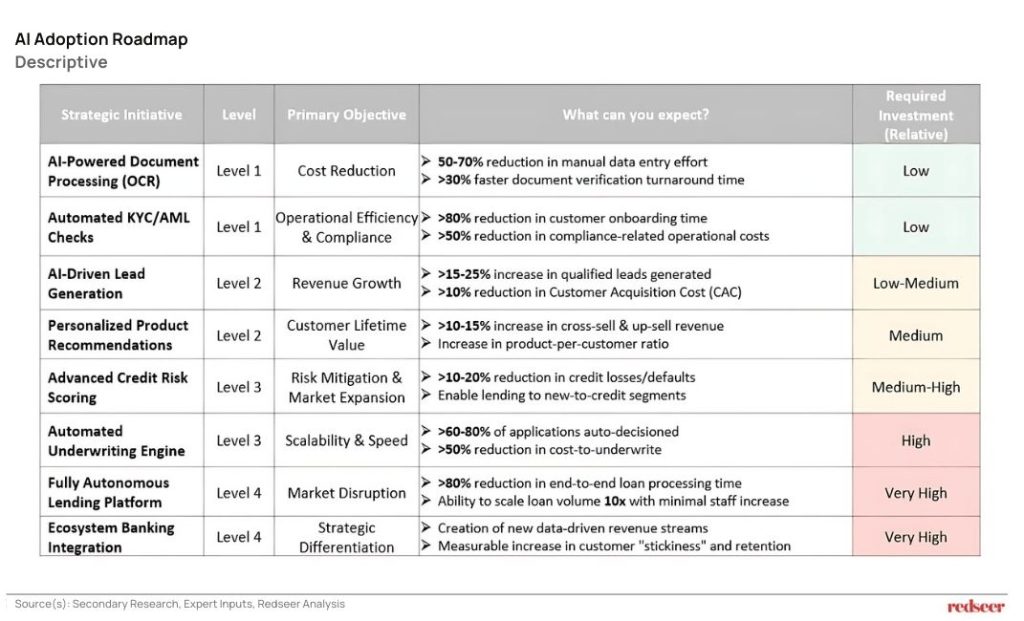

Artificial intelligence isn’t just a buzzword in MSME lending—it’s the technology that makes the unit economics work. By automating document processing, KYC checks, and underwriting decisions, AI can reduce operational costs by 50-80% while dramatically improving speed and accuracy.

The roadmap from basic document processing to fully autonomous lending platforms shows a clear path to competitive advantage. Early movers implementing Level 1 and 2 AI capabilities today will build the data advantages needed to reach Level 4 market disruption tomorrow.