In one of our previous updates, at the start of this year, we spoke about the Indonesian travel market and its immense opportunity. In this article we take a deeper look at the Online Travel Agent (OTA) market and what trends are going to be shaping up the industry. And as a bonus, we also talk about the upcoming Ramadan 2024 trends in Travel.

01. Globally OTA space is Winners Take All

While smaller players either die or are M&A targets – we are seeing a significant 3rd shaping up

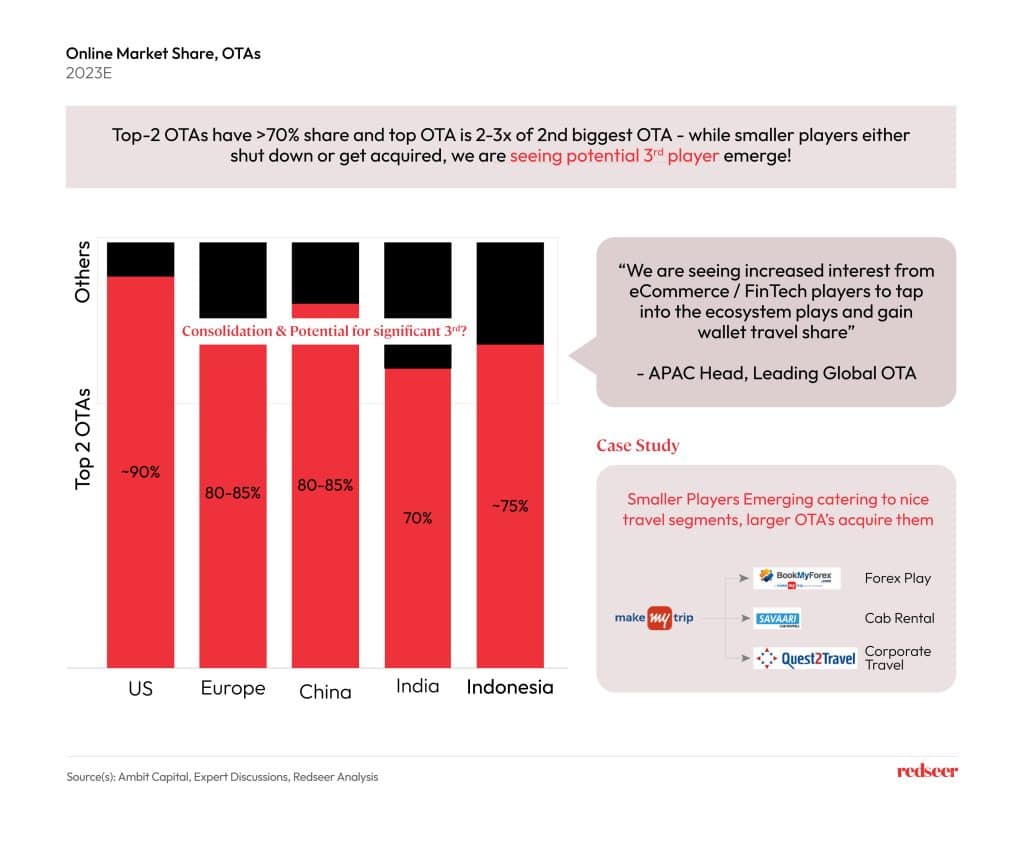

Globally if you look at the OTA market, it’s a winner-takes-all-all. Across geographies, we have seen that the Top 2 OTAs control 70%+ online travel market.

What’s even interesting is that the top player across geographies is often 2-3 bigger than the second biggest player. In Indonesia, this holds – exhibit Traveloka & Tiket.com. As for the rest, we have seen a lot of players close or simply get acquired by larger entities be they local or global.

However, amidst this consolidation – we are also seeing interest from eCommerce / Payment players to expand their ecosystem play and enter this space. This in a lot of cases is giving rise to the potential of a 3rd competitor vying for the piece of the pie.

02.OTAs have managed to create a strong dominance in the Flights & Stay categories – the next phase of growth to be around expanding wallet share & profitability

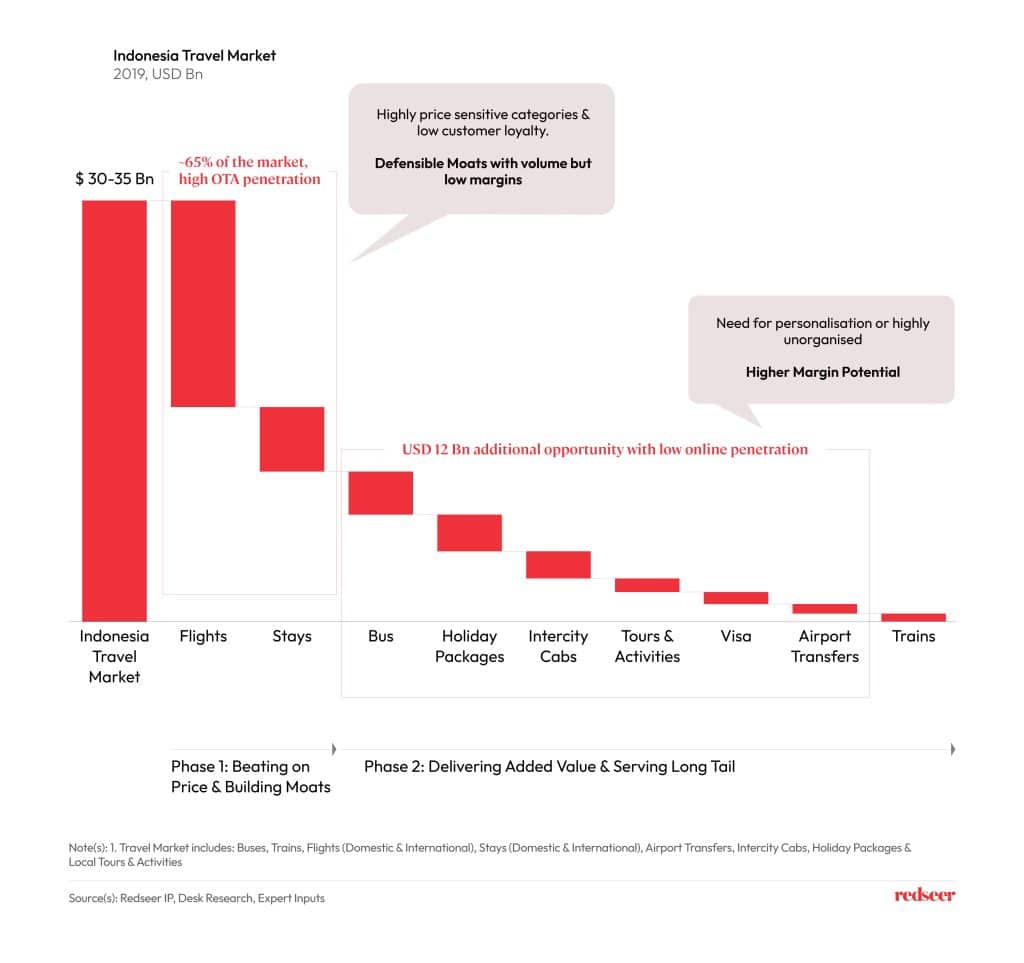

In the previous iteration, we spoke about the lucrative Indonesian Travel opportunity – but in this iteration, we break the market down further from the point of view of an OTA. As of 2019, the Indonesian travel market was valued at USD 30-35 Bn. Of which ~65% is attributable towards Flights & Stays.

The two segments that were key to the rise of online platforms – as in Phase 1 of the OTA story they solved for accessibility as well as discovery for the categories.

However, in both categories, consumers are highly price-sensitive & exhibit low loyalty. Though on the backend with enough volume & inventory – large players develop defensible moats. The next phase of growth for OTAs is going to be all about increasing profitability. These mature players are now looking to expand their wallet share by offering value-added & complementary services. This is going to be at the core of the second phase of growth for OTAs. Further, we are going to see a focus to solve for more personalized and higher margin needs – such as Holiday Packages which largely remain offline. And a move to get the unorganized aspects of the travel market under one roof – such as cabs, buses, etc.

03. Key themes for OTAs

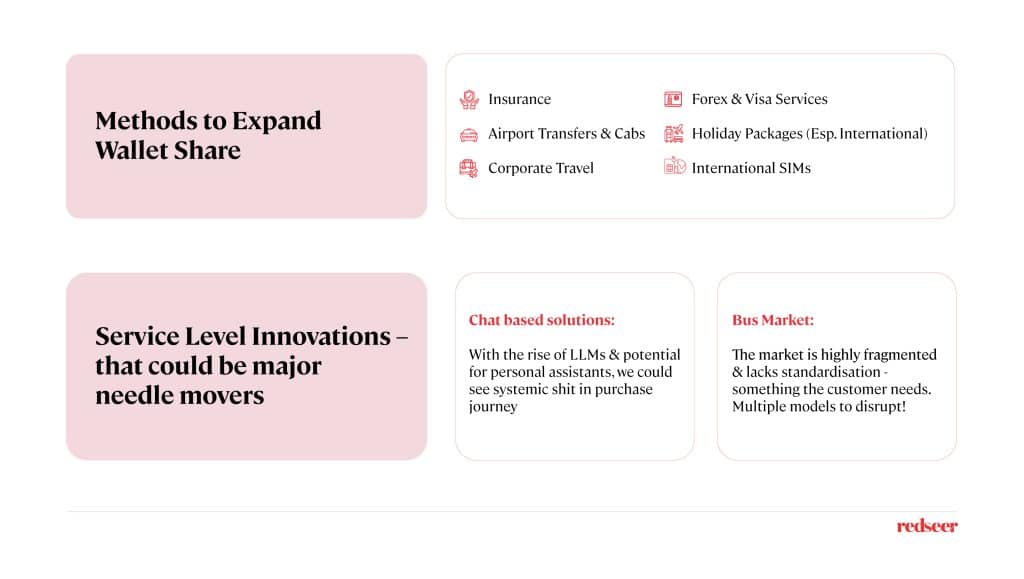

Some interesting levers that we see potentially being quite lucrative for OTAs to expand market share is going to be Airport Transfers & Cabs – globally we have seen attach rates of ~25%+ on flight ticket bookings. Furthermore, developing solutions for corporate travel especially MSMEs is key. This could also be a lever used by the 2nd / 3rd largest player to challenge the status quo.

International Travel – provides a lot of room to grow, with the potential to upsell services like forex, visa, and international sims. But the biggest problem to solve here is also customizable International Trips. This is where AI-based solutions could help platforms make a difference.

Apart from these – travel insurance & offering local experiential trips, especially open trips remain fast growth opportunities. Structurally, we also see major disruption to be coming because of LLMs & chat-based solutions. How the consumer shops/searches could completely move to the route of an LLM-backed AI assistant. The player that gets this right could potentially stand a chance to gain a lot of market share – or we could also see a rise in D2C bookings.

Buses are also an attractive category wherein the unorganized market is ripe for disruption as consumers want more reliable & standard quality. We are seeing a couple of innovative models solving this – from operational & branding models to new-age bus operators.

04. Ramadan 2024, Expect a higher & wider interest to travel

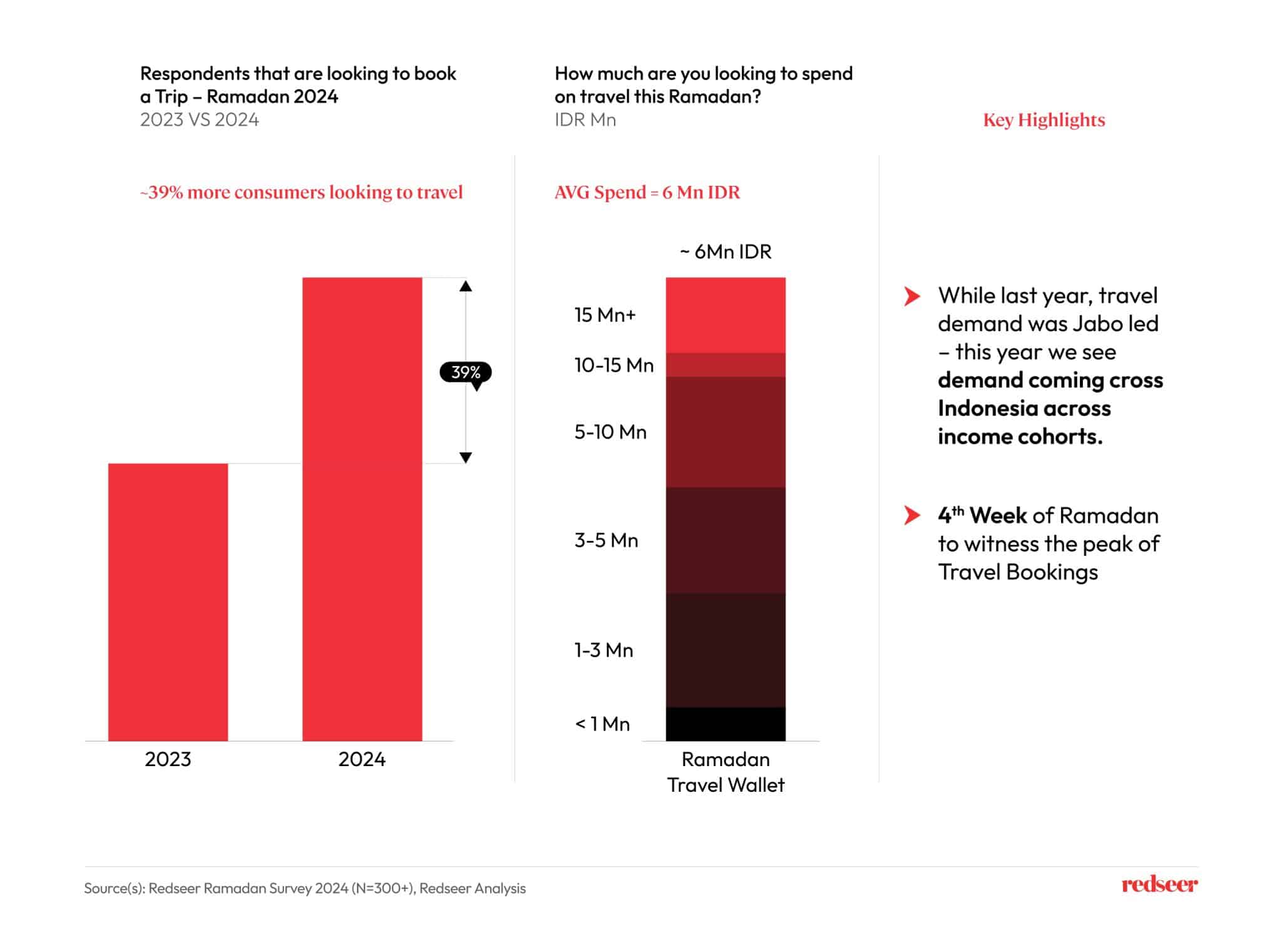

As an ending note, I would like to call out specific insights from our Ramadan 2024 report pertaining to travel. This year, we expect to see a much sharper increase in travel demand. Last year demand was more centred around the affluent and in Jabo regions. This year the demand will be more distributed.

The average Indonesian is expecting to spend ~6 Mn IDR on a trip & social media is the key driver in trip ideas. While most bookings happen around the 4th Week of Ramadan. Considerations & Planning start around 30 days prior.