It’s been a frigid period for startups, characterized by tightened investor budgets and a visible slowdown in the fervor that was once the hallmark of the sector. However, beneath the icy exterior, a subtle yet steadfast undercurrent of optimism remains. The belief is that this downturn is just a temporary phase, laying the foundation for a forthcoming period of renewed growth and opportunity. Kanishka Mohan, a distinguished partner at Redseer, offers a perspective that shines a light at the end of this wintry tunnel. He envisages that the ongoing funding freeze is merely setting the stage for a more vibrant and robust future in India’s public and private funding sectors.

India’s Startup Evolution

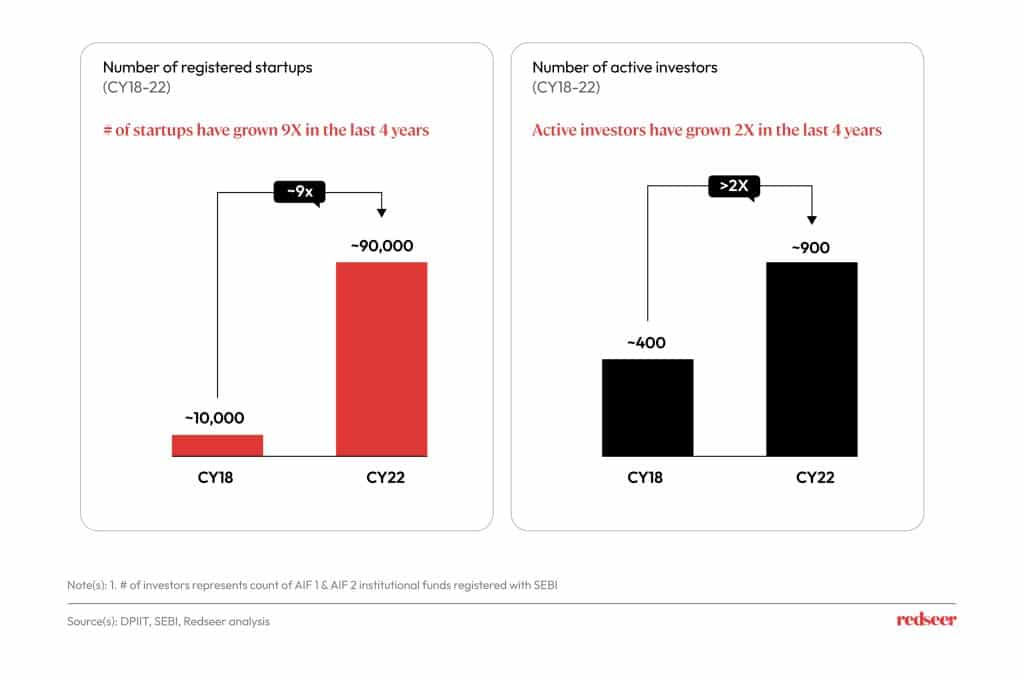

The transformative journey of the Indian startup ecosystem over the past five years is nothing short of remarkable. The digital revolution has acted as a catalyst, igniting a startup boom at an unparalleled pace. Starting from a modest base of approximately 10,000 registered startups in CY18, this number skyrocketed to an impressive 90,000 by CY22.

This exponential growth hasn’t escaped the keen eyes of investors. Attracted by the vast potential and promise of the Indian digital landscape, the investor count has seen a twofold increase, moving from 400 in CY18 to an impressive 900 in CY22.

Diversifying the Global Funding Pool

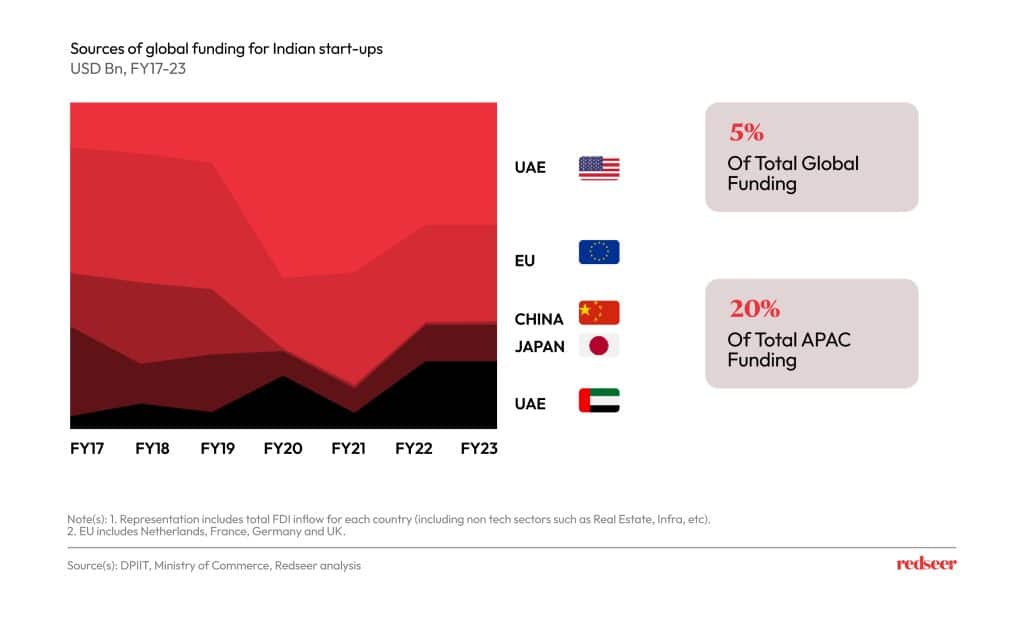

With India’s rapid digitization trajectory, numerous sectors are buzzing with opportunities and innovations. Whether it’s healthcare, education, FinTech, or eCommerce, there’s a gold rush of activity and innovation. Fresh, groundbreaking solutions are not just gaining traction within Indian borders but are also capturing the attention of global investors.

No longer is foreign investment concentrated from a few primary sources. Today, the investment tapestry is rich and varied, with substantial inputs flowing in from regions as diverse as the USA, EU, UAE, Japan, and China. Such diverse global attention underscores the position of Indian startups as significant players on the world stage, grabbing significant portions of both global and APAC funding.

The Hope Beyond the Funding Winter

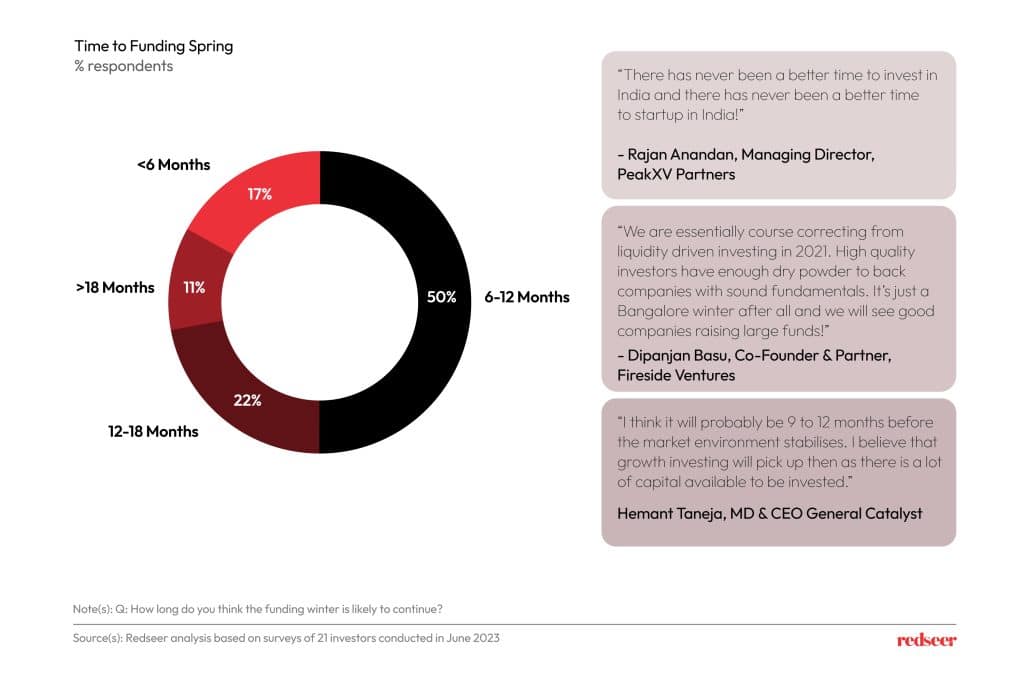

Amidst the chill of the funding winter, it’s essential to note that cold phases often serve as periods of consolidation and reflection. Seasons change, and just as surely as winter arrived, the spring of funding optimism is on the horizon.

Startup funding winter to pass in 6-12 months

Investor sentiment, despite the prevailing circumstances, remains largely optimistic. A recent survey highlighted that approximately half of the investors are sanguine about the funding environment, expecting a resurgence in the next 6-12 months. They believe that this period is an opportunity to recalibrate strategies, evaluate market potential, and prepare for the forthcoming bloom. A noteworthy 17% of those surveyed are even more bullish, expecting the return of the funding spring in less than six months.

A Look Ahead: 2023 and Beyond

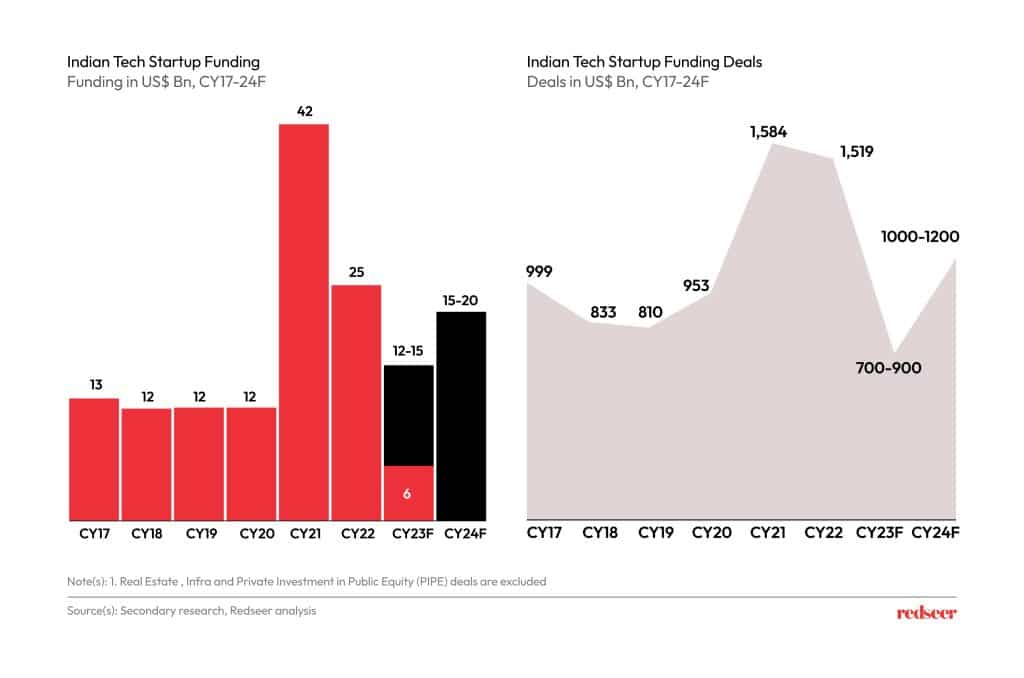

The trajectory of startup investments, while impacted by short-term economic factors, often adheres to a more stable long-term trend. Historical data reflects this sentiment. Despite the pandemic’s unprecedented challenges, startup funding witnessed a massive surge in CY21, with investments reaching an astonishing $42 Bn. This growth, however, was met with a slight dip in CY22, primarily attributed to macroeconomic pressures.

While the figures project a potential decrease in funding to the tune of $12-15 Bn for CY23, this aligns with the long-term trends observed since CY17. More importantly, 2024 promises a brighter outlook, with a projected healthy growth that could reach between $15-20 Bn. The resilience of the startup sector is further highlighted by the consistent interest in early and growth-stage funding. A remarkable 90% of all deals since CY17 have been seed or early-stage, reflecting the unwavering investor confidence in the potential of new businesses and innovative ideas.

In Conclusion

While the ebb and flow of investments may mimic the unpredictable whims of nature, the roots of the Indian startup ecosystem remain deep and robust. The winter, with its challenges and introspection, will inevitably give way to a string of opportunities. With the resilience displayed by startups, combined with unwavering investor interest, India’s entrepreneurial landscape is poised for an exciting and prosperous future.