The increase in the number of unicorns in the Indian start-up ecosystem is testimony to the new-age tech companies coming of age. A few of them are listed in the public markets over the last couple of years. However, their valuations witnessed corrections due to the ongoing macro-economic environment as well as due to growth obtained at higher costs. And with startups choosing a focused and goal-based approach to their listing journey, India may witness up to 80 Potential Tech/New-Age IPOs over the next five years.

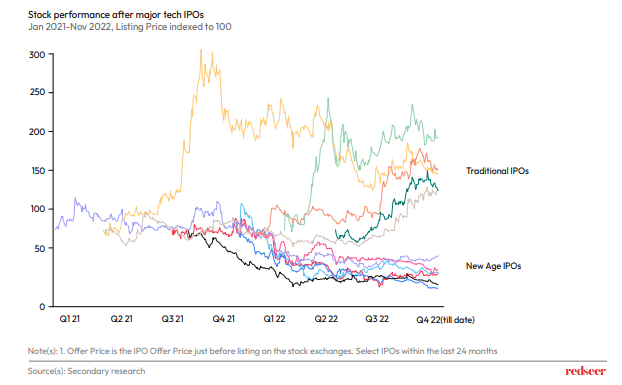

1. Lately, the stocks of Tech/New-Age IPOs have corrected more sharply compared to that of other/traditional companies

Due to the ongoing global macro situation, with rising interest rates, profits are much more valuable. A typical company that would be cash flow positive two years from now would see discounting of at least 20-30% of their valuations in a low-interest rate situation, which goes up significantly in a high-interest rate situation which we are seeing right now. And Tech/New-Age companies have prioritized growth at higher costs. Therefore, of the companies listed in the last couple of years, while traditional IPOs in India saw milder corrections in valuations, in comparison to that of Tech/New-Age listings.

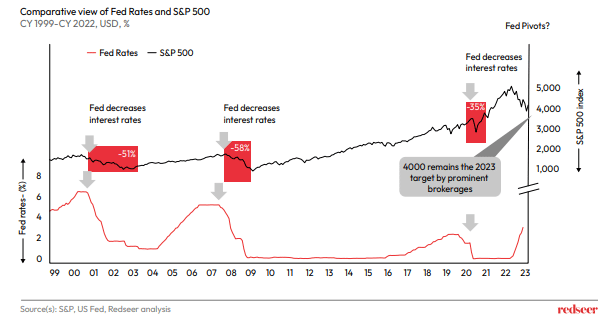

2. The markets are likely to take some time to bounce back

With current interest rates being higher, valuations are significantly affected. Taking note of similar situations in the past 20-odd years, it still takes a bit of time for markets to come back sustainably, even after the interest rates start dropping. Because, in effect, the market rates would have already factored in the decreasing interest rates into the prices. The learning is that there may be more time, maybe a few quarters, for the markets to recover.

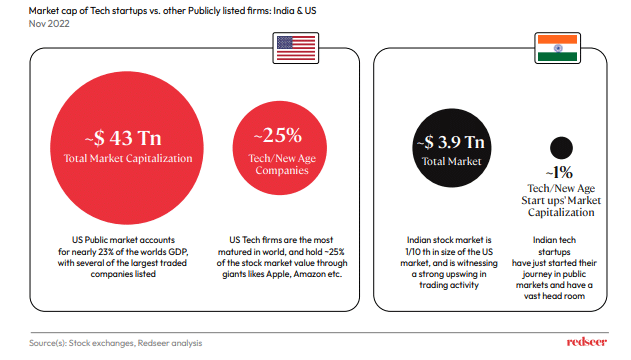

3. India has a significant room for growth in public market capitalisation, especially for Tech/New-Age companies

India’s market capitalization to GDP ratio is lower than that of larger economies like the US, UK, China, etc. This reflects the growth headroom for public markets in India. The under-penetration is starker in the case of Tech/New-Age companies. That is, in comparison with the US, where about 25% of the $43 trillion total public market capitalisation can be attributed to Tech/New-Age companies (this includes giants like Apple, Amazon etc). In India, only about 1% of the $3.9 trillion total public market capitalisation can be attributed to Tech/New-Age companies. It’s just the start of Indian Tech/New-Age coming up and going towards their path to profitability, then looking at

that public market journey.

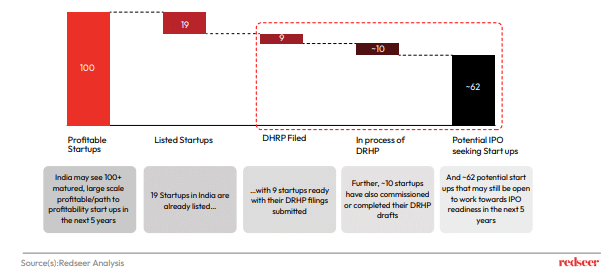

4. In the next five years, India is likely to see 100+ matured, large-scale profitable/path-to-profitability start-ups which leads to a pipeline of 80 potential Tech/New-Age IPOs in the period

With about 20 of the 100+ matured, large-scale profitable/path-to-profitability start-ups already being listed, about 80 start-ups have the potential to IPO. While the markets have been challenged, the potential is out there, especially for tech.

According to the report, there are a lot of metrics that the startups will need to focus on in their IPO journey, including market leadership, clearly visible total addressable market, multiple use cases, predictable revenues, high operating leverage, sustainable unit economics and a clear path to profitability.